DeFi Saver integrates Euler v2

DeFi Saver integrates Euler V2, a recently launched modular lending platform that lets builders create customizable vaults using various digital assets.

Back in the day, Euler (oy-luh, not ju-luh or ju-lər) v1 quickly gained momentum upon launching in December '21, becoming one of the leading lending protocols in the Ethereum ecosystem with hundreds of millions in TVL, before unfortunately being hit by one of the largest exploits of 2023.

The devastating exploit happened on March 14, 2023, with the protocol losing around $200 million. The attacker exploited a vulnerability in the protocol's donateToReserves function, allowing them to create unbacked debt and manipulate the system with flash loans.

Multiple assets, including ETH, WBTC, USDC, and DAI, were stolen, downsizing Euler's TVL from $264 million to $10 million. Despite immediate efforts to recover the funds, some assets were already laundered through Tornado Cash, leaving slim chances for compensation.

But then a real miracle happened. Three weeks after the exploit occurred, and following a series of back-and-forth communications, the attacker “Jacob” returned all of the recoverable stolen assets to the Euler DAO treasury.

The whole story behind the hack is broader and stranger, with plenty to learn from. You can read it here.

After handling the situation well, the Euler team dedicated themselves to regaining trust and continued to build.

Comeback with v2

The new protocol version lets builders create customizable vaults using various digital assets, expanding lending and borrowing options compared to v1.

Euler v2 was launched in early September, introducing updates to improve DeFi with a modular design. Rather than a single lending project, you now have a platform for creating different lending setups with user-made token vaults. Each vault holds just one asset, simplifying things.

The v2 addresses common issues in lending platforms and focuses on becoming a flexible liquidity layer for DeFi. Monolithic protocols like Aave v3 achieve capital efficiency by pooling collateral but have strict rules for adding new assets, often requiring governance approval. On the other hand, isolated lending protocols like Compound v3 and Morpho offer more flexibility with collateral use but can lead to fragmentation, which might lower overall capital efficiency. Euler v2 aims to balance both.

Introducing Euler Vault Kit

A key feature in v2 is the Euler Vault Kit (EVK), which allows for permissionless deployment of ERC4626 vaults, along with the Ethereum Vault Connector (EVC) for linking vaults.

You can now choose between governed vaults, which have active management, and ungoverned vaults, where you maintain full control. This setup offers flexibility based on your preferences and risk tolerance. The interconnected system helps grow liquidity by letting old vaults be used as collateral for new ones and allowing new vaults to tap into existing liquidity.

Euler v2 introduces several classes of vaults.

Governed Vaults: These vaults are actively managed. The governance system handles decisions like risk and asset management, so it works if you prefer structure.

Ungoverned Vaults: Here, you’re in charge. There’s no external oversight, giving you full control to manage your assets how you want.

Escrowed Collateral Vaults: This class allows users to deposit assets as collateral while keeping them in escrow. This feature helps manage risk and boost security during lending and borrowing.

Yield Aggregator Vaults: Finally, these vaults automatically find and optimize yield by aggregating and redistributing earnings from various strategies, so you can maximize returns.

For more on this update, take a look at the full article here.

Euler v2 brings new incentives

With the v2 rollout, Euler has launched a new incentive program. rEUL (Reward or Royal EUL) is a new locked version of EUL designed to reward early adopters of v2 while also simplifying the existing points system, which will be phased out.

Over the next year, up to 5% of the total EUL supply will be distributed as rEUL to both supply and borrow sides of selected markets, with some campaigns targeting specific collateral/debt pairs. rEUL converts to EUL at a 1:1 ratio over six months, unlocking 20% right away and the rest gradually. Note that any locked EUL remaining when redeeming will be forfeited.

What does the DeFi Saver integration bring to the table?

Let’s dive into the details of DeFi Saver’s integration with Euler. Here's what it offers.

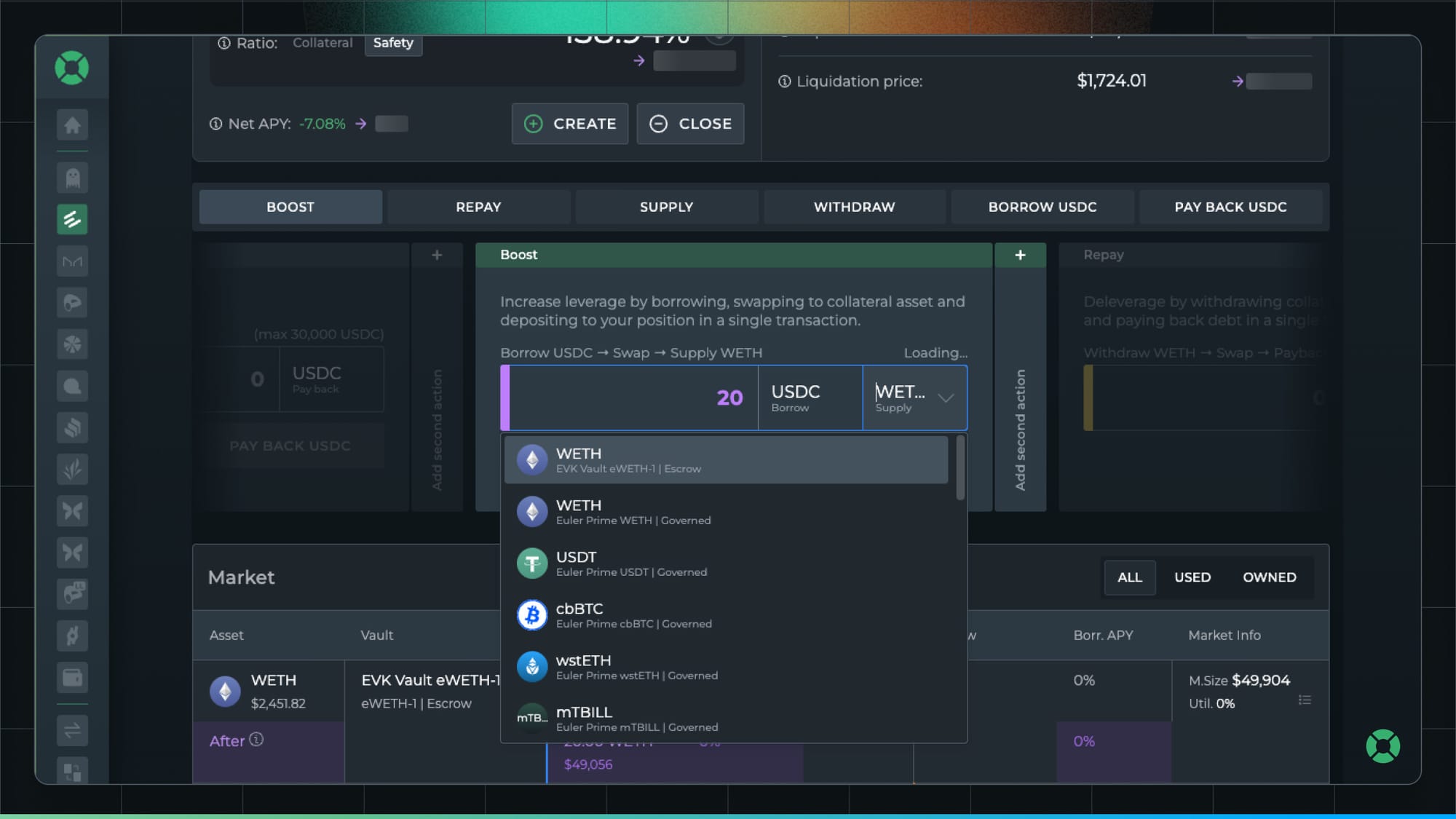

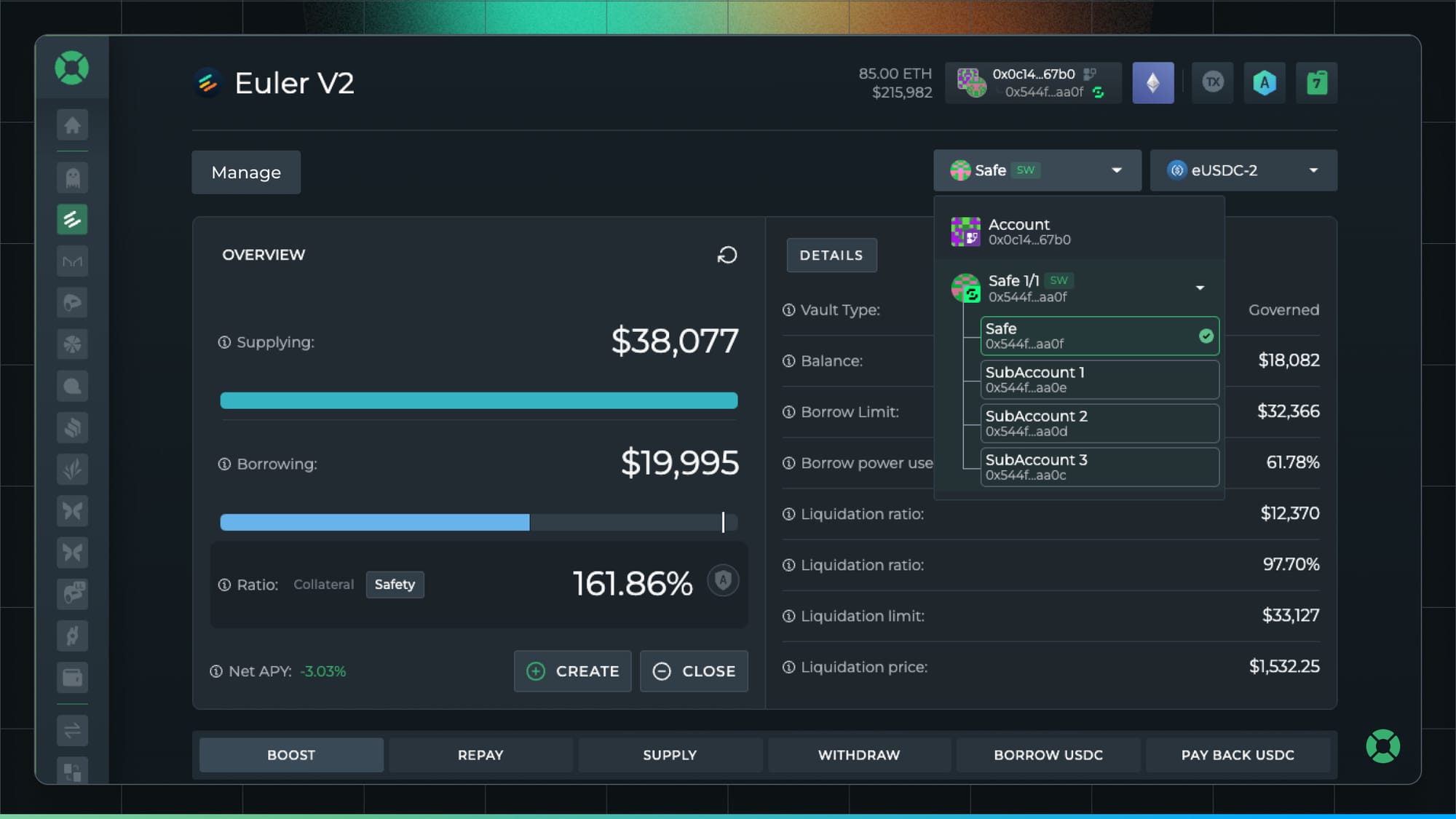

You'll find our standard set of advanced actions also available in the Euler dashboard. Our signature features, Boost (increasing your asset exposure in one transaction) and Repay (reducing it), are both available.

Plus, you can use Open and Close options for creating and closing (either simple borrow or leveraged) positions in a single transaction, making everything more efficient. One thing that is missing is Automation, but that may just be the case for now.

That’s a wrap for today. Hope you’re as excited about another major integration as we are. You know the drill – feel free to drop any suggestions and requests in our Discord server, especially about this integration. The pack of Nikolas (and non-Nikolas) is always at your service.