How to long or short any asset using DeFi lending protocols

A guide on longing or shorting any asset supported by decentralized finance protocols such as MakerDAO, Compound and Aave.📈📉

Generally speaking, longing and shorting equities is an activity associated with the stock market, where one would take long positions in stocks that they expect will grow in value and short positions in stocks they expect to decline. These terms seem to be used in this sense ever since mid-19 century, if not even earlier.

In the crypto world the option to long or short different cryptocurrencies and tokens has been commonly available on centralized exchanges. But ever since the onset of decentralized finance, it has been one of the most popular and growth driving activities in the ecosystem.

As soon as the earliest versions of the DeFi lending protocols showed up, users quickly realized they could utilize them for creating leveraged positions with assets supported by the protocol, with one of the earliest options being MakerDAO, launched in December 2017.

On November 14th 2018, the total amount of ETH locked up in @MakerDAO CDPs hit 1 million.

— Anthony Sassano 🦇🔊 (@sassal0x) January 31, 2019

Just 2 & a half months later, that number now stands at 2 million ETH (~$218 million USD).

MakerDAO continues to show the incredible power of open finance 🦄 pic.twitter.com/4h6MQZMERo

The main advantage of decentralized finance over more traditional, centralized options is its trustless nature — you never give over your assets to a different entity.

The concept is fairly simple — one supplies a certain asset, borrows a different one and then uses the borrowed funds to obtain more of the supplied asset to achieve leverage. Doing this creates an amplified upside potential or, put more simply, allows for greater profits if the market moves in the predicted direction.

Specifically, in the example of MakerDAO, it allowed people to supply ETH and generate DAI stablecoins in return, which they then used to obtain more ETH for their position. This effectively created a Long ETH position where they would eventually have more ETH to walk away with in case it went up in value.

Nowadays, there are a number of projects that allow users to create long or short positions on different assets and with a greatly improved user experience, so let’s talk about how this can be done with some of the most popular DeFi protocols today.

MakerDAO

(Assets supported: ETH, WBTC, BAT, MANA, ZRX, KNC, USDC, USDT, PAXUSD, DAI)

MakerDAO was one of the first and still remains one of the most popular protocols used for decentralized leveraging of assets.

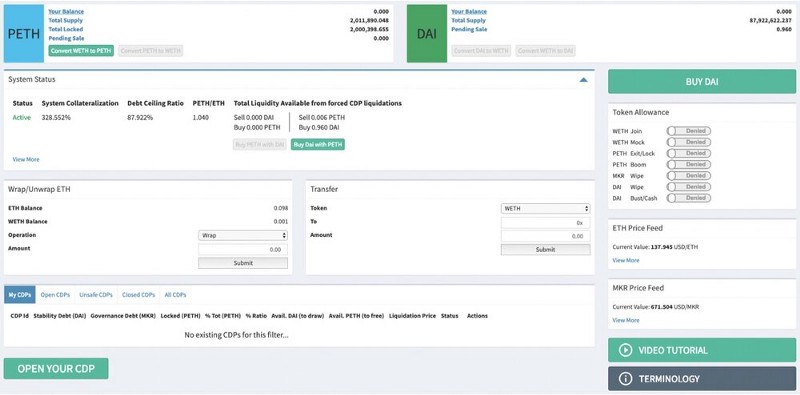

However, things have changed since 2017, when even with all the clunkiness of Maker’s original DAI Dashboard (where you even had to manually wrap ETH before proceeding), it didn’t stop people from setting up long ETH positions using the protocol.

Thankfully, today we have much nicer interfaces and a greatly improved overall experience. Additionally, MakerDAO has been upgraded to the Multi-Collateral DAI version of the protocol that since introduced support for many additional collateral types besides ETH.

Longing assets with MakerDAO

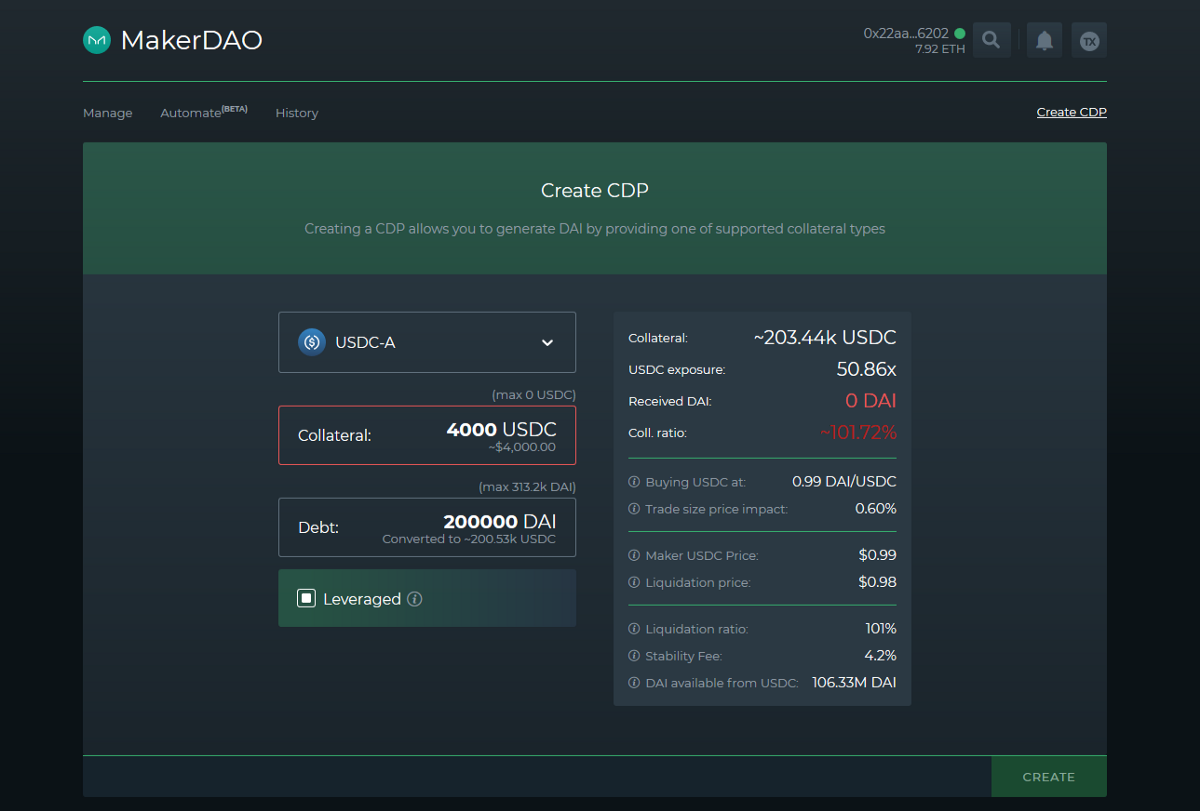

If you want to set up a long position with any of the supported assets in MakerDAO (ETH, WBTC, BAT, MANA, ZRX, KNC), these days it’s just a matter of navigating to our MakerDAO dashboard and selecting the Create CDP option.

You will be greeted with the screen shown below where you can select the asset you want to long. The next steps would be to enter the amount of collateral you want to supply, tick the Leveraged checkbox and configure your exposure level by setting your target debt.

Note: Always be mindful of the collateralization ratio of your position and the minimum collateralization ratio allowed for the used asset. You can find more information about the risk of liquidation and the potential ways to protect yourself in this post.

Once you have everything set as you want it to, you can go ahead and hit the Create button to execute the needed transaction. Depending on if you previously used MakerDAO and which asset you select to use, there may be 1 to maximum 3 transactions needed.

The one case of shorting in MakerDAO

Given the unique nature of MakerDAO, where you can use different assets, but you always borrow (or rather generate) DAI which is a stablecoin — it makes it impossible to short any of the earlier mentioned assets such as ETH and WBTC.

However, the one asset that can be shorted using MakerDAO is actually DAI itself. This is an option that was initially introduced after Black Thursday to help get DAI back down to its target 1 USD peg.

You can short DAI by using USDC or PAXUSD as collateral, as shown in the example below.

This is something you would want to do in case DAI goes high off peg again (e.g. to $1.05+). And if you were to do this, you could walk out with a profit if you close your position once DAI returns to ~$1.00.

Pros and cons of using MakerDAO

+Still considered the most secure DeFi protocol by many

+1-hour price oracle delay helps prevent liquidation

- Highest liquidation penalty (13%)

- Can only be used to long assets (except for DAI, which can only be shorted)

- Lower LTV allowed for some assets (most notably ETH) than elsewhere

Using Compound

(Assets supported: ETH, WBTC, ZRX, BAT, REP, DAI, USDC, USDT)

With the current, v2 of the Compound protocol launched in May 2019, Compound is definitely also considered as one of the older, original protocols in the DeFi ecosystem.

One thing Compound has fallen slightly behind MakerDAO in the meantime, though, is the list of supported assets, but this is hopefully something that will change with the recent launch of Compound Governance. For example, there’s currently an on-going vote to add UNI support that will probably go through with unanimous support.

Longing assets with Compound

The process to set up a long position using Compound is only slightly different to one we have for MakerDAO. Once you connect your wallet and navigate to the Create Compound position screen, you will be able to configure the wanted details.

Since Compound isn’t a one way protocol like Maker, you actually have the choice of using different stablecoins to leverage against — DAI or USDC would be the usual choices.

Shorting assets with Compound

In order to short an asset using Compound, you will need to supply a stablecoin (either DAI or USDC). The concept being that you’re borrowing and the asset you want to short, meaning that once it drops in value your debt will decrease and you will be able to close out your position with a profit.

Pros and cons of using Compound

+Lower liquidation penalty than in MakerDAO (8% vs 13%)

+You receive COMP tokens as reward for using the Compound protocol

- Most limited asset support out of the three (could change quickly)

Using Aave

(Assets supported: ETH, WBTC, LINK, YFI, MKR, SNX, LEND, REN, MANA, KNC, BAT, ZRX, ENJ, REP, DAI, USDC, USDT, TUSD, BUSD, SUSD)

Aave is the youngest protocol of the three, having only launched onto the mainnet in January this year. But right from the release they made it clear they want to be the most innovative lending protocols, with unique features such as flash loans, and a very long list of supported assets.

Aave is also our latest integrated protocol, so it doesn’t have the fancy 1-transaction option of creating a leveraged long or short position.

But the process is still very simple and it includes two steps:

- Supply your wanted collateral

- Boost the pair of that asset and the one you want to leverage against

For example, if you want to create a long LINK position, you would need to supply LINK and then use Boost for the DAI/LINK or the USDC/LINK pair. This will borrow DAI (or USDC) and instantly use these borrowed funds to buy more LINK and add it to your position.

Or, alternatively, if you wanted to create a short MKR position, you would need to supply either DAI or USDC and then use Boost for the MKR/DAI or the MKR/USDC pair. Doing this would borrow MKR and instantly sell it for DAI (or USDC) that would be added to your position.

Pros and cons of using Aave

+Supports most assets of the three

+Lowest liquidation penalty out of the three (5%)

Additional notes

It’s important to note that this same concept could be applied to any other lending protocol. For example if you wanted to use CREAM finance because of some of the unique assets they support, you certainly could.

The process would be the same, though you would unfortunately have to take things step by step. You would need to first supply your funds, then borrow the wanted counter asset, and then take those borrowed funds to an exchange to convert into your supplied asset so you can supply those and then repeat the process. Much less convenient, yes, but still certainly doable.

We hope this post helped clear up some concepts, but if you feel there’s anything else you’d like to check with someone before jumping into this yourself, then definitely feel free to join the DeFi Saver discord. There’s always around and we’ll be very glad to have you!👋

Until next time, stay safe out there!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter