DeFi Saver Year in Review and Roadmap Preview

A look back at 2020 and a peek at what’s coming next.

The year 2020 started so promising, with crypto seemingly entering a new bull phase and a wave of new users joining the decentralized finance space to try things out. However, things quickly turned grim as the news of the pandemic started spreading, eventually culminating in what seemed to be the Crypto Doomsday for anyone caught in the midst of it — Black Thursday on March 12.

Still, once the dust settled a bit, things quickly got back on track. We made it through the thick and thin and we got to experience some amazing new things along the way.

There was Compound kicking off the yield farming craze, there was Uniswap starting a new airdrops season, there was MakerDAO reaching 1 Billion Dai in circulation and there was the successful launch of the ETH 2.0 Beacon chain, to name just a few highlights.

While the happenings outside kept us at home, it seems it only made everyone build more — and build we did.

A year of redefining the DeFi Saver experience

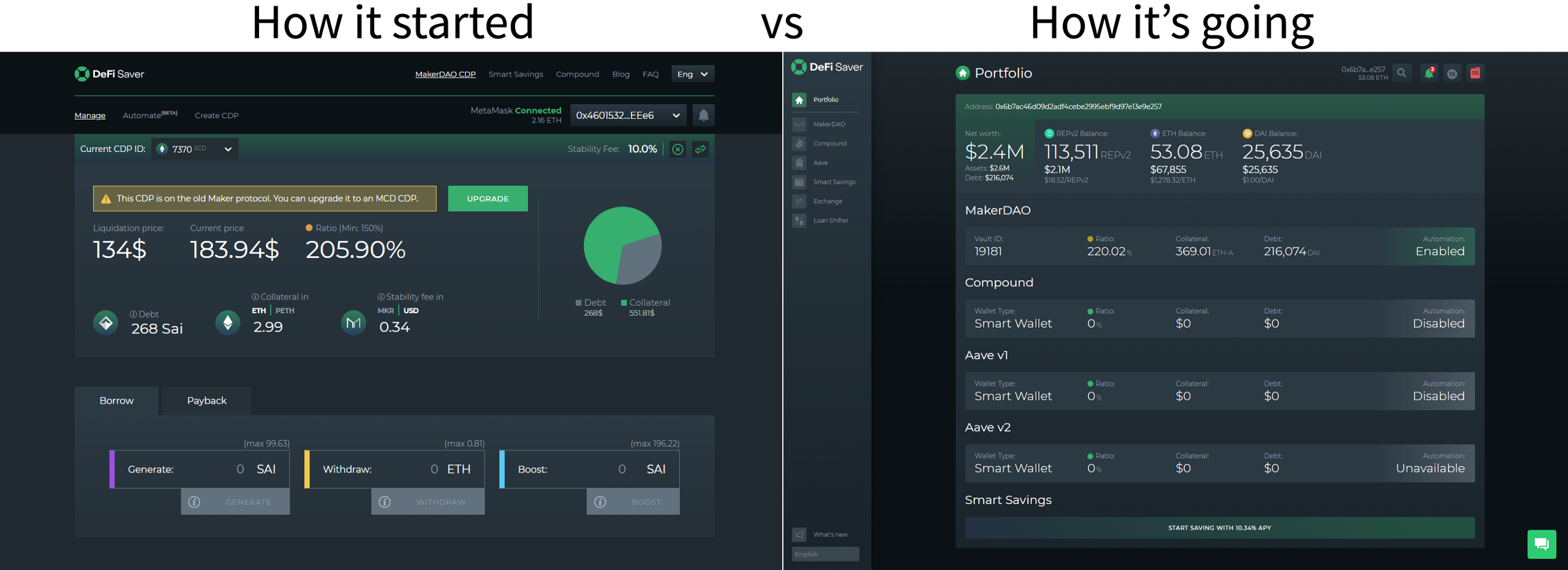

During 2020 we focused on providing the best experience for debt and leverage management and we really hope that the stark difference between what DeFi Saver was on January 1st versus what it became by December 31st shows that.

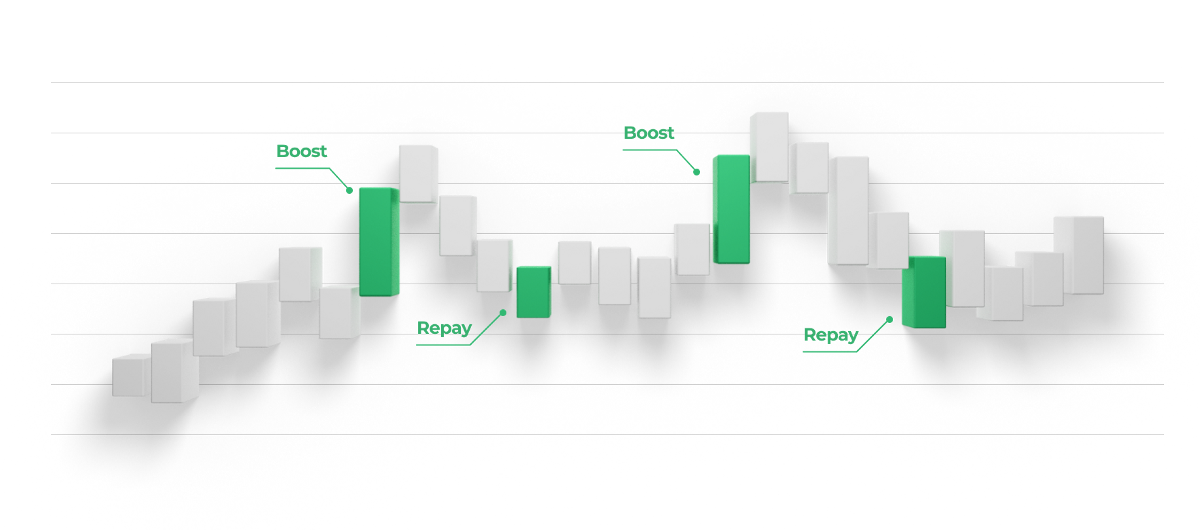

We entered the year as an almost exclusively MakerDAO management app, though there was also some basic Compound support without any kind of leverage management. At that point, Automation was already live, but any advanced features outside of it only included basic Boost and Repay.

During 2020 we introduced:

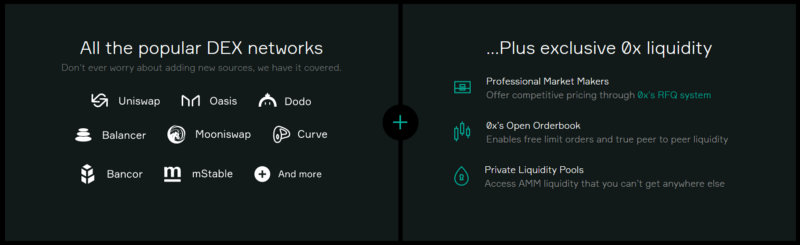

- Expanded liquidity with 0x API

Where we previously had Kyber, Uniswap and Oasis integrated, all DeFi Saver users now have access to 20+ DEXes (including the likes of Uniswap v1 and v2, Sushi Swap, Curve, Kyber, Mooniswap, Balancer and Bancor) thanks to the 0x API aggregation engine.

- A completely new Compound dashboard

Our previous, very basic Compound dashboard was completely redesigned from the ground up and now features advanced leverage management that was previously only available to MakerDAO users. - Portfolio tracking and account monitoring

This user experience focused update finally allowed anyone to enter their (or anyone else’s) address for portfolio monitoring. - Automation for Compound

What used to be a MakerDAO exclusive feature, finally launched for Compound, too. By the end of the year there were more than 70 unique Compound positions with Automation enabled. - A new Aave dashboard

Aave was potentially the protocol we built most features around in 2020, as we started using Aave flash loans for both MakerDAO and Compound leverage management, and then introduced Aave to our Smart Savings Dai lending dashboard and finally introduced full Aave support. - 1-tx leveraged positions creation in Compound

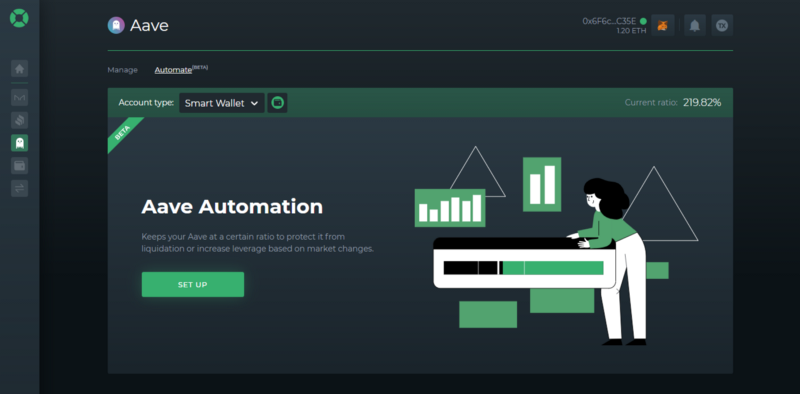

This was a very unique feature release as it enabled creating both long and short positions in a single transaction, compared to our previous feature for MakerDAO where only long positions are possible. - Automation for Aave

One of our goals for Automation in 2020 was to expand support to more protocols and we were very happy to have Automation for Aave launched later during the year.

- Gas Prices extension and in-app widget

Transaction fees and gas prices have been one of the constant struggles of decentralized finance and our extension (available for Brave/Chrome/Edge as well as Firefox) aims to help with that with historical charts and alerts. - Loan shifter

Potentially one of our most unique tools to date, the Loan Shifter allows anyone to move their position between protocols (e.g. from Compound to MakerDAO) or to instantly change their collateral or debt asset to a different one. Our follow up article covered some of the most popular use cases in detail. - Aave v2 support

We were very happy to introduce support for the new version of the Aave protocol from day one and we are even more so looking forward to building new amazing features on it.

The last update we believe is very much worth mentioning is the one we made to the DeFi Saver team — we very extremely fortunate to expand the team with two new members during last year. Even if it maybe doesn’t sound like much, this was actually a 33% increase to the team size, bringing us up to 8 members in total.

While the the amount of improvements and updates may seem impressive to some, let’s take a look at something even more interesting — last year’s stats.

2020 in numbers

In our previous year recap post for 2019 we were extremely proud to share that more than 16m of volume was made at DeFi Saver in 2019.

In 2020 we smashed this record by February and then set a new one at 18 times that with over 291 millions in actual trade volume made with our leverage management tools.

Let’s break things down and take a closer look at how this developed throughout the year.

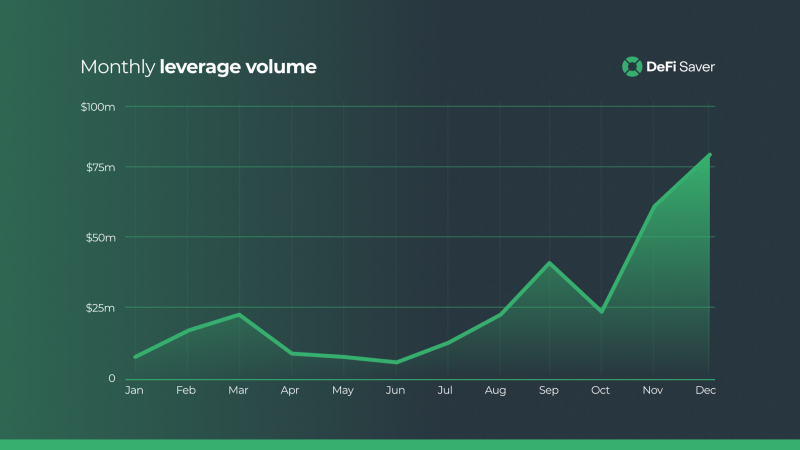

If we look at the monthly volume chart, we can see a noticeable spike in March, driven by deleveraging during the Black Thursday crash, as well as some brave leveraging afterwards.

The next few months went by with relatively low volume, but then activity ramped up sharply from summer onwards.

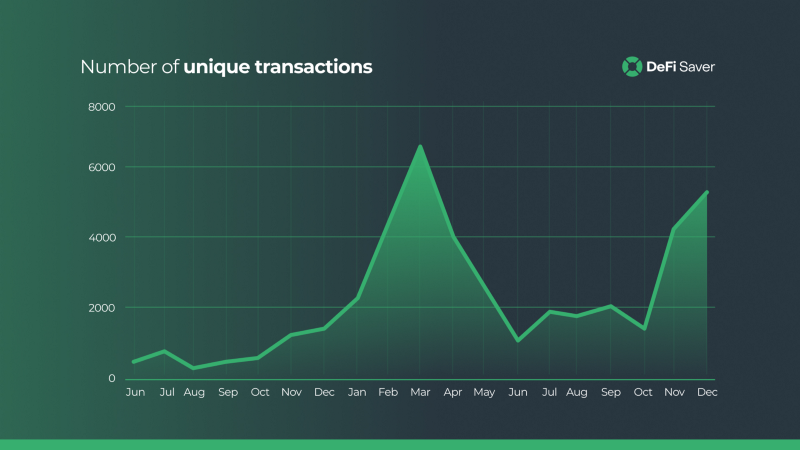

Overall, there were over 36,000 unique transactions made throughout the year. And this isn’t counting any standard protocol interactions, that’s all just advanced leverage management. But let’s take a look at how this was spread out during the year.

When it comes to monthly transactions, we instantly notice that the spike in March was much greater than on the volume chart and there is a simple explanation for this — at the time of the Black Thursday crash we still didn’t have Extended Repay or Boost implemented (the ones powered by flash loans). That resulted in an incredible amount of transactions needed for unwinding user positions. It also goes to show just how useful flash loans can be.

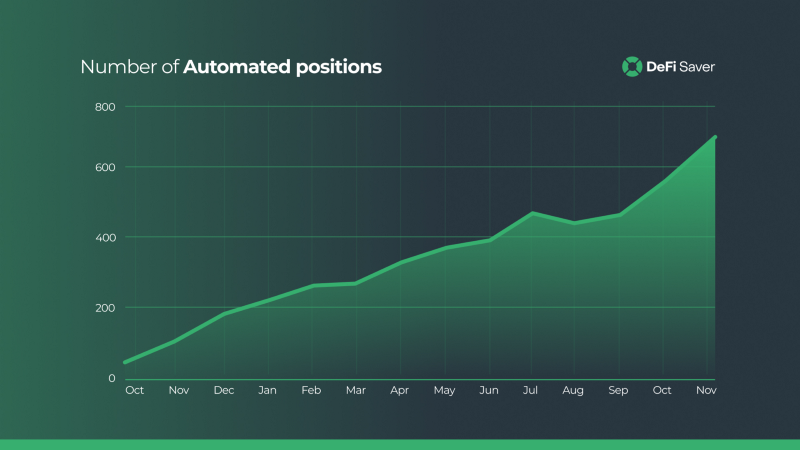

Last, but most certainly not least, let’s take a look at some Automation numbers.

Where the year started with a total of 160 automated MakerDAO positions, by the end of 2020 there were more than 650 automated positions in MakerDAO, Compound and Aave.

Overall, to say that we were stunned by the adoption, activity and volume we saw in 2020 would be an understatement. Yet, with only three weeks in the new year, we can already share that the 2020 volume record has been broken.

As a fully self-funded, bootstrapped team that’s been developing in the Ethereum ecosystem since 2017, this is absolutely amazing to see.

Thank you for using DeFi Saver and for constantly pushing us onwards.

2021

We have great plans for this year, with work on many of the planned updates already well underway. And while we don’t want to share too many details, we can give a few hints as to what we’re aiming to deliver.

More freedom

One of our goals for this year is to provide everyone with more freedom to cook up their own actions. While we were always quick to call DeFi Saver “the advanced DeFi management app”, we realized that our approach with providing ready-made options doesn’t really align with that.

You guys always have new ideas that we can hardly keep up with, so we want to provide you with the tools to turn those into actions yourselves, instead of being limited to only what’s already on the menu.

More automation

Automation remains our flagship product and our goal is to provide more of it. Stop losses, trading signals, gas price conditions, multi protocol interactions — we want to keep expanding on the safe, hands-off experience we initially introduced.

Besides rolling out new features, our utmost priorities will also be stability and security, and we’ll be talking more about those in the coming weeks.

Thank you once again for being with us on this journey and here’s to 2021 — let’s make it a great one.

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter