DeFi Saver 2024: A year in review

As we get closer to the year’s end, we wanted to take a moment and take a good, long, retrospective look back at everything done and rolled out in one of the best years for DFS so far.

While I’m sitting here feeling like the whole space has been through a turbulent year, in reality it’s definitely been a positive one. From spot ETFs for both BTC and ETH approved, to Ethereum Dencun going live and the crypto market cap almost touching $4T, there’s obviously been some major affirmative events for the industry.

Coming back to DeFi Saver, this year has been a very prolific one. But let's start with two major milestones of 2024: our move to Safes and the TxSaver release.

DeFi Safer

The most significant news this year by far was our transition to Safe.

In our quest to keep building DeFi in an open and permissionless way, we decided to switch to Safe, the most used smart wallet, in the Ethereum ecosystem. This allows us to build the same cool DeFi features and tools as always, while providing maximum interoperability and enhanced security (through native multisig support in DFS).

If we look at numbers, there were over 10,000 (‼) Safes deployed through DeFi Saver, with 1,531 on the mainnet, which we think is rather impressive given that existing users don't need or have to migrate (though now they can).

In general, the reactions to the change have been nothing but positive, and we obviously think it simply makes sense given the incredible compatibility Safe has within the ecosystem - a unique advantage DFS users now have compared to how similar DeFi apps work.

We're super proud that we quickly became one of the most prominent Safe integrators (in their own words!).🫡

TxSaver: smoother & safer transacting

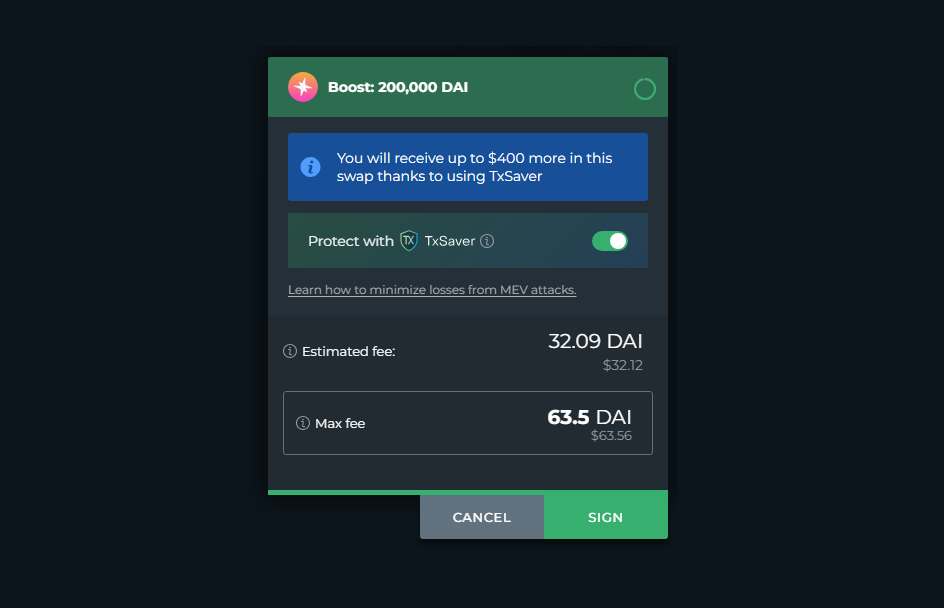

We introduced TxSaver to tackle a growing challenge: MEV attacks affecting user swaps. But we didn't stop there - we also made the whole transaction handling experience smoother.

In short, TxSaver lets you simply sign your transaction (e.g. Boost or Repay,) and handles everything else, including swap route refreshing and actually submitting the transaction onchain using MEV-preventing RPCs.

One thing we'd like to highlight is that TxSaver doesn't introduce any extra cost or additional fees. We just recognised a pain point for our users and set out to solve it.

So far, it's handled and protected over 550 transactions and $30 million in swaps volume, and we're expecting at least double the percentage of transactions submitted through TxSaver in the coming months.

New integrations

Given how differently time works in this space I kind of lost track of things and thought, well we didn't integrate that much new stuff this year, did we?

But boy did we ever:

- Sky Protocol

- Morpho (on both mainnet and Base)

- Euler v2

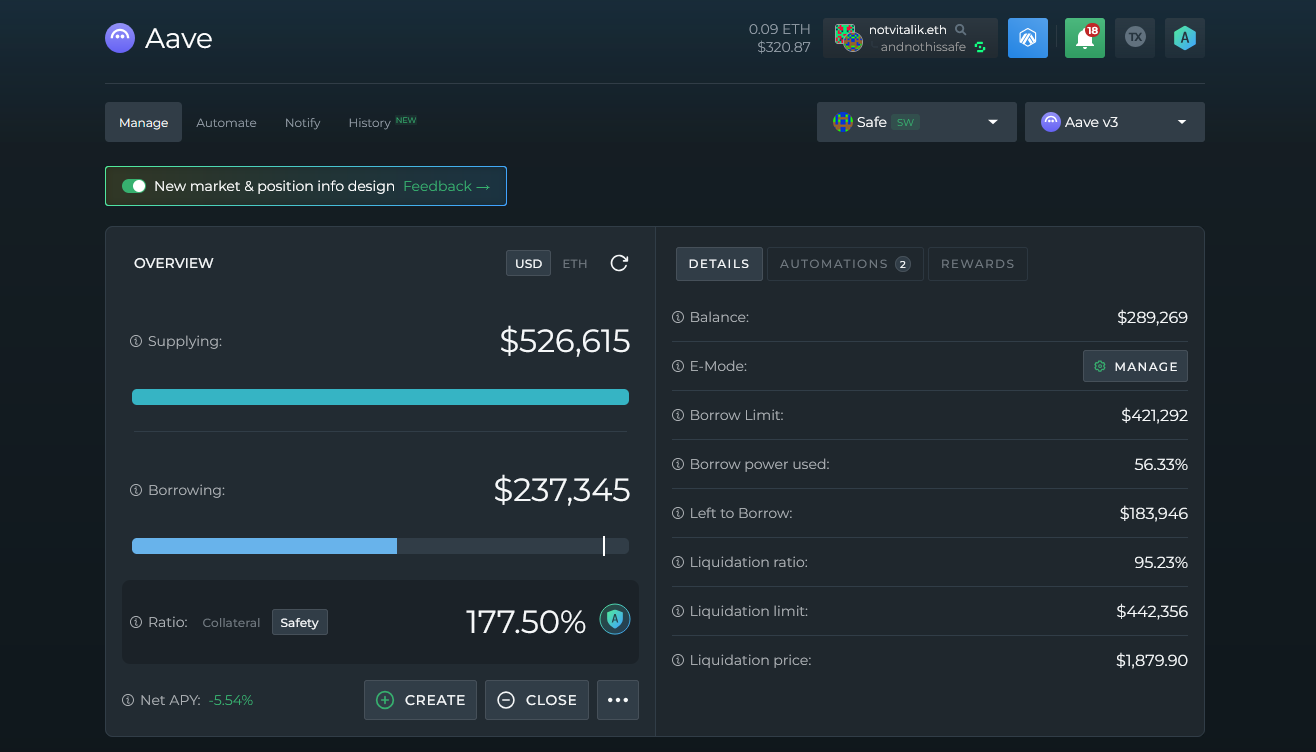

- New Aave instances (Lido & Etherfi on mainnet, v3 on Base)

- Multiple new Compound v3 markets across mainnet and L2s

- LlamaLend (on both mainnet and Arbitrum)

- Liquity v2; (we are so ready for launch‼)

This is a record number of new integrations in a single year for us, and we'll likely keep up the pace in 2025, too. The goal is to provide more choice to existing users, as well as an entry into this world of interconnected DeFi protocols to users of more protocols.

Additionally, we didn't just add new protocols this year; we made sure you can use them smarter:

- Introduced Loan Shifting for Morpho & LlamaLend

- Integrated Morpho Vaults into Smart Savings

- Pioneered Morpho and CurveUSD Automation options

- Integrated another DEX aggregator (Odos) to further ensure users get best rates

On top of all this, there have also been a number of various updates or ongoing developments that we believe make a lot of sense in the grand scheme of things. For example, there were the Automation security dashboard and Automation status updates, both of which provide more transparency and control to users.

And there were EOA leverage management (Boost and Repay) options added for all Aave and Spark users, making access to these signature DFS features a lot easier. These turned out even more popular than we expected, with over 1,200 Boosts and Repays executed for EOA positions alone.

Finally, there's also a redesign of our dashboards that's being tuned iteratively thanks to your feedback.

