DeFi Saver Newsletter: March 2021

Welcome to DeFi Saver Newsletter: Reflexer (RAI) dashboard released, Aave v2 Automation introduced, DeFi Pulse listing, March stats, and more...

The month of March kept everyone on their toes as it approached, with the trauma of last year’s disastrous crash on March 12 ominously present in the air.

However, March came and went rather peacefully, and while it may have been trauma that caused the late-February market dip, the recovery and push back towards $2,000 for ETH seemed to indicate the bull market was all but over. What’s more, the Ethereum community had more great news, with the long-awaited EIP1559 confirmed and scheduled to go live with the “London” network upgrade in July.

In the decentralized finance space, the most prominent piece of news must have been the announcement of Uniswap v3 with incredible efficiency improvements (and let’s not forget the beautiful teaser video on the day before). Some other highlights from the month included Compound releasing prototype of Gateway (previously announced as Compound Chain), Aave introducing an AMM market (with support for a number of Uniswap v2 and Balancer LP tokens) and MakerDAO community sharing plans regarding an Optimism Dai Bridge.

Something else we feel we need to touch on separately in this post are various scaling options, either upcoming or already launched. In terms of L2 networks currently in the works, March brought the unfortunate news of Optimism mainnet launch delays, with the full public mainnet launch expected sometime in July. The Arbitrum team recently shared a similar timeline, with their mainnet release candidate testnet just launched. And then there was also zkSync (which is based on zkRollup technology, compared to Optimism and Arbitrum that are based on optimistic rollups) that shared somewhat unexpected news of full mainnet launch expected in August.

Most of the DeFi community probably also caught news of Aave launching on Polygon (previously known as Matic), though the adoption so far seems to indicate that most users are willing to wait for L2s rather than hastily jump to sidechains — Aave on Polygon currently has a TVL of just $6,3m, compared to $3,6b in Aave v2 on Ethereum L1. The difference between L2 networks and sidechains being that L2s carry over the security from the Ethereum L1 chain, while sidechains are basically L1s of their own, completely separate chains with asset bridges that are often very centralized.

As for our team, we spent March completing security audits for our architectural upgrade and polishing our upcoming new features for an imminent release, as well as as bringing some of our current integrations up to speed.

DeFi Saver news and updates

First look at our upcoming features

Our front-end team lead Nikola Vuković has joined the MetaFEST Conference held by MetaFam on March 16 to showcase some of the new features we’ll be rolling out soon. If you’d like to get a sneak peek into simulated accounts and transactions, cooking up DeFi recipes and how natural language processing can turn your words into a ready-made batch of actions for you to run — then feel free to check out the recording right here:

We won’t be going into any more details on any of this right now, though, as all of this is very close to release.

Reflexer (RAI) dashboard released

The Reflexer protocol and RAI were one the most highly anticipated launches in the recent DeFi history and we were very glad to introduce support for managing Reflexer Safes almost from the first day.

You can now manage your RAI positions using @DeFiSaver ❤️https://t.co/FbneJnCxjc

— Reflexer Labs (@reflexerfinance) March 6, 2021

The goal of RAI is to be a trust-minimized, stable asset backed only by ETH. One of its most promising use cases right now is leveraging long ETH at low interest rates, as a good alternative to MakerDAO.

Our current support for Reflexer includes all basic protocol interactions, as well as our 1-tx leverage management options Boost and Repay. If you have any other feature requests for Reflexer, make sure to let us know in our Discord!

If you’re interested in opening a Reflexer Safe or already have one that you would like to manage more efficiently, please feel free to check out our dashboard at: https://app.defisaver.com/reflexer. It’s fully compatible with Reflexer’s own app and you can freely switch between the two whenever you wish to.

Aave v2 Automation introduced

We finally introduced Automation support for Aave v2 towards the end of March, after a number of internal revisions and testing cycles. The improvements compared to Automation for Aave v1, however, should make it well worth the wait.

Automation for Aave v2 includes three very important upgrades over Aave v1:

- Boosts and Repays in Aave v2 are extended — they have added support for flash loans, meaning much greater leverage adjustments can be made in one transaction. This is something that’s not present in our Aave v1 options, due to minor compatibility issues with the v1 protocol.

- Gas usage has been optimized and Boosts and Repays in Aave v2 now use up to 30% less gas per leverage adjustment, compared to transactions in Aave v1. This was made possible both due protocol optimizations made by their team, as well as thanks to some clever Boost/Repay logic reworks by our team.

- You can use a lower minimum Safety ratio of 115% for Automation (compared to 120% with Aave v1). Note that the Safety ratio in Aave v2 is still associated with the collateral factor (maximum Loan-to-Value) allowed by protocol. However, the liquidation point in Aave (both v1 and v2) is beyond that point (for some assets noticeably beyond) and we understand that most of our users would like to see Safety ratio connected with this point. This would obviously make using Automation more risky, so it’s not something we’ll be doing right now, but it is something that we’re considering for the future.

If you have an Aave v2 position in DeFi Saver, you can now setup automation for liquidation protection or automated leverage management at https://app.defisaver.com/aave/ (though note that currently minimum debt of $60,000 is required to do so).

In case you have an Aave v1 position on a Smart Wallet, you’ll be able to migrate to v2 in two weeks, when our migration tool will also be released.

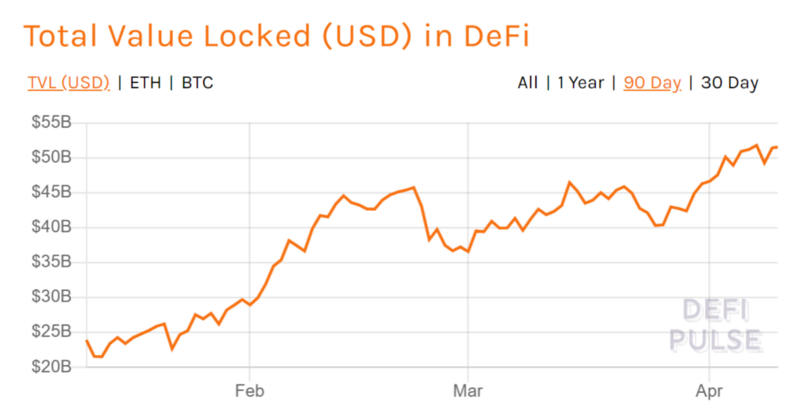

DeFi Pulse listing

This was a long time coming, but we’re very glad to share that DeFi Saver is now featured on the DeFi Pulse’s Leaderboard.

🎊🎊NEW LISTING🎊🎊@DeFiSaver is now listed in our #DeFi rankings at #15 with $577.1M Total Value Locked https://t.co/gIXSZWstoA pic.twitter.com/wl4Q762YFX

— DeFi Pulse 🍇 (@defipulse) March 15, 2021

Joining the ranks at #15 in terms of USD TVL, the number we’re more proud of is the amount of Ether that is currently managed by our Automation services — 0.25% of all ETH supply.

March stats

As of March 31, there were 638 MakerDAO, 77 Compound and 28 Aave (v1+v2) positions with Automation enabled — a total of 738 automated positions.

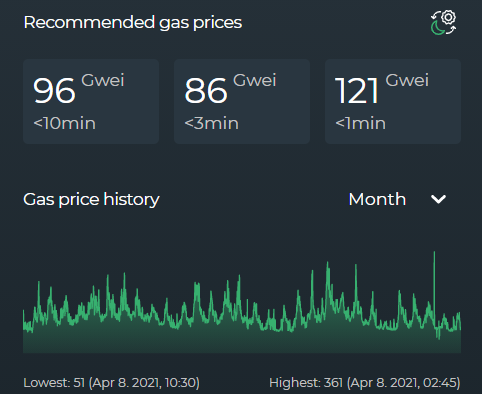

This is a decrease of some 20 positions compared to February, which was almost certainly caused by the greatly increased minimum debt requirements in the light of extremely high gas prices during the late February market crash. As a reminder, the minimums are now $40,000 for MakerDAO, and $60,000 for Compound and Aave (both v1 and v2).

The total amount of managed collateral at the end of February was 279,400 ETH, 985 WBTC, 66,685 LINK, 174,677 UNI and 3,538 AAVE, among other collateralized assets. In total, DeFi Saver Automation was managing over $618m of collateralized assets in different user created positions — an increase of 1,6x over February.

The user activity at DeFi Saver in March remained very high, in line with what we’ve seen in the first two months of 2021.

Overall, transactions made in March resulted in over $285m volume made in over 4000 unique transactions.

This means that there has already been over $1 BILLION trade volume made at DeFi Saver in Q1 of 2021. To put this into perspective, the volume for all of 2020 was more than 3x lesser, at ~$291m.🤯

Community shoutouts

This post has come out slightly longer than our previous newsletters, so we’ll try to cut things short with just a few shoutouts.

Maria shared an appreciation for creating a (successful👀) position with Maker using DeFi Saver, and the post actually turned into a whole wholesome thread.

hi this is a @DeFiSaver appreciation post.

— María Paula ⏳🧂 (@MPtherealMVP) March 29, 2021

opened a leveraged vault yesterday and I've still not regretted it!

And there was this very cool post from the brass who seems to have created a long position at a very convenient moment.

Throwback to 1 year ago.... while this place was in a panic and noobs were licking their liquidation wounds....

— the brass 0x (@brass_0x) March 16, 2021

I was convinced that the crash had bottomed and it was time to BTFD with my CDP. Tested out @DeFiSaver's Boost feature....boom! Now I chill here. pic.twitter.com/vRwg5wRuAC

Thank you for checking out our latest newsletter and for being with us.🙌

Stay tuned and talk soon!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum