Automated Strategies - The Next Era of DeFi Automation

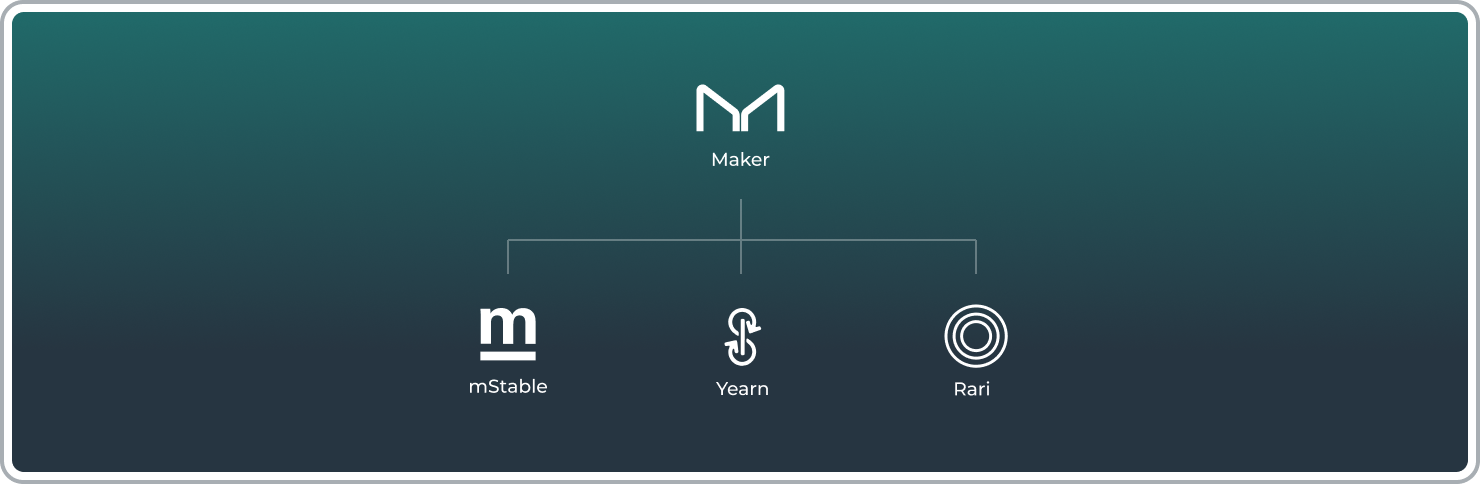

The first automated strategy that is going live is one that connects MakerDAO with yield farming protocols such as mStable, Yearn and Rari.

Back in 2019 we pioneered automated options for decentralised finance with the release of DFS Automation, our signature automated leverage management system. Initially released for MakerDAO only, we expanded support to Compound and Aave in the following years, together with a major technical update in 2020 that introduced use of flash loans for leverage management, as well as continuous optimizations for reduced gas usage and more.

Today we’re extremely proud to announce that our next generation of automation services is going live.

The path to more automated options

Our first major step towards a more generalised automation solution that would eventually allow release of a vast variety of strategies was the introduction of our completely new “recipes architecture” on the smart contract level back in April 2021.

The showcase feature of the possibilities of this new architecture has been our Recipe Creator, an interface that allows anyone to create countless combinations of various interactions with multiple DeFi protocols. Combinations that enable users to execute collateral or debt swaps, protocol shifts, creation of positions in multiple protocols at once and more.

After integrating over 10 major decentralised finance protocols during 2021, the next step in our vision was to prepare a new smart contracts and backend framework that will enable automating various unique recipes under different conditions, as described in our automated strategies technical overview post.

And this leads us to today’s release..

First new automated strategy: automated liquidation protection using funds in yield farms

The first automated strategy that is going live with today’s release is one that connects MakerDAO with yield farming protocols such as mStable, Yearn and Rari (and any others we may have integrated in Smart Savings later on).

Compared to our historically popular liquidation protection through automated repays, the difference is that there is no selling of the collateral in this case. The Dai deposited into any of the mentioned protocols are simply withdrawn and used to pay back part of the debt and prevent liquidation - automatically, without the need for any additional input from your end, as soon as the configured threshold is reached.

If you're interested in enabling and using this first new automated strategy today, these would be the requirements and steps:

- Have a MakerDAO CDP

- Have Dai deposited into one of the protocols available in Smart Savings

- Enable this strategy under https://app.defisaver.com/makerdao/saver

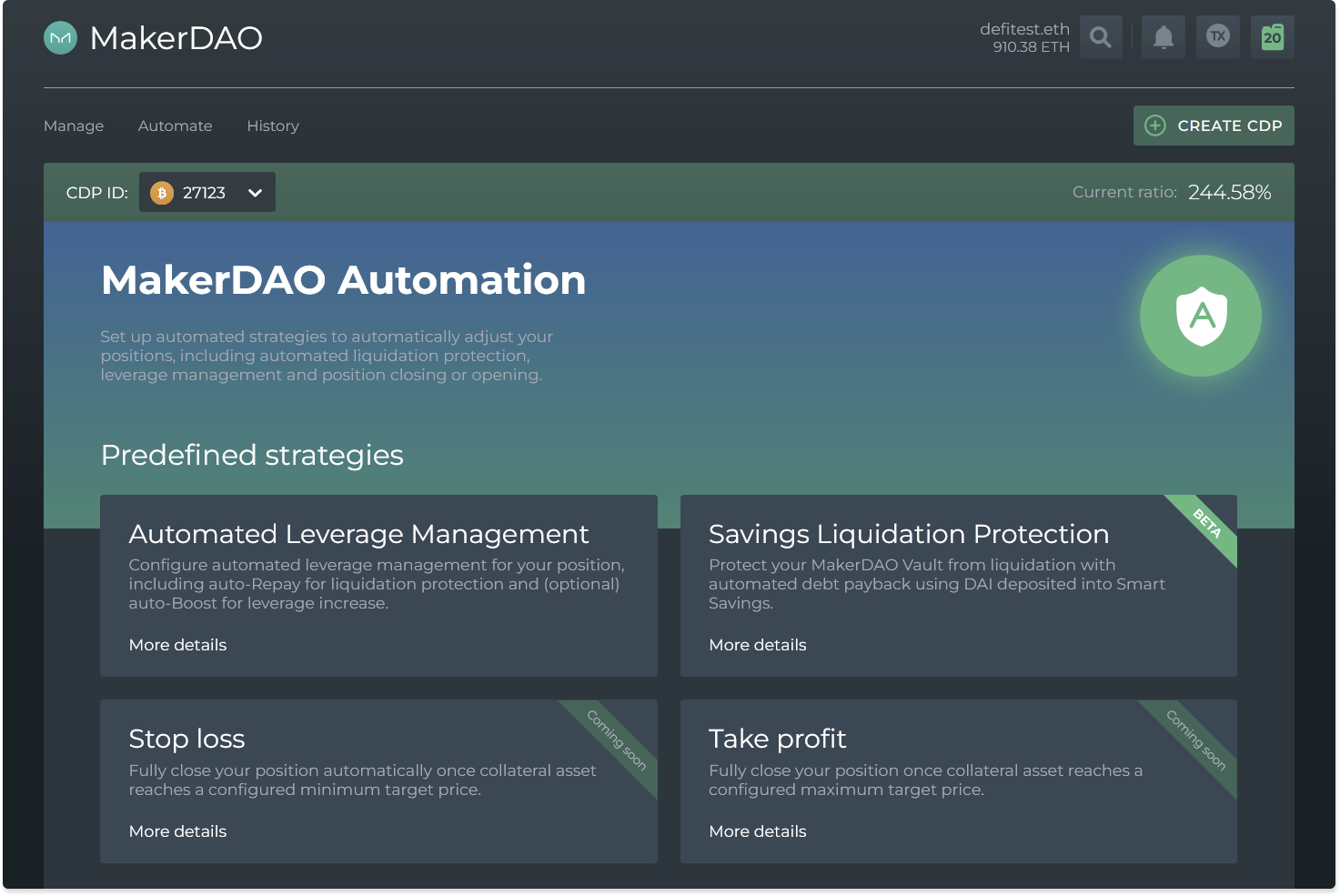

The new Automation UI

With this new release, we’re also introducing an overhauled automation centre which will provide you quicker access to all available automated strategies for your positions, as well as a better overview of currently enabled strategies.

You can expect this screen to gradually fill up with new strategies over the coming months.

Automation safety

As always, safety is a key concern in our development process and especially so when it comes to all automation options, which are meant to serve as a trustless and non-custodial solution towards convenience in decentralised finance.

While the new system is more modular, it doesn’t sacrifice security at any point. In order to ensure this, all new automation smart contracts have once again been fully audited by Dedaub, our continued partners and rising stars on the smart contracts security scene.

The future of Automation

As you probably noticed in the screenshot of the new interface, it contains teasers of some strategies that are coming soon, like stop loss and take profit options for your collateralized debt positions. This is because moving forward we intend to continuously introduce new automated strategies as soon as they are prepared and tested.

Some of the automated strategies you can expect to see next are the existing automated leverage management added for more protocols, such as Reflexer and Liquity, both of which were frequent requests over the last year.

We also want to start adding smaller, more specific strategies. For example, strategies to claim Aave staking rewards if the gas cost is lower than a configured amount, or one to claim (and re-supply) MTA rewards from mStable.

This is where we want to hear your feedback. What would you want to have automated? Jump into our discord and let us know.