DeFi Saver Newsletter: April 2021

Welcome to the DeFi Saver Newsletter: Recipe Creator has been released, Simulation mode is live, DeFi Saver Architecture Overhaul, Aave news

Ah, spring — the season when everything is blooming, days grow longer and Ethereum reaches new all-time highs. Though only that last bit is true on both sides of the Equator.

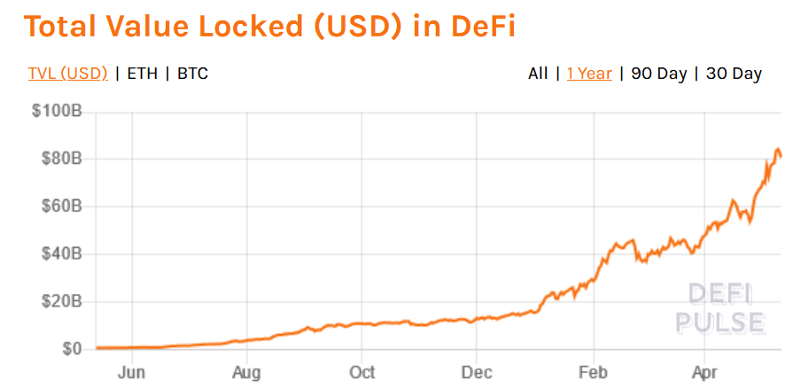

For all of us building through the bear market, it really was pretty incredible to see Ethereum rising to $3,000 and climbing onwards steadily. And, with the market soaring, we also saw the total value locked in DeFi continously rising higher, too, reaching a staggering $80B.

In other Ethereum news, the Berlin network upgrade rolled out successfully, introducing some gas pricing changes, but no updates that would result in lower transaction fees. However, the core devs suggested a block gas limit increase soon afterwards and the miners quickly voted it in. This seems to have helped a bit, combined with flashbots adoption and some activity moving over to L2s and sidechains.

With Berlin behind us, EIP-2929 included, and Geth by default running snapshots (if you're not, do), I don't have any immediate objections to raising the gas limit to say 15M (let's not go crazy). Not saying to- or not to, just that I myself see no instathreat doing so. #Ethereum

— Péter Szilágyi (karalabe.eth) (@peter_szilagyi) April 20, 2021

The DeFi ecosystem had some major news, too, one of them being the launch of Liquity, an ETH-only lending protocol that allows users to borrow LUSD, a USD pegged stablecoin, down to a minimum of 110% collateralization ratio, though with some additional rules. The project attracted so much attention that they had $100M TVL in hours, $1B in 10 days, and over $3B by the end of the month.

On the other hand, the much-hyped algorithmic stablecoin project Fei got off to a pretty poor start, quickly crashing off peg by 50% as developers tried to resolve previously undiscovered issues. While the protocol’s genesis period attracted over 600k ETH, the amount of Ether in the protocol has gone down 4x in a matter of weeks and has been sitting there since.

But let’s now move on to some of our biggest news, because we’ve had an incredible month, too.

DeFi Saver news and updates

Recipe Creator has been released

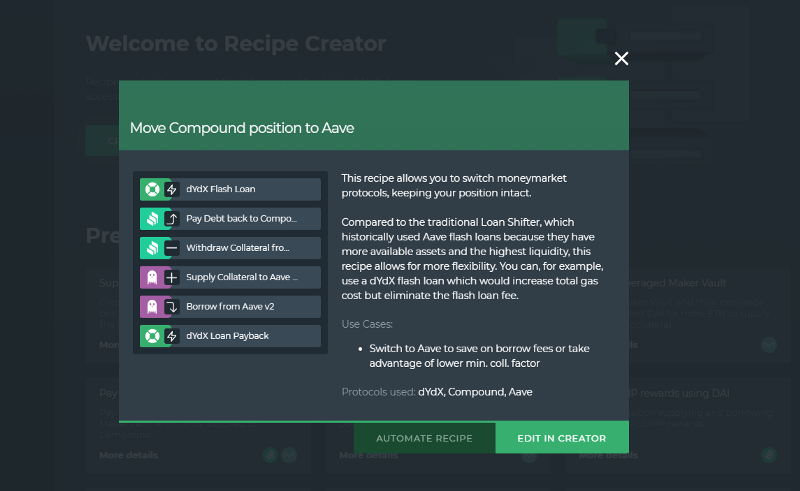

This latest addition to the DeFi Saver toolbox allows users to put together various DeFi legos in the form of different actions involving multiple protocols and running them in a single transaction. We aimed to provide this functionality through an informative, approachable, and highly functional interface, as our users have come to expect.

The Recipe Creator currently allows users to combine flash loans from Aave and dYdX with actions from protocols that include the likes of MakerDAO, Compound, Aave v2, Reflexer, and Uniswap v2. We have a plan for a gradual expansion and addition of other major DeFi protocols as we move forward and you can expect a few more interesting integrations very soon.

One small addition that many found interesting is the natural language processing option that allows users to simply tell the interface what they want to set up and let the app prepare their recipe. For example, users can type in “borrow 10,000 Dai from Compound and deposit into Aave v2” in the app and let it create the custom recipe for them. Although this is still in an early stage, the plan is to make the tool even more welcoming to new users.

Today we're introducing the Recipe Creator - an advanced DeFi transaction builder!🥳

— DeFi Saver (@DeFiSaver) April 19, 2021

The Recipe Creator allows users to combine any number of actions from different DeFi protocols, as well as flash loans and swaps into a single transaction.🧑🍳

👉https://t.co/TI8wnZhjIF pic.twitter.com/eOpEXlNQIK

The release has seen overwhelmingly positive reception from the community, with many praising the interface and we’ve already seen over ~200 different recipe transactions executed in the first two weeks.

Simulation mode is now also live

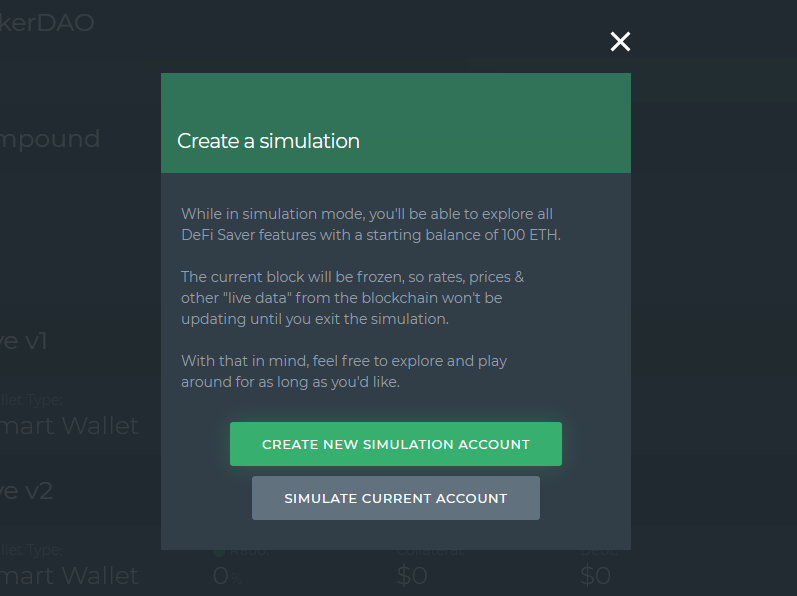

Together with the Recipe Creator, we released another pretty major feature many were eagerly awaiting — the Simulation mode. It allows users to experiment and play around with any DeFi Saver tools without having to pay any fees or spend any funds at all. This turned out to be hugely beneficial for both testing the little nuances and providing users with a testing ground to see how things would work prior to actually doing it. Launching it together with the Recipe Creator was of the essence and certainly made many users more comfortable with trying the real thing.

What the simulation mode does in fact, is it essentially creates a private fork of the Ethereum mainnet for users at the moment they turn it on, with the available choice of simulating using their existing account or a fresh account loaded with 100 ETH. This is a perfect option for anyone looking to get comfortable with the DeFi Saver app, as well as for everyone who wants to test out their created recipes or ideas without having to commit actual funds right away.

We’ve already seen over a thousand variants of recipes being tested and created using the Simulation mode, proving how useful this really is.

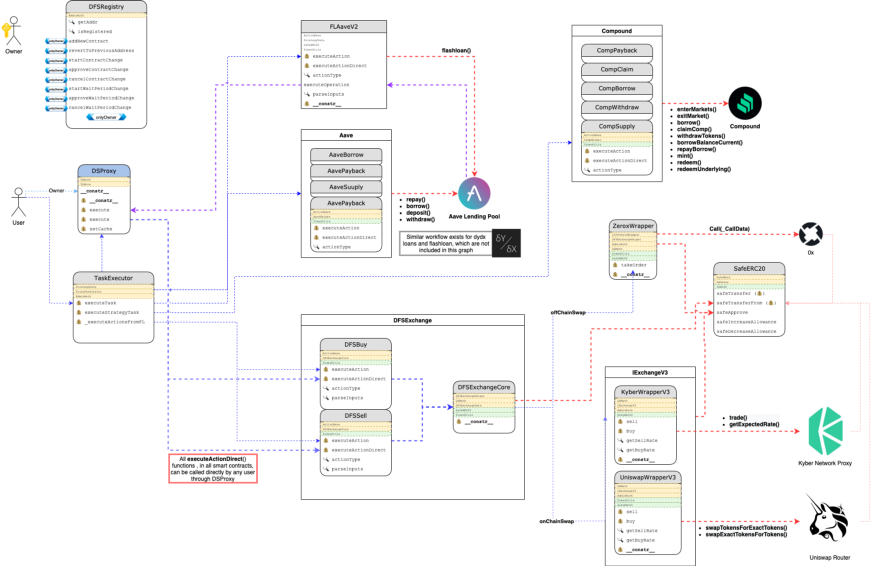

DeFi Saver Architecture Overhaul

The architecture upgrade we mentioned in the previous newsletters is now live. In fact, the Recipe Creator is actually the showcase feature of the smart contracts overhaul we had in the works for more than a few months now.

Before, complex, multi-step actions were coded as a single long sequence of actions, while now the new architecture consists of a number of small, separate actions which, when combined, can create any advanced action, something that provides those Recipe Creator functions for users. This new approach will allow our team to be better and quicker at revisioning any existing protocol integration, while at the same time granting more freedom to the users.

With the new architecture we also laid the groundwork for a quick launch on any of the upcoming L2 networks such as Optimism, Arbitrum, and zkSync once they launch publicly.

Secured & Audited

We continued with the practice of inviting external auditors to check all of the features prior to the release. This time around, two teams audited all of the smart contracts, ConsenSys Diligence and Dedaub, both of which are teams that will likely also audit any future protocol integrations. Feel free to check out their reports here.

The new architecture doesn’t allow for any ERC-20 token approvals to be made to commonly-used contracts. Instead, the user’s smart wallet is used, thus mitigating the risk present in some protocols. We’re staying firmly devoted to the security and safety of our users, with the goal to protect users from both unnecessary smart contract risk as well as market risk, as was already the case with their automated liquidation protection features.

Aave news — liquidity mining, v1 to v2 migration and more

Almost coinciding with our launch of the Recipe Creator, was the Aave introduction of liquidity incentives. Aave Improvement Proposal (AIP) 16 received almost absolute support, allowing liquidity providers and borrowers in Aave’s USDC, DAI, USDT, GUSD, ETH, and WBTC pools to earn stkAAVE rewards in addition to their standard rates.

📢Liquidity incentives are now live on @AaveAave v2!

— DeFi Saver (@DeFiSaver) April 26, 2021

💡If you want to maximize your rewards, you can create leveraged same asset positions (e.g. $DAI/DAI or $USDC/USDC).

👉You can do this at https://t.co/4KE0j5xscv - just select the "Mine AAVE rewards" recipe and fine-tune it. pic.twitter.com/PpSEOiksDx

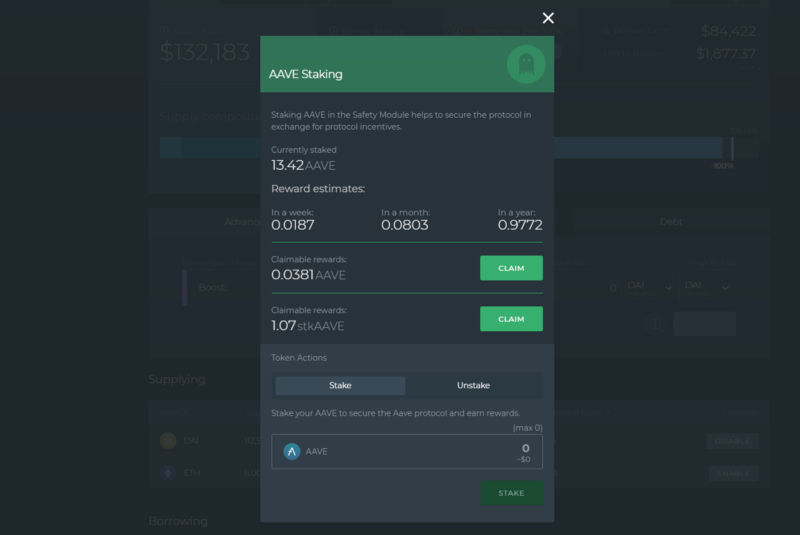

With liquidity incentives live on Aave v2, we quickly added $stkAAVE rewards to our dashboard. Anyone can now find, check and claim their rewards in the [STAKING] tab of our dashboard. Anyone can also check their estimated yearly rewards.

With Aave v2 offering better rates, gas optimisation and the aforementioned liquidity incentives, we also introduced an Aave v1 to v2 migration tool for Smart Wallet users.

⚠️Note that Automation support for Aave v1 will be deprecated in June 2021. If you’re still using Aave v1, we strongly recommend migrating to v2, especially for Automation, as it has reduced transaction costs and more powerful, flash loan powered, Boosts and Repays.

DeFi Saver bug bounties with Immunefi

This month we’ve also posted bug bounties on Immunefi, a leading bug bounty platform in the DeFi and broader Ethereum space.

Our bug bounty program is primarily focused on smart contracts, while we are mostly concerned with the potential loss of user funds and approval/auth attacks. Learn more about this in our announcement blog post.

Together with regular smart contract audits, this is another step towards making DeFi Saver the safest possible environment for all of our users.

April Stats

As of April 30, there were 513 MakerDAO, 70 Compound and 50 Aave positions with Automation enabled — a total of 633 automated positions.

This is a decrease of some 100 positions compared to March, caused in the greatest part by the greatly increased minimum debt requirements for Automation, though we have also seen a number of older positions being closed out by users. As a reminder, the minimums are now 40,000 Dai debt for MakerDAO or $60,000 in debt for Compound and Aave.

The total amount of managed collateral at the end of April was 280,000 ETH, 730 WBTC, 131,390 LINK, 223,960 UNI, and 3,840 AAVE, among other collateralized assets. In total, DeFi Saver Automation was managing over $940m of collateralized assets in different user-created positions at the end of April — an increase of 50% over March!

The user activity at DeFi Saver in April was extremely high and our users set new, incredible records.

In total, the transactions made in April resulted in a new monthly volume record of $481m in over 5000 unique transactions.🤯

Community shoutouts

This has been one heck of a month with lots of stuff happening, in all of Ethereum, DeFi, and here at DeFi Saver. You guys shared a lot of praise for the Recipe Creator update and we can’t help you enough for that. Here are some of the highlight shoutouts from a thrilling April.

The Alchemy team, our now long-standing partners, have helped us share the Recipe Creator news:

HUGE congrats to the entire @DeFiSaver team on this incredible launch🚀

— Alchemy | We're Hiring! (@AlchemyPlatform) April 19, 2021

We are extremely proud to be powering this game changing product!! #AlchemyAmplify https://t.co/r2EYZt4IQl

Chris went ahead and posted some praise for our Recipe Creator:

🙌 @DeFiSaver is one of those projects that is always just quietly working in the background, getting better and better, staying trustless in the process.

— Chris Blec (@ChrisBlec) April 26, 2021

Their new "Recipes" feature (incl flash loans) is wild. Be careful tho, don't get rekt. https://t.co/SWpNF5YQHi

Marc from Aave posted some tips on getting the most out of AAVE liquidity incentives:

Nice thread,

— 0xAave-Chan 🦇🔊 (@lemiscate) April 26, 2021

But do you even cross-chain yield farm bruh?

AAVE -> Polygon market -> Borrow USDC -> Zapper bridge to L1 -> USDC to @Instadapp or @DeFiSaver USDC Deposit/borrow leverage loop$MATIC rewards on AAVE deposit and USDC borrow

Stk $AAVE rewards on USDC leverage loop https://t.co/nHUNS8aX7z

Darren also suggested using DeFi Saver to maximize AAVE rewards:

.@AaveAave had AIP-16 go live, which means

— Darren Lau 👘 (@Darrenlautf) April 28, 2021

-> 2200 $stkAAVE per day will be distributed at a 50/50 ratio between depositors and borrowers.

-> AAVE now in the 10 billy club

-> You can use both @Instadapp and @DeFiSaver to maximise your yields 👨🌾

Captain Nemo posted about our new Simulation mode:

My two fav gangs did something amazing @TenderlyApp @DeFiSaver

— Captain Nemo 🇪🇹🦞🦇🔊 (@ncerovac) April 19, 2021

Now you can do a test simulation of your newly created recipes via DeFiSAver.

Kinda like being a responsible ape! https://t.co/jjdtSFKDid

And Mariano had a post about a new liquidations engine in MakerDAO and how that could make things spicier all around:

Honestly, I can't wait to see what kick ass integrations you build with this 🤩

— mariano.eth ✨ᕙ༼🐶༽ᕗ✨ | 🦇🔊 (@nanexcool) April 19, 2021

This is @DeFiSaver heaven right here

Thank you for being with us and make sure to jump into our discord to talk more!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum