DeFi Saver Newsletter: December 2025

DeFi Saver nears the close of 2025 with some cool upgrades, including Auto Collateral Switch, Discover for Yield, and expanded Notify, alongside fresh integrations like Morpho on Arbitrum and $SKY staking.

Good to see you back for this month’s edition of the DFS Newsletter!

Here are some of the main news and updates we’ll cover:

- One of the biggest hacks of 2025 and the Cloudflare crash;

- Auto-Colateral switch, Morpho x Arbitrum support, Discover Yield launch, Notify gets an update;

- Latest Stats and user feedback!

- Position of the month analysis.

DeFi meets Bad gateway

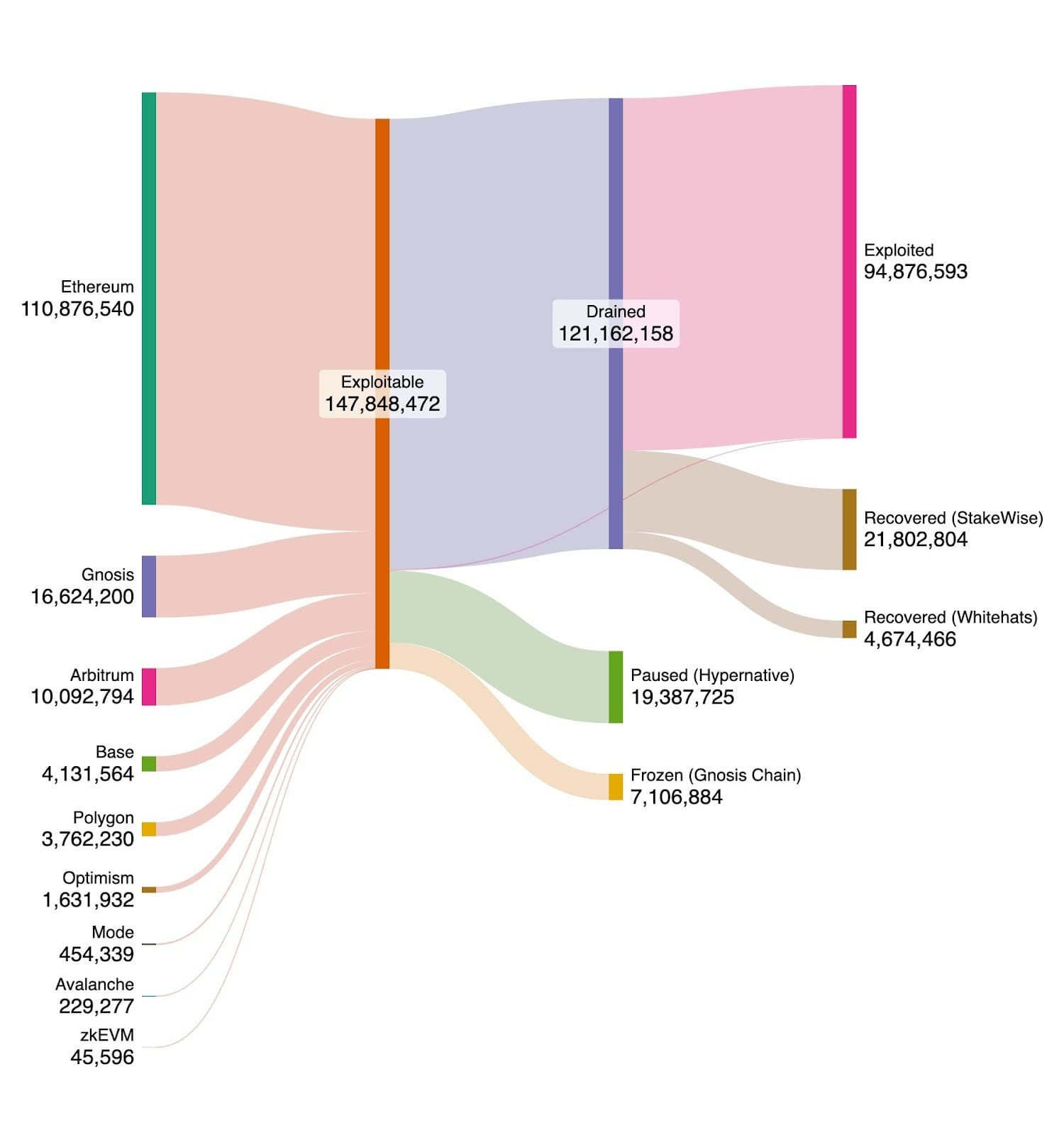

A whopping $128M hack hit the Balancer protocol at the very beginning of November, having practically halved the protocol's TVL from $442M to $214.5M, in a matter of about 24h, which additionally prompted one whale to withdraw another $6.5M.

So far, around $19M has been recovered due to a swift response. However, according to Crystal Intelligence, around 52% of the drained assets have already reached addresses controlled by the hacker, whereas 40% of total stolen assets were transferred using services that make token tracing arduous, or even impossible.

Now, while we’re on the topic of things going wrong this month (I was told to blame Mercury Retrograde), the nightmare of every marketing team came to fruition: as all socials went dark, blogs were down, and sites were unreachable.

And as we quickly found out, one of the world's largest internet service providers faced issues with “a configuration file that is automatically generated to manage threat traffic,” as it “grew beyond an expected size of entries and triggered a crash”.

First day in #Cloudflare as system engineer 😍

— bunnysayzz (@bunnysayzz) November 18, 2025

wish me luck pic.twitter.com/7pfQQJ352i

Regardless of the crash, we’re happy to say no harm was done at DeFi Saver. However, our team at DevConnect in Buenos Aires was left with finding…alternative ways of presenting demos to booth visitors. And we could not be more proud of them!

And to conclude our overview of the ecosystem news, as of 3 December, Fusaka is officially live on Ethereum! This 17th major update implemented 13 EIPs, which focus less on bettering user experience and introducing staking innovations (that were seen in Pectra), and more on backend enhancements that enhance network scalability. We’ll talk about Fusaka more in the upcoming issue of the DFS Newsletter, so stay tuned!

The Fusaka upgrade is now live on Ethereum.

— DeFi Saver (@DeFiSaver) December 3, 2025

The highlights for us have to be the higher 60m block gas limit and the increased blob capacity, both expanding total capacity and further lowering tx costs for users.

Congrats to the Ethereum community and onwards to Glamsterdam! https://t.co/O4IYwfg2vr

DeFi Saver news&updates

We’re nearing that time of the year (cue Mariah Carey) - but we’re not easing into the holiday season just yet. We’ve rolled out multiple upgrades that will help DFS users wind down as the year comes to a close.

DeFi Saver launches Auto Collateral Switch

This long-requested feature allows users to set up Automation that will instantly switch from your initial collateral asset to another the moment your chosen trigger is met.

Not only that, but you can also filter your search to fit your strategy, assets, as well as sort by protocol or chain. What’s especially useful is the possibility to simulate profits for your chosen asset and strategy, for any chosen period of time.

📢The long-awaited Automated Collateral Switch for @Aave v3 is here!

— DeFi Saver (@DeFiSaver) November 26, 2025

Users can now set up Automation to instantly switch from your initial collateral asset to another the moment your chosen trigger is met.

More details below👇 pic.twitter.com/7rCSZUvxVh

It’s available to Aave v3 smart wallet users on Mainnet, Arbitrum, Optimism, and Base, and can be found in the Automate section of the Aave dashboard.

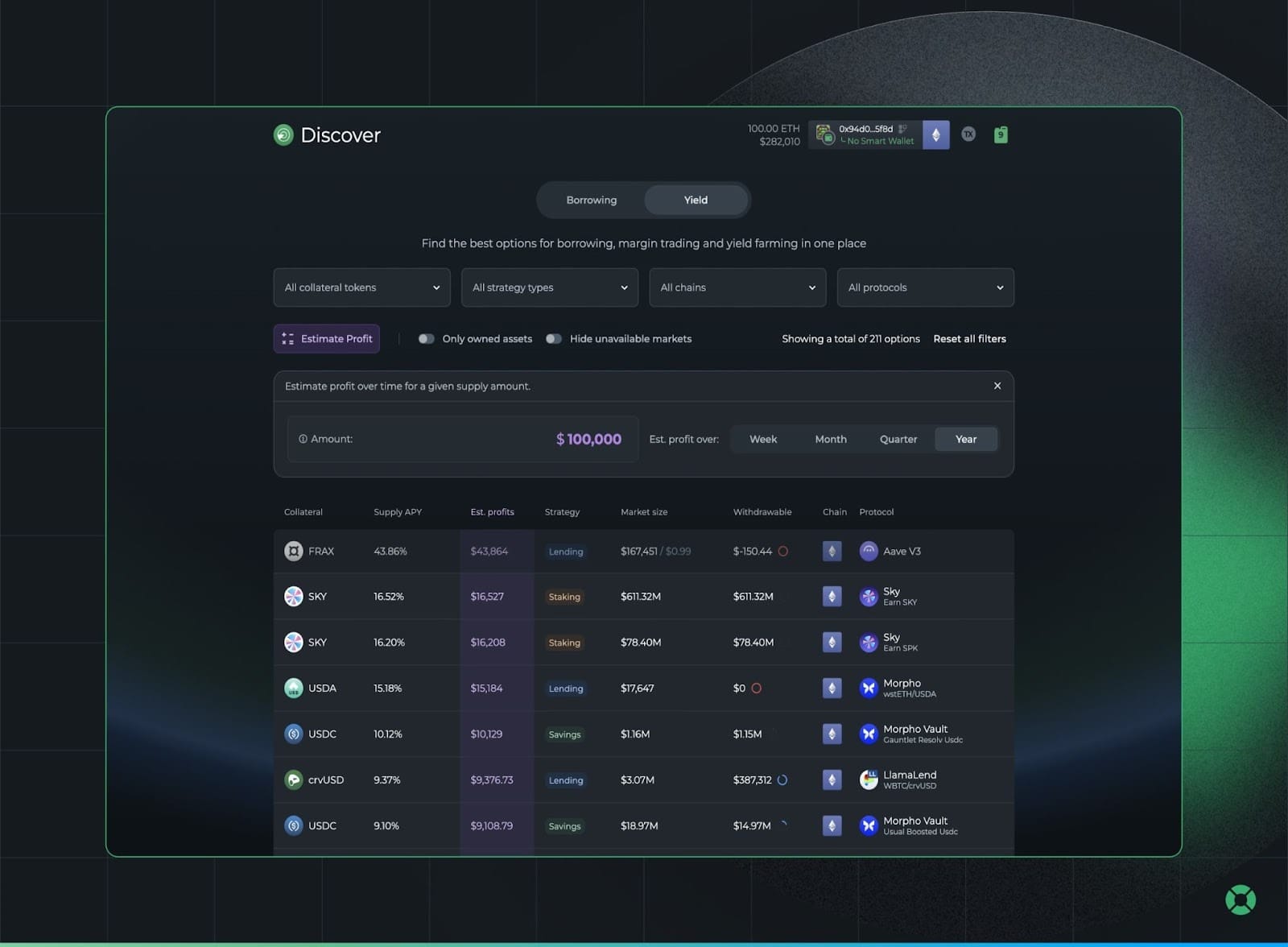

DFS Discover for Yield is live

We’re happy to announce the expansion of our DFS Discover page, with a new Yield exploration tool.

It’s a unified dashboard that displays stablecoin and ETH yield opportunities across all six supported chains on DeFi Saver: Mainnet, Arbitrum, Optimism, Base, Linea, and Plasma.

You can adjust filters by asset and strategy type, protocol, and chain, and even simulate potential profits for any supply amount over the chosen period of time. And of course, no wallet connection needed. All through a single interface.

Try it out, and don’t forget to share your feedback via our Discord server!

DFS Notify gets an upgrade

You may already be familiar with Notify, a DFS tool that keeps you informed about your positions across Mainnet, Arbitrum, Optimism, and Base, with alerts sent through the DFS app, Telegram, email, or Blockscan Chat.

💡 DFS Notify upgrade for Telegram is live!

— DeFi Saver (@DeFiSaver) November 21, 2025

If you’re new to Notify, it’s our alert system that keeps you updated on your positions across Mainnet, Arbitrum, Optimism, and Base - with alerts delivered through the DFS app, Telegram, email, or the Blockscan chat.

However, during… pic.twitter.com/XE81KvpveH

But now, we’ve introduced a Notify Telegram update that lets you snooze/unsnooze or delete notifications entirely, all from your phone without opening the app or signing anything.

Morpho x Arbitrum now live on DFS

Users can now create Morpho positions, manage existing ones, use 1tx leverage tools, enable Notify, and configure Automation directly on Arbitrum.

This launch includes support for five markets: syrupUSDC/USDC, wstETH/USDC, ETH/USDC, and sUSDC/USDC. For more info, check out our thread on X👇:

Support for Morpho on Arbitrum is now live at DeFi Saver.🦋🔵

— DeFi Saver (@DeFiSaver) November 13, 2025

You can now create new and manage existing @Morpho positions on @Arbitrum, use our 1-tx leverage options, enable position health notifications, as well as configure automation for your position.

More details below.🧵 pic.twitter.com/k72HYlL0of

And with the Arbitrum Drip Campaign well underway, this presents an extra opportunity for DFS users to earn rewards on Arbitrum. Be sure to follow our DFS Trending page to stay updated on the newest opportunities on this network.

Staking $SKY now enabled on the Sky Staking engine

DeFi Saver now enables users to stake their $SKY rewards, currently offering around 16% APY, through the Sky dashboard, or through the new Dicover for Yield feature.

The @SkyEcosystem Staking Engine on DeFi Saver just got a nice update:

— DeFi Saver (@DeFiSaver) November 7, 2025

Users are now able to stake their $SKY in order to earn $SKY rewards, and capitalize on the current 17.37% APY

All available with a few clicks in the DFS app. pic.twitter.com/XdhNGSc1Q6

DFS goes to Argentina

From 17-22 November, our team attended DevConnect, held in sunny Buenos Aires, Argentina.

Ethereum World Fair day 3 is underway!👋

— DeFi Saver (@DeFiSaver) November 19, 2025

The sun is out, the wifi is (currently!) working and the crowd is slowly picking up - seems it'll be another lovely day in Buenos Aires.

This is the last day for the DFS booth at @EFDevcon, so make sure to stop by while we're here! pic.twitter.com/7PaQoaUkIk

As always, we enjoyed meeting all of you who visited our booth, and our support guy, Milos, shared some of his highlights: “Devconnect landed us right at the entrance of the "DeFi District" part of the event hall. This prompted us to speak with tons of talent from the industry, as well as existing/potential DFS users. It’s always invigorating to see people’s reactions when we share how DeFi Savers helps users solve problems within the DeFi landscape”.

A couple of snippets of DeFi Saver's experience at DevConnect in Buenos Aires, Argentina.

Our next stop is ETHDenver, so book your tickets in time, pay us a visit, and look forward to some limited-edition merch!

DFS November stats

DFS Automation statistics are currently showing 1,186 active automated positions, with collateralized debt assets totaling $395 million. So despite price changes, these numbers are unchanged compared to the previous month.

