Introducing Automation v2, now with flash loans and next price support

We are proud to introduce the latest iteration of our Automation system that can now react to the next price in the MakerDAO protocol and…

We are proud to introduce the latest iteration of our Automation system that can now react to next price in the MakerDAO protocol and utilizes flash loans for better-optimized ratio and leverage adjustments.

DeFi Saver Automation is an automated management system for collateralized debt positions. Based on user configurations, it increases or decreases leverage as the price of underlying collateral asset changes, effectively providing automatic leveraging and liquidation protection.

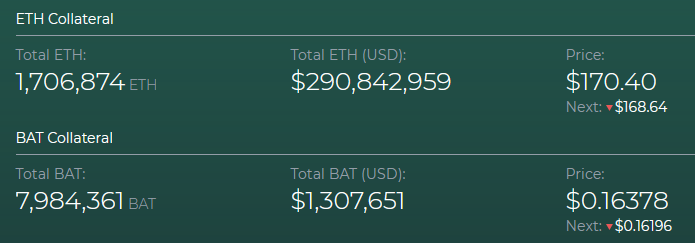

We initially introduced Automation in September 2019 and until today it has been trusted by hundreds of users to protect and leverage their positions, with a peak of 85 500 ETH and 280 unique positions managed during the recent February bull run.

Since introduction, there have been three noteworthy iterations of Automation. The very first one proved too fragile only three weeks after launch where it couldn’t keep up with network congestion and quickly rising gas prices. Only a few days later, the next version was launched with an aggressive transaction speed up/resending mechanism which ran smoothly for Single-collateral Dai users until deprecation some few weeks ago.

The third iteration was introduced with the launch of Maker’s Multi-collateral Dai, with full support for MCD and its different asset types, new price feed system and an overall overhauled code. This iteration still runs without issues, but the lack of a way to react to the next price update in MakerDAO before it is pushed as the current price meant that it was unable to protect some CDPs on Black Thursday.

We are now ready to share the fourth iteration of the system.

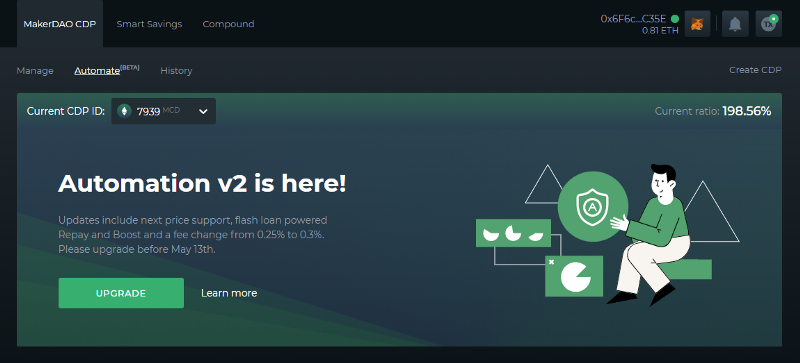

Introducing Automation v2

Today we are proud to introduce the next major iteration of Automation, one that can react to next price updates and includes support for our new flash loan powered features for better optimized ratio adjustments.

Counteracting the next price update

The MakerDAO protocol has a unique price feed system that currently updates every one hour and at the same moment schedules the next price update for the next hour. All CDPs/Vaults in MakerDAO and its ratios are dependent solely on the price that’s currently in the protocol. We wrote about the price feeds in Multi-collateral Dai in more detail when we first added the next price element to our dashboard.

This is good, because it removes the possibility of a flash crash at one source to affect the whole system and potentially smoothes out temporary market spikes/drops. But it was bad for Automation users because the system only had access to the current price on-chain, which meant that a large enough price update could completely bypass a user’s Automation configuration, dropping the price in the protocol from above their minimum ratio to below 150% in one update. This is what happened for some users on Black Thursday.

Because of this, we have updated Automation so it can respond to next price updates, too. If the next price update in MakerDAO moves your position below your configured threshold, Automation will now be able to protect your CDP even before this price update goes through.

We still don’t have access to Maker’s next price on-chain, as they need to provide permission to DeFi Saver smart contracts for this to be possible, even though the value is already available on-chain. Because of this, the next price is currently being fetched by a read call via our Ethereum node and then fed into Automation smart contracts. We plan to switch to having both the current and the next price fetched directly by Automation smart contracts as soon as we gain access to the MakerDAO Oracle Security Module.

Contract updates and timelock

The previous iteration of Automation, the one launched with MCD, already had an update option, but it was an option we never used. We are now improving the update mechanism and putting it behind a timelock. The initial timelock period for Automation updates will be 24 hours, with plans to further extend it in the future.

The option to update Automation contracts will be available to a multisig-managed account sitting in cold storage, to ensure it cannot be abused.

Flash loan features

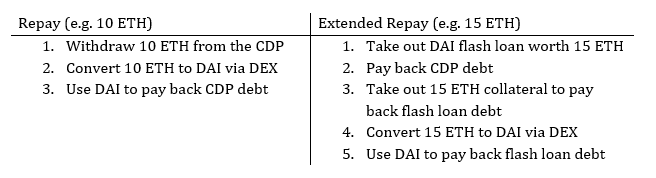

We introduced flash loan powered features into our MakerDAO dashboard in the beginning of March. After a sufficient testing period, we now feel confident adding flash powered Boost and Repay into Automation, too.

Extended (or Flash) Boost and Repay allow for far greater adjustments in one transaction and will therefore reduce the total number of transactions for both users and the system as a whole. This will also translate to less overall fees paid by users in many cases.

Extended Repay is especially useful as it makes it possible to increase the CDP ratio by large increments even if the ratio reaches as low as 151%, where our standard Repay (via simple CDP unwinding) was otherwise limited by the 150% minimum ratio and would need dozens of transactions to get that CDP back to 170%+. Moreover, Extended Repay can actually be applied even with the CDP <150%, but this is a last resort measure and not one that we want to count on, even though it would have also helped rescue CDPs on Black Thursday, due to delayed liquidation bites.

More configurability

With this update, we will be introducing an option to disable automated Boosting in our interface. You will no longer need to work around the lack of such an option by configuring a ratio of 9999% for Boosting.

This is a very minor change, but it’s only the first in line of multiple additional options coming to Automation in the future.

Automation fees update

With this update we are also changing the fee for each automated adjustment from 0.25% to 0.3%. This means that each adjustment made by Automation will have a service fee of 0.3% of the Repay or Boost amount.

Ever since introduction, the fee for automated and manual adjustments has been the same. We believe that increased stability, resilience and configurability of Automation from the initial release are all clear indicators of the convenience level that Automation provides and the needed differentiation from fees on manual adjustments.

As you may already know we are a fully self funded team and all fees collected are being used to maintain DeFi Saver and to sustain further development.

Please note that we have no plans to change the fees in the future without informing everyone publicly and asking for user’s explicit approval to accept any such change.

How to update to Automation v2?

In order to update your CDP to the new system, you simply need to update your configuration in the Automation configuration tab. No need to change any of your parameters, simply clicking the update button and confirming the transaction will get your CDP to Automation v2.

We recommend upgrading as soon as possible. The previous version of the system will be shutdown on May 13th 2020.

Automation v2 is a major update of the system and we are very proud to have everything ready this soon after Black Thursday. If you have any feedback or questions, we’d love to have you in the DeFi Saver Discord.

Stay safe, both you and your CDP.

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter