Liquity V2 is now live at DeFi Saver

Liquity V2 launches on January 23rd with instant DeFi Saver support.

Liquity V1 came to life in 2021 as a fully automated, governance-free, decentralized borrowing protocol. The novelty Liquity brought to the space was interest-free loans against Ether as collateral. You’d put your ETH in a Trove (where you take out and maintain your loan) and get paid out in LUSD with a big-hearted collateralization ratio of 110%. LUSD is directly redeemable, meaning you can return your LUSD at face value for the underlying collateral at any time.

Besides its primary USD-pegged stablecoin, V1 also introduced its protocol token, LQTY. LQTY rewards only go to Stability providers — those who deposit LUSD to the Stability Pool, frontends who facilitate the deposits, and liquidity providers of the LUSD: ETH Uniswap pool.

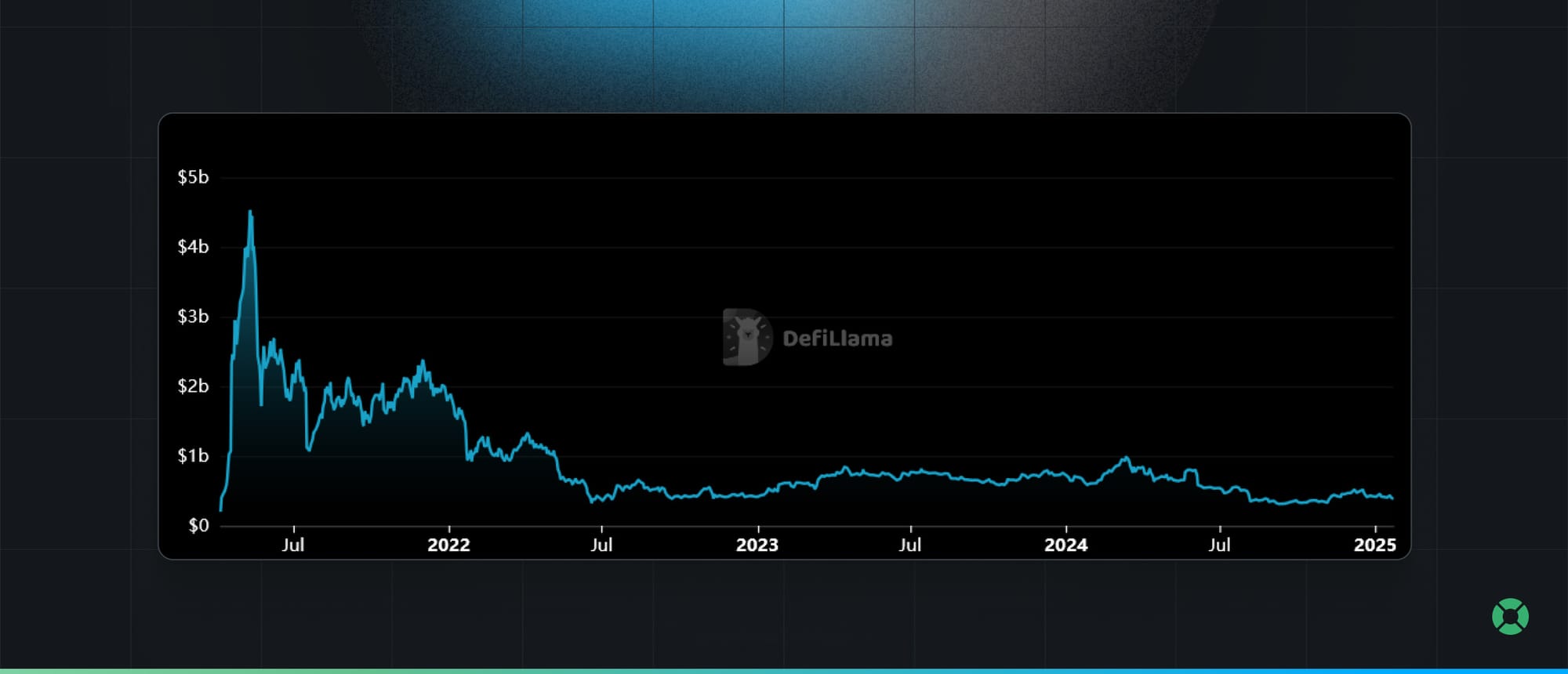

The protocol quickly became noticed for its efficiency and, over time, for its security (zero exploits to date). Liquity V1 also piled up over $4bn in TVL, becoming one of the most important players in the whole DeFi ecosystem.

Yet, V1 wasn’t flawless, mainly because the fixed (and rather low) borrowing costs combined with the redemption mechanism started to show its limitations. This feature allows you to redeem your LUSD tokens for ETH at a fixed ratio against Troves with the lowest collateral ratio. Specifically, it allows anyone to convert any amount of LUSD to ETH at a fixed rate of 1 LUSD = $1 ETH.

While redemptions play a central role in maintaining the peg with USD, they’ve become aggressively high over time, leading to forced deleveraging of positions and souring the user experience.

Liquity V2 addresses V1’s shortcomings and offers more

Earlier in 2024, the team behind Liquity announced the second iteration of this protocol, and the public release of the V2 codebase happened in September. As expected, V2 continues to uphold the protocol’s vision, again launching as fully immutable, while bringing new features to improve efficiency and user experience.

Here’s a quick recap of what matters the most:

A BOLD stablecoin

The new stablecoin is designed to be resilient with some distinctive features compared to notable counterparts like DAI, crvUSD, and GHO. BOLD will also be immutable and backed entirely by crypto assets. Plus, it’s crafted to again be directly redeemable, so you can convert it anytime. Compared to Liquity V1, Liquity V2 also directs 100% of protocol revenue (from interest payments) towards growing BOLD between two venues: 75% to the various Stability Pools, and 25% to drive Protocol-Incentivized-Liquidity.

User-set Interest Rates

In Liquity V2, you can set your interest rate when opening a Trove, anywhere between 0.5% and 1000%, and change it when you want to. Interest builds up continuously but only compounds when your Trove is interacted with, and your total debt gets periodically minted as BOLD.

Unlike V1, where redemptions targeted Troves with the lowest collateral ratios, redemptions now focus on those with the lowest interest rates.

This differs from MakerDAO, for instance, where interest rates are set through governance, or crvUSD, which uses a dynamic peg system.

Multi-collateral system

Liquity V2 uses a multi-collateral setup where different types of collateral are managed in separate branches. Each branch has its own rules for collateral ratios and its own Trove Manager and a separate, dedicated Stability Pool. Troves in a branch only hold one type of collateral, and liquidations are handled within that branch, with any gains paid out in the same collateral.

Speaking of collaterals, V2 supports WETH and two currently most popular liquid staking tokens: Rocketpool's rETH and Lido's wstETH.

Stability Pool and Yield

Liquity V2 offers a nice perk for Stability Pool depositors by enshrining steady yield (75%) through interest payments in BOLD. This means there should be consistent demand for holding BOLD, which helps keep it stable over the long haul.

The V2 Stability Pool is an upgrade from V1, which mainly relied on LUSD deposits to cover under-collateralized loans but didn’t provide continuous yields. Plus, Liquity V2 directs the remaining 25% of interest revenue to liquidity providers on DEXs, aiming to keep about 10% of the BOLD supply available on platforms like Curve and Uniswap.

Other things to consider

With Liquity V2, several improvements make borrowing more appealing:

- V2 doesn’t charge upfront fees, allowing short-term borrowers to pay interest over the loan duration, which lowers initial costs and enhances flexibility.

- 1-click leverage allows users to quickly increase their borrowing power with minimal steps.

- Transferable Troves make it easy to transfer debt positions, offering greater flexibility in managing loans.

- In V1, Recovery Mode allowed loans with a collateral ratio below 150% to be liquidated if the system’s total collateralization fell below that threshold. V2 has no recovery mode. With this change, you can benefit from a permanently high LTV of up to 11x, so you won’t have to worry about being liquidated as long as you stay within the maximum LTV.

- Also, in V1, each address could only have one Trove open at a time. In V2, you can have multiple Troves, even with the same collateral type, allowing you to apply different strategies to different parts of your portfolio.

What will happen with V1?

Liquity V1 will continue to coexist with V2, and there’s no way to shut down or force migrations from V1 to V2. You are free to continue using it, though the increased risk of Trove redemptions will certainly still be there.

Let's now get to the DeFi Saver part.

What does DFS bring to the table for Liquity V2 users?

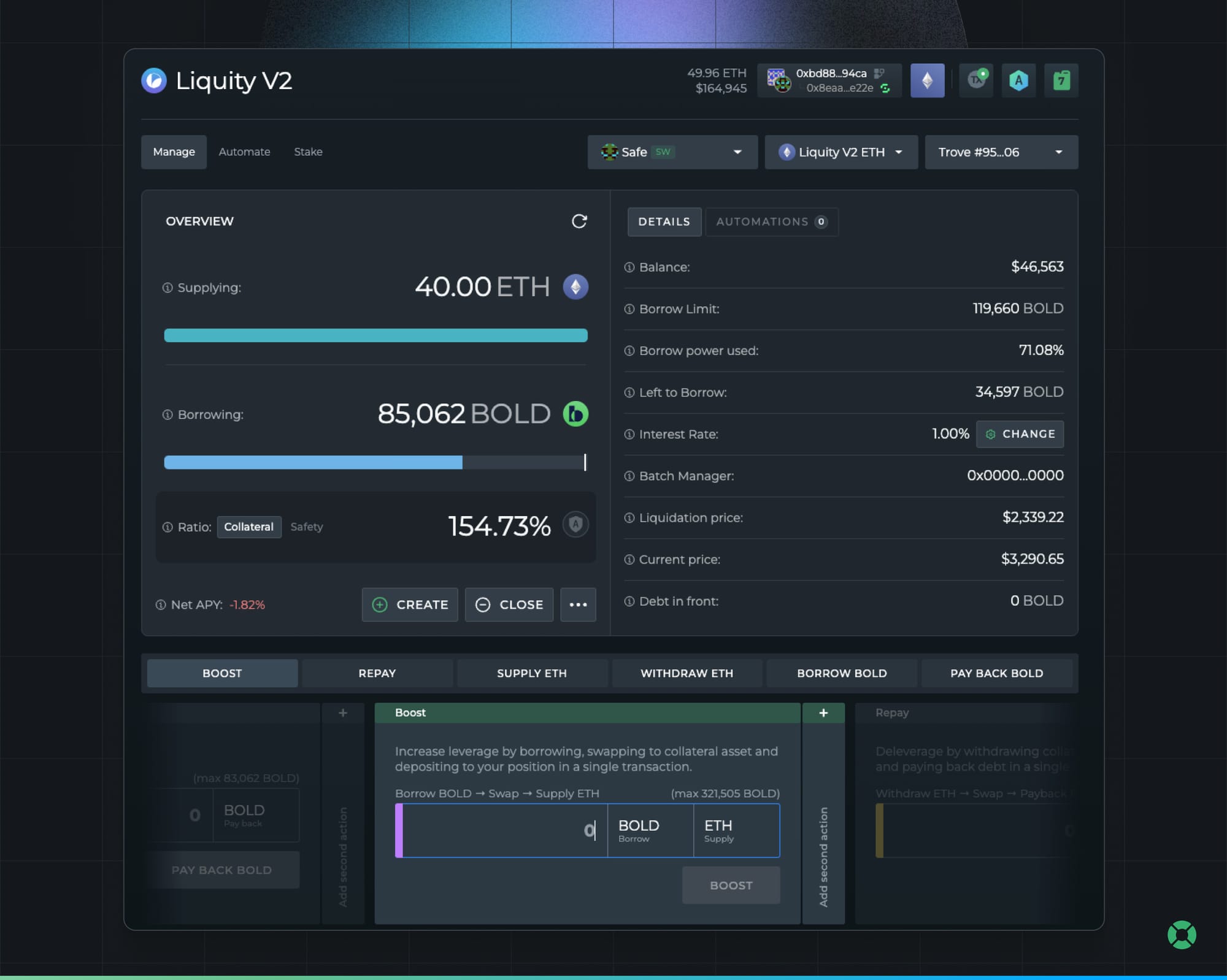

You can expect a bold, feature-complete support for Liquity V2 right from day one.

This includes:

- A custom, dedicated Liquity V2 management dashboard,

- Our 1-tx leverage management features (Boost, Repay, and instantly creating or closing leveraged positions):

- Loan Shifter support which allows moving from V1 or other supported lending protocols to Liquity V2;

- Multiple automation features, including our signature Automated Leverage Management, as well as Stop Loss and Take Profit and recently very popular Boost on Price and Repay on Price options;

- A purpose-built Liquity V2 instance of DeFi Explore.

And this is just the initial rollout. We'll be listening for any feedback and requests (e.g. in our discord) and we'll be looking out for any protocol specifics that we can help with. For example, automated interest rate management is something we're already looking into.

See you all on mainnet tomorrow!🫡