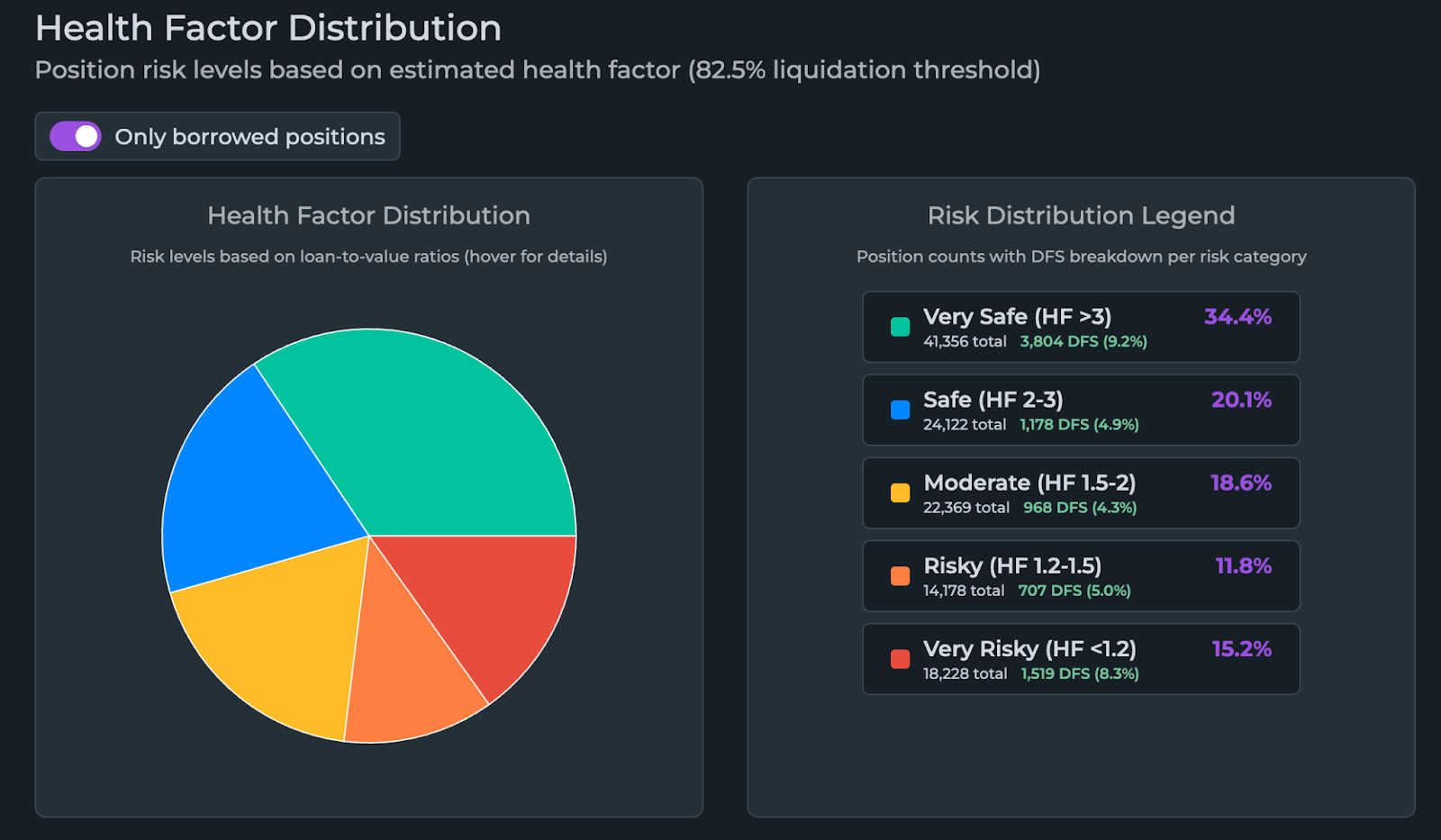

As far as our Aave metrics go, Aave’s total TVL is currently around $30.9 billion, and DFS users make up for $979.75 million. In terms of Health Factor Distribution, 34.4% of all Aave positions made by DFS users have an HF>3, considered very safe. Lastly, the top 3 most common debt/collateral pairs used in Aave are: WETH/weETH, WETH/USDT, and wstETH/USDT.

Position of the month

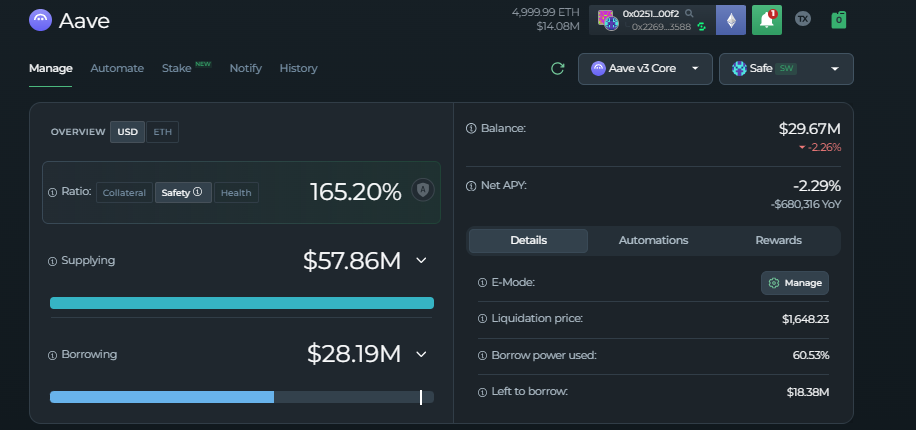

This month, we’re spotlighting one bold whale (0x0251) that we’ve seen in the transaction logs a few times by now. And as we’ve seen plenty of aggressive leverage moves this year, this one stands out both in capital and in precision.

This person closed their previous DFS position on 20 July, and opened a new leveraged setup on 21 November, using around 3000 ETH (roughly $8M) as collateral while borrowing $5.46 USDT.

In just one day, they executed Boost twice, supplied more ETH, and then did a quadruple Boost once again. So the initial position on 21 November ended at around 19.604 ETH as collateral, and a $23.16M USDT debt.

As the price of ETH rose from around $2700 to $3000 in a matter of three days, had he closed the position then, this user could have walked off with a whopping profit of around $35M.

While this user made the right call, we do hope they’re using DFS notifications to keep them alert whenever the market decides to go for a dip.

So make sure to stay safe, and we’ll see you in our next holiday edition of the DFS Newsletter!

Until the next post!👋

Stay connected:

📢: Official Twitter/X