Market resilience

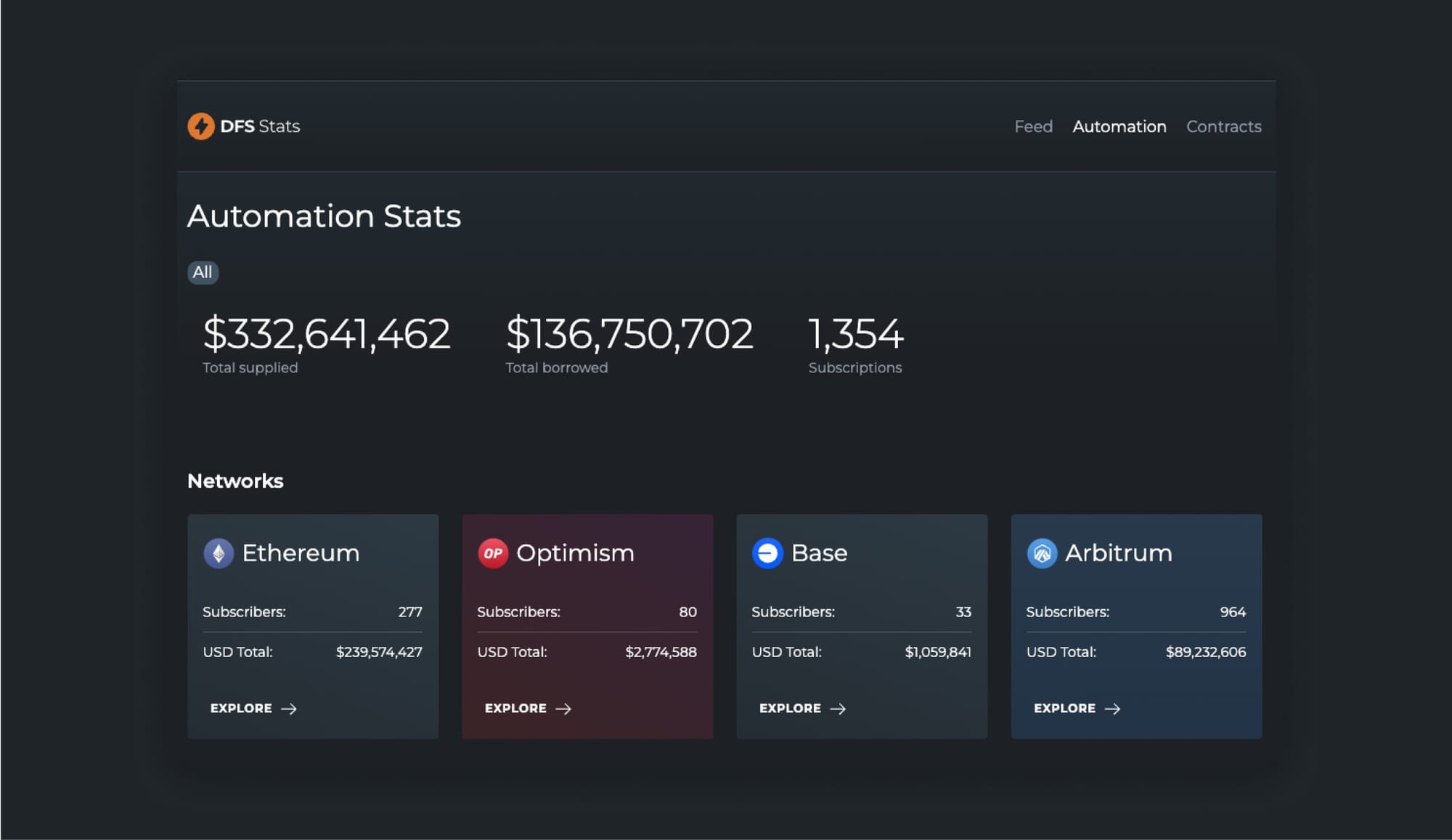

While it's been a bumpy year in terms of market activity, one thing's certain - the number of DFS Automation users was up only. The year started with a mere 426 automations running, but here we are today at 1,354 - a solid 3x.

On top of this, if we look at the sheer number of transactions, there were over 45,000 automated adjustments executed for users. We're still trying to add up the volume, though, so make sure to follow us on twitter for some more follow ups on stats.

Having pioneered DeFi automation since 2019, it’s superb to see its adoption grow, now faster than ever, as Ethereum L2s gain traction and lower transaction costs. We're thrilled that what began as a first ever feature in DeFi, evolved into a reliable automation system with an ever growing number of options.

With more automations in the pipeline (did anyone ask for Repay on Price and more protocols for Boost on Price?), we feel like this growth is a trend that's very likely to continue. And, as always, feel free to keep the requests coming.👂

P.S. For anyone interested in more numbers right away, you can always check out DFS Stats or the recently refreshed DFS Dune dashboard.

Touring in 2024

As is customary, we spent a good amount of time at community events. And this year was all about the B-places: we started things off with Berlin (for Dappcon and Safecon), then got back home for EthBelgrade, before heading out to EthCC in Brussels and wrapping the year up in Bangkok.

Each event had something special: Safecon was obviously very focused and great to meet up with more teams active in the Safe ecosystem, Belgrade was a great second edition of the team’s home event, EthCC was the usual highlight even for Europe, and Devcon was the perfect cherry on top as the incredible gathering of *everyone* working in Ethereum.

Plans for next year's travels are somewhat similar. For starters, we’ll be heading to Denver (excited to return after a two year break!), and then following that up with Safecon, EthBelgrade and EthCC with more TBD.

As for plans for DeFi Saver itself, we basically announced the next two integrations above, as well as some upcoming automation options. That'll make for a strong start of 2025. For anything else, it'd be best to join the DFS Discord - both for getting that inside scoop, as well as sharing feedback and requests.

Ultimately, the plan is to keep building the best tools for DeFi management.

And that is where we'll wrap things up for now.

To everyone who's used DeFi Saver this year, everyone we've worked with and everyone else in the trenches of DeFi and crypto - we wish you a happy holiday season and may 2025 be a good one!🥂