LSTs and leveraged ETH staking strategies at DeFi Saver

The Ethereum Shanghai upgrade is live and LSTs and leveraged ETH staking strategies are now available in the DeFi Saver app! Check out this article and find out the best way to utilize this feature!

The Ethereum Shanghai upgrade, the hard fork that enables validators to withdraw their staked ETH (EIP-4895) is scheduled for tomorrow (April 12th)! This is a huge event for the Ethereum stakers community and its expected to drive even more attention to (liquid) ETH staking narratives and strategies in the DeFi space.

We've already seen the 'peg' of various liquid staking tokens tighten up after the successful Merge back in September last year, so it only makes sense for the introduction of withdrawals to further improve confidence among users of staked ETH across DeFi.

The number of validators running on the Beacon Chain has also increased by around 25% in the last 6 months, boosting the security of the Ethereum network and paving the way to an even more decentralised future.

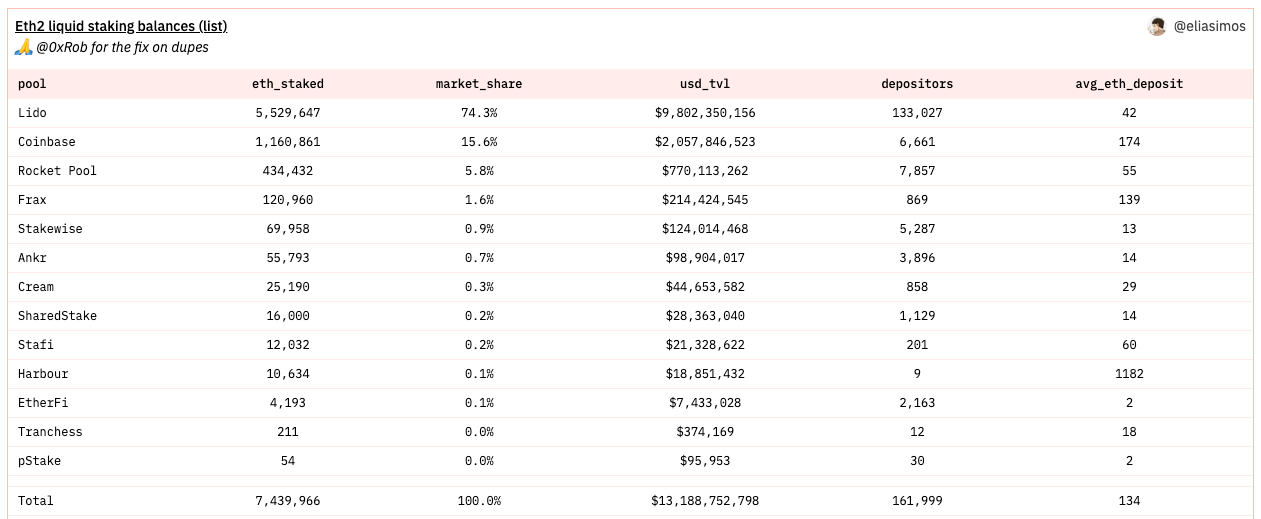

At the time of writing, there is over 17m of ETH staked, representing around 15% of total ETH supply. Approximately 40% of that staked ETH is staked via pools, with Lido, a decentralised liquid staking protocol, leading the way by taking more than 77% of the pooled-staking market share.

Today, we'll try to give a short rundown of the most popular liquid staking protocols and how their liquid staking tokens (LSTs) are being used across DeFi (Saver).

Popular liquid staking tokens in 2023

A quick comparison of the three most popular liquid staking options, according to the Ethereum.org criteria, boils down to this:

But let's also do a quick rundown of each of these three options separately.

Lido Finance - stETH

As mentioned earlier, Lido Finance, a decentralised liquid staking protocol launched back in December 2020, managed to become an absolute leader in the pooled staking industry when it comes to the amount of ETH staked.

Consequently, stETH, Lido's liquid staking token, also has the deepest liquidity across lending markets and decentralised exchanges. Most notably, there's Aave (v2 & v3) and the Curve stETH/ETH pool, which have around 1.1m of ETH ($2b at the moment), and 400k of both ETH and stETH ($1.5b at the moment), respectively.

Note that there are two versions of Lido's staked ETH tokens: stETH and wstETH (wrapped stETH).

Both tokens follow the ERC-20 token standard, but they reflect the accrued staking rewards in different ways. The standard stETH is a rebasing token, meaning that the stETH balance increases periodically. In contrast, wstETH's balance is constant, while the token increases in value (compared to stETH).

Since most DeFi lending protocols don't support rebasing tokens (except from Aave v2 and Curve, for example), wstETH is mostly used across decentralised apps like Maker, Compound v2 & v3, Aave v3, Uniswap, etc.

To learn more about Lido protocol and see how Lido and its validators are performing (security-wise), we recommend checking out their docs and scorecard.

Rocket Pool - rETH

Rocket Pool protocol is an OG in the decentralised Ethereum staking space. It's designed to support anyone to trustlessly stake as little as 0.01 ETH to a network of decentralised node operators.

You can simply stake ETH and receive rETH - RocketPool's liquid staking token that accrues staking yield using an increasing exchange rate (increases in value).

In addition, RP offers users to stake 16 ETH as node operators (aka Smart Nodes) in the protocol, earning rewards on their own stake fee free, plus the commissions and RPL rewards from the network, generating a higher ROI by staking in the protocol vs staking outside of it as a solo node operator.

Smart Node providers earn RPL rewards in return for initially putting up RPL as collateral, thus insuring their node against bad behaviour.

This neat 16 ETH opportunity can be offered thanks to the minipool validators smart contracts. These smart contracts are created by node operators who deposit 16 ETH on their node, and receive another 16 ETH from users who stake ETH (rETH holders). After getting the 32 ETH in total, a new validator is created on the node which performs the consensus duties for that deposit to earn staking rewards.

To learn more about the RP protocol, check their full docs here.

Coinbase - cbETH

Coinbase, the second largest CEX by volume, has launched their version of ETH liquid staking token called cbETH back in August 2022. Until then, the only participants exploring the liquid staking game were DeFi protocols like Lido and RocketPool.

The cbETH is minted exclusively by Coinbase, and users can stake their ETH through the 'Earn' program on Coinbase, which requires them to pass the KYC and identification process, meaning that staking ETH through Coinbase is not permissionless.

On the other hand, since cbETH complies with the ERC-20 token standard it can be bought, sold, transferred, and used across DeFi as any other ERC-20 token on Ethereum blockchain.

Currently, cbETH is the second largest ETH liquid staking token by TVL, right between Lido's stETH and RocketPool's rETH.

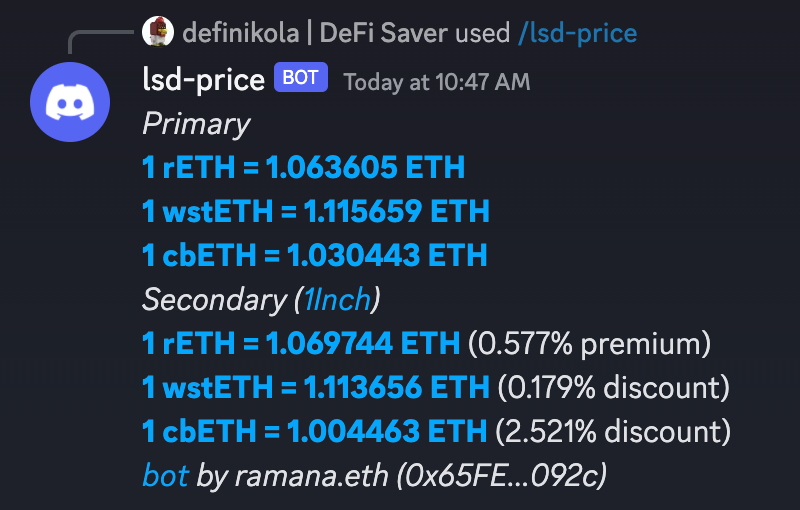

The Peg

Since the exposure to liquid staking tokens can be gained not just via staking directly through their respective staking providers, but also by buying them on exchanges, it could be useful to check their current 'peg' status.

Namely, the LSTs are meant to keep the 1:1 ratio with the underlying ETH (or with their internal conversion rate, if not rebasing), but considering the fact that withdrawals are yet to be enabled, they usually trade at a certain discount on the open markets.

This can serve as useful info when deciding to gain exposure to some of the LSTs available on open markets, and potentially using them in DeFi afterwards.

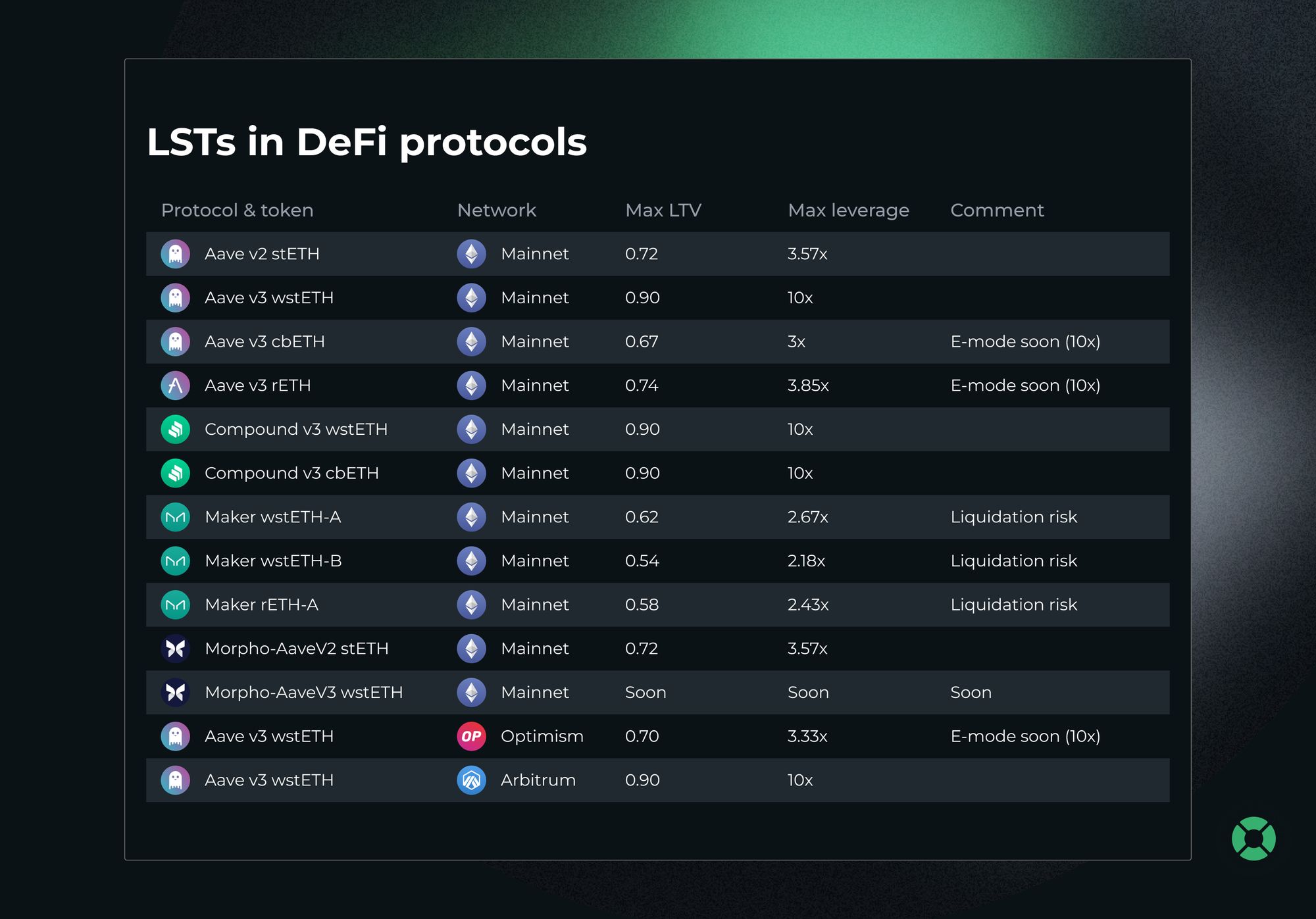

Different LSTs in DeFi lending protocols

As one of the most popular strategies in DeFi right now, leveraged-staking is seeing a rapid growth not just in volume but in the number of options available through multiple tokens, protocols, and even networks (L2s).

Below, we've gathered all the relevant options (so far) in one place with the info about max leverage possible based on the Loan-To-Value available in the underlying protocols.

Leveraged ETH staking on DeFi Saver

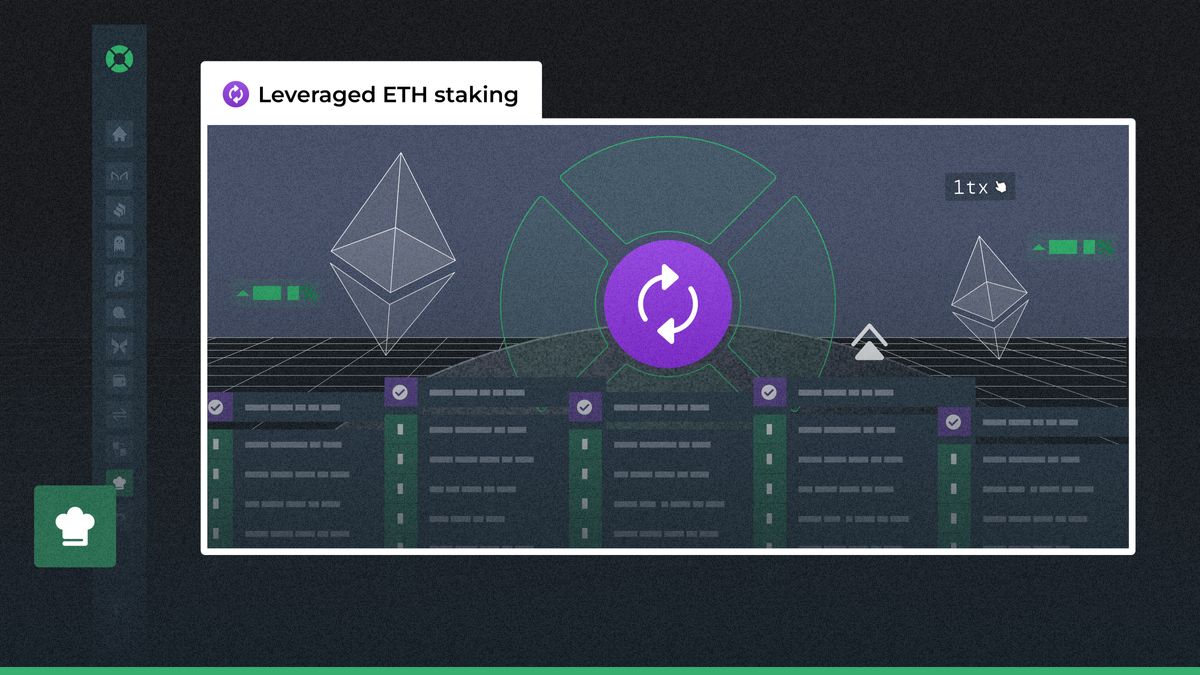

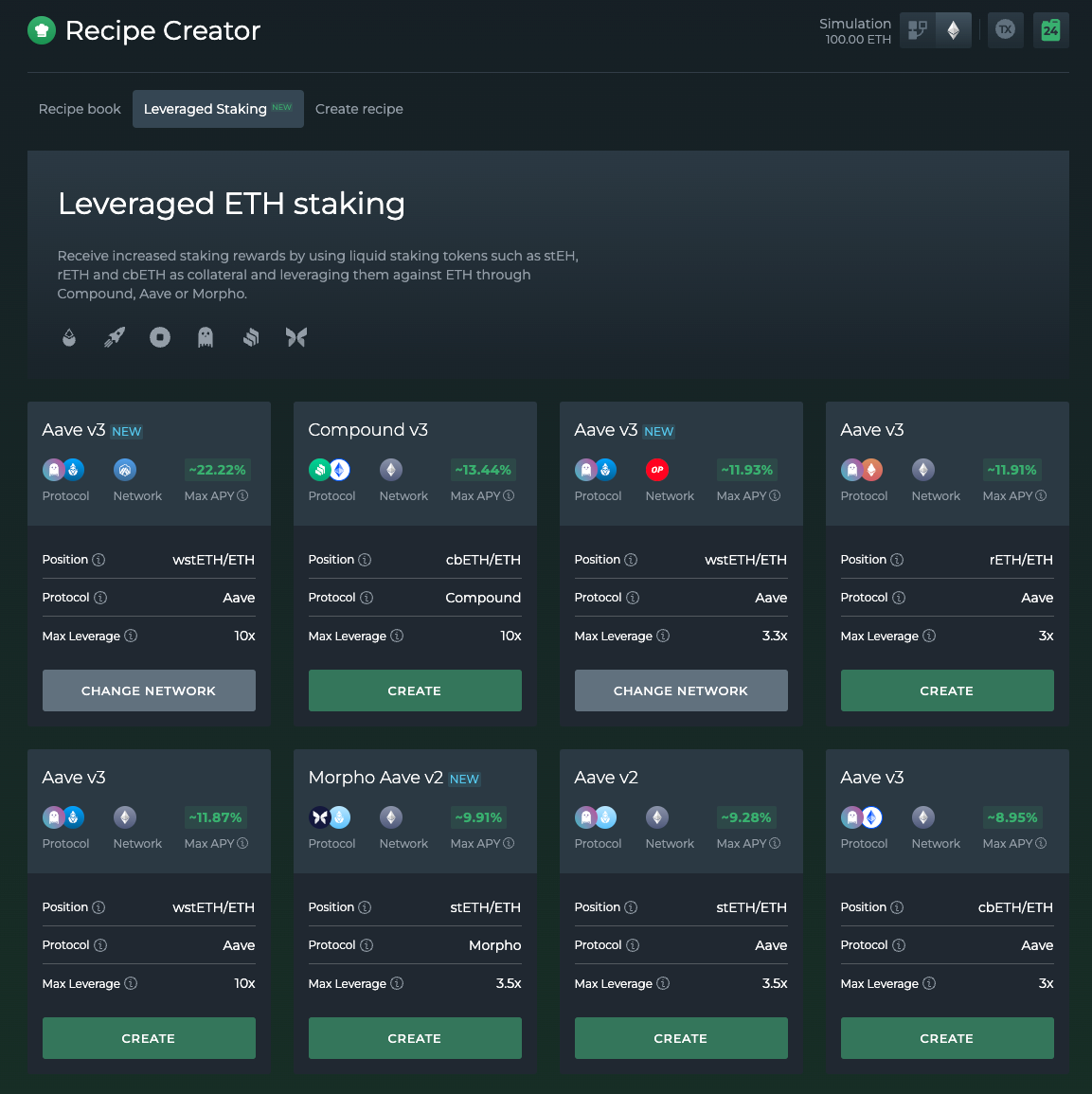

Today, we are excited to introduce our new dedicated dashboard for a 1-click leveraged ETH staking!

You can now seamlessly compare staking yields between various liquid staking derivatives across lending protocols (and networks), all in one place.

The new leveraged ETH staking dashboard is available here:

https://app.defisaver.com/recipes/leveraged-staking

Currently available options cover (w)stETH, cbETH, and rETH, and so far we've included nine unique 1-tx recipes, utilising protocols such as Aave v2 & v3, Compound v3, and Morpho-Aave-v2.

There are also a couple of options we have in the pipeline including Morpho-Aave-v3, and other LSTs on L2s. 👀

With the LST and underlying protocol of your choosing, you'd be able to increase your ETH staking exposure up to 10x in a single transaction, while also effectively increasing the yield you're earning.

Leverage staking strategy explained

The opportunity for this strategy lies in the spread between the staking yield that LSD tokens provide, and the ETH borrow rates on different lending protocols.

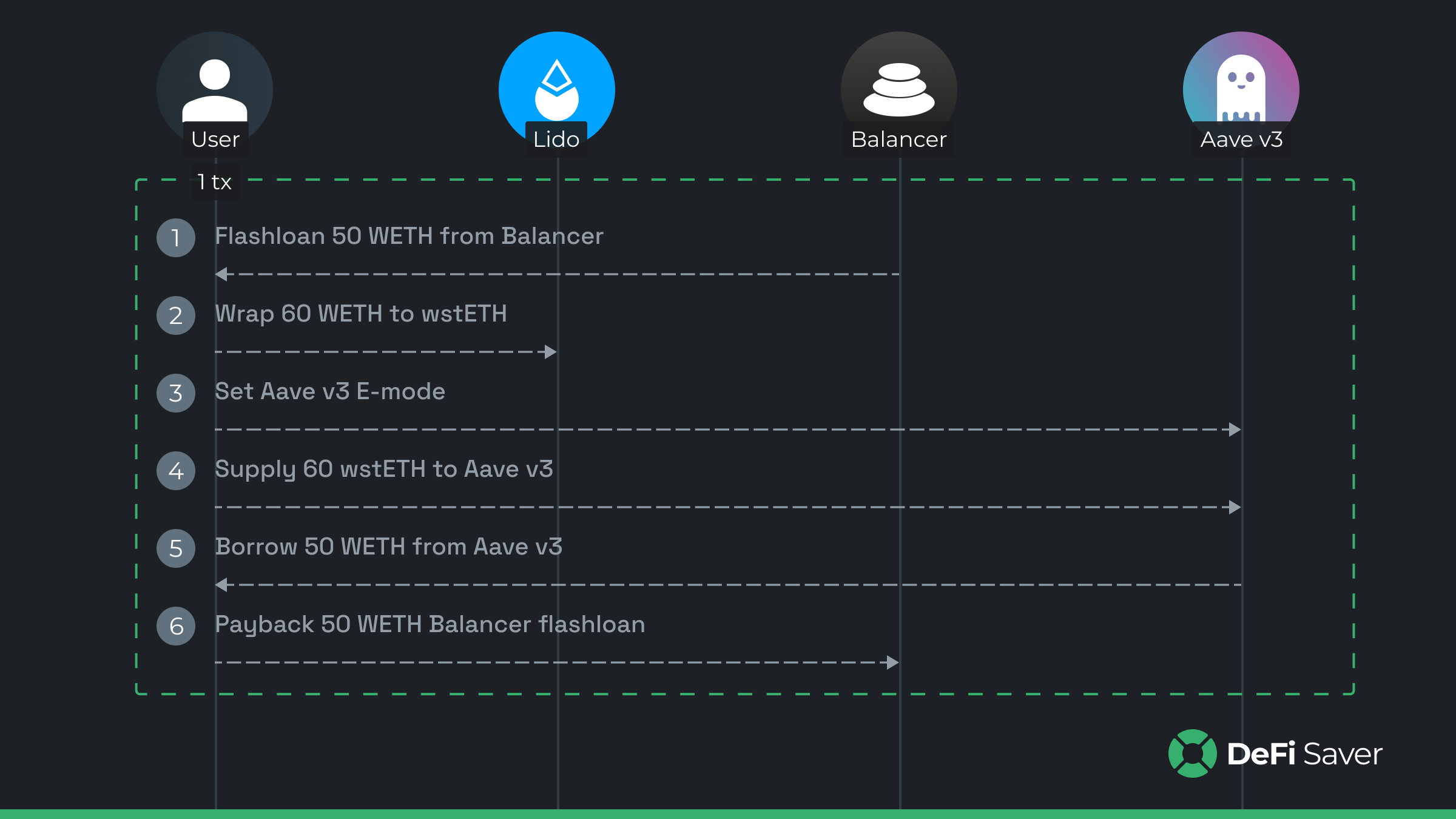

Here is an example of a 1-tx recipe for opening a 6x leverage wstETH position on Aave v3:

The outcome of the recipe would be an Aave v3 position with 60 wstETH collateralised and 50 WETH borrowed.

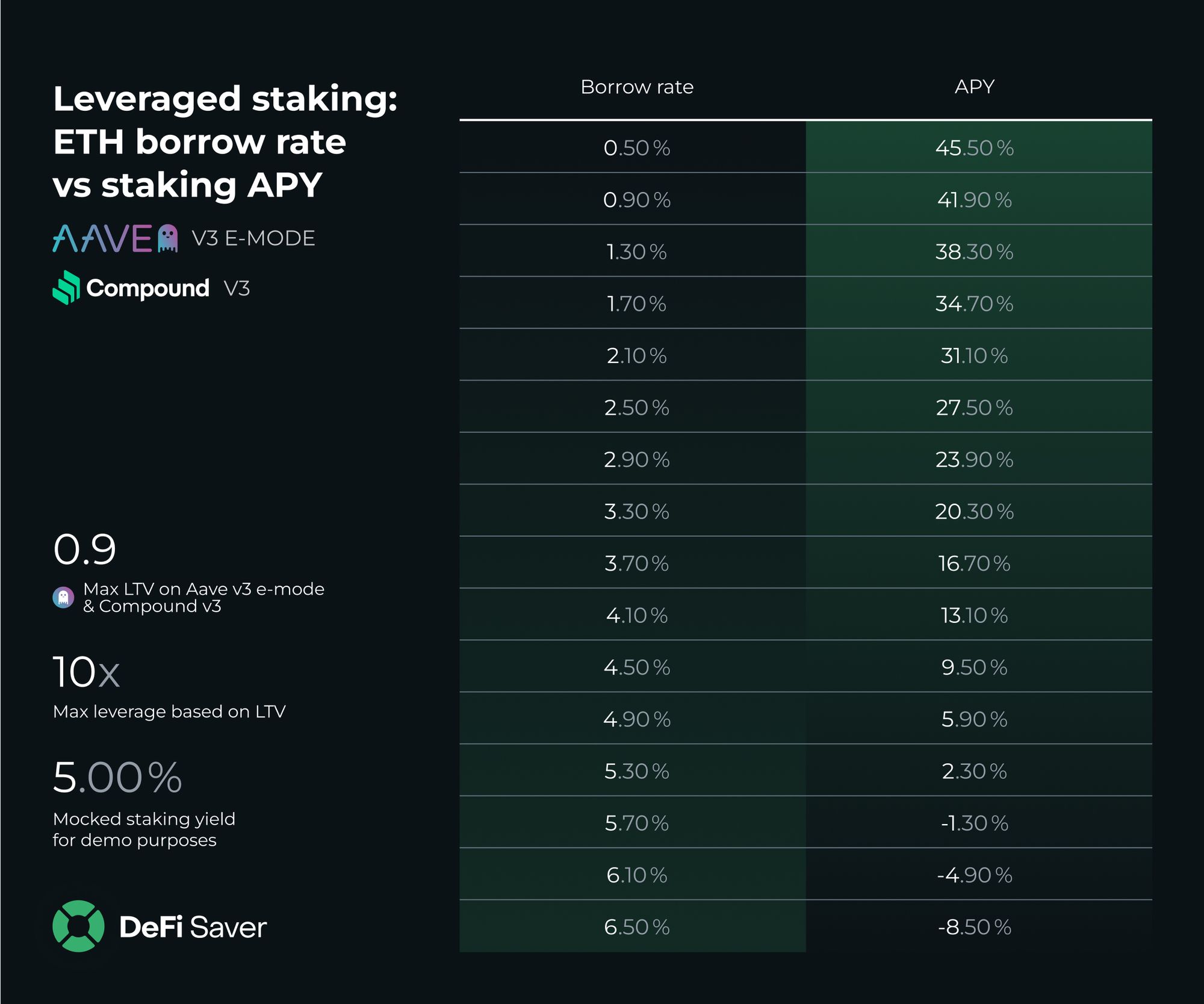

Assuming the staking yield is at 5%, the 10x leveraged staking APY distribution on Aave v3 (emode) & Compound v3 would look like this.

If you are wondering what the potential risks involved in these leveraged staking strategies are, we've previously discussed them in more details here (with a focus on stETH in Aave v2, though the same principles apply with all LSTs):

Risk analysis of leveraged stETH/ETH strategy.

— definikola.eth (@definikola) April 15, 2022

1. Borrow rates go up

2. Lido validators (big) slashing event

3. Liquidation hunting by whales

4. Curve stETH/ETH pool (dis)balance (depeg)

5. SC risks (including every dapp that has onboarded stETH)

Explanation of each point👇.

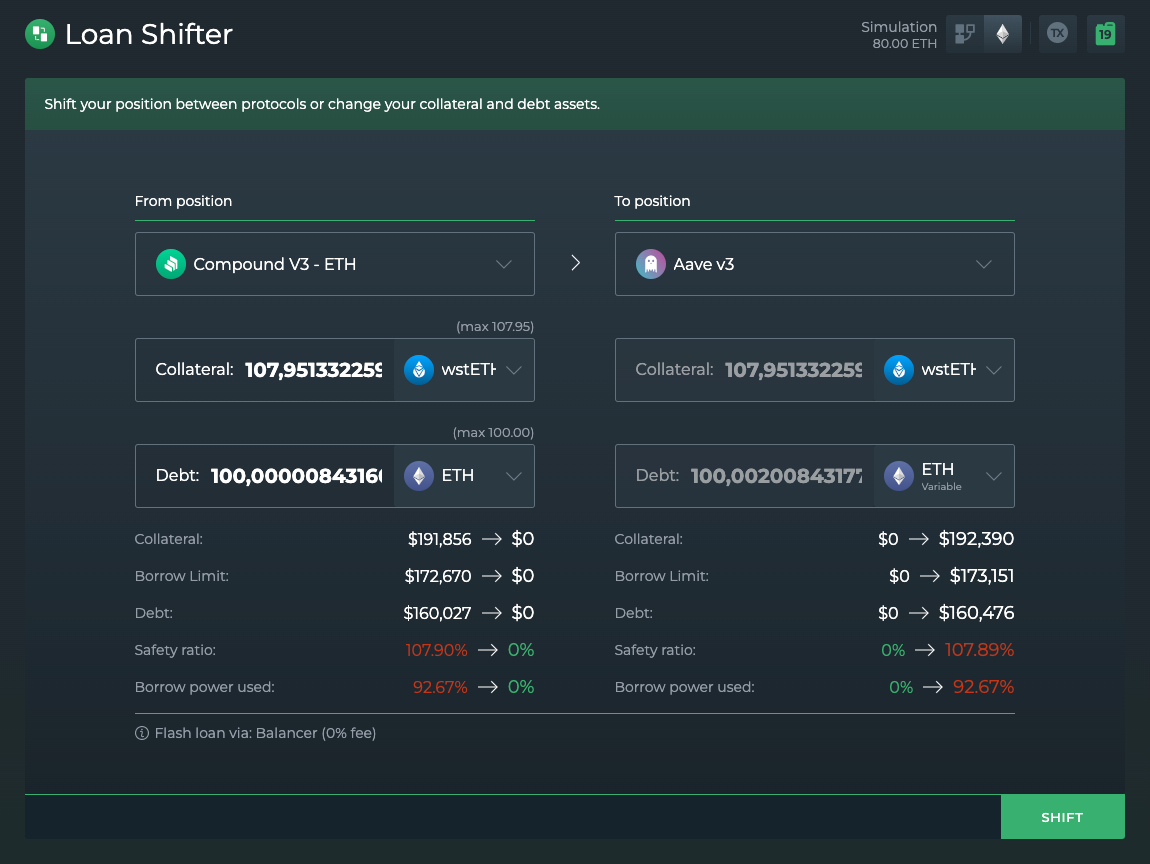

Shifting between different leveraged staking options

In case better opportunities with higher APY arise, users can shift their entire positions (both collateral & debt) to the protocol of their choice using our Loan Shifter dashboard in one go.

Though note that we'd always recommend trying this in simulation first, just to make sure the outcomes are exactly what you want them to be and that your position entering the target protocol isn't affecting the potential APY noticeably.

New DeFi Saver Stats Page

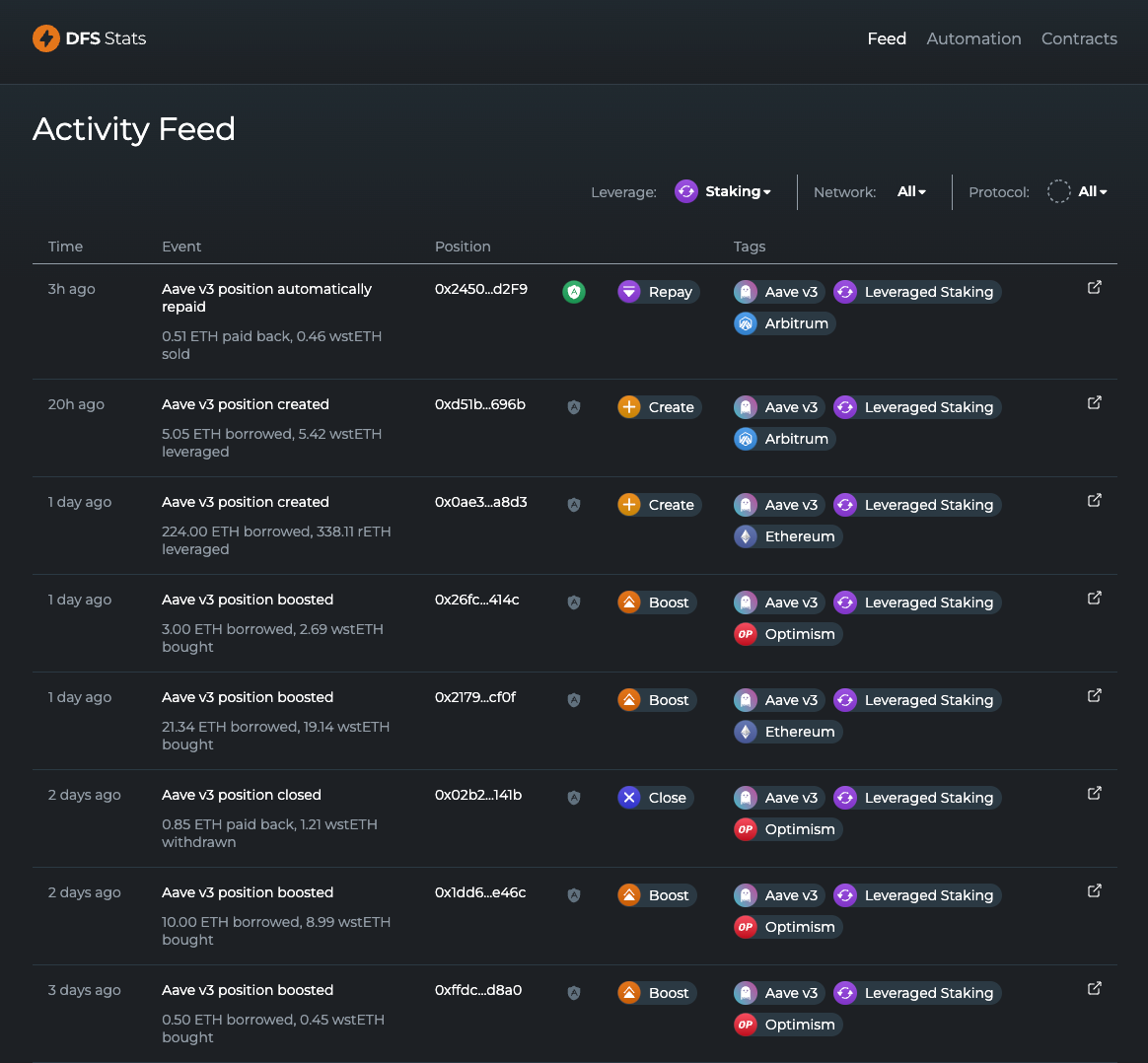

If you are curious about the usage of lev-staking recipes so far (or activity on DFS in general), we recommend checking our recently released stats page at: https://stats.defisaver.com/!

Today we're very glad to introduce DFS Stats.📊

— DeFi Saver (@DeFiSaver) February 28, 2023

Our goal with DFS Stats is to provide better insights into user activity and automation usage, as well as smart contract changes throughout DeFi Saver.

Check it out today at https://t.co/loT0FQaLTL - or read on for more details.🧵 pic.twitter.com/SWC7JnEp4y

Anyone can now get a quicker overview of user transactions, including automated adjustments and custom recipes being executed on DeFi Saver. This also includes these leveraged staking actions, that you can find by selecting the 'Staking' filter.

We hope that the leveraged staking dashboard, all the custom recipes and the new stats portal are useful tools that help you navigate and make best use of these new strategies.

As always, feel free to join us in the DeFi Saver discord where we'd love to hear all your comments, feedback and suggestions, and you'll always find us available for any questions or assistance needed.

Happy Shanghai, everybody!