Fluid protocol – the newest DeFi Saver integration is now live

We’re continuing to expand the DFS toolkit by adding Fluid protocol into the mix.

Built by the Instadapp team, Fluid Protocol was initially introduced in late 2023. The idea behind the protocol was to merge key elements from well-known projects like Uniswap, Aave, Compound, Curve, and MakerDAO into a new lending and borrowing app optimized for efficiency, usability, and security. In their own words, Fluid Protocol is described as “the fundamental layer for DeFi, upon which many protocols can be built.”

Now, let’s take a closer look at what makes Fluid Protocol interesting and what are some of the key features.

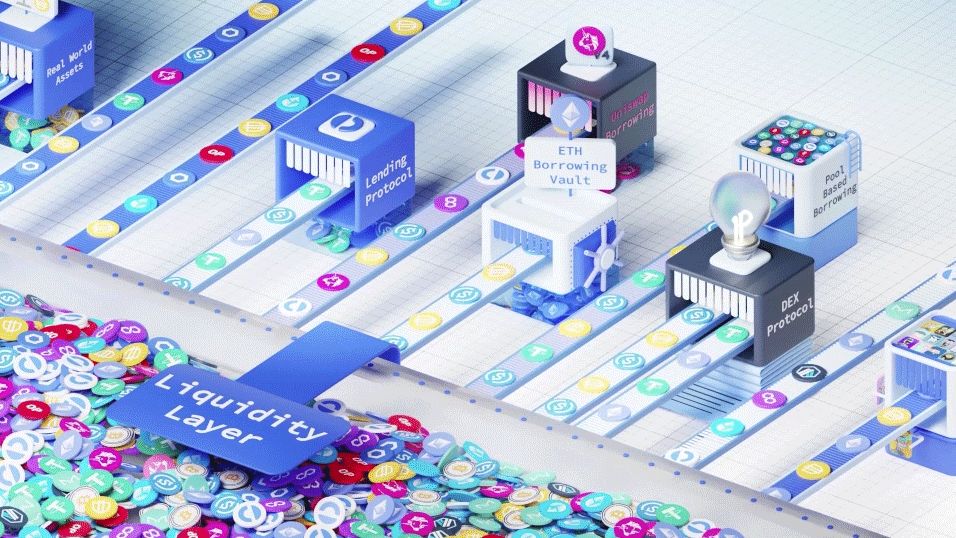

Liquidity Layer: The Backbone of Fluid

At the core of Fluid is the Liquidity Layer – a shared pool where different DeFi protocols pull and share liquidity. Instead of each protocol managing isolated funds, they tap into this common layer. It automatically handles things like deposits, withdrawals, borrowing, and repayments, while users interact with those protocols rather than the layer itself.

One of the biggest headaches in DeFi is liquidity fragmentation. Every time a new version of a protocol launches, it starts with zero liquidity and has to be built up from scratch, which might take months or so.

The Liquidity Layer tries to help by keeping liquidity in one place. If someone switches from one protocol to another within this system, liquidity doesn’t move, and interest rates stay stable. That means borrowers can take advantage of better terms in newer versions without lenders needing to chase returns elsewhere.

Automated Ceiling

Managing risk in DeFi usually means setting borrowing and collateral limits. The downside is that these limits often require manual adjustments, which can be slow and inefficient.

Fluid’s Liquidity Layer takes a different approach with Automated Limits. Instead of fixed ceilings, it adjusts borrowing and collateral limits dynamically. If funds start getting close to their cap, the system automatically tightens restrictions to prevent sudden, oversized transactions. This helps stop potential exploits or unintended risks from spreading too quickly, giving governance time to step in if needed.

How it works

The Liquidity Layer itself is simple: it holds liquidity securely while individual protocols manage their own risk. More established protocols get higher limits, while newer ones start with stricter caps.

Key parameters include:

- Base ceiling – the default borrowing or collateral limit

- Max ceiling – the highest possible limit over time

- Rate – how quickly the ceiling adjusts

- Limits in % – thresholds that trigger changes

What’s Built on Fluid?

Now, let’s take a quick look at some of the protocols initially built on top of Fluid Protocol – specifically, the Lending Protocol, Vault Protocol, and DEX Protocol.

Lending protocol

At its core, Fluid’s lending protocol is a basic lending market – users lend assets and earn yield. Since there are usually more lenders than borrowers, the focus is on keeping things simple and efficient.

Most improvements in lending protocols tend to benefit borrowers, often forcing lenders to move their funds to new versions. Fluid’s lending protocol tries a different approach by offering a stable, long-term yield while still integrating new borrowing features without requiring lenders to move their assets.

The protocol follows the ERC4626 standard and optimises gas costs for easy integration. This makes it a solid foundation for other protocols to build on, similar to how Balancer, Maker, and Aave have built on existing lending markets.

Vault protocol

The Vault Protocol works like a hybrid of Aave and MakerDAO. Borrowers earn interest on their collateral while accessing flexible borrowing options. Here’s a quick recap of its most important features.

Higher LTV Through Better Liquidations

It’s typical for borrowing protocols to lower LTV to manage risk, but the Vault Protocol takes a different angle here by improving the liquidation process instead.

Inspired by Uniswap v3, the Vault Protocol liquidates bad positions all at once instead of one by one. This notably reduces gas costs, about 150k gas per liquidation.

Traders as Liquidators

Liquidations work similarly to a DEX swap, meaning DEX aggregators can integrate it like any AMM. That means that traders of any size can help liquidate debt without needing to cover the full amount.

Minimizing Liquidation Losses

Instead of liquidating entire positions, the Vault Protocol only liquidates what’s necessary – around 5% of the debt- thus reducing forced selling and price crashes.

Also, liquidation penalties are much lower – as little as 0.1%, which sounds pretty encouraging compared to the usual 5–10%.

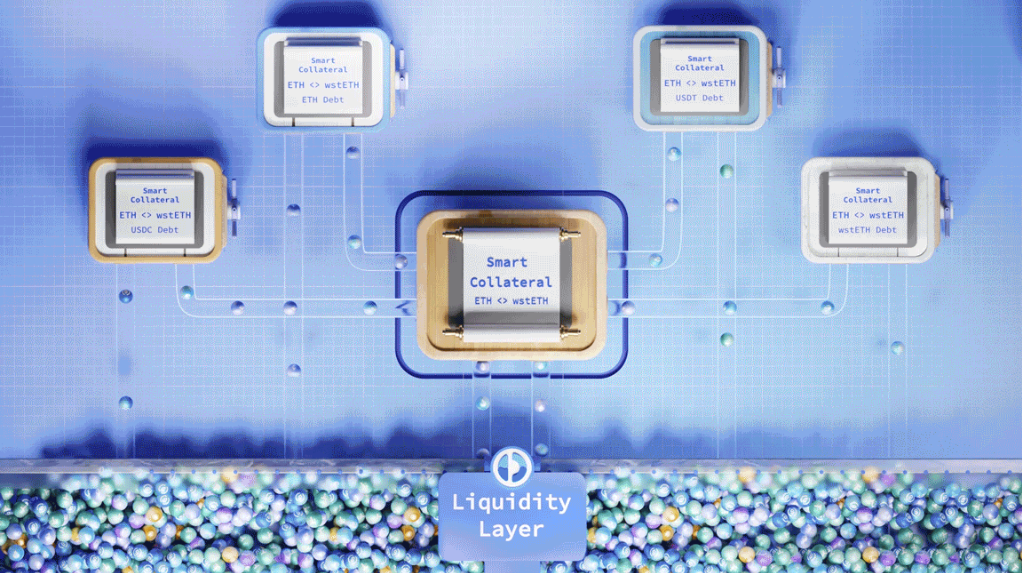

DEX protocol

The DEX Protocol introduces smart debt and smart collateral, allowing users to put their debt and collateral to work as liquidity for trading. The first version is a blend of Uniswap v2 and v3, with the simple UX of Uniswap v2 and the efficiency of Uniswap v3’s concentrated liquidity.

Smart collateral pools work like AMM pools, meaning users earn trading fees while still using their collateral for lending and borrowing. On the other hand, smart debt pools take the opposite approach – borrowers provide debt as liquidity, letting traders trade against it. Instead of accumulating tokens, debt actually reduces through trading fees, which can offset borrowing costs.

The system is designed to protect borrowers from extra losses, even if a token in the debt pool loses value. Borrow rates typically stay between 3-5%, but trading fees vary based on activity.

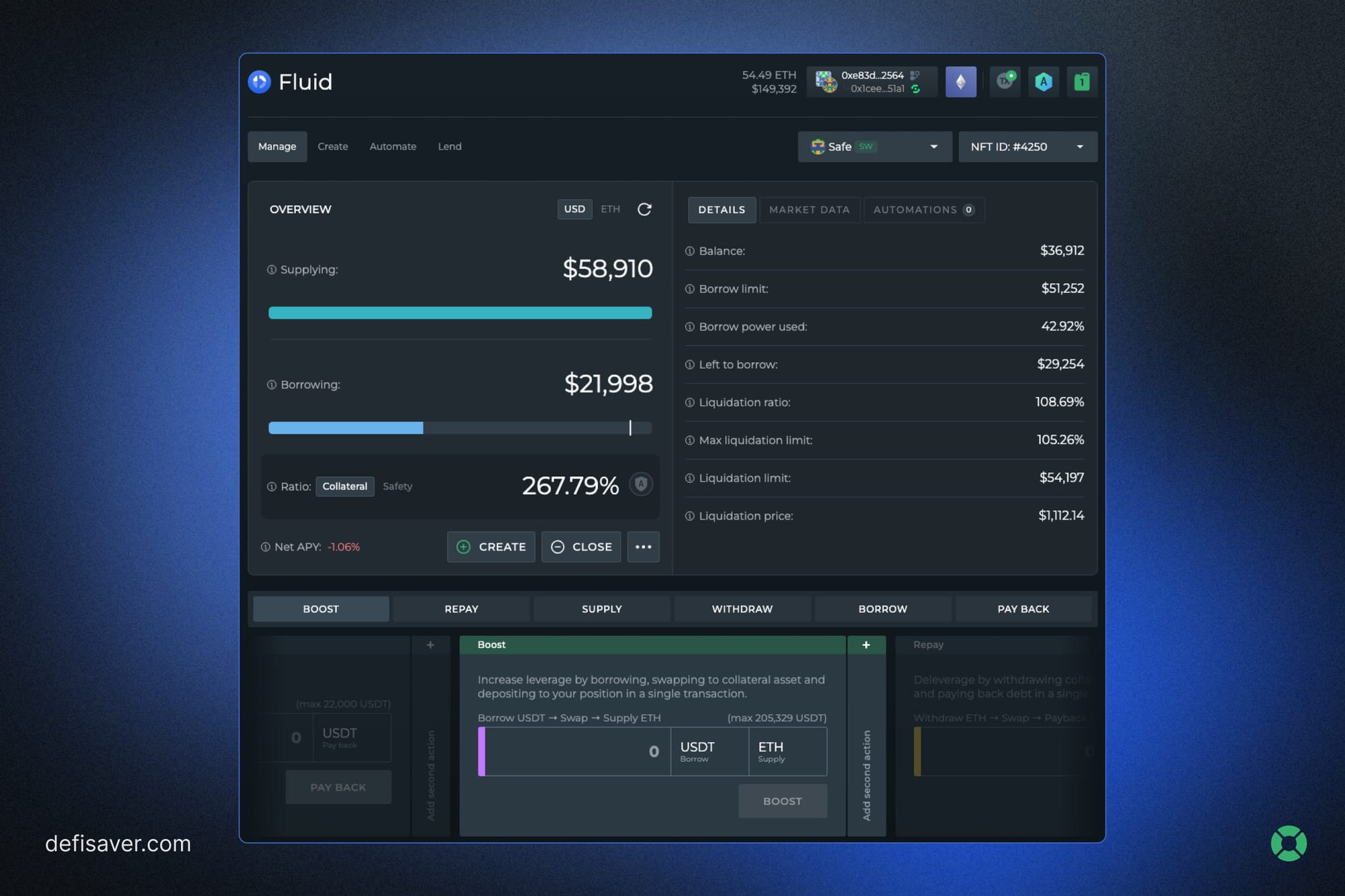

What Does DeFi Saver Bring to Fluid Users?

We’ve put together a dedicated Fluid management dashboard with everything you need in one place. Here’s what you can do:

- 1-tx Position creating and closing – Whether you're looking to borrow assets or create an instantly leveraged position, both can be done in a single transaction.

- 1-tx Leverage management – Our signature Boost & Repay options allow you to leverage up or unwind any position, with liquidity sourced from multiple dex aggregators to ensure the best rates.

- Automated Leverage Management – Our most popular automation option is now available for Fluid, too, meaning you can set up Boost & Repay to automatically kick-in based on market conditions.

- Lend assets - Supply assets to the Fluid liquidity layer and earn yield or other incentives.

- Transfer Fluid NFTs – Easily move your position between different accounts or smart wallets.

And this is just the initial release, with more to come in the following weeks - make sure you're following on X/Twitter to be the first to know.

That’s a wrap for today. Hope you’re as excited about another major integration as we are. As always, feel free to drop any suggestions and requests in our Discord server, especially about Fluid.

Until the next one - stay safe out there.🛟