Top 5 most popular Loan Shifter use cases (so far)

Taking a closer look at the most used Loan Shifter options up to now.🧐

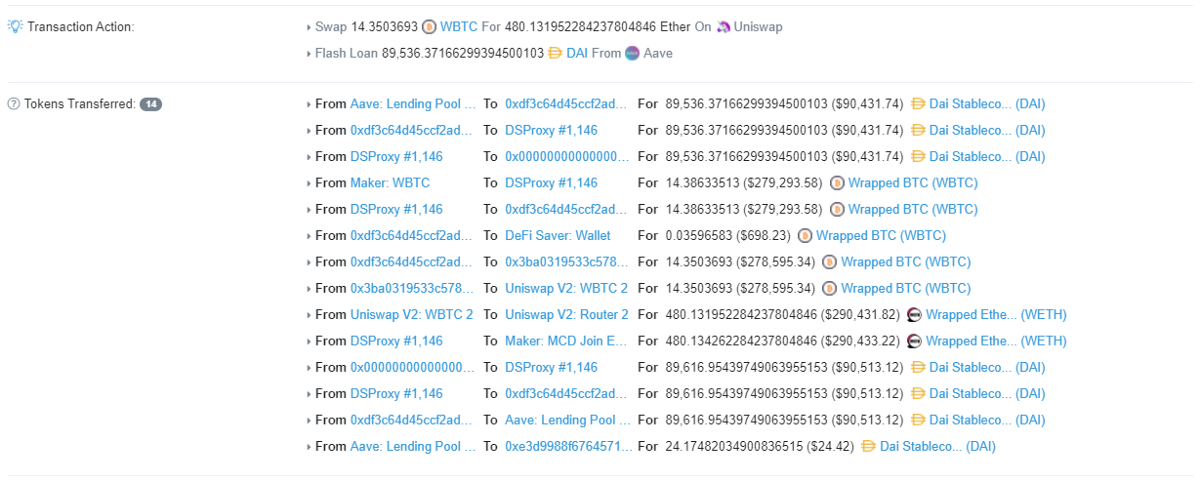

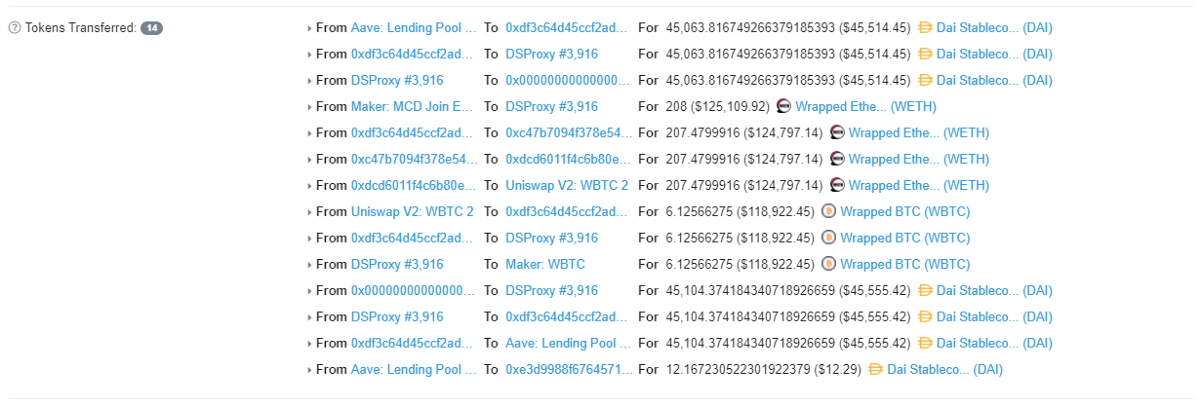

The Loan Shifter might be our most interesting feature launched in the recent months and it was quickly picked up by many users as an essential new tool for managing positions in the decentralized finance space.

I’m adding @DeFiSaver to my DeFi toolkit😉 https://t.co/MgxqRIaYdO

— Wilson🔺KUU - Liquidity Underwriter (@inPlanB) October 28, 2020

It’s now been a full month since we first released it and with more than 120 shifts done, we thought this might be a good time to take a closer look at the stats so far and figure out what kind of options are showing up as most popular so far.

This is a list of the five most popular use cases of the Loan Shifter in its first 30 days, with a few more worthy mentions towards the end. Let’s get to it.👇

1. Shift from Maker ETH-A to ETH-B

No. of shifts: 28

Volume: 8379 ETH🔥🔥🔥

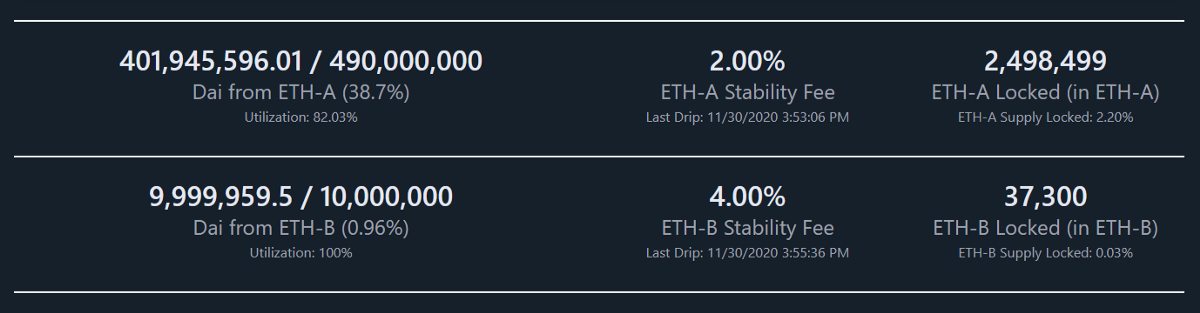

The number one most popular use case so far has definitely been the shift from Maker ETH-A to ETH-B. This is a type of shift that will also be possible for any other collateral assets where MakerDAO introduces -A and -B types.

For example there’s already USDC-A and USDC-B, too, though this isn’t nearly as interesting as ETH-A and -B.

Why do this shift?

MakerDAO introduced the ETH-B Vaults just a few days before the Loan Shifter introduction and with it it allowed users to go as low as 130% on the collateralization ratio on ETH. First time in MakerDAO, that is, since a very similar allowed ratio has been available in both Compound and Aave for a while.

The reason, then, why people would want to switch from ETH-A to ETH-B is because they can generate more DAI from the same amount of ETH and, subsequently, also apply more leverage if they are using MakerDAO to create long ETH positions, a use case for Maker that we talked about in an earlier post.

The higher amount of DAI or higher level of leverage does come at a cost, though, and ETH-B Vaults have a 4% Stability fee, compared to only 2% at ETH-A. Whether that difference is negligible or a show stopper is of course up to you to decide.

In case you’re interested in making one such shift yourself, we previously wrote a short guide for the ETH-A to ETH-B shift in the r/MakerDAO subreddit that you can find here.

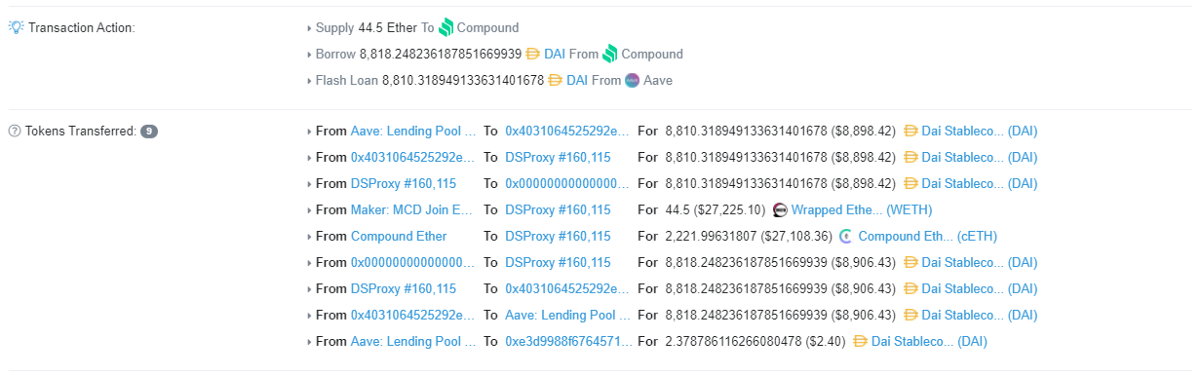

2. Protocol shift from Maker to Compound

No. of shifts: 16

Volume: 3854 ETH + 57.440 BAT + 0.25 WBTC🔥🔥

The second most popular option in both number of executed shifts and volume is the one from MakerDAO to Compound. This was an option that would surely be loved by many during summer of 2019 when the Stability fee rose to as high as 20.5% in August.

Why do this shift?

There may be a number of reasons why one would want to move from Maker to Compound, with most likely ones being the lower liquidation penalty at Compound (8% vs 13% in MakerDAO), COMP rewards that are given out for usage of the Compound protocol, as well as the ability to add and mix assets as collateral in your portfolio in order to make your position more secure against liquidation.

Still, with Maker introducing the ETH-B option, they now have an edge on Compound in terms of maximum LTV allowed for both ETH (76% vs 75% in Compound) and WBTC (66% vs 60% in Compound). Additionally, Compound recently had a DAI price oracle related issue that affected (and unfortunately liquidated) a number of DAI based positions, so it will be interesting to see how this affects the number of Maker to Compound shifts moving forward.

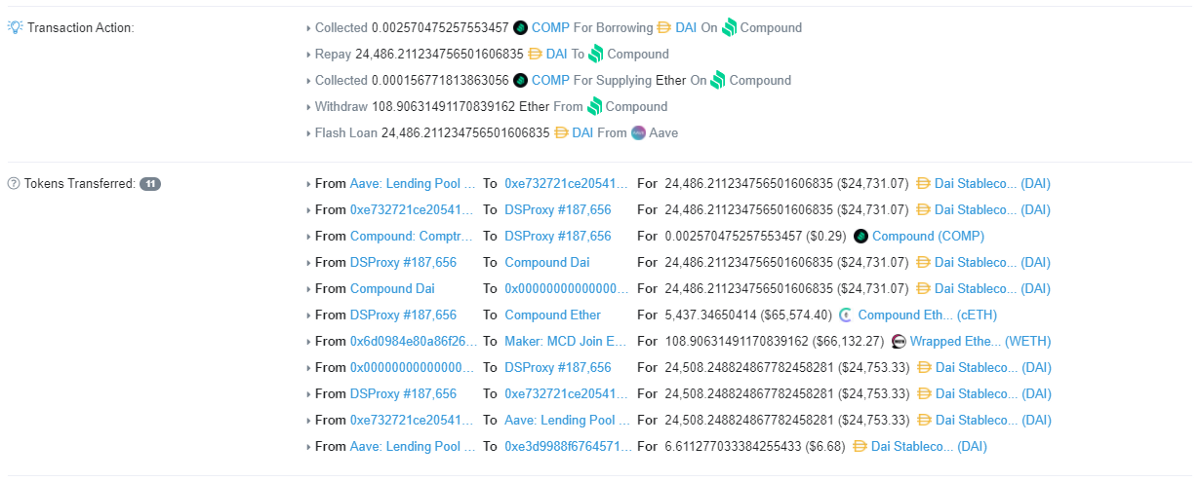

3. Protocol shift from Compound to Maker

No. of shifts: 15

Volume: 1114 ETH +30 WBTC🔥🔥

On the other hand, the opposite shift from the previously mentioned one has just one shift less made in the last 30 days, with 15 people moving their ETH and WBTC based positions from Compound to Maker.

Why do this shift?

We already mentioned one MakerDAO advantage earlier (the slightly higher allowed LTV), but there’s a few more important ones to consider.

The most important one might be the 1-hour price update delay that’s been present in MakerDAO ever since the Multi-collateral Dai launch in November last year. This is something that allows anyone to know if their position may be entering liquidation territory a full hour in advance, giving them plenty of time to react (be it by adding more collateral, paying off part of the debt or using Repay at DeFi Saver for anyone not using Automation for liquidation protection already).

Additionally, the borrowing rates are semi-fixed in MakerDAO. The Stability fee rates, as these are known in Maker, are voted on and changed by the MakerDAO Governance, so you will likely not see them changed more often than once per month and you will always know at least a full day ahead what kind of changes are being introduced.

These kinds of certainties are surely a very wanted feature for any borrower and could be one of the driving forces behind the Compound to Maker shifts.

4. Collateral shift from WBTC to ETH

No. of shifts: 14

Volume: 33.8 WBTC (shifted to 1156 ETH)🔥

Our first collateral shift in this roundup and the most popular one by quite a noticeable margin is the shift from WBTC to ETH.

Why do this shift?

The main reason why anyone would want to do a collateral shift at all would be believing that the asset they’re shifting to will perform better (or less worse) than their current collateral asset.

We believe the same applies in this case and people were merely shifting from WBTC to ETH thinking that ETH will outperform (W)BTC over a certain future time period.

5. Collateral shift from ETH to WBTC

No. of shifts: 8

Volume: 676 ETH (shifted to 19.4 WBTC)🔥

Unsurprisingly, the second most popular collateral shift also revolves around the two most popular assets in the crypto world, though this time it’s the other way around.

Why do this shift?

The reason most likely remains the same as in the previous shift — a number of people simply saw WBTC as a potentially better performing asset over a certain time frame and wanted to capture the benefits of that.

While the crypto markets in general aren’t really predictive, it’s often the case that when one of these two moves either up or down in value, the other one follows, so we’ll probably keep seeing people who try to capture gains in attempts to predict such moves.

Notable mentions

There have been a few more prominent use cases that we believe are worth mentioning.

Firstly, there is the collateral shift from ETH to USDC, which is right there behind ETH->WBTC with 7 shifts done so far.

This shift provides a unique option of “parking” a position temporarily instead of closing it out. It’s something that you would want to do when you expect a market retrace or straight drop that you’d prefer to not be affected by. This then allows you to jump back into the market once things settle down and, as expected, the opposite collateral shift, from USDC to ETH, is also right there with 6 shifts done so far.

Secondly, with the recent Compound DAI price oracle issue in mind, a shift that Compound users with DAI debt may want to consider is the DAI-USDC debt shift. Since USDC is pegged at 1.00 in the Compound protocol and doesn’t have an active price oracle, this move would make these positions safe from any potential future issues with the DAI price oracle.

Finally, we should mention that the Loan Shifter will soon have even more options, as updates are coming.

The option to partially shift a MakerDAO Vault, for example, should go live some time this week. This is an option has been requested by some users who would like to shift just 25% or 50% of their ETH Vault to WBTC, or vice versa.

And, more importantly, the support for Aave👻 is coming in the next two to three weeks.🤞 With their v2 release just around the corner, we expect to have it added very soon afterwards, which will enable more interesting options, such as shifting between Maker<->Aave and Compound<->Aave protocols.

Hope you enjoyed the post and see you soon with more intriguing content and brilliant updates!😉

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter