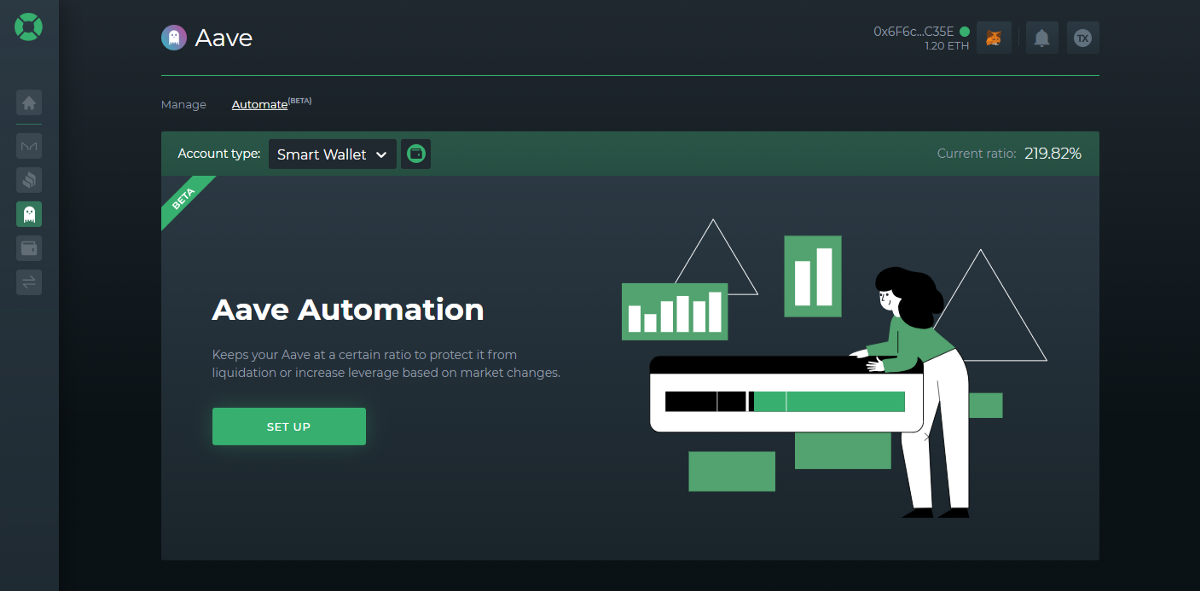

Aavetomation is now LIVE — with automatic liquidation protection and leveraging available

Our Automation services are finally available for Aave, too!🥳

After initially integrating the Aave protocol for their flash loans that we utilized for leverage management options within other protocols and, more recently, introducing our fully fledged Aave management dashboard, it is now time to complete the Aave-DeFi Saver puzzle.

Starting today our Automation services are available for Aave users, with both automatic liquidation protection and automatic leveraging options.

If you’d like to dive right in, you can go ahead and navigate to our Aave dashboard. Or keep on reading for more information.

How does DeFi Saver Automation work?

Automation is a trustless and non-custodial system that allows you to configure automated leverage adjustments for your position, effectively enabling automatic liquidation protection in case of market drops and automatic leveraging in case of continued uptrends.

Once enabled, Automation constantly monitors your portfolio and triggers adjustments using our Repay and Boost features as soon as your configured minimum and maximum configured thresholds are crossed.

This is possible because by enabling Automation you provide Automation with the privileges to make adjustments to your position, all while keeping it limited by your configuration — Repay can only be applied once your position drops below the minimum configured ratio and Boost can only be applied if it goes above the maximum configured one.

Why use Automation?

There are two main reasons one would want to use Automation right now — liquidation protection and automatic leveraging.

Liquidation protection is achieved through means of position unwinding, meaning that part of your supplied collateral is being used to pay off your debt. This process is called Repay at DeFi Saver and the result is decreased debt and increased Safety ratio, but at the cost of decreased collateral supply.

Liquidation protection can be useful for anyone using Aave, be it for leveraging of a certain asset or for an actual loan.

Automatic leveraging, on the other hand, is achieved by taking on more debt and using it to obtain more of the supplied asset (this process is called Boost) as market movements allow. For example, if you have a leveraged long LINK position setup, then you could enable automatic Boosting which would increase your LINK supply by borrowing more DAI, USDC or whichever stablecoin you used, as the market keeps moving up.

This option is mostly useful for those who are using Aave to leverage a certain asset, as described here.

How to setup Automation for your Aave position

In order to enable Automation, simply login with your wallet at the DeFi Saver Aave dashboard and navigate to the Automate tab.

Once you’re there, it’s just a matter of entering a target Safety ratio around which you want your position to stick at all times. Or you can tick the Advanced checkbox to get more detailed control and configure liquidation protection and automatic leveraging separately. This is where you can also disable auto-boosting, if wanted.

Frequently Asked Questions

Q: Are there any requirements for using Automation?

A: There are two requirements, yes: 1- that your Aave portfolio is on the Smart Wallet; and 2- that your current debt value is greater than $4000.

Q: What is a Smart Wallet and why do I need it?

A: Smart Wallet is a proxy wallet contract that is owned and managed by your main Ethereum account. In technical terms, Smart Wallet is actually the DSProxy, a proxy wallet used by other DeFi projects, most notably MakerDAO where every CDP/Vault owner has one (meaning you may already have yours ready, too). Using a Smart Wallet is needed because it enables creating and executing complex transactions such as Boost and Repay and, additionally, it includes the option to provide certain privileges to another account, which is what makes Automation possible.

Q: What are the fees for using Automation?

A: The fee for automated adjustments is 0.3% per transaction. Enabling and simply having your position actively monitored does not entail any fees as such (except standard Ethereum transaction fees for enabling/disabling Automation).

Q: How are transaction fees for automated adjustments paid?

A: The transaction fees for any adjustments made by Automation are charged to the position. Automation cannot access your main Ethereum account in any capacity.

Q: Can I only enable liquidation protection, without auto-leveraging?

A: Yes, you can. Simply tick the “Advanced” checkbox and then deselect the Boost option below.

Q: Automation is configured based on a “Safety ratio” — what is it?

A: The Safety ratio is in a way similar to Aave’s own Health factor. Dropping to 100% Safety ratio would mean that you are utilizing your maximum borrow power and anything further than that is getting extremely close to liquidation, although Aave does have an additional safety padding before liquidation ensues as we explained in our post on liquidations in decentralized finance.

Technically speaking, we should note that Safety ratio=1/Borrow power used.

If you have any additional questions or really anything you would like to check with us, please feel free to jump into the DeFi Saver discord — we’ll be super glad to see you there!👋

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter