DeFi Saver Newsletter: January 2021

Vulnerability within Compound importing contracts, support for B.Protocol MakerDAO Vaults, Automation simulation tool, Updated 0x aggregation API

January was such a thrilling month, with Ether picking up momentum and breaking its all-time highs multiple times, after three full years.

That doesn’t mean everyone stopped to look at the charts, quite the contrary, the events in the space never stop — there was Kyber Network announcing version 3 of the protocol, Reddit coming out with a partnership with Ethereum and 0x launched v4 of their decentralized exchange protocol, to name a few highlights.

Last month unfortunately also saw us go back to levels of network congestion similar to last summer, with barely any days with gas prices below 100 Gwei, which has left many users dissatisfied while numerous teams keep working on L2 scaling solutions.

We had a bunch of news to share from our camp, too, so let’s take a look at a summary of last month at DeFi Saver.

DeFi Saver news and updates

The recently discovered vulnerability within Compound importing contracts

In the first week of the New Year, we were contacted by the Dedaub team who found an exploitable vulnerability in our smart contracts used for importing (or migrating) Compound positions.

We performed a white hat action on all affected accounts and we are glad that we can share no users suffered lost funds.

We published a summary post as soon as everything needed was completed, and the Dedaub team shared their view of these events on their blog, too, which we definitely recommend checking out for anyone interested. The Dedaub team has also received a bug bounty for finding the issue and helping us handle it properly.

Security is our utmost priority and we have already engaged with the Dedaub team in auditing our Automation services, while we also arranged for audits for our upcoming architectural updates with the Consensys auditing team.

Added support for B.Protocol MakerDAO Vaults

The B.Protocol team is working on providing a stable backbone for decentralized finance, where any larger liquidation events wouldn’t lead to larger than expected losses for users. Moreover, B.Protocol actually aims to reduce the liquidation losses, as explained in their introductory post.

As of early January, you can manage your MakerDAO positions that are in B.Protocol using DeFi Saver, including all standard protocol interactions, as well as our Boost and Repay features.

Now you can use B.Protocol at @DeFiSaver,

— B.Protocol (@bprotocoleth) January 21, 2021

Boost and repay your Vault.

Read here how:https://t.co/WPDaXMu8Bp

Great work by DeFi Saver team, and we look further for more supported features soon. https://t.co/BP7dHTScwX

We also plan to add Automation support for any positions in B.Protocol, as we see these options as complimentary in reducing uncertainties for end users.

The team was also kind enough to prepare a short guide on using DeFi Saver, so give it a look if you’re interested in switching over.

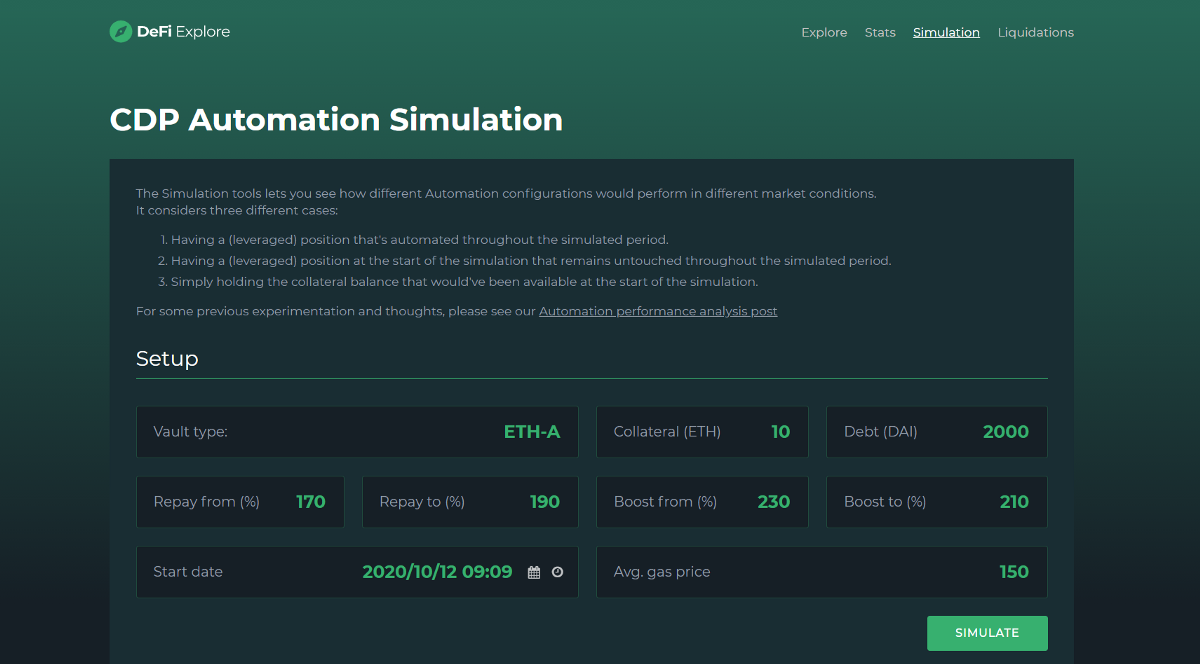

New Automation simulation tool

Our Simulation tool available at DeFi Explore has received a major update and now supports all collateral types available in MakerDAO.

Perhaps even more importantly, though, it now also considers estimated expenses on transaction fees, which have been constantly high ever since the summer.

Note that the Simulation tool isn’t perfect, but it should give you a rough idea of what you could expect over any simulated periods with different starting balances.

Updated 0x aggregation API

Ever since the beginning of 2020 we have gradually been integrating the 0x API into all DeFi Saver features. As the market activity ramped up at the start of the year, some users noticed occasionally lagging prices during times of high market volatility.

0x v4 is our biggest protocol update so far

— Fulvia 🍵 (@fulviamorales) January 8, 2021

Our team has been working around the clock to improve the protocol — the foundation for 0x API, our relayers and our market makers. Read more about all the improvements below 🚀#YearOfThe0x https://t.co/gOcfvlQS2G

We’re very happy to share the overall stability has greatly improved with the update to the newer 0x API version, which also included some noticeable gas optimizations, among other updates.

With the use of 0x API, we get to provide users with liquidity from 20+ sources, including Uniswap, Sushiswap, Curve, Kyber, Mooniswap, Balancer and Bancor. It’s the same aggregator engine that powers Matcha and it’s what enables having little to no slippage at DeFi Saver even with swaps of millions in one transaction.

January stats

As of January 31st, there were 635 MakerDAO, 73 Compound and 29 Aave positions with Automation enabled — a total of 737 automated positions and an increase of 81 over December.

The total amount of managed collateral at that point was 237,360 ETH, 2,700 WBTC and 36 YFI, among other user collateralized assets, totaling over $420m. You may notice that the managed ETH amount is significantly lower than in our previous newsletter, which is the result of the largest Maker Vault in existence disabling Automation during January, probably thinking they’re now definitely safe enough at 500%+ c-ratio, though they never really had active Automation transactions in the first place.

Now, for the slightly incredible part:

User activity on DeFi Saver in January resulted in over $430 MILLION in volume made in over 11,700 unique transactions.🔥🔥🔥

The 0x API has seen HUGE increases in volume through partners like @DeFiSaver recently. Defisaver has grown their volume through the 0x API by 500% in the last 30 days!

— Blake Henderson (@HendoVentures) January 28, 2021

When applications using the 0x API grow:

they win,

their users win,

and the ZRX community wins. pic.twitter.com/Qm6Fj1YBdt

If you’ve perhaps seen our yearly recap post, we mentioned there that our yearly volume for 2020 was $291,5m, making it an absolutely incredible achievement to smash that number within just the first month of the new year.

Community shoutouts

There have been a ton of posts from you guys lately — we can’t tell you how much we appreciate those.🙏

Lucas from Maple Finance shared some love for liquidation protection during the crash on January 11th.

Shoutout to @DeFiSaver for saving me a total of 7 times in the last 24h across two of my CDPs

— Lucas Manuel 🥞🌹🇪🇹 (@lucasmanuel_eth) January 11, 2021

Nik from MakerDAO talked about how low leverage long positions can work out great vs other options out there, and Gav gladly joined with a DeFi Saver recommendation for exactly that use case.

Degens & their boomer cash flow!

— 0xGav.eth (@0xGav) January 12, 2021

I agree using on chain conservative leverage is a great play. I did this via @MakerDAO / @DeFiSaver CDP https://t.co/L4xtmzvpQM

Icebergy, a popular member of the crypto twitter crowd, had a similar idea, though specifically for Aave.

allow me to introduce to you to AAVE and @DeFiSaver

— icebergy ❄️ (@icebergy_) January 25, 2021

Lastly, Simon shared some appreciation for our gas prices extension.

There's a great little browser extension from @DeFiSaver for those frustrated about the DeFi gas crisis (which let's face it isn't going to go away any time soon). It gives a convenient display of gas price info and will even notify you when prices drop to a predefined level. pic.twitter.com/xDOaPRFZge

— Simon Waddington 🌱🌖💉🦇🔊 (@enmodo) January 25, 2021

Hope you enjoyed our rundown of events that took place in January and here’s to a great February — may the gas prices be ever in your favour.🙌

Stay tuned and talk soon!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter