DeFi Saver Newsletter: May 2025

Welcome to our latest newsletter, covering recent DeFi Saver updates, latest stats, and ecosystem happenings amid Q2!

As promised, we’re back once again to let you in on the latest developments here at DeFi Saver, as well as some of the most interesting news from the DeFi community.

So, let’s get started!

ETH: from market crash to comeback

The first few months of 2025 were challenging for ETH investors, however, the beginning of Q2 has brought a shift in not only numbers but also user sentiment.

In May alone, ETH surged by nearly 50%, rising from $1800 to around $2700. While optimism is running high across socials, especially Twitter, it’s worth taking a step back to consider one particular event that happened this month, which might have contributed to such a great comeback.

In May, $ETH broke above its Realized Price at $1.9K, putting the average holder back in profit. Price is now above the True Market Mean ($2.4K), a bullish sign - but reclaiming the Active Realized Price at $2.9K remains key for further confidence: https://t.co/EdqeH4GGXO pic.twitter.com/BHEN9Mgdfs

— glassnode (@glassnode) May 23, 2025

On May 7, we were met with the long-awaited Pectra upgrade. Some hail it as the biggest upgrade since the Merge of 2022, which transitioned the network from proof-of-work (PoW) to proof-of-stake (PoS). Others might even argue that it's the greatest improvement since Ethereum went live, in terms of the number and significance of proposals.

Regardless of how you put it, it is apparent that Pectra carries a significant weight. There are 3 fundamental pillars of this change:

- Enhancement of user experience: Wallet-impacting changes, such as allowing for scheduled and push payments, cross-chain abstraction, batch transactions, etc.

- Validator consolidation: The staking cap was increased from 32 to 2048 ETH on a validator, which is meant to accommodate both smaller and institutional validators;

- Cost optimisation: Tackling the issue of high network congestion and cutting gas prices.

Debates around whether Pectra contributed to ETH’s market value are inevitable, however, its long-term benefits for users are undeniably promising. We’re eager to see how the changes play out in the months ahead.

DeFi Saver news & updates

Now, let's take a look at the latest DeFi Saver improvements and updates our tools got this May.

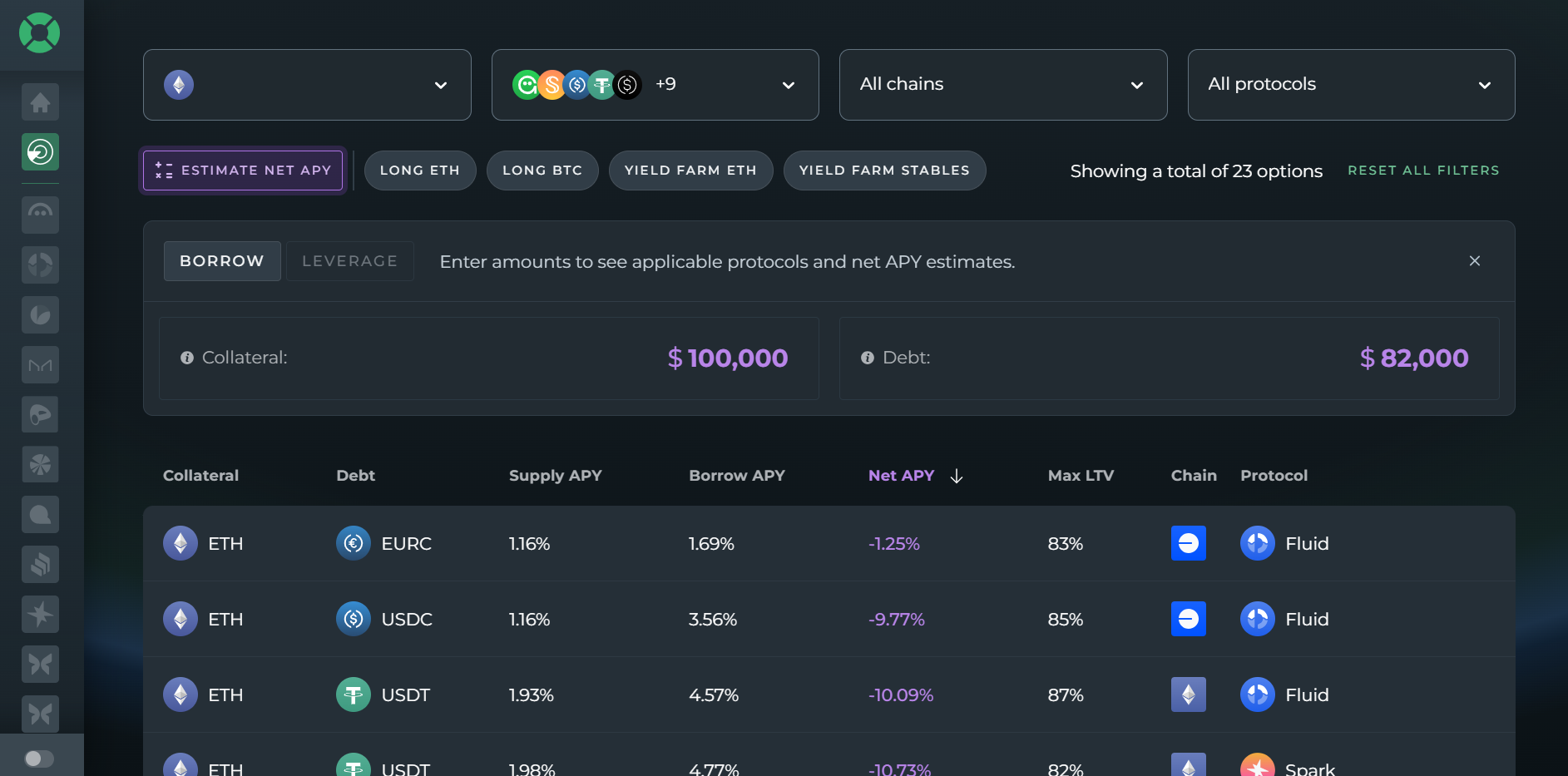

Discover page now includes NET APY Estimation

In case you missed it, we launched a loan Discover(y) tool that helps users optimize their borrowing, leveraging, and yield-earning strategies by providing a clear overview of all available options across different protocols.

Not only that, but we decided to take it one step further and enable users to filter investment opportunities based on the amount of collateral they want to supply, the debt they wish to borrow, as well as the amount of exposure they wish to have to a certain asset.

With the first iteration of the Discover page, you could easily filter markets by specific assets, compare supply and borrow APYs, or use strategy presets like Long ETH/BTC or Yield Farm ETH/Stables - without connecting your wallet.

— DeFi Saver (@DeFiSaver) May 16, 2025

With the second iteration, we are taking… pic.twitter.com/gaZzlErDQ3

Full Pendle support for Aave on DeFi Saver

One milestone we were especially proud of in May was the launch of Pendle support on DeFi Saver. Pendle is a DeFi protocol that strives to bring the concept of interest rate derivatives to DeFi, as its pTokens allow users to lock in fixed returns and redeem them when the maturity period expires.

With Aave now supporting Pendle pTokens (PT-eUSDe and PT-eUSDs) to be used as collateral, we were quick to integrate them and enable users to create and leverage positions easily.

However, as the initially onboarded PTs neared their maturity date, we got to work on designing extra tools, as users will either want to close their positions or continue earning yield with new PTs.

Since handling these transactions manually is a hassle, we’ve created tools that aid users in easily executing Rollovers, or simply closing or repaying their positions.

We just released some very handy tools for Pendle users on @aave.🛠️

— DeFi Saver (@DeFiSaver) May 30, 2025

With the initially onboarded PT eUSDe May now expired, we realised many will be looking to either unwind their positions or to roll them over into new PTs.

And that's why we created tools for handling both.

1.… pic.twitter.com/2zyxv0mXFC

Events

June is packed with ETH events, where you'll have the opportunity to meet the team behind your favorite DeFi app!

ETH Belgrade

As mentioned in our previous NL issue, we were beyond happy to attend this year's ETH Belgrade, from June 3 to June 5!

We’d sincerely like to thank the organizers, as well as all of you who took the chance to stop by and have a chat, get some merch, and test out some of the newest features on DeFi Saver! It was also nice seeing some familiar faces, so a big shout-out to all of you who dropped by to catch up.

On the first day, our co-founder @sterluu, opened the floor as the keynote speaker, deliberating on the evolution of how we perceive and interact in the web space, as well as the importance of values behind building digital products.

During the event, you also had the chance to hear our Product Designer @zarko_stamenic give insight into DeFi UX, highlighting the significance of industry-wide consensus on terminology, as well as the necessity of being flexible and adaptive in this field of work.

"The underlying principle I believe in is: make simple things easy, and complex things possible".@DeFiSaver's @zarko_stamenic on designing and simplifying DeFi UX for the masses. 🛟 pic.twitter.com/lFyuptNsZc

— Alex (@Alex_DeFiSaver) June 4, 2025

Moreover, on the second day, we had the pleasure of co-hosting the third Beers&DeFi event, together with the Curve Finance team. We met up for some cold drinks and DeFi talk, and we’d like to use this opportunity to sincerely thank you for helping us make each gathering even more enjoyable than the last.

Upcoming events

Couldn’t make it to Belgrade? No worries! June will be an extremely eventful month for us, as we’ll also be in Berlin, at this year’s Dapp con and SafeCon on June 18. So, if you’d like to meet our guys there, feel free to reach out to us on Discord!

Too busy for Berlin as well? How about the French Riviera? Join us at EthCC, the largest European Ethereum gathering, on June 30 and July 1! We’ll be there with our lovely booth and a fresh set of merch, so make sure not to miss us.

EthCC[7] is made possible by the generous support of our sponsors.

— EthCC - Ethereum Community Conference (@EthCC) April 9, 2024

Thank you @DeFiSaver for supporting us this year as a WAGMI sponsor!

🖤💛❤️https://t.co/aLgrraxzmK pic.twitter.com/IrEzMaRUzB

May stats

At the end of May, DeFi Saver Automation managed around $310M of collateralized assets across 1310 user positions, which is a significant increase in comparison to last month’s $221M.

In terms of total transaction volume, there have been approximately 8,000 transactions, amounting to around $125M, out of which 66.72% were automated and 33.28% were manually executed.

Little has changed compared to April in terms of the most common collateral/debt asset pairings: ETH/USDC still remains the most popular, followed by ETH/DAI, ETH/USDT, WBTC/USDC, with LINK/USDC newly emerging in the top five for May.

Position of the month

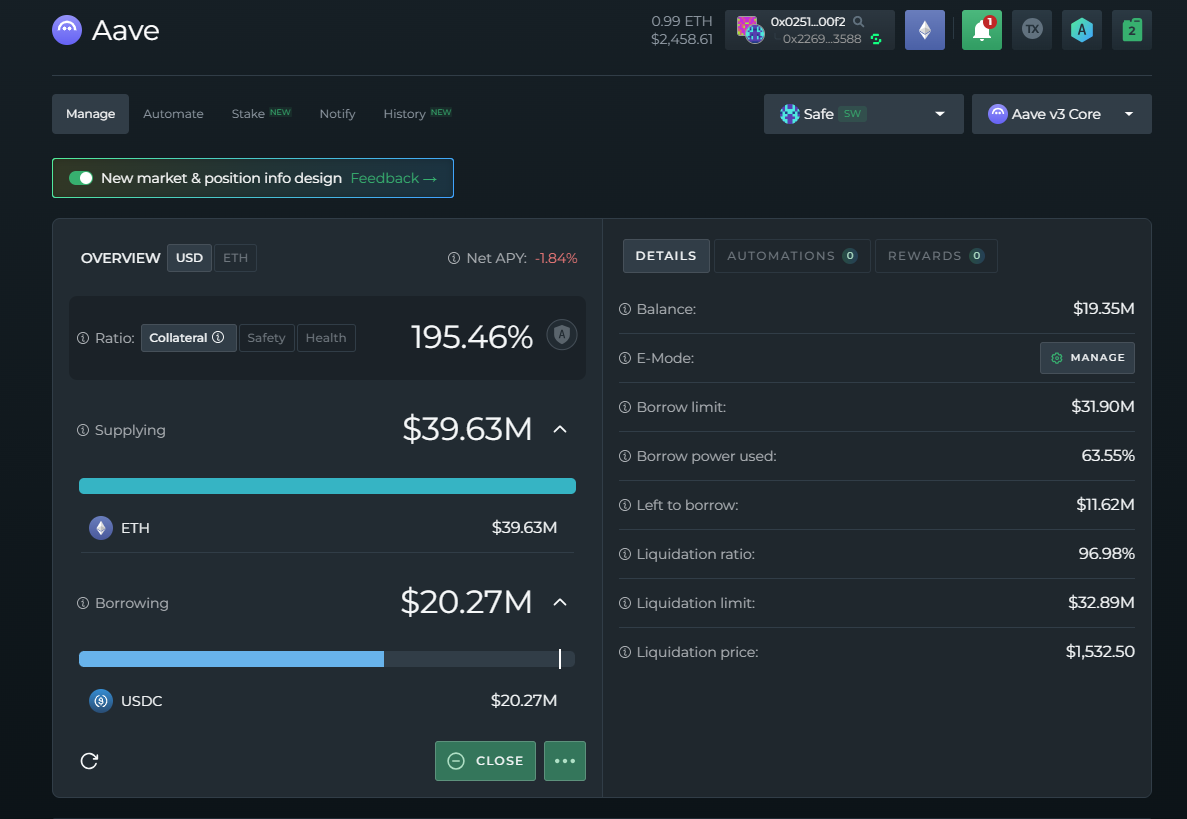

For this issue, we will be examining this whale’s impressive long position in Aave, a position that started with 5000 ETH and was then turned into a massive 3.18x long using DeFi Saver.

Now, while using lending protocols (such as Aave.) for margin trading limits you to lower leverage compared to using perpetuals, they’re often a better choice for long-term positions, as the costs of holding the position open are much lower.

Yesterday a user opened a massive ETH long in @aave v3 using defisaver.

— nikola_j (🛟,🛟) (@_nikolajankovic) May 4, 2025

Their position right now is:

- 15,9k $ETH ($29.3m) collateral

- 20.18m $USDC debt

~$9.1m balance (4.95k ETH)

Why'd they chose @defisaver to create this? I think 3 things stand out:

1. leveraging in 1-tx… pic.twitter.com/sPMGPZbmA2

This experienced user knew exactly what they were doing. By splitting the swap into three different transactions, they minimized the trade size impact and avoided unnecessary losses.

Here’s a summary of what their three transactions achieved:

- The user supplied their 5000 ETH to Aave;

- They acquired 10.940 ETH (priced at $1834 per ETH) by Boosting their position with $20.2M USDC, which means that the borrowed USDC was instantly swapped to ETH (in 3 separate chunks) and re-supplied as extra collateral to their position in Aave.

If they had supplied their original 5000 ETH and stopped there, today they would have $12.5M (around 5008 ETH thanks to the supply APY).

However, their net worth has grown significantly more than that since they opted to go long, meaning they could walk away with a $6.7M profit if they were to close it today.

For anyone considering following in the footsteps of this person, we just wanted to highlight a few more tools you should consider at DFS:

- Look into available automation options you can configure, so that your position gets automatically rebalanced during market movements, or at least consider setting up notifications;

- Use TxSaver to ensure your swaps will be protected from any MEV attacks.

We hope you enjoyed this month’s Position of the Month segment. If you have any comments or ideas on what topics you’d like us to cover next, or want to share your thoughts on this month's Newsletter issue, we’re always happy to chat on our DFS Discord.

That would be all for this issue of the DFS Newsletter. Thank you all for reading, and see you again next month!

Stay connected:

📢: Official Twitter/X