DeFi Saver Newsletter: May 2021

New Recipe Creator integrations: Reflexer and Uniswap v2, MakerDAO Automation updates, May Stats, Community shoutouts and more...

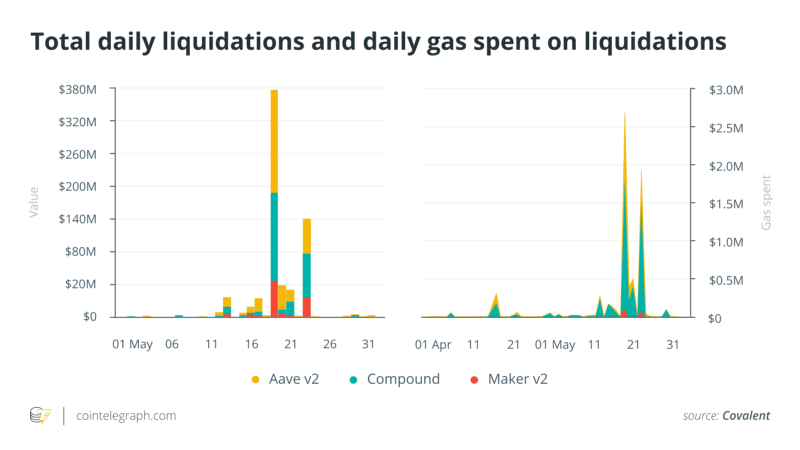

May was such a polarizing month, with the market making incredible new all time highs, only to drop 50% lower in the next ten days or so, causing over $370m worth of collateral to be liquidated across the DeFi landscape on May 19 alone.

Still, as always, the DeFi space was mostly unfazed by the violent market movements, especially given how much better all protocols performed in these conditions, with no issues with liquidations at Maker, Compound, Aave and even the barely one-month-old fan favourite Liquity (although the protocol apparently almost went into emergency mode).

The highlight release of the month in the ecosystem would surely be that of Uniswap v3, which became the #1 DEX by volume in a mere matter of weeks, while some other news worth mentioning include the launch of Balancer v2 (with some impressive gas savings announced), as well as Arbitrum, one of the most promising L2 networks, going live on the mainnet, though in a developers-only closed beta.

Here at DeFi Saver we continued polishing our new Recipe Creator and preparing new integrations, while Automation kept all protected positions safe from liquidation during the multiple large crashes.

DeFi Saver news and updates

New Recipe Creator integrations: Reflexer and Uniswap v2

We introduced two new integrations during June and anyone can now create custom combinations of interactions with two additional protocols: Reflexer and Uniswap v2.

The best part is that these two actually work great together and anyone can create a Reflexer Safe, generate RAI and deposit their RAI and ETH into a Uniswap v2 pool — all in one single transaction. And doing this also makes you eligible for future $FLX rewards, as mentioned here.

2⃣You can create a @ReflexerFinance Safe and deposit RAI/ETH into Uniswap v2 to farm $FLX rewards - all in one transaction!

— DeFi Saver (@DeFiSaver) May 31, 2021

This recipe allows you to create a Safe, swap 50% of the generated $RAI into $ETH and deposit that into the Uniswap v2 RAI/ETH pool. pic.twitter.com/HIJcddBGbN

The Uniswap v2 actions can also be combined with MakerDAO, where users can now efficiently manage their Univ2LP Vaults. For example, anyone can create a leveraged UNIv2DAIETH position to make the absolute most out of the liquidity available to them.

1⃣You can create an instantly leveraged @MakerDAO UNIv2DAIETH CDP if you'd like to maximize your liquidity usage and receive more swap fees.

— DeFi Saver (@DeFiSaver) May 31, 2021

This recipe allows you to create a Vault, swap 50% of the generated Dai into ETH and deposit those into Uniswap to obtain more LP tokens! pic.twitter.com/iDlb0PYWjG

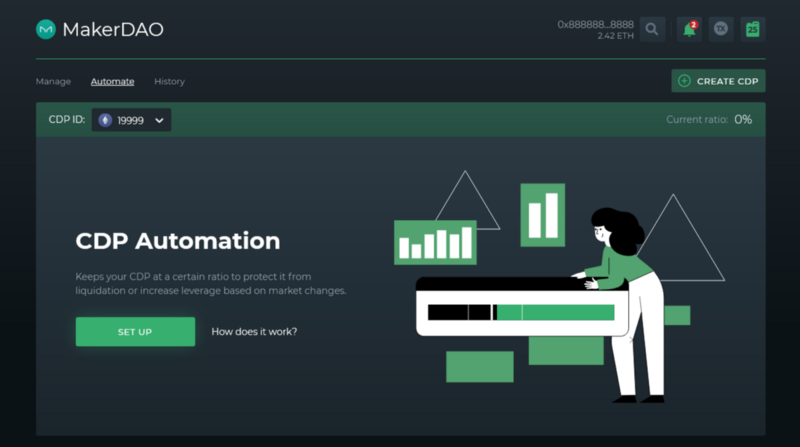

MakerDAO Automation updates

For the longest time, there was a required 20% ratio gap between the minimum ratio for any certain Maker Vault type and the minimum (“Repay from”) ratio allowed in Automation.

Given how mature the Automation system has grown and how stable it has been through all of the recent market crashes and basically every larger market movement since Black Thursday onwards, we have decided to reduce this gap.

The minimum allowed ratio in Automation for MakerDAO positions is now just 10% above the minimum ratio for the used Vault type. For example, for ETH-A you can now set auto-Repay at as low as 160%. And, regardless of your configured minimum, if there’s a large price change in MakerDAO with a next price update that drives your position to liquidation — there’ll be an emergency repay kicking in based on that next price.

We have also greatly updated the Automation articles in our knowledge base to help onboard any users with crucial information and you can find those here.

May Stats

As of May 31st, there were 453 MakerDAO, 69 Compound and 49 Aave positions with Automation enabled — a total of 571 automated positions.

The total amount of managed collateral at the end of May was 165,000 ETH, 616 WBTC, 123,000 LINK, 162,000 UNI, and 5,000 AAVE, among other collateralized assets. In total, DeFi Saver Automation was managing over $502m of collateralized assets in different user-created positions at the end of May —an unfortunately noticeable decrease compared to April, owing for the greatest part the mid-May market crash.

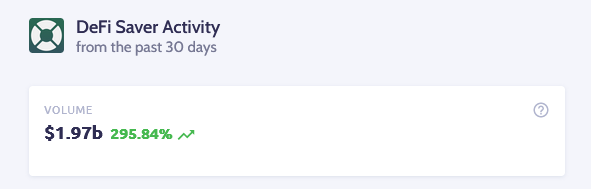

The user activity at DeFi Saver in May was beyond anything we’ve seen so far.

In total, the transactions made in May resulted in an incredible new monthly volume record of $1.9b made in over 11,200 unique transactions.🤯

Community shoutouts

May was a pretty wild ride for many participants in the space and we really want to thank everyone who shared posts of appreciation for Automation features as the dust settled after the market crashes.

There was Nemo:

mad respect to both @MakerDAO and @DeFiSaver this was a crazy ride and the whole system had a smooth sail! <3

— Captain Nemo 🇪🇹🦞🦇🔊 (@ncerovac) May 19, 2021

And Androo:

Some peeps reached out thanking me for showing them @DeFiSaver

— dogmaxi.eth - $DOG ( ✨ ) ᕙ༼🐶༽ᕗ ( ✨ ) 🦇 🔊 (@androolloyd) May 19, 2021

The thanks belongs to them!

What a team.

Keeping so many positions alive, and always shipping.

Truly amazing.

And Jonny:

Slept like a baby last night @DeFiSaver #DeFi

— Jonny (@JonnyFiat) May 19, 2021

And Wizard:

@DeFiSaver will be there for you when you stay irresponsibly long through the crash 😇

— Degen.Wizard ✨🦇🔊 (@SaintBurban) May 19, 2021

"This feature is in beta. Use at your own risk"@_nikolajankovic @miliboii are like family, bending over backwards, helping me navigate the chaos in the wake of my poor decisions 😭🚀

As well as Jacob from 0x:

I dunno how many CDPs DeFiSaver saved. But from the volume they did in 24h, it was a lot. @DeFiSaver you dropped this 👑👑👑 pic.twitter.com/vP1cdB5psX

— jacob (@dekz) May 19, 2021

And Jack who shared praise for how stable Automation worked through the wild market conditions and extremely rough network congestion:

I would be remiss to not also call out @DeFiSaver. They also used Black Thursday as a learning opportunity and were clearly extremely successful 👏https://t.co/1dmZL1cbWf

— Jack Clancy (jackclancy.eth) (@jack_clancy93) May 21, 2021

Besides the Automation related posts, there were also a number of shoutouts for our new Recipe Creator, such as this one from Lefteris, a friend working on Rotki, the open-source privacy-focused portfolio tracker.

Time to give credit to 1 of the best teams in crypto again!

— Lefteris Karapetsas | Hiring for @rotkiapp (@LefterisJP) May 25, 2021

Did you know that @DeFiSaver has a recipe creator? You can create custom actions using common #ethereum #DeFi primitives.

Example: Use @dydxprotocol flash loans to switch @MakerDAO ETHA to ETHChttps://t.co/GPvx8yoVql pic.twitter.com/S1dishuqkR

And, finally, we have to mention that there’s been a lot of people looking at our gas prices extension and commending the used permissions (or lack thereof) — thanks for everyone who helped shared the word about it!🙏

Shoutout to @DeFiSaver for being the good guy here pic.twitter.com/98eUbY2QNQ

— TΞtranodΞ (@Tetranode) May 26, 2021

Thank you everyone for a truly incredible month. We’re VERY excited about all the news we expect to share in June!🙌

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum