DeFi Saver Newsletter: September 2020

Welcome to our latest monthly release covering September events, updates and stats!

September started off as a wildly active period in the decentralized finance ecosystem, continuing the trends set in August. However, this soon turned out to be the final crescendo of the DeFi Summer 2020 madness, at least for now.

New farms stopped popping up daily, people stopped tending to crops on the older ones, and no new people seemed interested in entering the DeFi agriculture sector. Yields plummeted and the practice of continuously searching for the next big food token became futile.

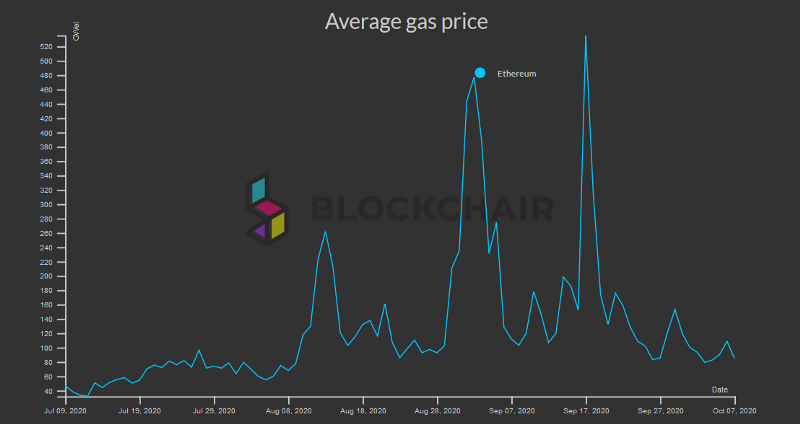

One very welcome side effect of such developments was that gas prices eventually dropped, too, and we haven’t had 24 hour periods of 150+ Gwei prices for a few weeks now. We’re even getting blessed with <50 periods more and more often, it seems.

Overall, although many were calling this the end of DeFi Summer, in reality it was merely the end of the DeFi Farming Season, with all teams previously focused on long term solutions still heads down building.

This is certainly the case for our team, so let’s do a quick recap of all updates we shared throughout last month.

DeFi Saver news and updates

Automation for Aave introduced

After our fully-fledged Aave dashboard launched in August, we now completed the Aave feature set with Automation support.

Automation for Aave supports all assets supported by the Aave protocol and it can protect your position against liquidation in case of a market drop, as well as automatically increase leverage in case of continued market uptrends.

For a more detailed introduction, please see our Aavetomation announcement post which also includes setup steps.

P.S. The LEND to AAVE migration is now live, as is the new Aavenomics system that includes the option of AAVE staking. Please see this post on the Aave blog for more info.

COMP, LINK, and LRC added to MakerDAO

During September, MakerDAO Governance voted in and onboarded three new collateral types — COMP, LINK, and LRC. They’ve been gradually picking up steam and you can check current stats for their usage in MakerDAO using DeFi Explore.

All three new collateral types have already received the full DeFi Saver treatment and this means that you can now create an instantly leveraged CDP with any of these assets, use Boost and Repay, and eventually use the instant Close option, too.

Finally, Automation support for these new collateral types will be added later this week.

New DeFi tokens added

September also saw the introduction of two new relevant DeFi tokens — Uniswap’s governance token (UNI) and the DeFi Pulse Index token (DPI) created in collaboration between DeFi Pulse and Set Protocol.

Both of these tokens are already available in the DeFi Saver Exchange, as shown below.

Uniswap introduced UNI through an airdrop to all users of Uniswap v1 and v2 that caught everyone by surprise. Congrats to everyone who received the airdrop!

However, please note that there’s an on-going proposal for sending out a followup airdrop to any proxied users, which would also include DeFi Saver users. You can check the current status of the proposal on the Uniswap governance forum.

DeFi Saver featured in MetaMask Mobile

As of recently, DeFi Saver is a featured app in MetaMask Mobile, the wallet management app that recently reported over 1 million monthly active users.

Very glad to see https://t.co/Tecyt1ghPM featured in the new MetaMask Mobile wallet.👌

— DeFi Saver (@DeFiSaver) September 10, 2020

Congrats on the recent launch @metamask_io!🥳 pic.twitter.com/4ED6ljChnL

MetaMask Mobile is one of the most recommended mobile wallets out there and we’re proud to see DeFi Saver highlighted in their app among other other leading decentralized finance projects.

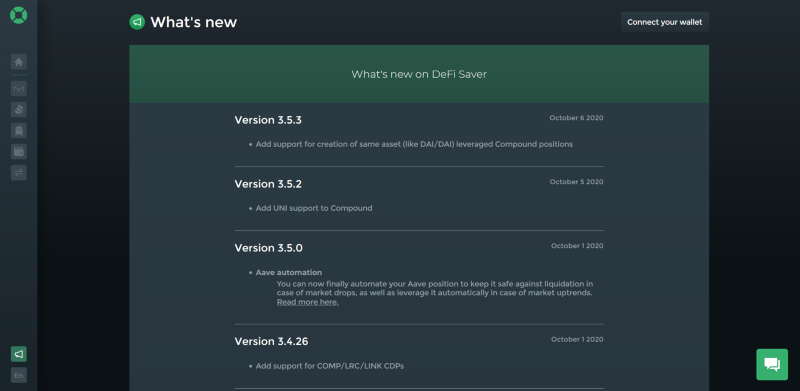

What’s new in DeFi Saver?

So far the only way to keep track of the recent updates in DeFi Saver were our monthly newsletters. Well, not anymore!

Whenever you want to check what’s recently been added to the app, you can now visit the What’s new page we recently introduced at https://app.defisaver.com/whats-new.

September stats

As of September 30th, there were a total of 400 MakerDAO and 27 Compound positions with Automation enabled, with the system managing over 379 600 ETH and 92 WBTC in collateral.

The total amount of ETH collateral protected and managed by Automation has more than doubled during September

Overall, user activity on DeFi Saver in September resulted in over $47m in volume made through 2500+ unique leveraging and deleveraging transactions.

This is the highest monthly volume we’ve seen so far. To put it into perspective, this is 3 times the total volume made in all of 2019 at DeFi Saver ($16m) and more than double of that made during the March 2020 madness.

Community shoutouts

As always, we also want to take a minute to share some of your posts that showed support for DeFi Saver during the month of September.

First of all, with the latest Gitcoin round over, we want to thank everyone who joined and contributed to our grant. With 105 unique contributors this has been our most successful round so far and has brought the total number of contributors to 220!🙏

Secondly, we’d like to thank everyone who ever posted about DeFi Saver helping them sleep better — this has definitely become our favourite compliment and Regen recently brought it up on Twitter again.

I hereby state that I have been able to sleep peaceful nights because of @DeFiSaver

— rΞgΞn (@regencrypto) September 22, 2020

Finally, we wanted to thank Mariano for all the recommendations he has been posting about DeFi Saver lately. It really means the world to us, especially when it’s coming from someone who helped build and shape MakerDAO.🙏

Please use a tool like @DeFiSaver to manage your Vaults.

— mariano.eth ✨ᕙ༼🐶༽ᕗ✨ | 🦇🔊 (@nanexcool) September 21, 2020

Liquidations in @MakerDAO are 100% preventable. https://t.co/NwKGxzL1zl

That’s it for the September newsletter and you can expect some major October updates to start rolling out this week, as we’ve got quite a few things in the pipeline.

One of the upcoming releases might have something to do with converting your loan into a different asset or moving it over into a different protocol, for example.🤔

Stay tuned and talk soon!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter