DeFi Saver Newsletter: September 2025

Ethereum reaches ATH, Fusaka is approaching, Ethena gains momentum, and DeFi Saver releases a new strategy execution shortcut.

Welcome to the latest edition of the DFS Newsletter!

Starting with this edition, our DFS Newsletters will be named after the month in which they are published. For example, if an issue is released in September, it will be titled DeFi Saver Newsletter: September 2025.

Why the change? Simply put, we wanted to make it easier for you to find and reference the information you need. By tying each issue to its publication month, the whole process becomes more intuitive and reader-friendly.

Now, let's take a look at everything we’ll cover for August:

- Ecosystem news: ETH hits ATH, Fusaka progress, USDe circulating supply ATH;

- DFS upgrades and launches: Trending page, Zaps, History, Compound automations, and the new DFS Searchbar shortcut;

- Latest DFS Stats for August;

- DFS user position analysis-Ethena Liquid Leverage edition.

Ethereum hits ATH

The ETH community had plenty to celebrate on 24 August, as ETH officially set a new ATH, having surpassed the $4.878 peak from November 2021.

Aside from the general bullish sentiment, the surge in price can be attributed to the growing institutional demand, along with a plethora of macroeconomic influences in 2025 that proved favourable and profitable for ETH.

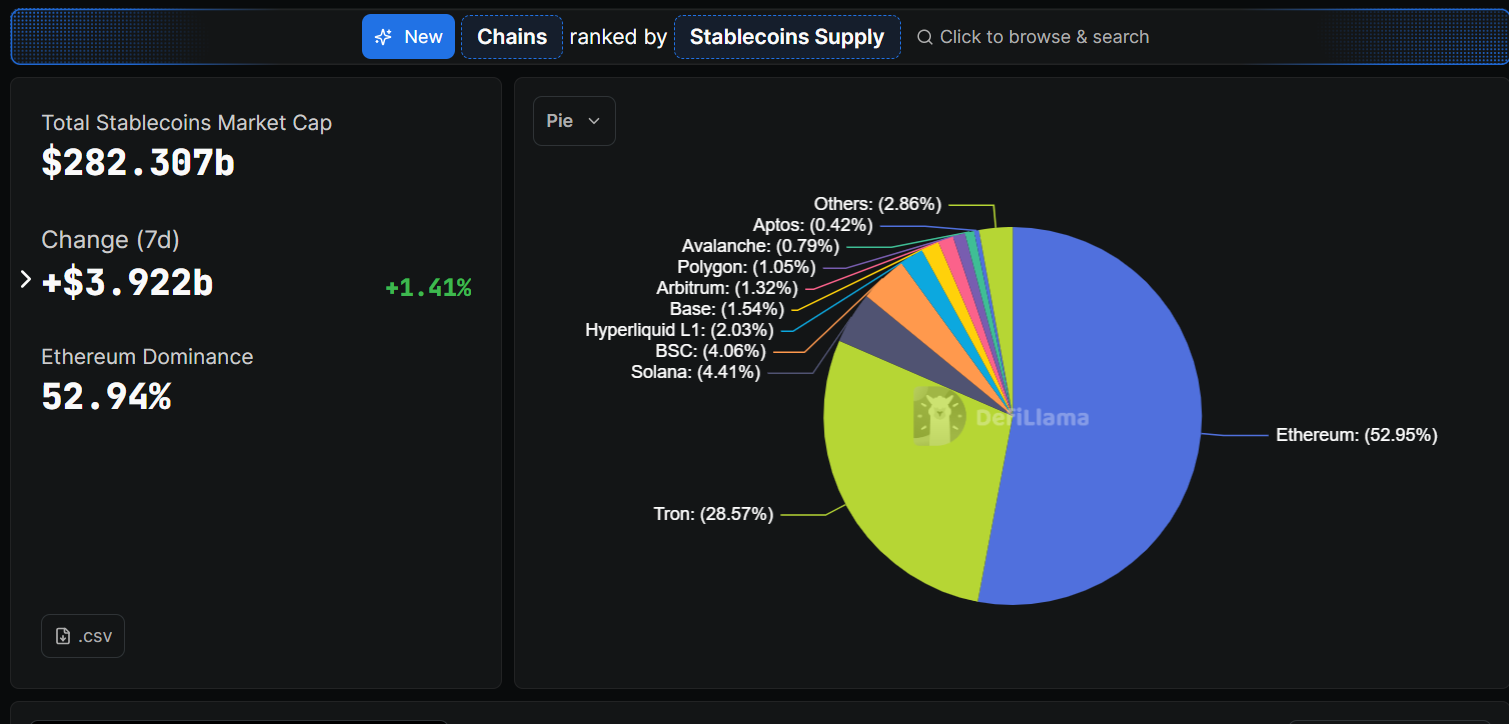

One key catalyst worth mentioning is the GENIUS Act, the newly passed US stablecoin bill. As the Ethereum blockchain already serves as the leading network for large stablecoin transactions, this activity grew even further following the adoption of the bill.

Apart from regulatory improvements, devs have also been doing their part to further simplify and improve the Ethereum network. The Fusaka upgrade, initially scheduled for release in November, is now believed to go live in the first half of 2026, due to the need for extensive testing. Fifteen EIPs are currently included, aiming to improve the EVM and optimise L2s.

The delay from its initial November launch reflects the complexity of Fusaka’s key features and the need for rigorous testing. The features in question are:

- PerDAS (Peer Data Availability Sampling): allows consensus layer nodes to verify large transactions by sampling small, random parts instead of entire blobs. Lowers hardware demands and reduces cost for node operators.

- EOF (Ethereum Object Format): reorganises smart contracts and replaces the current bytecode model. Nodes could be more efficiently validated, with lower gas costs and risks involved.

Though less prominent, other EIPs have also emerged, other than major updates. Ethereum's co-founder Vitalik Buterin, and Andres Elowsson, released EIP-7999, which aims to improve capital efficiency and allow users to specify the maximum fee for all tx components.

🧵Introducing EIP-7999: Unified multidimensional fee market.

— Anders Elowsson 🌻 (@weboftrees) August 11, 2025

Ethereum is like a supermarket with one inventory label. There are 45M eggs, 45M cheese, 45M snacks. etc, but everything scans as "1 food". To avoid empty shelves, it closes once 45M food has been sold during the day. pic.twitter.com/UUgg1dfr9Y

On a slightly different note, another ATH was also welcomed last month, when Ethena’s USDe stablecoin reached $9.3B circulating supply by the beginning of August.

Ethena’s USDe stablecoin has reached an all-time high market capitalization of $9.3 billion, a significant 75% increase in supply over the past month.

— The Defiant (@DefiantNews) August 4, 2025

Read the full article here: https://t.co/ODgdEkPXKP

Ethena (ENA), launched in 2024, is a synthetic dollar protocol that employs a delta-neutral hedging strategy to provide stability to its native USDe stablecoin. Today, Ethena has 786K users, and has broken its initial record with a supply of 12.5B USDe on 24 chains.

One of the driving forces behind this has been the Liquid Leverage incentives campaign by Ethena and Aave. At this point, it’s already fully up and running at DeFi Saver, and now, you can even instantly Zap into this position via the new DFS Trending page.

All you need to know about Liquid Leverage by @ethena_labs & @aave🧵

— DeFi Saver (@DeFiSaver) August 7, 2025

This incentives campaign allows you to run a 50/50 position made up of sUSDe and USDe while receiving yield as if it were 100% sUSDe.

These positions regularly run at >50% APY, so let's share some tips.

1.… pic.twitter.com/HZBKXDzNWz

DeFi Saver news & updates

August is usually a slow month for some, but we all know there’s no slow month in DeFi. It’s a non-stop progress, and it’s been the same at DeFi Saver, with a few updates that we think move the UX needle quite a bit.

DeFi Saver launches Trending page

The DFS Trending page and DFS Zaps are two interconnected features that enable strategy browsing and execution at the click of a button.

The Trending page offers an overview of the most popular strategies currently being executed via supported DFS protocols. Each strategy is paired with a Zap, our pre-made transaction bundle, that lets you execute multiple complex moves in a single step.

For example, you can now Zap yourself into a long or short ETH/WBTC position, boost rewards on sUSDe and USDe with Ethena Liquid Leverage, grab extra incentives for USDC on Base-and much more!

Bear in mind that as trends change, so will the exhibited strategies. So follow DFS Trending regularly, for more cool Zaps to come!

🆕Our latest release just went live: Trending & Zaps

— DeFi Saver (@DeFiSaver) August 14, 2025

The new Trending page aims to highlight most popular strategies available at DeFi Saver, all of which can be executed using 1-transaction Zaps.

It also features a mix of protocol and DFS news to keep you on top of things.❇️ pic.twitter.com/rkEiv9GD2X

History update for Compound, Spark and Aave

The DFS History page is now updated for Aave users and officially available for all Spark and Compound users!

This lets you track every action on your position, see USD values based on oracle prices at the time of execution, as well as view or export your full position history (Export CSV).

With the updated History page, you can now get a full breakdown of your @aave positions.

— DeFi Saver (@DeFiSaver) August 27, 2025

Here's what you get:

- one-click CSV exports

- USD values based on oracle prices at time of tx

- covers both automated and manual actions (including Boost, Repay, Create and Close)

-… pic.twitter.com/ATGOSNoaM3

And by using our Tracking feature, you can also view the position history of any position, regardless of whether it was made with DeFi Saver or not!

The new DFS Searchbar option is live

Navigating through DeFi Saver recently got simpler and faster. DFS users can now press Cmd/Ctrl + K and instantly jump to the section they’re looking for: a specific protocol, DFS tool, DFS Discover, or even a specific Zap.

just deployed something cool to show off tomorrow at @EthCC:

— nikola_j (🛟,🛟) (@_nikolajankovic) June 29, 2025

🪄try pressing CTRL/CMD + K next time you use @defisaver🪄

(yes, it's a quick access command bar and we'll be looking to make it more useful in the coming weeks - consider it beta rn!) pic.twitter.com/tDlNk2pwng

Fresh set of automations for Compound

Now, Compound users can automatically adjust leverage when their collateral hits target prices or set thresholds to secure profits or limit losses.

A new set of automations is now available for @compoundfinance at DeFi Saver!

— DeFi Saver (@DeFiSaver) August 19, 2025

The following features are now supported for both EOA and smart wallets on Ethereum mainnet, @arbitrum, and @base:

- Boost on Target Price

- Repay on Target Price

- Stop Loss

- Take Profit pic.twitter.com/4Wh9jwLtVW

All automations are accessible directly through the Compound dashboard on DFS or via the DFS extension in the Compound app, making it simpler than ever to stay on top of your positions.

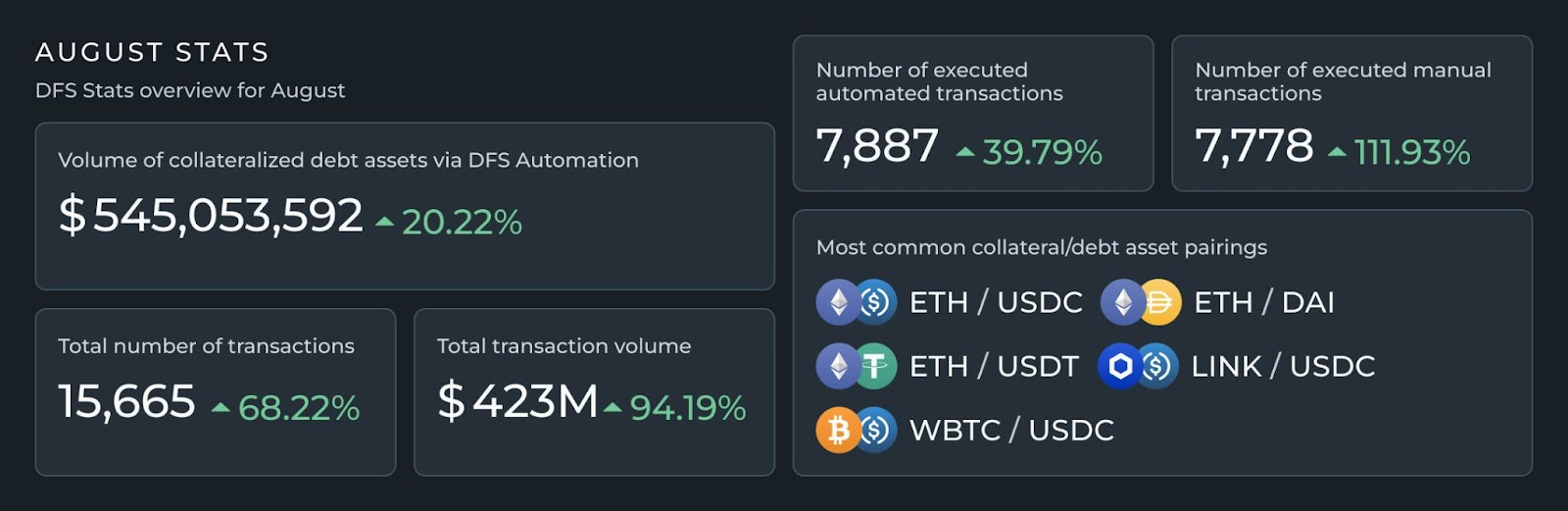

DFS August stats

As always, here are the DFS Stats for the month of August. Please bear in mind that the numbers currently do not account for Ethena, Pendle, and collateral & debt switch transactions. We will be looking to include those metrics in the coming months.

Position of the month

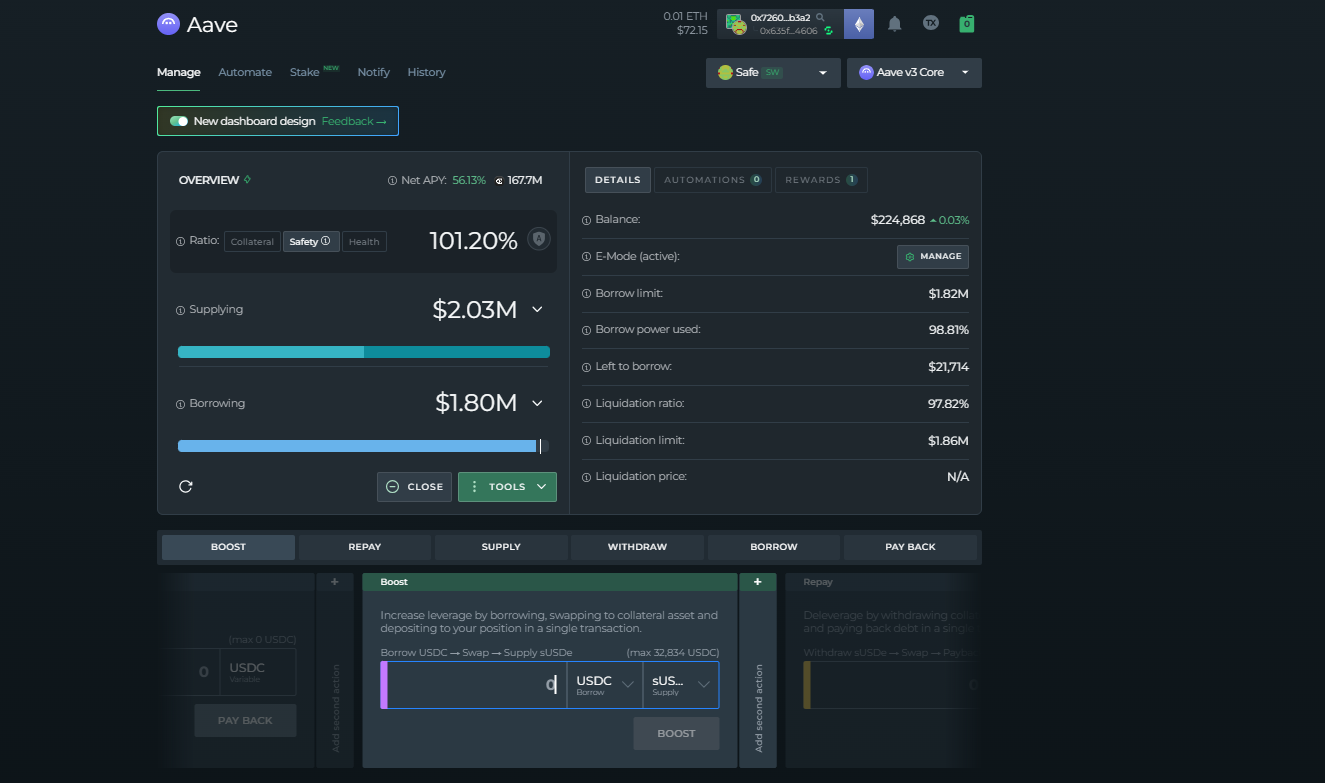

To further explain the latest Ethena trend, and give you insight into just how profitable these strategies can be, today we’ll be analysing one DFS user’s Ethena Liquid Leverage position.

On 16 August, they spotted the opportunity on the DFS Trending page, and jumped in with 189.705 sUSDe starting capital, which was then allocated into a 50/50 leveraged sUSDe/USDe position.

This means the starting balance was $225.1K (1sUSDe=$1.1869 at that day).

Fast forward 18 days later, with sUSDe growth and additional incentives (some of which are still to be claimed), the balance is $227.494.

The total profit made in 18 days is $2.334, which would mean he’d make $47.328 in a year, with the projected APY staying around 23%, based on the profit made thus far.

Ethena strategies have become quite handy for those looking to maximize yield. Such is the case for this user, who secured an admirable profit in just 18 days, in a few clicks on the DFS Trending page. And he is certainly not alone, as DeFi Saver users currently make up 32.9% of Ethena Liquid Leverage x Aave users, and account for a supply of $327M.

You too can also stay up to speed with the most popular strategies out there by checking out DFS Trending. And as always, if you have any additional questions or just want to give us a shoutout, make sure to stop by our Discord server..

We value your input

Help us customise our Newsletters to better suit your preferences by answering one quick question:

That would be all for this issue of the DFS Newsletter. Thank you all for reading, and see you again next month!

Stay connected:

📢: Official Twitter/X