DeFi Saver Newsletter: November 2025

In this issue, we break down the October crypto market crash, share the newest DFS chain integrations and updates, as well as the latest Aave and Automation stats for October.

Welcome to this month’s edition of the DFS Newsletter, where we get you up to speed with major ecosystem happenings, market changes, DFS upgrades, and much more.

For this month, we’ll cover:

- The unprecedented October crypto market crash;

- Aave x Plasma support, Position Flip launch, Aave automation upgrades, and Stani visits DFS;

- Latest Stats and user feedback!

The October crash and lessons learnt: What happened?

On October 10, in a matter of 24 hours, more than $19 billion worth of positions were liquidated, from more than 1.5 million accounts. Bitcoin dropped 8.4%, ETH by 6.7%, and some altcoins even plummeted by 30-40%.

Sure, this is not by any means the first market crash in crypto history - but it is the largest one, both by volume and perplexity of the causes and issues it exposed.

My thoughts on yesterday’s crypto crash:

— Simon Dedic (@sjdedic) October 11, 2025

TLDR: We’ll be fine. We always are.

I’ve been in this industry for 9 years now, and I’d say I’ve really seen it all. The COVID crash, the $LUNA meltdown, the FTX collapse, you name it.

But what we witnessed yesterday felt very different…

This October event has revealed numerous market trading infrastructure shortcomings, including weaknesses in exchange auto-deleveraging mechanisms, oracle systems, and liquidity management, among others.

Trying to point to just one cause of the crash would be an oversimplification, but it is widely believed that US President Trump’s announcement of 100% tariffs on Chinese imported goods and software export controls may have contributed partially. In turn, China answered by imposing restrictions on earth minerals exports to the US, which further ignited the dispute.

For a more detailed analysis of how the crisis came about and how it shed light on infrastructural vulnerabilities, feel free to check out this post from X:

One key issue that we would certainly like to highlight is the problem with oracle price fetching. The crash has revealed that many exchanges set oracles to “calculate collateral values based on internal spot market prices, rather than external oracle feeds”.

This presented a whole new array of issues for dApps utilising or aggregating those exchanges, including receiving incorrect price data from certain DEXs, which further caused miscalculations and blocked trades.

Even though the incident was in no way insignificant, our Automation team did tremendous work and reacted quickly, which is why DFS Automation helped a great deal of users save their positions.

This is exactly why we consistently highlight the importance of Automation for position management, and in this case, tools like Stop Loss or Repay at Target Price can help tremendously.

And if you are unsure or have questions about how it works, check out our DFS Knowledge Base, or contact our support guys directly via our Discord server.

DeFi Saver news&updates

From a new chain integration to launches of handy new DFS tools for position management, this month had it all. Without further ado, let’s start with the second new network addition we’ve had in the last 2 months:

Aave x Plasma now live on DFS

In just one month, we integrated two up-and-coming chains. First came Linea, and now-Plasma.

Plasma was launched on September 25 this year and has since shown great performance both in terms of TVL and adoption. This newly launched L1 blockchain is purpose-built for stablecoins, offering full EVM compatibility, low-cost transactions, and high throughput.

Aave on Plasma has been the fastest growing Aave market ever, becoming second largest in mere days.

— DeFi Saver (@DeFiSaver) October 8, 2025

And it's now live at DeFi Saver.

Starting today you can manage @aave positions on @plasma using DFS, including our signature leverage management and other tools - details below. pic.twitter.com/HFhLi9zhQ9

With this new integration, users can now manage their Aave x Plasma positions through the same dedicated dashboard they’re used to, as well as fully utilise DFS tools such as Boost & Repay, collateral and debt swaps, and automation options they know and trust.

Our Exchange and Bridge options are also live, with the standard DFS meta-aggregation through 0x and Kyberswap, and others coming soon.

Automations now available for all Aave v3 positions

DeFi Saver’s signature Automation feature is now available for all Aave EOA users across Mainnet, Arbitrum, Base, and Optimism.

Of course, even prior to this update, users were able to execute collateral and debt switches and leverage management, regardless of the wallet they used.

However, setting up any of our automation options previously required users to migrate their positions to a (Safe) smart wallet, which is exactly the hurdle we set out to remove. Now, any Aave v3 user can simply log in with their account that holds an existing position and set up automated leverage or any of the other options immediately.

DFS Automation is now available for *all* Aave v3 positions.👻

— DeFi Saver (@DeFiSaver) October 21, 2025

Starting today, you can setup our automation options for @aave v3 positions on accounts (EOAs) across Eth mainnet, @Arbitrum, @Base and @Optimism.

Find more details below or get started in our Aave dashboard. pic.twitter.com/0GTQtP3hOz

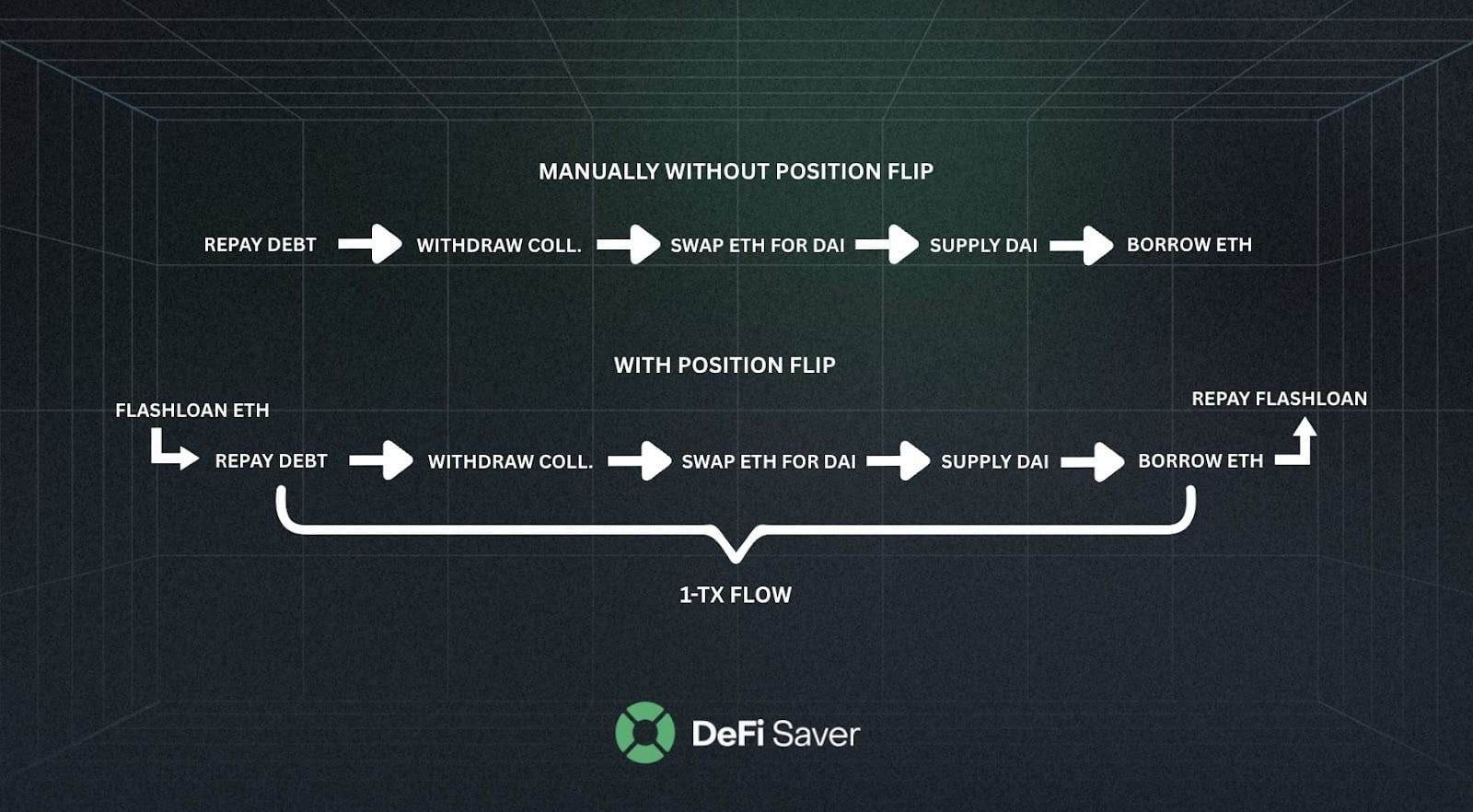

DeFi Saver launches Position Flip feature

We're proud to share that we've also introduced a long-requested new feature: Position Flip, which allows you to switch a long position into a short position instantly, and vice versa.

You’ll find the Position Flip feature under the Tools menu in the DFS Aave dashboard. It’s available for all Aave v3 instances across Ethereum, Arbitrum, Base, Optimism, Linea, and now Plasma.

Have you ever wanted to be able to convert a long into a short or vice versa?

— DeFi Saver (@DeFiSaver) October 15, 2025

Well, starting today you can: Position flip is now live for @aave.🔄

It lets you instantly switch the collateral and debt assets of your position, replacing them for one another, all in 1-transaction. pic.twitter.com/ahpHGMJy4V

Not only that, Position Flip is up and running for Spark users, and we'll be looking to enable it for other protocols as well.

A certain Stani visits DeFi Saver

During October, our team had the pleasure of welcoming a few people from the Aave team to our offices, including no other than Stani himself.

We spent the day discussing Aave v4 and the protocol design changes it introduces, as well as the new challenges it introduces on the UI side of things. We brought the questions on what's new, Stani came in with the answers, and together we discussed tailor-made solutions, zaps, and automations that DeFi Saver can introduce for v4 users.

As you may know, we were one of the first (if not the first?) integrators of Aave v1 back in 2020 and have been working closely with Aave ever since, catering to thousands of advanced Aave users along the way.

We're super excited about yet another major step in the Aave evolution and are looking forward to working on it together in the coming months to help users make the most of what Aave v4 has to offer.

¡Buenos Aires, allá vamos!

From 17-22 November, our team will be heading to DevConnect, held in Buenos Aires, Argentina.

Make sure not to miss out and visit our DeFi Saver booth for some DeFi chat, as well as some limited-edition merch, specially designed for this conference!

We're mega excited to join the first ever Ethereum world fair!

— DeFi Saver (@DeFiSaver) October 7, 2025

Looking forward to seeing everyone in Buenos Aires🇦🇷 https://t.co/t1Qj90O61o

As always, if you’d like to meet our guys for a feedback sharing session, some DeFi talk, or simply want to say hi, feel free to reach out to us via our Discord channel.

DFS November stats

We’ve talked about market crashes, and we’ve mentioned the importance of being prepared for abrupt market changes.

In that sense, our Aave DeFi Explore page has proved to be especially handy, as you can simulate price changes of your collateral or debt assets using our Price slider tool, to see how it would affect your positions.

Our team is currently working on expanding DFE to cover other protocols and their positions, so make sure not to miss out and follow our socials and subscribe to our DFS blog!

Now, let’s take a look at this month’s Aave metrics:

- Aave’s total TVL is $34.16 billion, and DFS users make up for $1.10 billion;

- In terms of Health Factor Distribution, 35.6% of all Aave positions made by DFS users have an HF>3, considered very safe.

- The top 3 tokens used in Aave, by TVL, are: weETH, wstETH, and WBTC;

- While the top 3 tokens DFS Aave users prefer are: WBTC, wstETH, and weETH.

Regarding DFS Automation statistics, there are currently 1,186 active automated positions, with collateralized debt assets totaling $454 million.

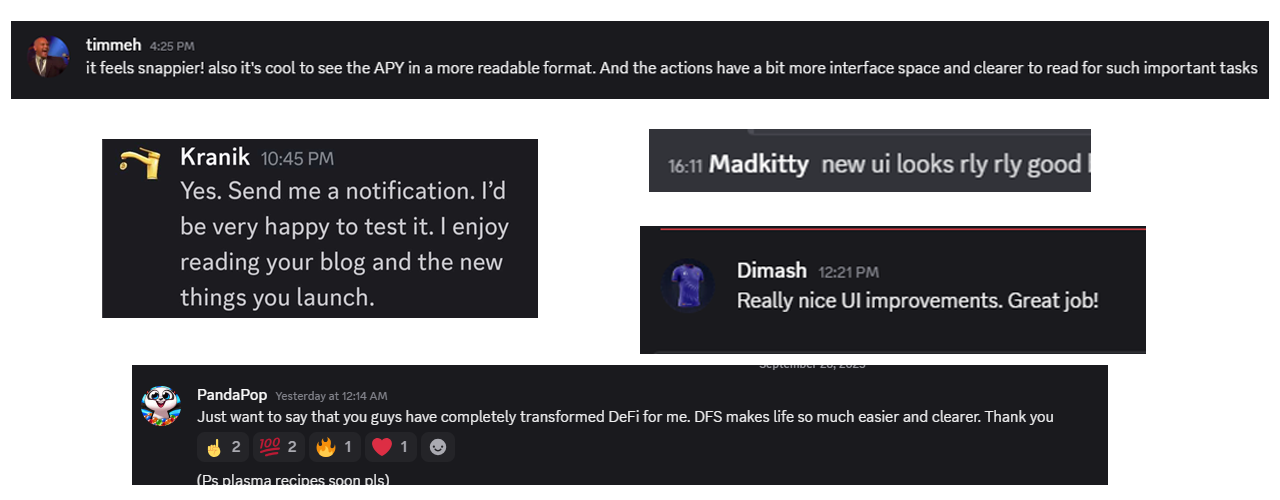

Community shoutouts

Market oscillations are nothing new in the field of DeFi, but what keeps us going is the positive feedback of our community. For example, one thing we got plenty of positive comments on recently was the new dashboard UI update.

Our goal is to provide a plethora of tools that aid users in optimising profits when markets are booming, and enable safeguards to protect their positions when downturns occur.

I’m a big fan @defisaver. Basically it’s a frontend for many defi lenders including AAVE (they also have other features). User friendly UX. Shows on UI what happens to your wallet before you do it. You can even use a simulator with fake wallet for what ifs

— 0xB0BA (@0x_ba) October 23, 2025

We listen to your feedback, be it positive or negative, so let us remind you that it’s always welcome via our Discord channel.

Until the next post!👋

Stay connected:

📢: Official Twitter/X