Compound v3 support now live with Automation and Notification features

With DeFi Saver Compound V3 supports several advanced features as well as Automation, Notification, Loan Shifting, and custom Recipe creation.

Compound first launched on Ethereum mainnet in 2018, introducing the concept of a money market protocol and quickly becoming a staple of decentralised finance, shoulder to shoulder with Maker.

In May 2019, the team released Compound v2, introducing more completely new concepts, such as collateral tokens (cTokens), and a year later, in June 2020, they announced the COMP governance token, effectively creating the first liquidity incentives program and consequently causing a rush of liquidity into DeFi and kicking off DeFi Summer 2020.

Although they've been relatively quiet since then, the team recently revealed Compound III, which has now been live on the Ethereum mainnet for over a month and quickly grew to $100m+ in collateralised and deposited assets.

Having supported Compound since our earliest days, today we are very proud to introduce our fully fledged Compound v3 integration featuring the signature set of power tools such as a dedicated dashboard with 1-tx leverage management features, Automation options, Loan Shifting tools, Recipe Creator support, as well as completely new Notification features.

If you're ready to dive into Compound v3 right away, you can find all of this at https://app.defisaver.com/compound/ - or read on for more details on each of these features!

Compound v3 features at DeFi Saver

Before we cover all of the available features, we should note that Compound v3 is slightly different than v2 and actually slightly simpler in a way, since v3 moves from the open money markets approach to isolated markets, where each instance of Compound v3 is meant to support only one debt asset.

(For a much better intro to Compound v3, feel free to check out this thread from our definikola.)

Currently, there's only the Compound v3 USDC market available, and this is the integration we're talking about today. Should any other Compound v3 markets come online, we'd expect to have support for them very quickly, and we're also hoping to see Compound v3 instances on L2s such as Arbitrum and Optimism.

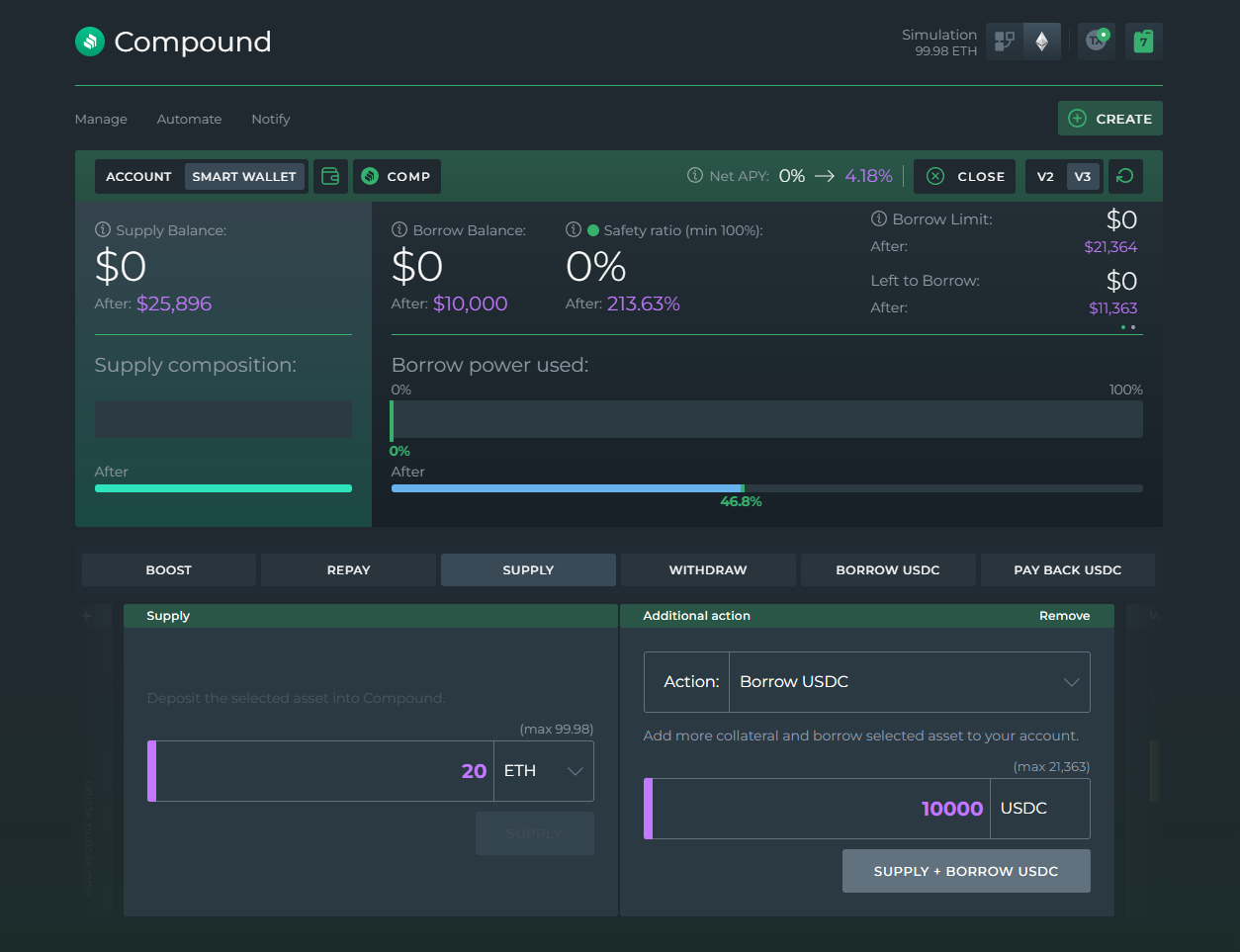

Our new Compound v3 dashboard

As it has come to be expected, our new dedicated dashboard for Compound v3 supports a number of advanced features:

- Supplying and borrowing assets in one transaction or creating instantly leveraged positions (note the Create button in the top right corner!)

- Closing positions in one transaction, either through debt payback or self-liquidation (also top right corner!)

- Boost and Repay as our signature 1-tx leverage management options for increasing leverage or partially deleveraging/unwinding your position.

We're sure the dashboard will feel familiar to any DeFi Saver user, but in case you haven't frequented the DFS app earlier, we recommend turning on the simulation mode and just trying every button and every input field there is. Once the simulation mode is turned on, it gives you 100 ETH in credits to use however you like, so it can be pretty handy for trying things out.

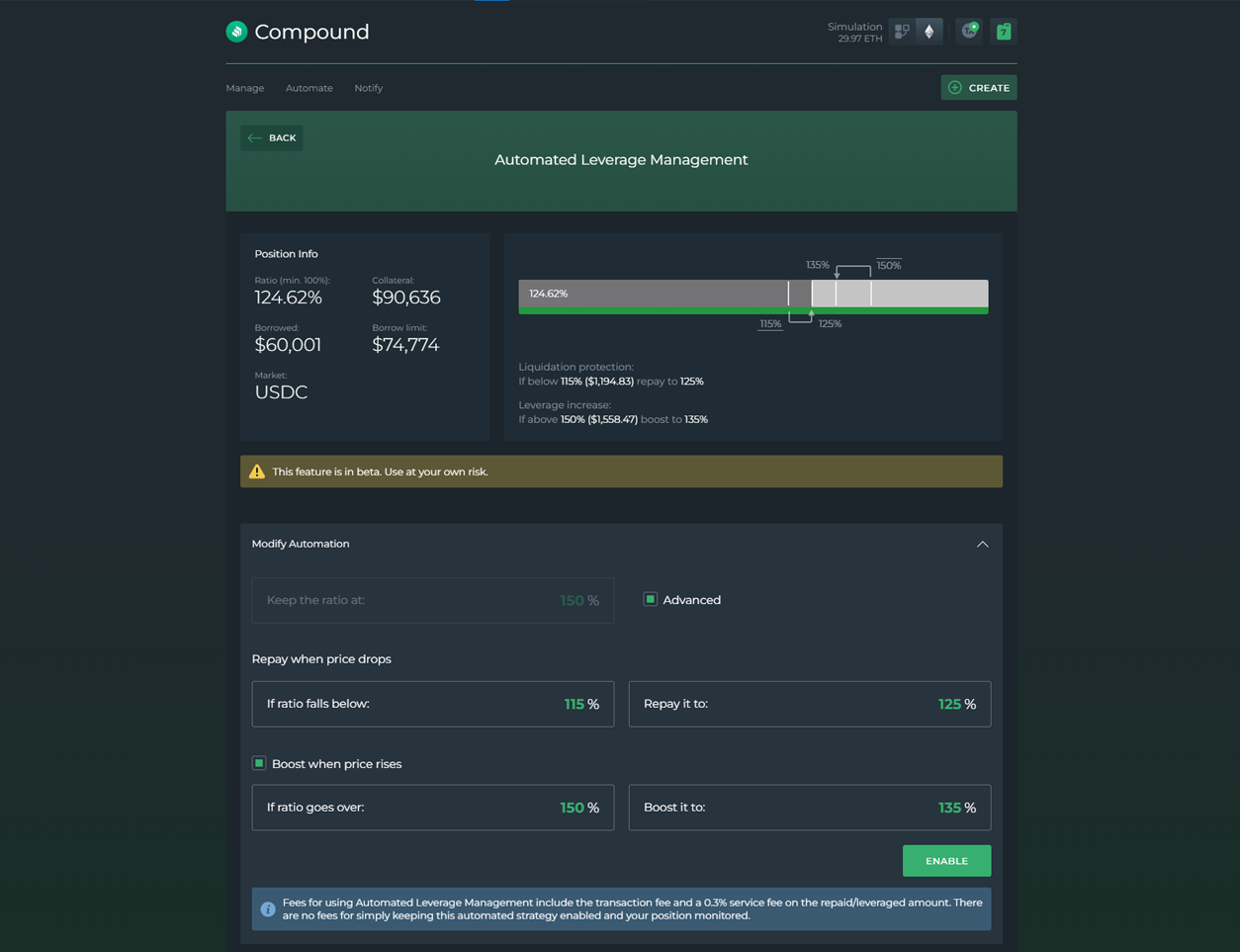

Automation for Compound v3

No DeFi Saver integration would be complete without automation options, and we're very glad to share that our Compound v3 support is going live with Automation available right away.

Starting today, you can enable automated leverage management for your positions, which includes:

- Auto-repay, for automated unwinding (aka partial self liquidation) for cases when your position drops under your configured threshold and gets close to liquidation.

- Auto-boost (which is optional and can be disabled) for cases when your position's ratio grows above your configured threshold, where it's safe to leverage more.

💡Auto-boosting can be beneficial during prolonged market movements in your predicted direction, e.g. if you have a long ETH position open with auto-boosting enabled and market keeps going up, you stand to benefit and end up with a higher ETH balance on that position. However, it's not recommended for choppy and turbulent market periods and should be considered an advanced tool.

Besides our historically most popular automated leverage management features, you can expect to see our newer automated strategies such as stop loss, take profit and trailing stop added for Compound v3 in the coming months, too.

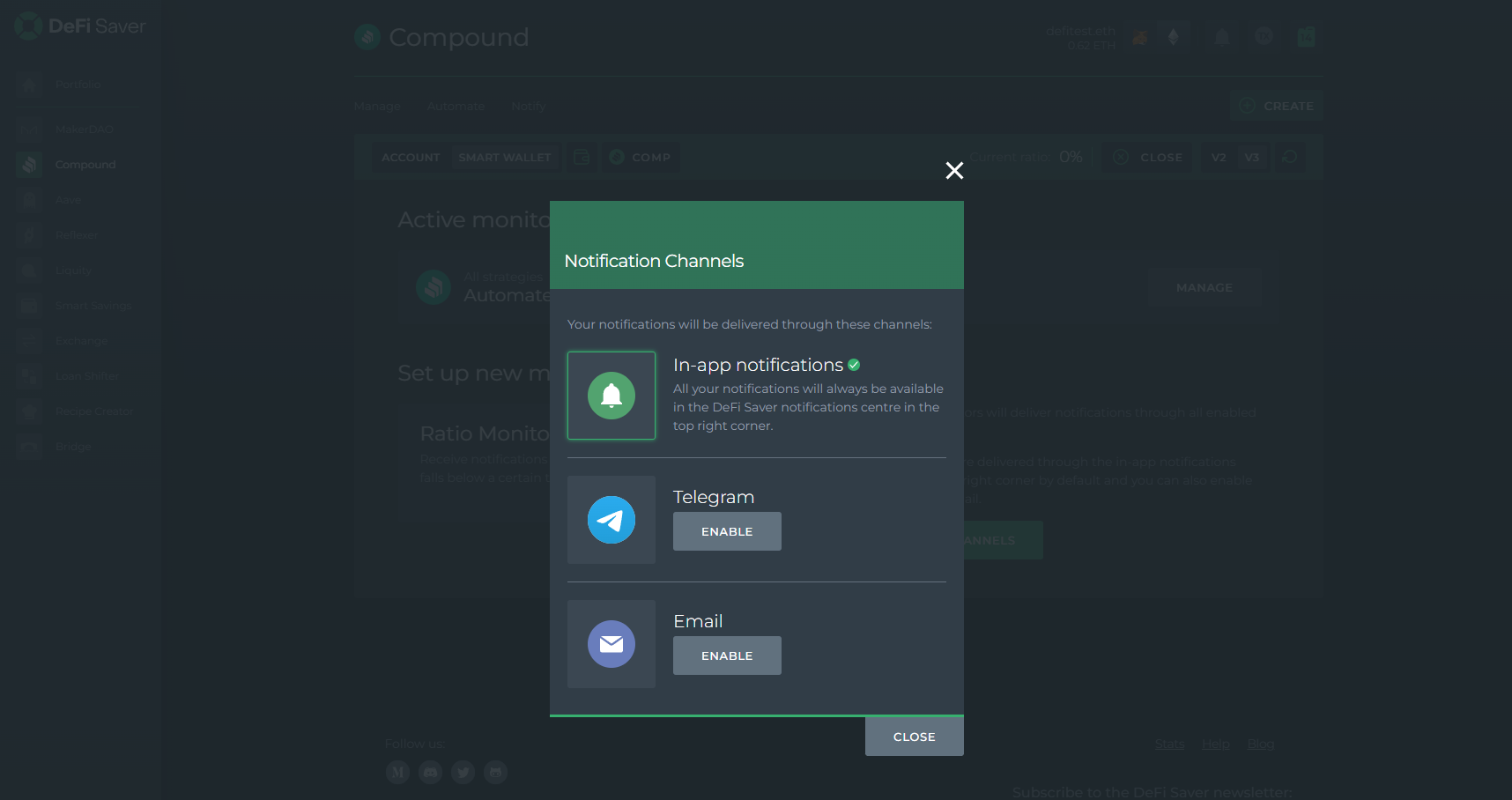

Notifications🆕

Together with our Compound v3 integration, we are rolling out a completely new feature: DFS Notify.

Notify lets you (finally!) receive notifications about changes to your positions via channels such as Telegram and Email.

Currently, you can configure two types of "monitors" for position changes:

- Ratio monitor, which lets you configure notifications for when your position's ratio drops below or rises above a configured threshold. Note: You can set multiple ratio monitors.

- Automated actions monitor, which is on by default, and will let you know each time an automated transaction is executed, for any of the strategies you have enabled.

Note that all notifications will always be delivered to the in-app notifications centre in the top right corner of the app, while all other channels are optional.

DFS Notify is now available for MakerDAO, Compound v2 & v3, Aave v2, as well as Liquity! We're not forgetting L2s, though, and we'll be expanding DFS Notify to support Arbitrum and Optimism later, too.

Loan Shifting

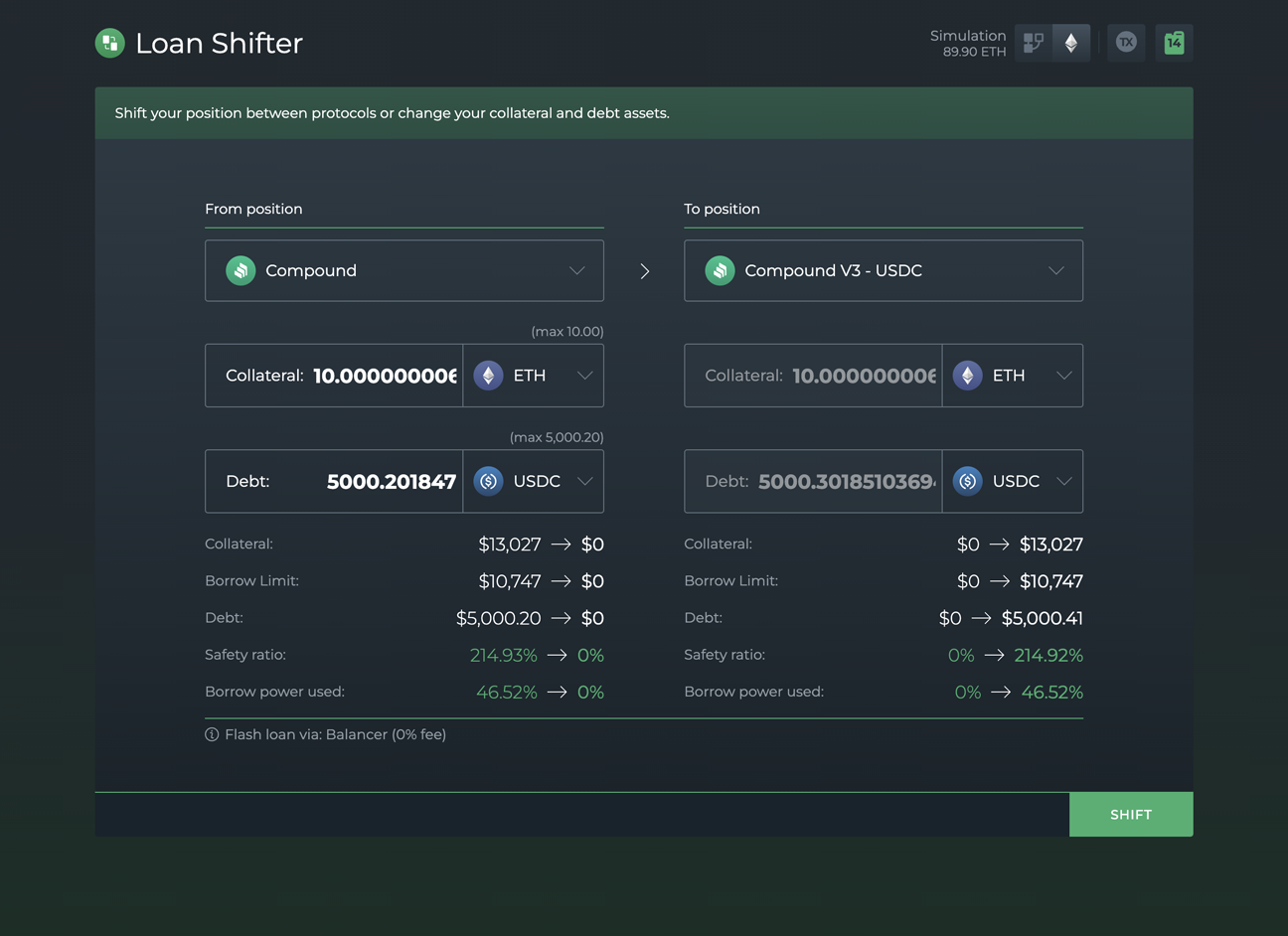

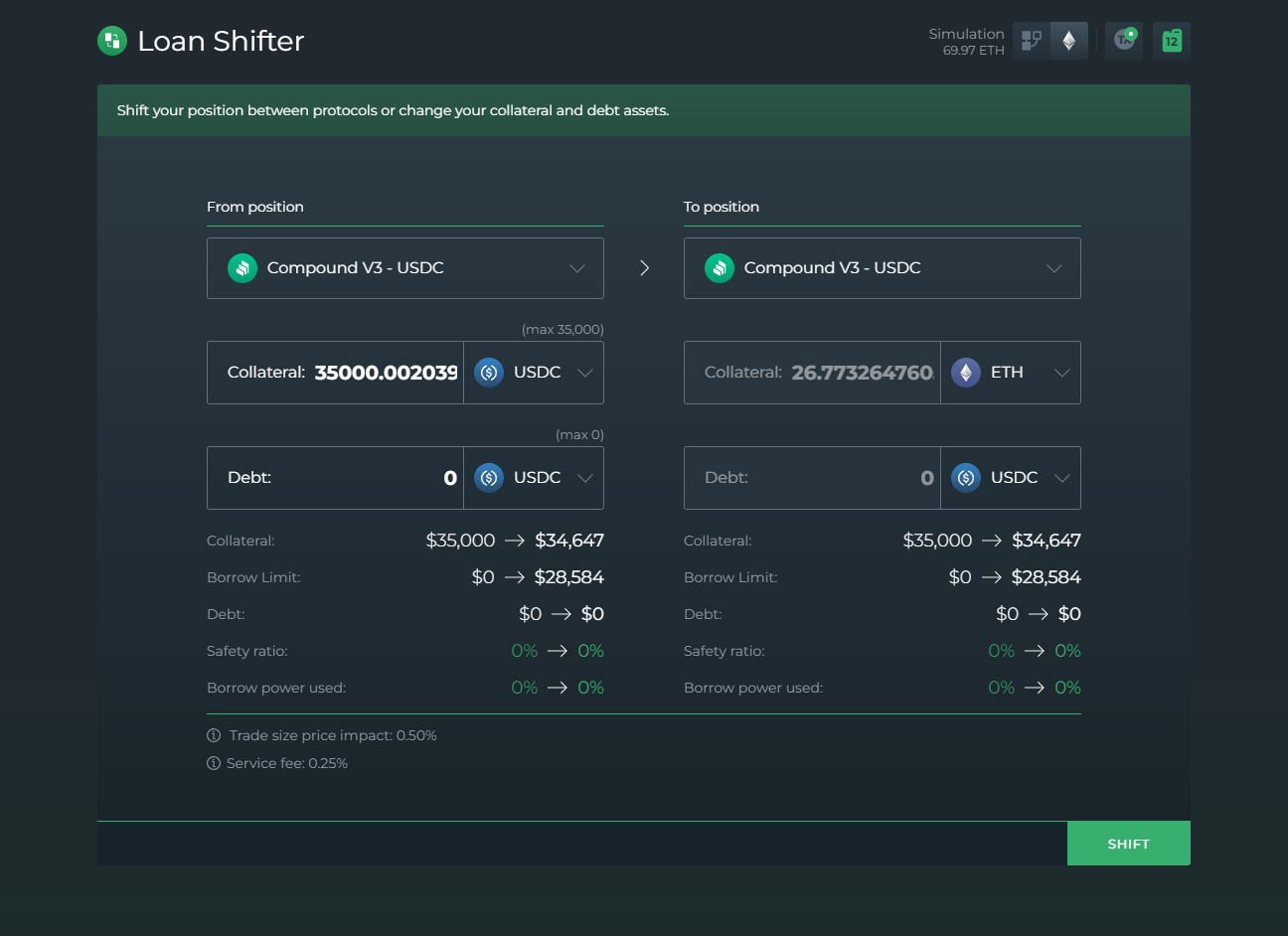

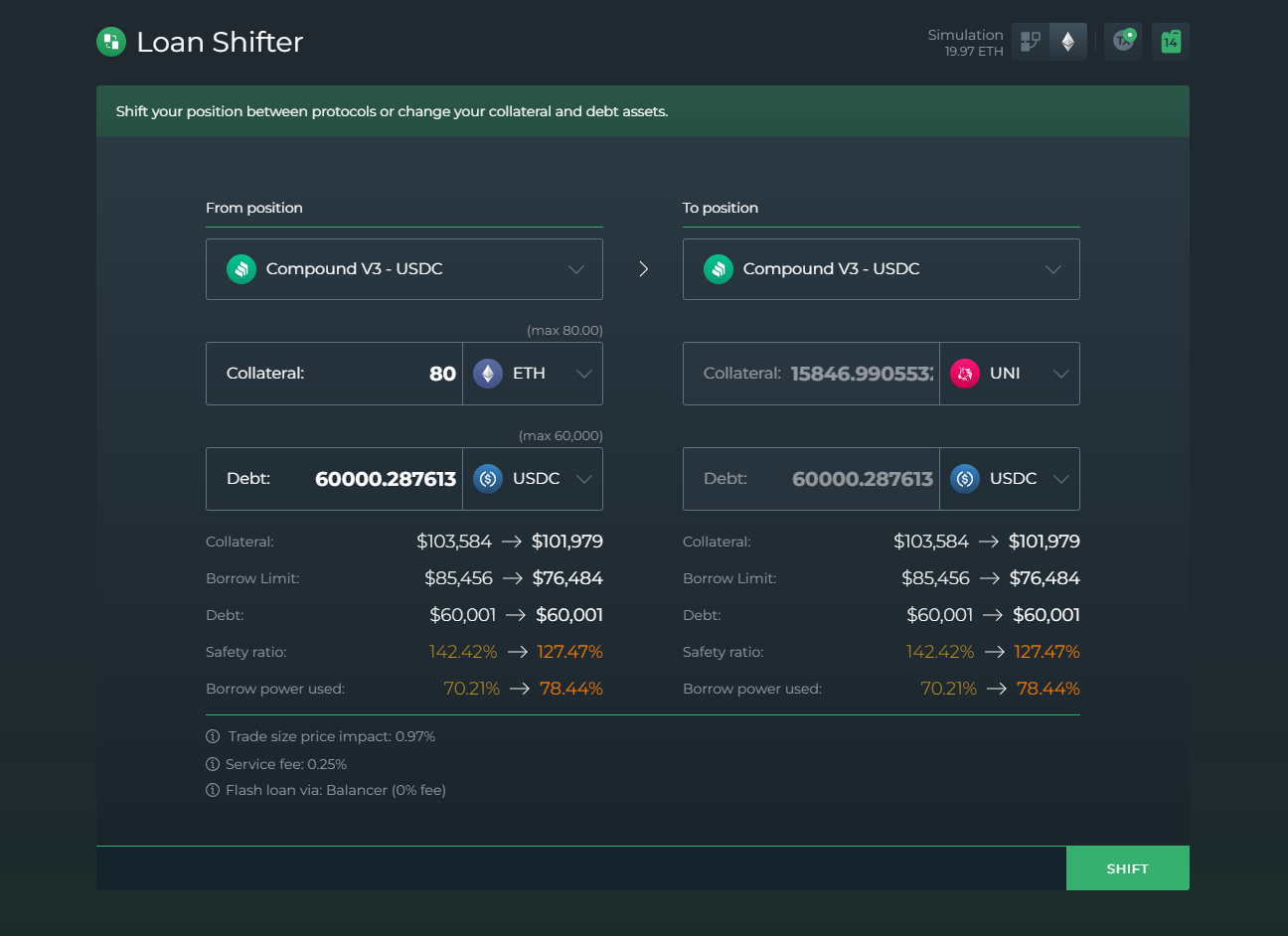

Right out of the gate, you can find support for Compound v3 in our Loan Shifter dashboard, too.

Here are some of the use cases where the Loan Shifter might come in handy:

- If you have an ETH/USDC or WBTC/USDC position in Compound v2 (or Aave v2) you can use the Loan Shifter to move the position to Compound v3:

- If you have USDC supplied to Compound v3, but would now like to swap that to one of the supported collateral assets, you can use the Loan Shifter to make a collateral swap:

- If you have an open position in Compound v3 and would like to swap (one of) the collateral assets for a different one, the Loan Shifter allows you to do just that:

Keep in mind that you can try any of these options in the Simulation mode, just like everything else in the app - it's a great way to try things out, estimate transaction costs, and double-check that exactly what you want happens.

Creating custom recipes with Compound v3

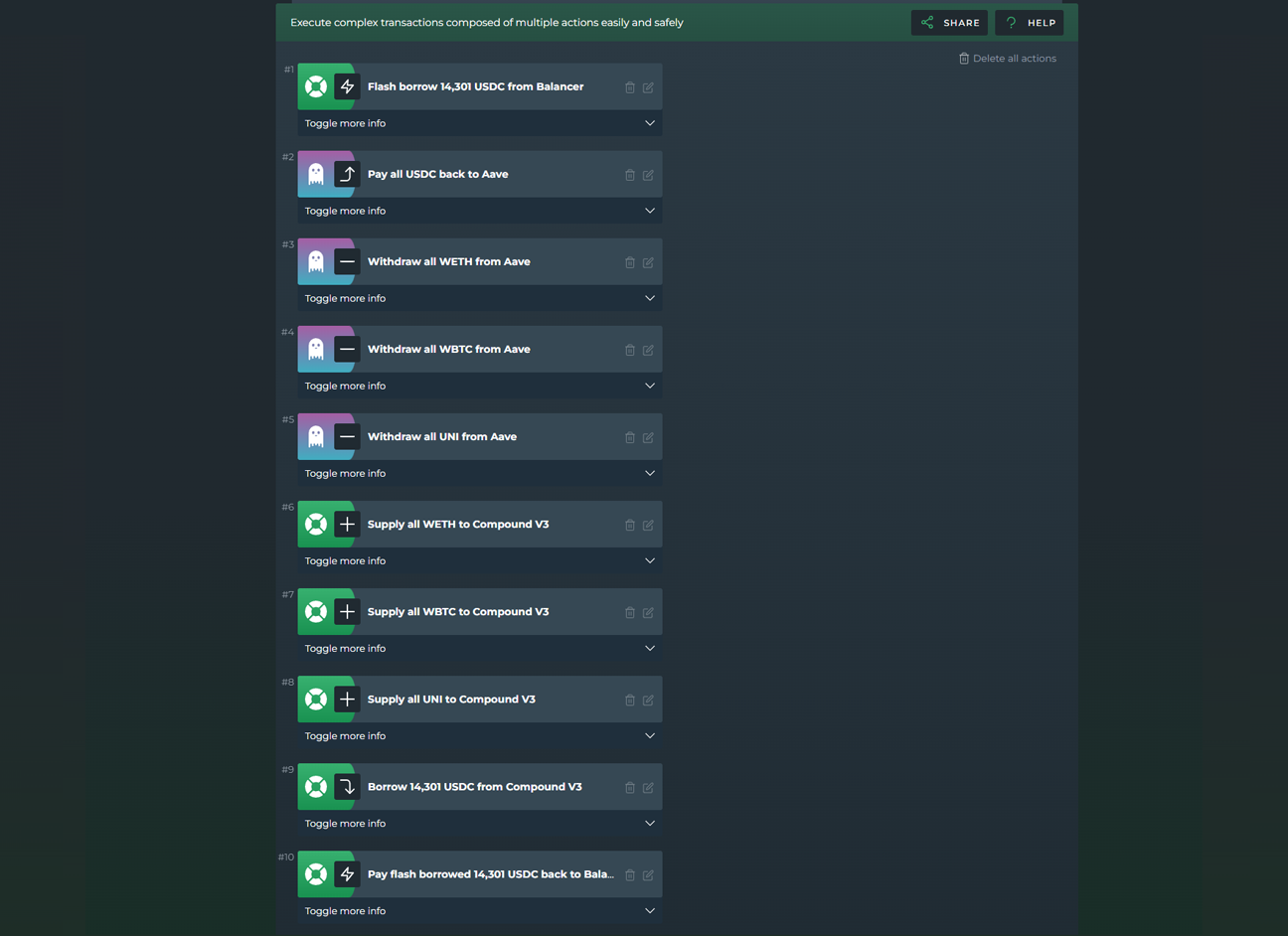

Last, but definitely not least, there's also our Recipe Creator support for Compound v3, where you can combine actions with those of all other protocols we have integrated.

One of the interesting recipes you could do is one where you move a more complex, existing position into Compound v3. For example, if you have an Aave v2 position where you have all of ETH, WBTC, and UNI supplied and USDC borrowed, you can create a custom recipe that will move that whole position over into Compound v3 in one single transaction.

Here's how that recipe could look like:

(And here is the link to the example recipe from the screenshot, for anyone interested!)

This is all we have in store for today, but we feel this is the first time we have released such a thoroughly complete integration right away. While it did take a bit longer, we think it was worth the slightly longer wait in this case.

Find us in the DFS Discord to tell us your thoughts on the new Compound v3 dashboard and to share how you like the new notification features!