DeFi Saver Newsletter: November 2020

Welcome to our latest monthly release covering November events, updates and stats!

November was a very pleasant month, to put it mildly, for pretty much anyone in the crypto space. Markets made a strong rally and Bitcoin went as far as almost beating its previous all-time high, with Ethereum following slightly behind.

The decentralized finance ecosystem made no breaks, either and we saw DAI supply surpass 1 Billion for the first time ever and Aave team teasing a v2 release with Kovan tests, among other news. There were also some less unfortunate happenings, though, including the Compound DAI oracle issues and the end of Uniswap’s UNI rewards for certain pools which resulted in tremendous liquidity decrease (though with no decrease in volume so far).

The total value locked in DeFi kept growing steadily and we saw record breaking numbers at DeFi Saver in November, but more on that a bit later — first let’s cover our recent releases.

DeFi Saver news and updates

Our updates in November were mostly focused on improving the user experience, while we kept working on much greater future releases in the background. Let’s check out some of the most interesting updates.

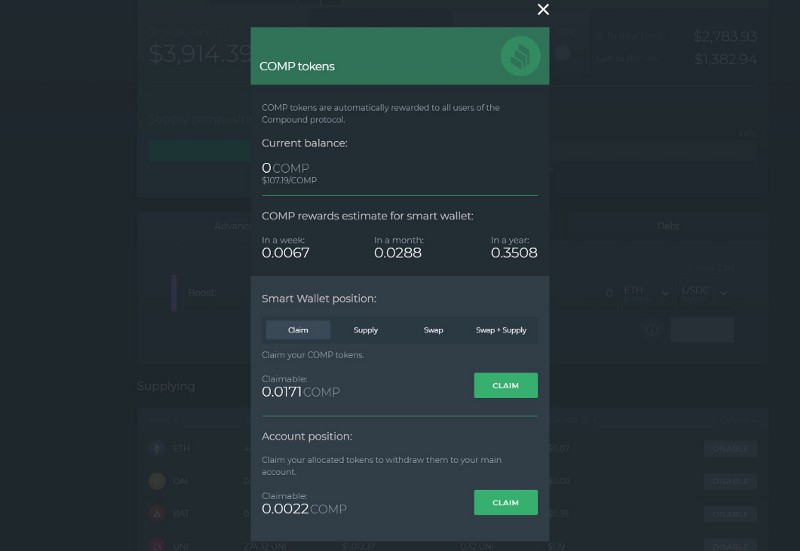

COMP farming improvements

We introduced a number of improvements for everyone mining COMP tokens using DeFi Saver, including the options to:

- Claim and supply your COMP to Compound in one transaction

- Claim and swap your COMP to a different asset in one transaction

- Claim COMP, swap it to a different asset and supply the new asset, all in one transaction

As a reminder, COMP is most effectively mined by leveraging an already supplied asset, as the Compound protocol allows supplying and borrowing the same asset. For example, many users set up DAI/DAI or USDC/USDC positions, where you supply DAI and then borrow and leverage more DAI. This is something that can be very quickly set up using our Create position or Boost options for Compound.

Note that Compound recently had a DAI oracle issue, though, so if you want to leverage DAI we recommend having only DAI in your Compound portfolio to be safe against any future issues before they upgrade their oracles for better resilience against exchange flash crashes.

AAVE staking support

We recently also added the support for AAVE staking in our Aave dashboard. This allows anyone to stake their AAVE tokens in the Aave protocol’s Safety Module and earn rewards for helping protect the protocol.

You can find more information about staking in Aave docs, but the important thing to be aware of is that you might potentially lose up to 30% of the staked AAVE in case the protocol faces a shortfall event, but you are also being rewarded additional AAVE for staking.

Are you an $AAVE holder? You can now stake your AAVE and help secure the @AaveAave protocol directly from DeFi Saver.👻🛡️

— DeFi Saver (@DeFiSaver) November 30, 2020

Also includes handy reward estimates.👌

Available now at👉https://t.co/VEmisNnCz7. pic.twitter.com/o0HunJoqNf

This is something you can now do in our Aave dashboard at https://app.defisaver.com/aave/.

