Comparing MakerDAO management apps— Oasis, Zerion, DeFi Saver and InstaDapp

Today, the MakerDAO protocol holds about $600m worth of collateral — a sizeable amount of collateral that needs to be properly managed.

Disclaimer: This article has been created by the DeFi Saver team with the best intention of providing objective information and a good overview of all projects included. We tried suggesting this idea to other entities but eventually decided to create it ourselves, being well acquainted with each included app.

MakerDAO wasn’t the first decentralized finance protocol on Ethereum, but ever since their whitepaper and the initial version of the protocol were introduced in 2017 it has quickly risen to become the most popular one. And it has remained in that position ever since. They have been recognized as trustworthy by the community and investors alike, with a16z investing $15 Million in 2018, and Paradigm and Dragonfly Capital joining with another $27.5 Million in late 2019.

Today, the MakerDAO protocol holds about $600m worth of collateral, almost four times more than the currently second largest (Compound) and around 58% of all funds locked in DeFi. That is a sizeable amount of collateral that needs to be properly managed. If you take into account the 150% minimum collateralization ratio and the fact that users primarily utilize MakerDAO positions to leverage and long ETH, it becomes clear that proper tools are needed. And this is what we’ll talk about today — the four most popular MakerDAO management apps, starting with Maker’s own: Oasis.

Oasis app

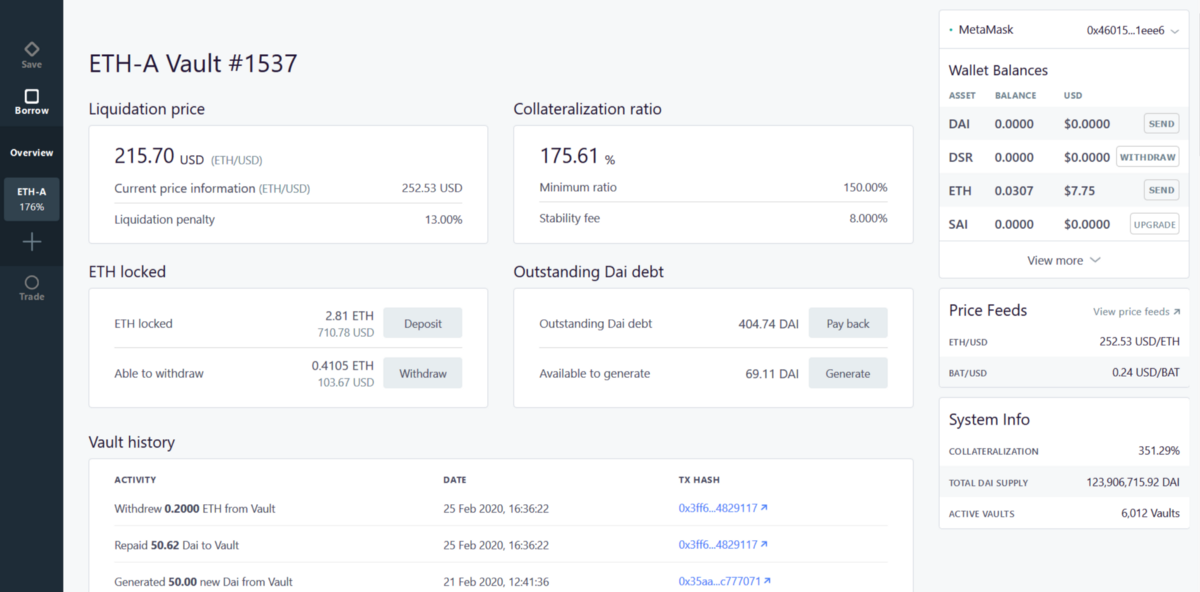

For most users, Oasis is the go-to app for everything MakerDAO related. And this of course makes sense, since it comes from the same people who created the protocol itself. Whereas their previous CDP Portal had the appearance of a niche app, Oasis aims for a more simplistic, beginner-friendly design.

In regards to functionality, however, it’s fairly limited compared to other apps, but for some it offers everything they need — all the basic, standard functions for CDP management (e.g. generating and paying back debt, and adding or withdrawing collateral), combined with access to DSR (Dai Savings Rate) and a built-in exchange.

Oasis Summary

- Unique features: N/A

- Compatibility: N/A

- Security: All contracts audited by numerous entities, some mentioned here

- Supported wallets: MetaMask, Trezor, Ledger, WalletConnect, WalletLink, mobile wallets

Overall, Oasis app is the vanilla MakerDAO experience, it offers only the basic interactions and doesn’t really have any bells or whistles. And for many this may feel enough. But what if you try some vanilla caramel gelato instead — would plain vanilla ever be enough again? Let’s see.

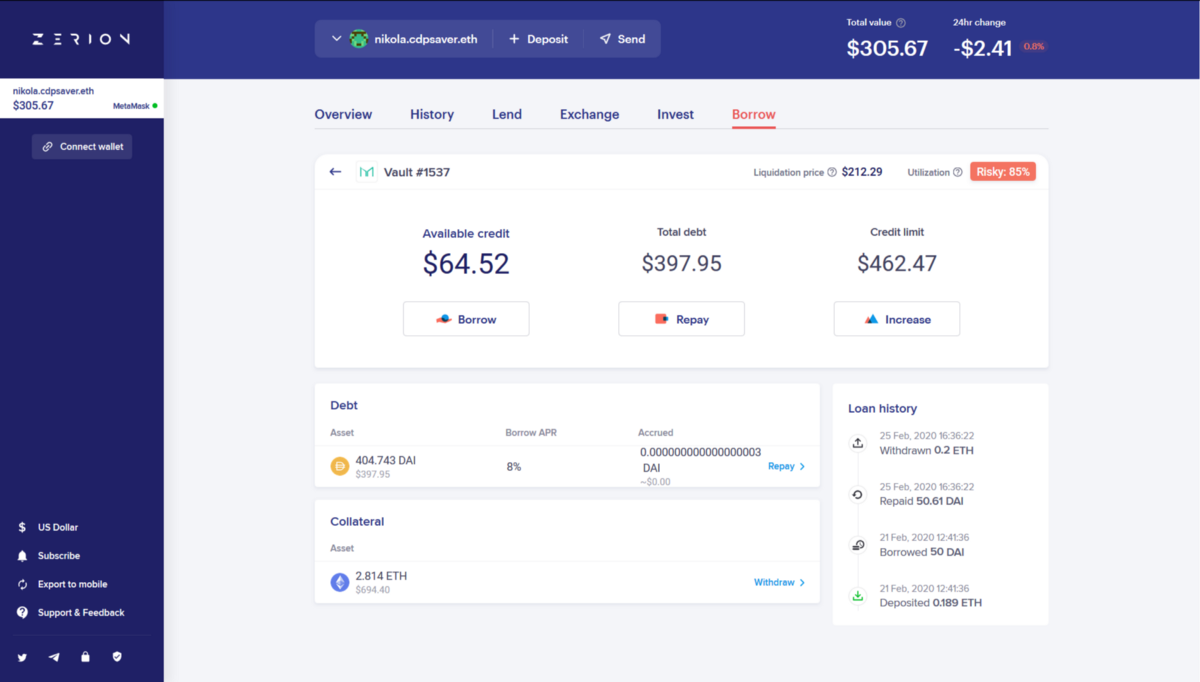

Zerion

Originally introduced as a portfolio management app, Zerion entered the world of decentralized finance in early 2019. Thanks to their previous background, it comes as no surprise how well thought out their interface is. There’s also a very convenient option of tracking an address without having to connect one’s wallet, as well as push notifications for CDP changes (which are also available in their portfolio tracking apps for Android and iOS), but that’s about it when it comes to unique features in regards to Maker.

Outside of the same basic CDP interactions available in Oasis, Zerion does also have a built-in exchange as well as a fiat on-ramp (though it’s EU only as of now), but there’s no access to DSR or any advanced CDP management features. Thanks to their numerous DeFi integrations, they recently raised a $2m investment.

Zerion Summary

- Unique features: Fiat on-ramp, portfolio tracking without connecting a wallet (also available as a smartphone app), push notifications

- Compatibility: Fully compatible with Oasis

- Security: Same security as Oasis, as there is no additional smart contract code

- Supported wallets: MetaMask, Fortmatic, WalletConnect, mobile wallets

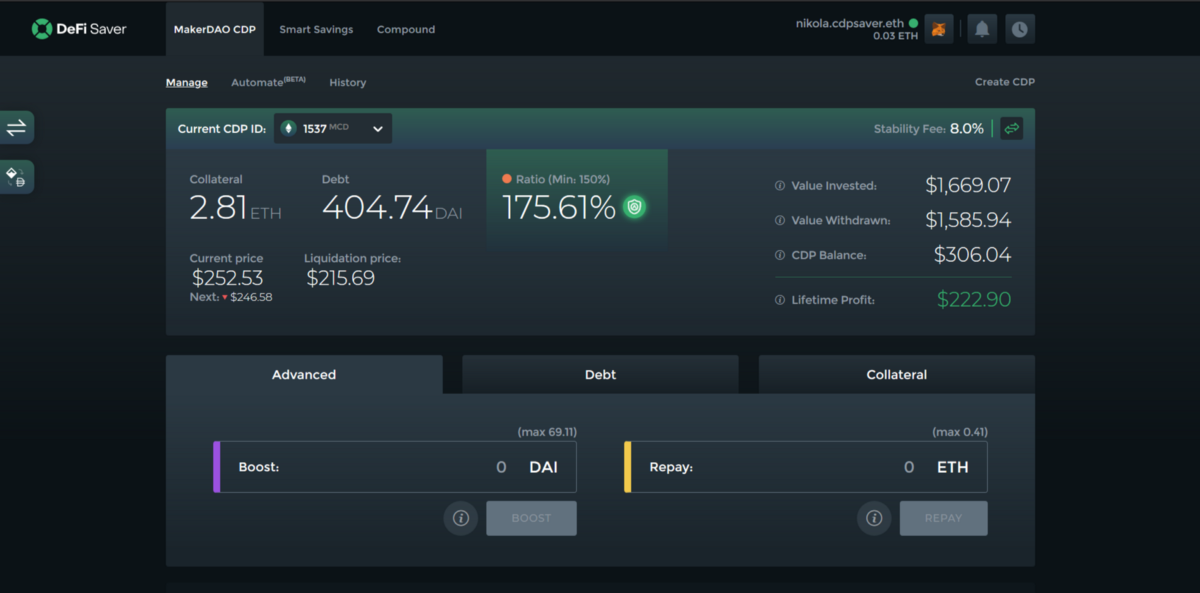

DeFi Saver

Initially introduced as CDP Saver in April 2019, this is an app that quickly grew to become one of the favourite tools of advanced MakerDAO users. This was mostly owing to the signature Boost and Repay (1-click, 1-tx leveraging and deleveraging) features the team introduced, but there’s no denying that the well laid out interface helped, too.

DeFi Saver was never just about the looks, though, as it packs another hefty punch (besides Boost and Repay) in the form of CDP Automation — a unique, trustless system for automated MakerDAO positions management. And the convenient part about all of this is that users can gain access to additional functionalities available outside of Oasis simply by logging into a different app. This is possible because DeFi Saver sticks to using Maker’s proxy wallet (each CDP sits on a proxy wallet that belongs to its user’s account) and building on top of that, convenient for both security and compatibility reasons. Besides CDP specific features, DeFi Saver also has a built-in exchange and access to DSR via the Smart Savings lending dashboard.

DeFi Saver Summary

- Unique features: Boost, Repay, CDP Automation, Profit calculator, Next price indicator

- Compatibility: Fully compatible with Oasis

- Security: Limited risk factors by sticking to Maker’s DSProxy, all additional code internally audited by the parent Decenter team

- Supported wallets: MetaMask, Trezor, Ledger, Fortmatic, WalletConnect, WalletLink, mobile wallets

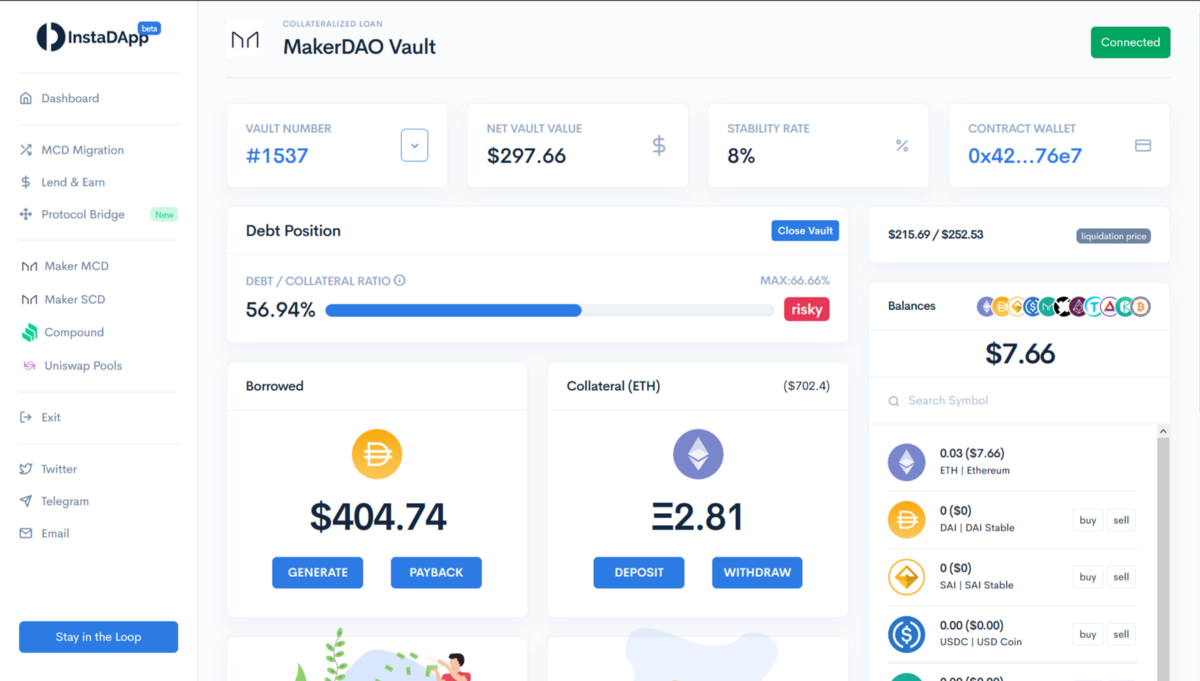

InstaDApp

What started as a hackathon project at ETHIndia 2018 has over time grown into one of the most popular apps in the whole of decentralized finance. At the time of introduction, InstaDApp offered a much simpler MakerDAO management utility compared to what was previously available in the pre-CDP Portal era where users had to run multiple transactions even to simply create a CDP. Having gathered a large following, the team’s efforts have been recently crowned with a $2,4m seed investment round.

In regards to unique features, InstaDApp quickly followed suit after DeFi Saver and introduced 1-tx Leverage and Save options (equivalent to Boost and Repay). They also have a unique protocol bridge for switching between MakerDAO and Compound that was highly sought after in 2019. One tricky thing in regards to InstaDapp, however, is that they rely on using a proprietary proxy wallet for all their users funds, which introduces potential additional risks and breaks compatibility with other apps. Outside of CDP-specific options, they do also have a built-in exchange, but lack access to Maker’s DSR.

InstaDApp Summary

- Unique features: Leverage, Save, Protocol bridge

- Compatibility: Proprietary proxy wallet incompatible with Oasis and others

- Security: Funds on their own contracts, code audited by OpenZeppelin

- Supported wallets: MetaMask, WalletConnect, mobile wallets

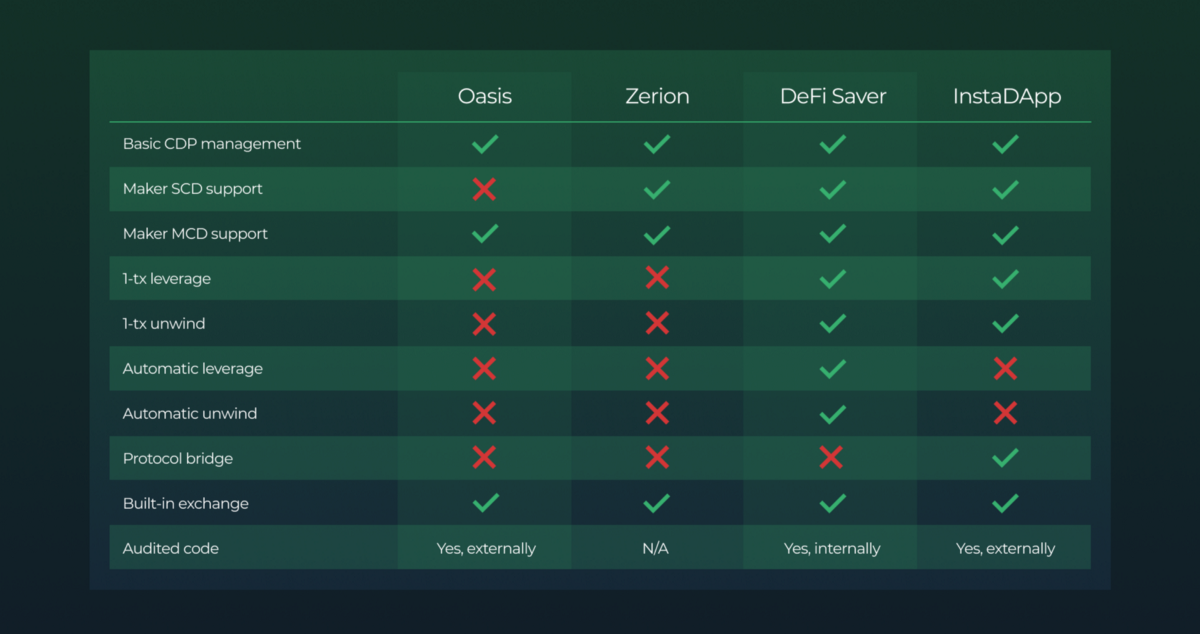

The Verdict

Each app has its strong points and we definitely wouldn’t feel comfortable crowning a winner — especially given how quickly things are developing in the DeFi world. Oasis shines in simplicity, Zerion provides another unique interface, DeFi Saver delivers leveraging options as well as peace of mind with Automation, and InstaDapp provides leveraging options combined with protocol bridging.

Another point worth noting is that each of these apps supports management of various other DeFi services. All of them have built-in exchanges. All of them except for Oasis also have support for Compound management. InstaDapp and Zerion include support for liquidity pools management and DeFi Saver has a Smart Savings DAI lending dashboard.

These are all aspects that will likely affect your decision, mostly for convenience reasons. What do we recommend? Head out there and try out all of these apps, connect with the teams behind them, figure out which app makes most sense for you and meets your needs the best.

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter account