DeFi Saver Newsletter: June 2021

Welcome to DeFi Saver Newsletter: June 2021. Our Liquity dashboard, New Recipe Creator options, June stats, and more are now live.

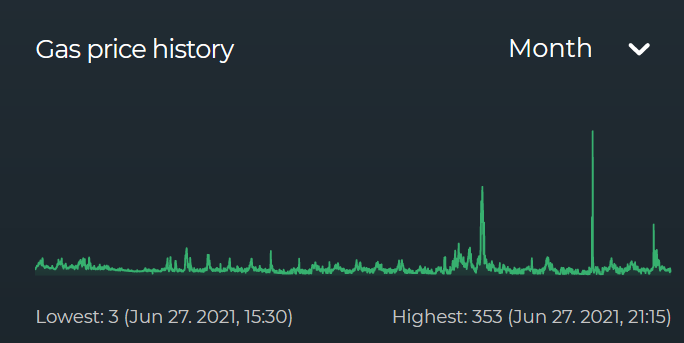

Things have settled down a lot after the wild ride that was the market peak followed by the subsequent ~50% crash in May. June has been a much less volatile month and the very low gas prices lately (except during a few recent generative NFT launches) are a very clear indicator that the on-chain activity is quite a bit lower, too.

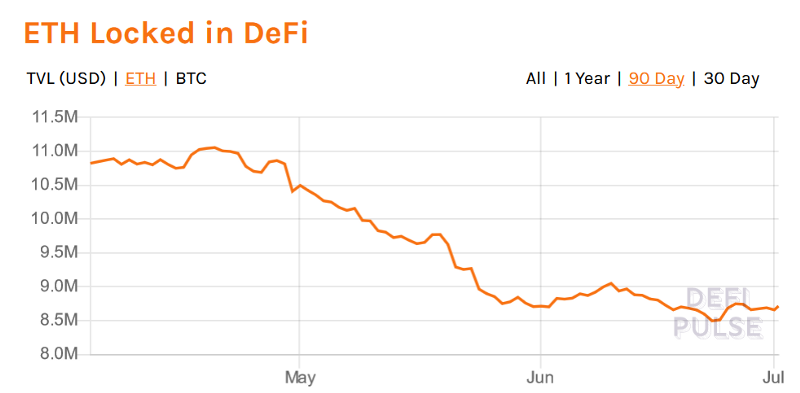

Even looking at the amount of ETH locked up in various DeFi protocols shows a trend of cooling down, but perhaps it’s just a temporary one, before another DeFi Summer kicks off? Guess we’ll find out over the next month or two.👀

In the meantime, even in a seemingly slow month, there have been significant news in the decentralized finance ecosystem, including Curve’s first volatile assets pool, Alchemix’s highly anticipated alETH launch (quickly followed by an unfortunate, though seemingly well isolated incident), as well as the announcement of the latest Andreessen Horowitz $2.2B crypto fund.

Here at camp DeFi Saver, we kept working on great new integrations, as well as our new Automation architecture.

Let’s get into more details about the latest additions and most recent stats.

DeFi Saver news and updates

Our Liquity dashboard is now live

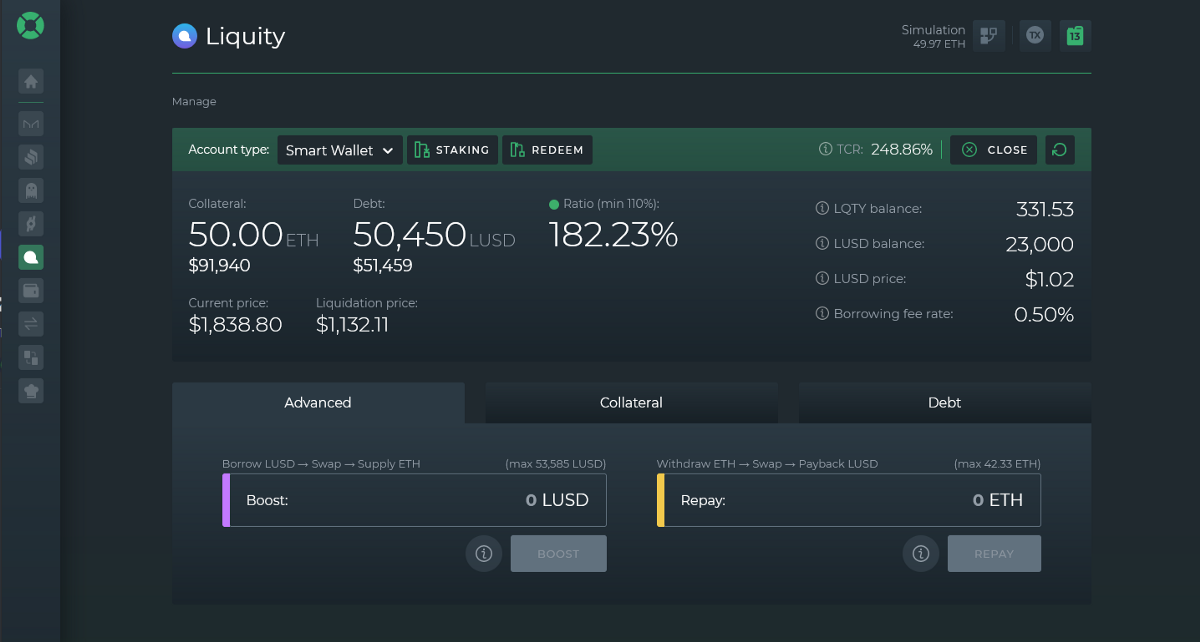

The latest protocol added to DeFi Saver is no other than Liquity, the project that introduced the LUSD stablecoin backed by ETH only, as well as a plethora of innovative internal protocol mechanisms including optimized liquidations, the Stability pool, LUSD redemptions, and more.

Liquity took off massively upon launch and it’s easy to see why — the protocol offers extremely low borrowing fees (there’s currently a 0.5% fee on the borrowed amount, without additional ongoing borrowing rates later on) combined with a very low minimum collateralization ratio of 110%. A quick math check shows that Liquity will be the cheaper choice (than Maker, Compound or Aave, for example) for any loan lasting longer than a month, basically.

Our completely new Liquity dashboard provides the full suite of management options for the new protocol, complete with our signature Boost and Repay features for 1-transaction leveraging or deleveraging.

You can find our more complete introduction to Liquity and unique new Liquity features that we enabled in our introduction post here.

New Recipe Creator options

With 13 completely new Liquity actions, 1 new utility action and a number of tweaks to previously available actions, the Recipe Creator is becoming one very powerful tool.

Some examples of new Recipes involving Liquity that users can now create and execute in one, single transaction include:

- Migrating a MakerDAO ETH CDP* to Liquity

(*or a Compound/Aave ETH position, or even a Reflexer Safe) - Creating a Liquity Trove and depositing LUSD in the Stability pool (to earn ETH and LQTY rewards)

- Creating a Liquity Trove and depositing LUSD/ETH in a Uniswap v2 pool

- Creating an instantly leveraged Liquity Trove (to long ETH using Liquity)

One stat we find very interesting is that there has already been over 2,748 ETH and 2.96m debt moved from MakerDAO to Liquity using our Recipes.

June Stats

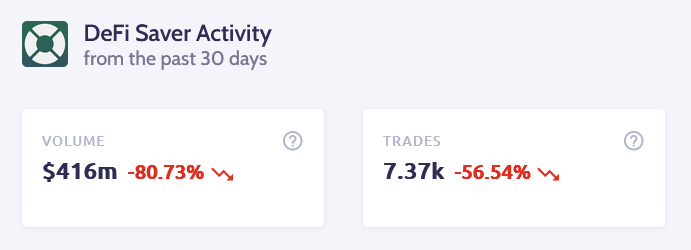

In terms of activity at DeFi Saver, we can definitely see that global network downtrend, too, with a really much calmer month than May (which we expect will remain a standout month for some time to come). Still, the volume and transaction numbers we’ve seen in June remain impressive and miles above any month in 2020.

In total, users made around $400m of actual trade volume in various leverage management actions and custom recipes during June, with over 5,100 transactions unique to DeFi Saver executed.

In terms of Automation specifically, at the end of June there were 423 MakerDAO, 57 Compound and 53 Aave automated positions — a total of 533 with Automation enabled.🤖

The total amount of managed collateral at the end of June was 157,200 ETH, 600 WBTC, 590 MKR, 80,000 LINK, 148,000 UNI, and 4,600 AAVE, among other collateralized assets. In total, DeFi Saver Automation was managing over $430m of collateralized assets in different user-created positions at the end of June.

Community shoutouts

While June may have been a much calmer month overall, there was certainly no lack of posts of appreciation from the community.

Firstly, a bunch of you went out of your way to show some love for the new Liquity integration, like Chase:

I created my first CDP with @LiquityProtocol at around $1900 per ETH using @DeFiSaver, super easy to setup and use.

— 🔱 Chase Yield 🦇🔊 (@0xChaseYield) June 22, 2021

And Connor, too:

This is incredible. I’ve seen so many people want to use Liquity but want to have an easy way to move their Maker CDP over first. Can’t wait to try this out. Great work guys!

— Connor Herman (@Connor_Herman) June 18, 2021

Then there were some throwbacks to our gas prices extension hype from the month before, from our Spanish speaking friends:

Que lindo los valores del gas en #Ethereum 😀

— DeFi Para Principiantes (@definovato) June 4, 2021

PD: me encanta la extensión de @DeFiSaver para el navegador ❤️ pic.twitter.com/NS2qr5XuaY

And, finally, we really have to mention Lefteris who jumped in to shill DeFi Saver in this thread by DeFi Prime.

For DeFi and ethereum only I would say @DeFiSaver.

— Lefteris Karapetsas | Hiring for @rotkiapp (@LefterisJP) June 27, 2021

Easily saved the lives of many ethereans, makes things easier for more and makes awesome tools for all of us.

Why undervalued? No token yet ;)

(In case you don’t know Lefteris, he’s the founder of Rotki, a brilliant privacy-focused portfolio tracking app you should definitely check out!)

No matter which direction the market goes, we’ll be there to continue building the advanced tools needed for the proper management of DeFi positions.

Stay tuned for more!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum