Aave Umbrella now live at DeFi Saver

Aave's Umbrella update is live on DeFi Saver. You can now stake USDC, USDT, GHO, WETH, and earn extra yield while contributing to Aave's safety mechanism.

Aavehave Umbrella is now up and running on DeFi Saver, and we thought it’d be cool to let you in on what it means exactly and what you can do with it on your favorite DeFi app.

Aave launched Umbrella on June 5, 2025. It’s meant to address the faults of the existing Safety module that relied heavily on governance intervention, and introduce an automatic mechanism that “slashes stakers in real time if bad debt in a particular asset exceeds a certain threshold”.

What is bad debt?

In traditional finance, it’s a term usually used to describe a situation when a debtor becomes insolvent or goes bankrupt, thus being unable to pay back the debt it owes to a certain party. It happens more often than you think, so numerous companies have started establishing accounting mechanisms to predict and minimise them as much as possible.

This concept extends to crypto as well, when the value of the borrower’s collateral becomes lower than the value of the debt. Though this is far less common than in TradFi, due to transparent on-chain activity and liquidation mechanisms in place, it’s still somewhat possible in highly volatile market periods.

Just like companies in TradFi, protocols like Aave had mechanisms in place to address and prevent this, hence Aave’s Safety Module.

How Umbrella improved Aave’s Safety module

The Safety module, launched in 2020, is a kind of emergency fund that incentivises users to stake their AAVE tokens in return for rewards. On the other hand, AAVE can use these funds for slashing events, cases when staked assets are used to cover bad debt (or any possible deficits).

It’s worth noting that the Safety module implies high reliance on Aave’s governance to determine various risk metrics, such as LTVs, liquidation thresholds, or any other key decisions for addressing risk vectors in DeFi.

Okay, so what’s the issue?

Well, the main problem was that every slashing decision had to go through DAO votes, which significantly slowed down the response during high-risk periods.

Umbrella fixes this by:

- Introducing the automatic slashing mechanism that acts on preset parameters;

- Enabling earning a base yield from aTokens staked on Aave, plus the yield linked to slashing exposures, simultaneously;

- Preventing bank runs with a 20-day cooldown period, followed by a 2-day withdrawal period.

Read on to learn how you can contribute to Aave’s Safety mechanism and simultaneously earn some extra yield.

And how you can do all that through DeFi Saver.

How you can access Umbrella on DFS

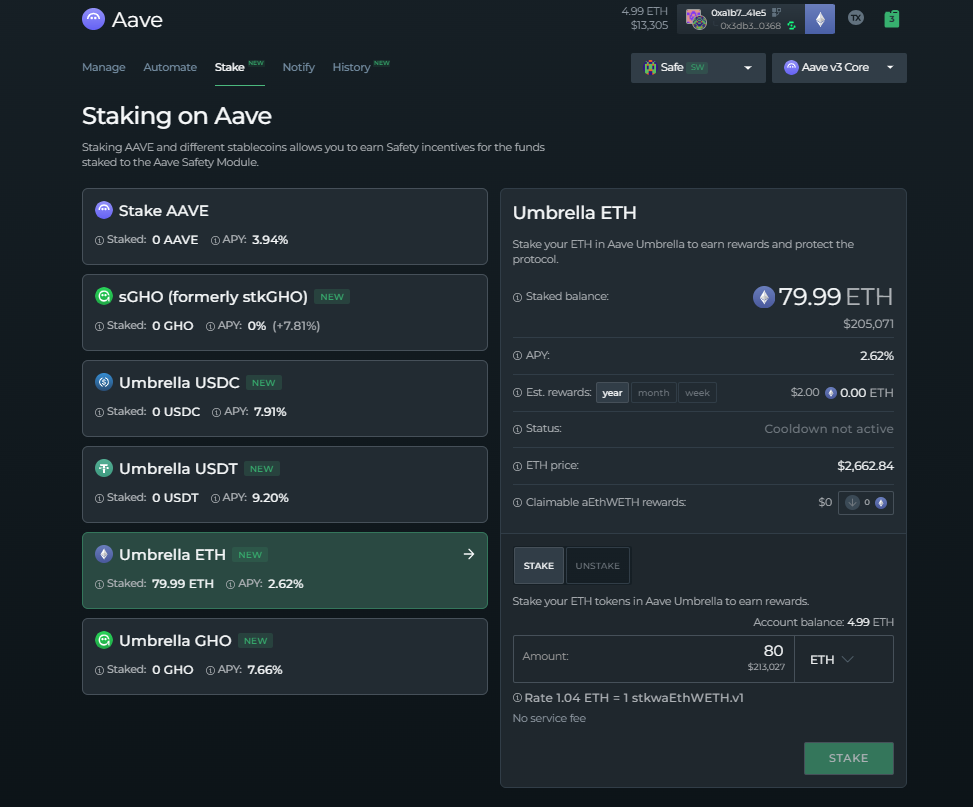

DeFi Saver allows you to stake USDC, USDT, WETH, or GHO directly through the Aave dashboard. You can do so with assets supplied to Aave, or you can simply stake them directly from your wallet.

For instance, if you have USDC, you can supply it to Aave at a 4.18% supply rate and then stake it through Umbrella, earning 7.91% APY at the moment.

Let us know if you have any remarks or questions about the new Umbrella integration on our Discord server.

Until the next post, stay Safe out there! 👋