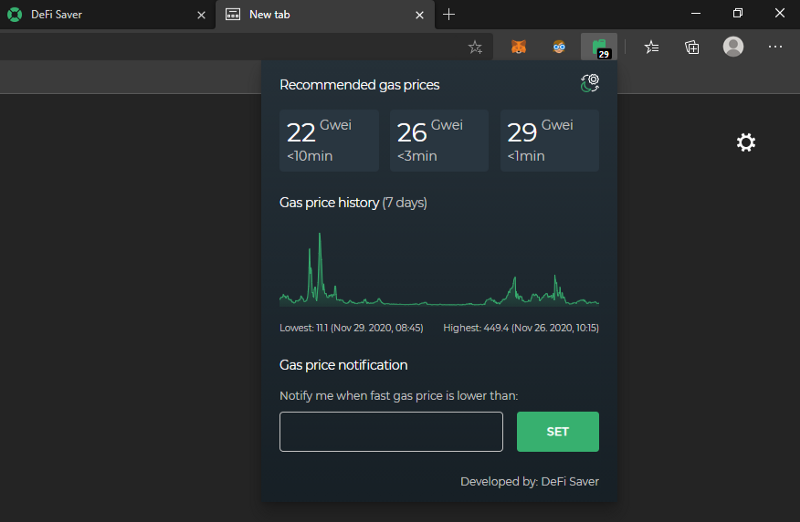

Our gas widget became a browser extension⛽

After a few helpful suggestions from the community, we decided to turn our in-app gas widget into a separate browser extension, too.

The extension so far includes white and dark modes, 7-day chart of historical prices, as well as configurable gas price alerts for when gas prices drop below your selected level.

You can get the extension for your browser here:

- 🌍Brave/Chrome/Edge: https://chrome.google.com/webstore/detail/defi-saver-gas-prices-ext/

- 🦊Firefox: https://addons.mozilla.org/en-GB/firefox/addon/defi-saver-gas-prices/

In case you have more ideas or suggestions yourself, please shoot it our way in the DeFi Saver discord.🙌

November stats

As of November 30th, there were a total of 469 MakerDAO, 59 Compound and 29 Aave positions with Automation enabled — an increase of more than 80 positions. Additionally, the total amount of managed collateral is now over 480 000 ETH and 200 WBTC.

Our recently introduced Loan Shifter has already seen more than 120 shifts done and we already analysed what some of the most popular shifts were and why in this post.

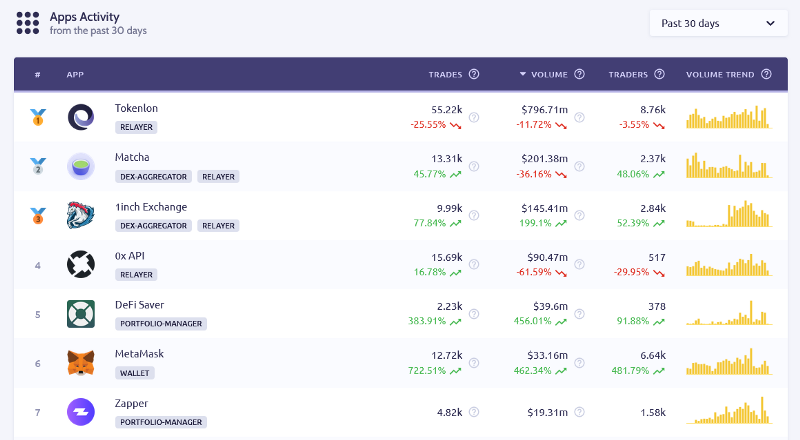

Overall, user activity on DeFi Saver in November resulted in over $57m in volume made in over 4200 unique transactions, including Boosts, Repays, and other leverage and debt management actions.

This is a new monthly record for DeFi Saver, well surpassing the previous ~$40m done in September.🥳

Thank you all for all the support and, most of all, for using DeFi Saver. It’s an absolute pleasure building DeFi Saver with such amazing users and we are super excited about sharing what we have in store next.

Community shoutouts

As always, we also want to take a minute to share some of you that showed support for DeFi Saver during the month of November.

One of the helpful DeFi authors in the space helped us share the news about the gas prices extension release, adding some words of support:

A great little browser extension for checking real-time Ethereum gas prices, the 7 days avg. chart is a cool addition!@DeFiSaver just keeps on shipping awesome stuff, grateful for all you've done for DeFi so far! https://t.co/gG0k3dKM6y

— DeFi Clippy 📎 (@DeFiClippy) November 16, 2020

A friendly Captain Nemo reminded that DeFi Saver is one of the essential tools for liquidation protection:

As @bneiluj says "next liquidation season will be awesome"

— Captain Nemo 🇪🇹🦞🦇🔊 (@ncerovac) November 24, 2020

If you wanna sleep without fear, I recommend @DeFiSaver https://t.co/f4Z8h1XQxQ

Finally, Stani, the Aave CEO, shared appreciation for our AAVE staking support:

Staking $AAVE became wider, great work @DeFiSaver 👻🛡 https://t.co/2rx6oqyxEg

— stani.txt (👻,🐻❄️) 👘 (@StaniKulechov) November 30, 2020

That’s it for the November newsletter, stay safe out there and talk soon!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter