DeFi Saver Newsletter: July 2025

Ethereum hits a decade, DeFi Saver rolls out powerful new tools, and user activity hits new heights. We're back with the latest stats, product updates, and a position analysis of a user who turned 5,000 ETH into over 10,500 ETH.

As Ethereum marks its 10th anniversary, we’re proud to celebrate 8 years of our own journey in DeFi. From our early days of working on Automation as CDP Saver to building an advanced app for DeFi management, we’ve grown in step with the ecosystem.

Regardless, our goal has always been the same: making DeFi comprehensive, efficient, and accessible, without compromising on users’ privacy or transparency.

Thank you for being with us through every iteration and upgrade, and we promise to continue working hard on bringing all the tools you need to navigate your way in DeFi confidently.

And with that, it’s time to dive into what’s new across the ecosystem and improved right here at DeFi Saver.

Ethereum turns 10: Pass the torch

On July 20, the Ethereum Foundation launched Torch to commemorate its first decade of existence, a commemorative NFT that would symbolically be passed from wallet to wallet over 10 days, and then burned once reaching Ethereum’s birthday on July 30.

1/ Honored to be carrying the torch today for @ethereum's 10 year anniversary celebration!

— sassal.eth/acc 🦇🔊 (@sassal0x) July 28, 2025

If you'll indulge me for a few tweets, I'd like to talk about my own personal journey in the Ethereum ecosystem :) pic.twitter.com/klAlP0wai3

Not only that, but a great number of Ethereum projects came together to celebrate Ethereum, with creative tributes to how far Ethereum development has come. Among those posts, one design particularly stood out. 😏

believe in somETHing pic.twitter.com/ri5BeL0nxc

— DeFi Saver (@DeFiSaver) July 29, 2025

However, this wasn’t the biggest news for the ETH community in July. Ethereum has officially raised its gas limit to 45M units, which is a 25% increase from the previous cap of 36M set in February 2025. Validators are now targeting a short-term gas limit of 60M, with the overall goal of reaching 150M following the upcoming Fusaka fork.

Almost exactly 50% of stake is voting to increase the L1 gas limit to 45m. The gas limit is already starting to increase, now at 37.3m. pic.twitter.com/omUKQHuBvz

— vitalik.eth (@VitalikButerin) July 20, 2025

Fusaka is believed to be the next biggest Ethereum upgrade after Pectra. Even though Pectra went live recently, the Ethereum community has been urging for regular and more efficient updates, hence the Fusaka upgrade, scheduled to launch on November 6, 2025.

DeFi Saver News & Updates

As we go about building new tools and improving existing ones, our priority remains the same: putting user needs first. Our focus is on providing extremely useful tools for proficient DeFi users, whilst using the best technology Ethereum has to offer.

We aim to support a wide range of user cases, even if they affect a small group, and our EIP 7702 upgrade is the perfect example of that.

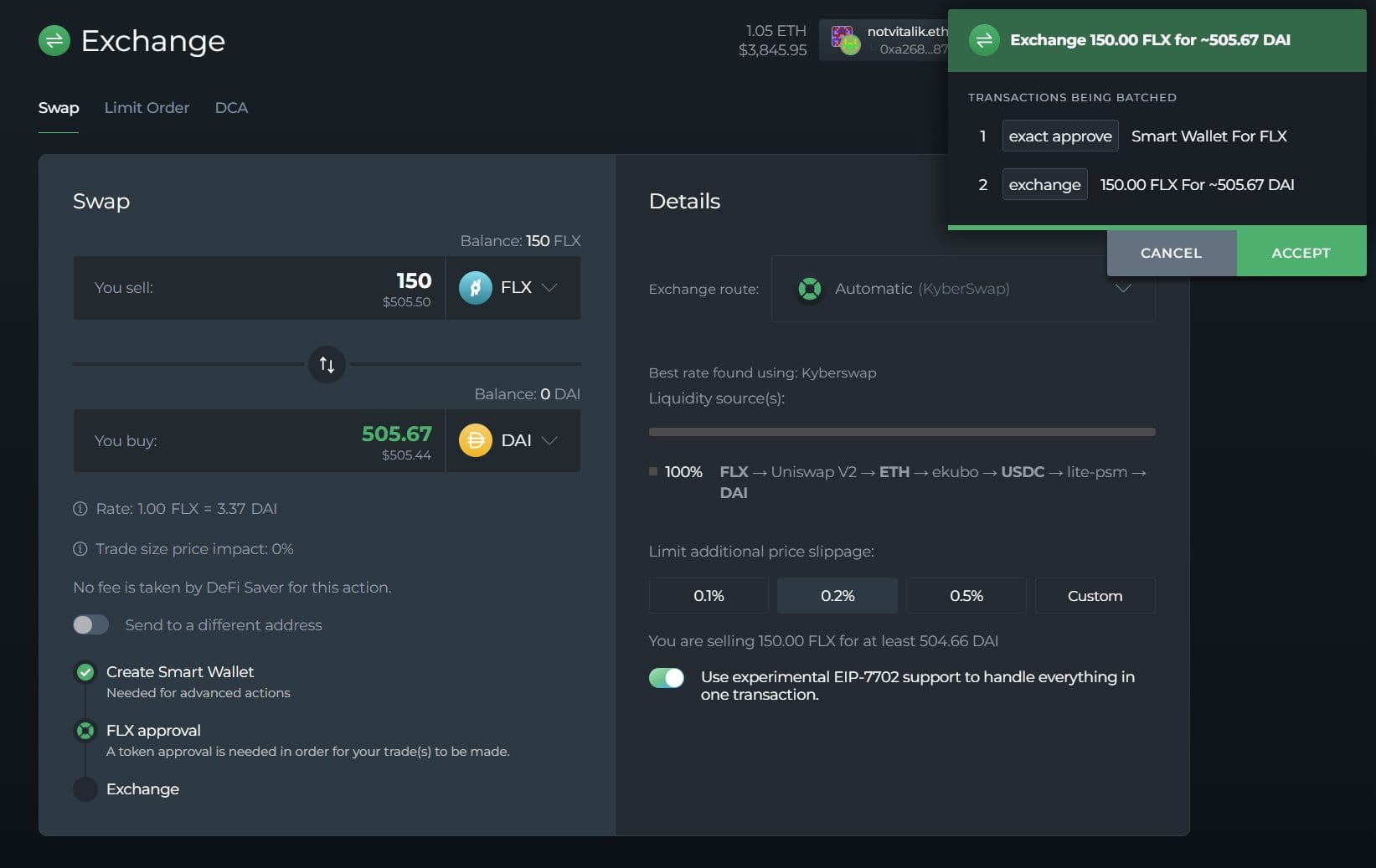

EIP 7702 support is now available in our Exchange

EIP 7702 support is now live on all networks we support: Ethereum Mainnet, Optimism, Arbitrum, and Base.

Now, DeFi Saver can batch approvals and swaps within a single transaction. To use it, for now you’ll need to have MetaMask, which is currently the only major wallet supporting EIP 7702. For those unfamiliar, EIP 7702 allows regular EOAs to act as smart wallets, enabling bundling multiple actions (like approving and swapping tokens).

Although broader ecosystem support for 7702 is still developing, we’re eager to expand usage as it matures, for example, enabling users to migrate their positions to a smart wallet within a single transaction.

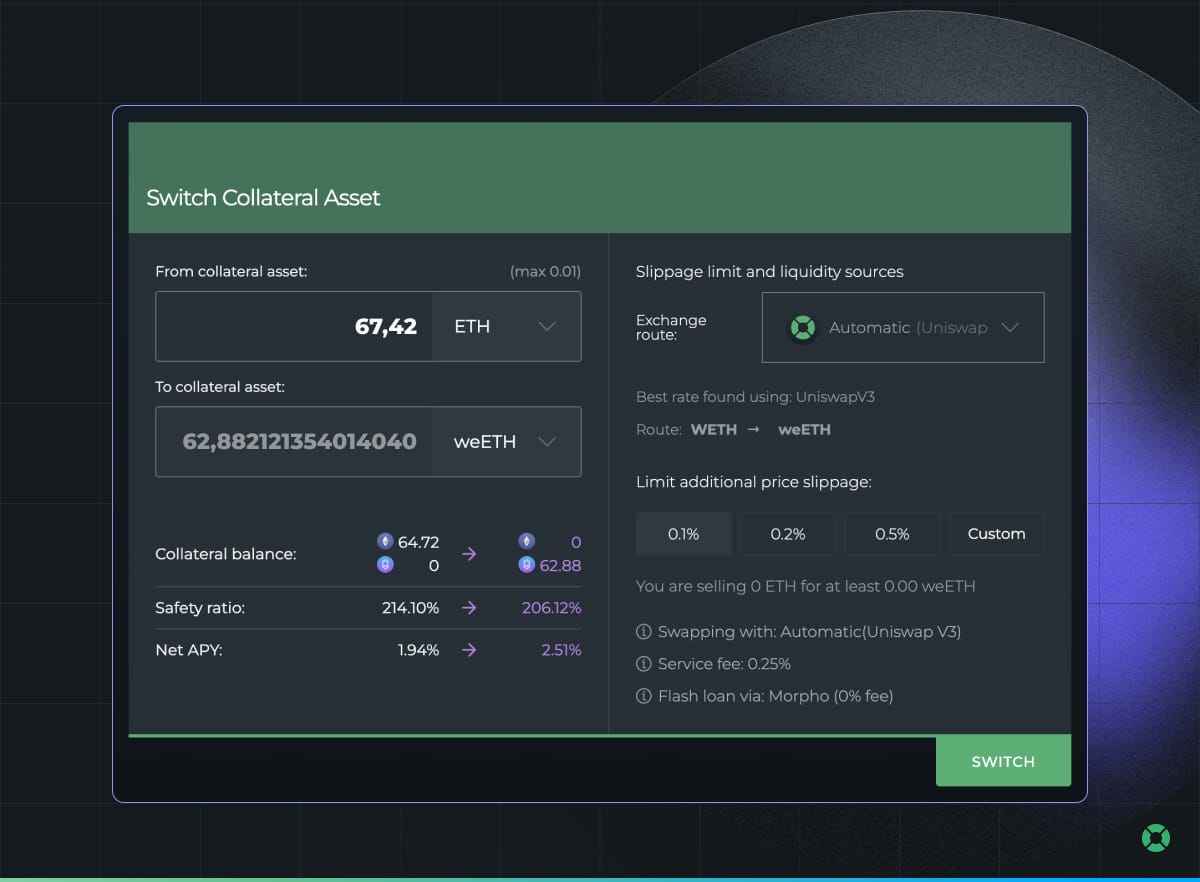

Collateral & Debt Switch for Aave now available on DFS

You are likely already familiar with our Loan Shifter feature, which allows you to swap your collateral and debt assets within the same protocol or move your entire position to another protocol.

Now, we’ve made this much easier for DFS Aave users.

Collateral and debt switching is now available in our @Aave dashboard!

— DeFi Saver (@DeFiSaver) July 15, 2025

While both of these were options we pioneered, they're now easier to access and simpler to use, allowing you instantenous (1tx) swaps with liquidity sourced from 5 DEX aggregators.

Read on for more details👇 pic.twitter.com/JS5zvTzTsV

If you want to swap your collateral or debt for another type of asset on Aave, you can now do so directly through the Aave dashboard on DFS. Simply open the Tools menu bar, and you’ll find the Collateral and Debt Switch options.

Not only that, but once you enter your desired changes, DeFi Saver will automatically show you post-transaction values, including the Net APY and the Safety Ratio. In this way, you can ensure everything looks right before signing the transaction.

Aave Umbrella is now live on DeFi Saver

Aave’s Safety module recently received a fresh update, which allows you to stake your USDT, USDC, GHO, and WETH and earn an extra yield on your assets, in addition to the base yield you already receive from staking your tokens.

By accessing Umbrella through the Aave dashboard on DeFi Saver and staking eligible aTokens, you can earn both the base yield from Aave, an extra yield tied to slashing exposures.

You can now access @aave's Umbrella staking module through DeFi Saver.

— DeFi Saver (@DeFiSaver) July 4, 2025

Umbrella is an automated staking system designed to cover bad debt and enhance protocol safety without relying on governance interventions (like with the legacy Safety Module).

That said, you can now stake… pic.twitter.com/5QwQcQsm2G

To learn more about Aave’s Safety Module, slashing, and the new Umbrella update, make sure to read our previous DFS blog post.

sBOLD and yBOLD now both available at DeFiSaver

sBOLD by K3 Capital is a yield-bearing stablecoin, backed by ETH and LSTs. It’s built on Liquity v2, allowing you to earn yield on the protocol’s Stability Pools. You can acquire them by depositing BOLD tokens into sBOLD vaults, which will then be distributed across Liquity v2’s multiple Stability Pools, letting you passively earn interest from liquidations.

yBOLD, created by Yearn Finance, also builds on top of Liquity v2 Stability Pools. You can mint yBOLD with your BOLD tokens, or acquire them through secondary markets, and you have the additional option to earn extra returns by staking yBOLD into Yearn’s auto-compounding vault to get ysyBOLD. Just like sBOLD, these tokens earn more value over time and are automatically reinvested.

So if you want to earn some extra yield on your BOLD, you can now do so through your favorite DeFi app.

Ethena Liquid Leverage now live on Aave via DFS

Ethena’s Liquid Leverage is now fully integrated in DeFi Saver, allowing users to enable E-mode, convert and stake assets, supply collateral, borrow, and loop. But instead of doing all of these steps manually, DFS does all of this for you in one easy transaction.

To qualify for Liquid Leverage rewards on USDe deposits, you had to have supplied a 50/50 split of sUSDe and USDe collateral, and borrowed either USDC, USDT, or USDS, and loop the position at least once.

Rewards distribution already kicked off, so if you meet the criteria, congrats! Head to DeFi Saver to claim in one simple click.

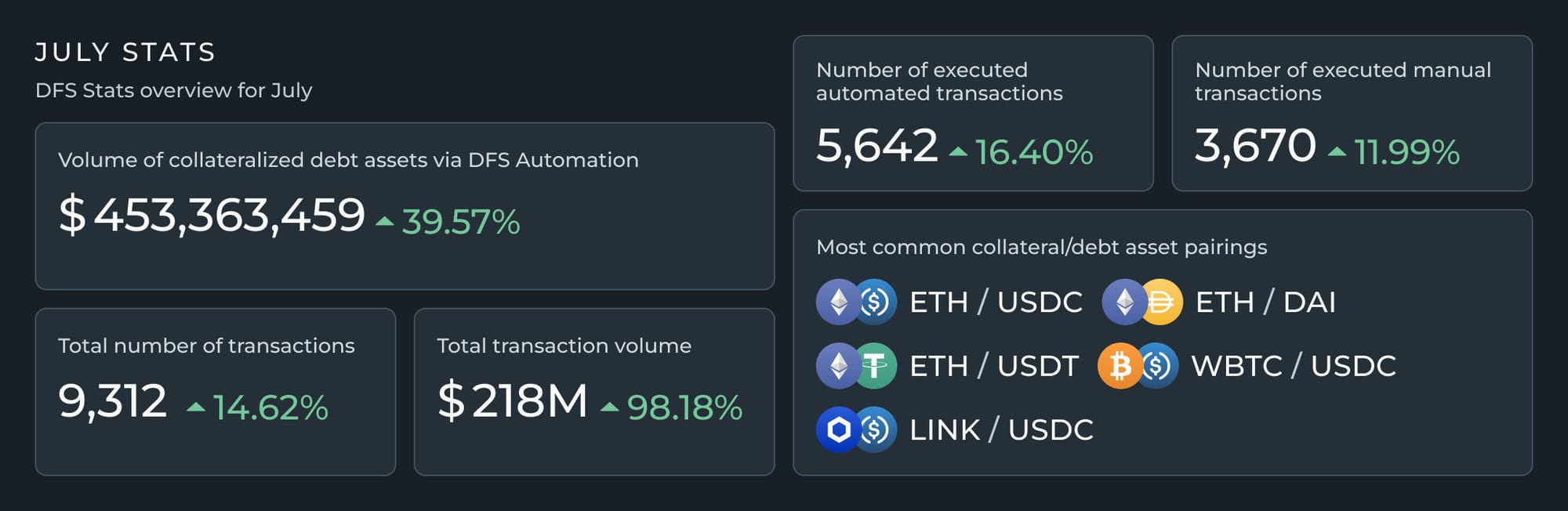

DFS June stats

Below you can find our regular monthly metrics, and it’s all good news. Everything’s up from last month, some numbers even doubled, and in our favorite color.

We’re also working on better understanding just how big of an impact and presence DeFi Saver and you guys, our users, have in the ecosystem. Some bits we can tease for now are that we see close to 5% of Aave (Core) and 7% of Spark assets were supplied through DFS.

This doesn’t sound like a lot, but if we say that’s $2B and $450M respectively, we think those are very cool numbers.

We’ll be looking to share more of these stats moving forward as we set things up better.

Position of the month

For this month’s segment, we’ll analyze one DFS whale that managed to go from 5,000 ETH to 10,564 ETH, essentially going from $9,200,000 to $40,255,092, without any risk of liquidation and tedious oversight. And with the trusty help of DeFi Saver.

Let’s break down what happened:

- On May 3, the user entered the market with 5,000 ETH, valued at around $9,21M, with the price of ETH being $1,842;

- They used this capital to open a leveraged position on Aave, creating 15,914 ETH worth of collateral. This was all accomplished by borrowing $20.18M worth of USDC against the position, all in one single transaction;

- Over the following months, ETH began to rally, and it reached the price of $3,740 by July 20;

- This pushed the total value of the user’s collateral to $59.6M, while the debt increased to $20.4M;

- On July 20, the user used Repay to pull 5418 ETH from the collateral, swap it into $20.4M and fully repay the debt;

- With the debt cleared, this DFS whale walked off with 10,564 ETH, worth around $40.2M.

All in all, this user doubled his ETH holdings and quadrupled their USD value by making smart leverage, sharp market timing, and of course, by using DeFi Saver.

For more position analysis like this, ecosystem news, and DFS updates, make sure to subscribe and follow our DFS socials.

That would be all for this issue of the DFS Newsletter. Thank you all for reading, and see you again next month!

Stay connected:

📢: Official Twitter/X