Introducing a simple MakerDAO collateral auctions dashboard

The MakerDAO auctions system has recently received some bad press in the light of Black Thursday events. The system performed very…

The MakerDAO auctions system has recently received some bad press in the light of Black Thursday events. The system performed very inefficiently during the market crash, but this was mostly because of how inaccessible the system currently is. Or rather was, because today we are introducing a simple to use MakerDAO collateral auctions dashboard.

Before we get to the interface itself, let’s first take a short look at just how the whole auction process works.

A quick overview of MakerDAO collateral auctions

The new, Multi-collateral Dai version of the MakerDAO protocol has introduced a heavily upgraded auctions system when it was launched in November last year.

There are three types of auctions in MakerDAO: Flipper (liquidated collateral auctions), Flapper (Dai surplus auctions) and Flopper (MKR auctions for protocol recapitalization).

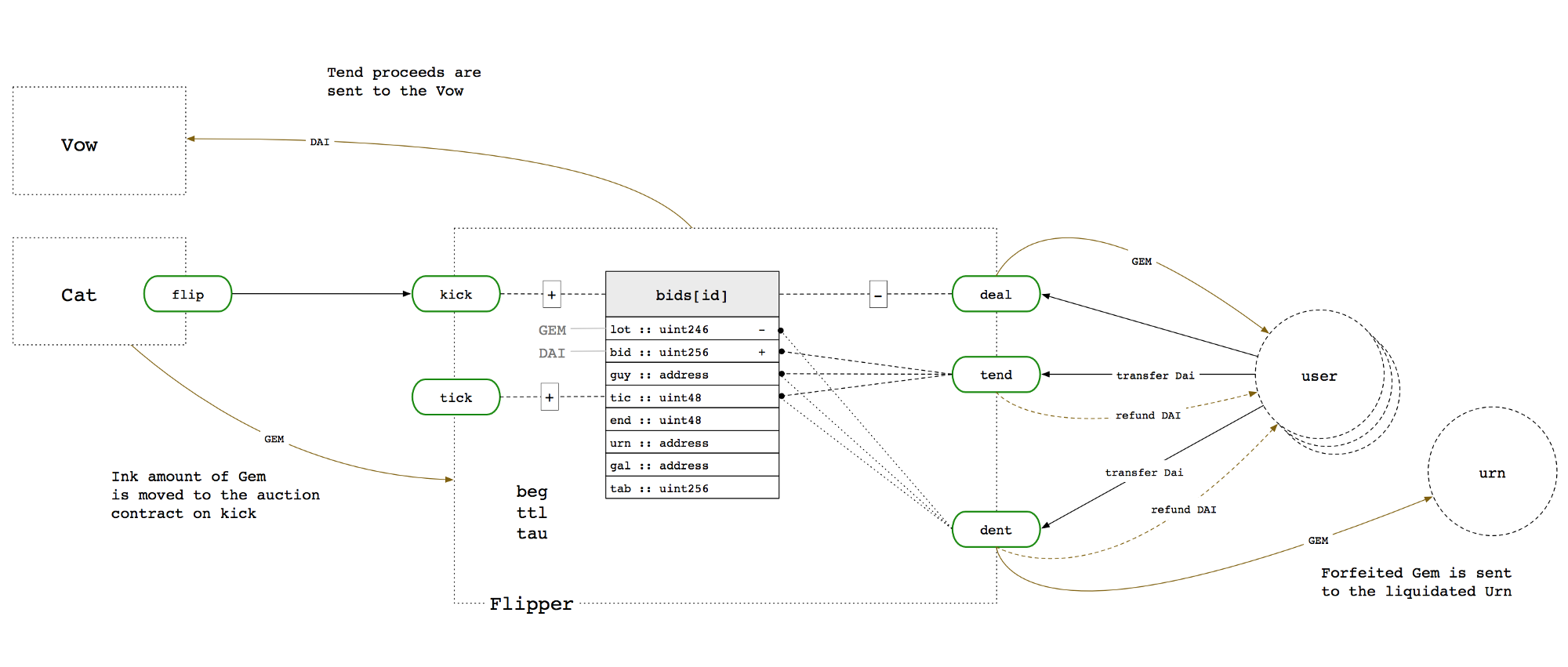

Today we’re focusing solely on Flipper auctions. These are the exact steps that happen from the moment a CDP goes under the minimum 150% collateralization ratio to the point where the debt is covered and collateral auctioned off:

- Liquidation of an undercollateralized CDP is initiated using Cat (Maker’s liquidation agent) by calling the cat.bite function. Anyone can make this request transaction and it will only succeed if the CDP is indeed below the 150% ratio. The final step of the bite is the kick which sends the CDP collateral to the Flipper.

*Note that liquidation can still be prevented if the ratio is brought back to 150%+ before the bite is executed. - Once collateral enters the Flipper, the first phase of the auction called tend begins. During tend auction participants bid for the amount of the debt they can or want to cover. Ideally, this will be 100% of the debt, in which case the second phase would commence immediately. Still, if a participant doesn’t have enough DAI to cover the 100%, they can bid less, which would still kick off the second phase if no higher bid happens.

Bids for less than 100% of the debt are allowed so that as much of the bad debt can be covered as possible in cases where auction participants don’t have enough funds to cover the full amount. - Dent is the name of the second phase and this is where participants bid for actual ETH collateral. The amount of DAI that will be paid for the collateral was set in the first phase, and now it remains to be seen how much collateral will be won. The trick with dent is that you’re bidding for how little ETH you would be OK with winning. And each next bid needs to be at least 3% smaller than the previous in order to be accepted.

The current maximum duration of a Flipper auction is 6 hours and whoever has the smallest ETH bid once the time runs out wins the auction and the collateral amount, with the DAI amount set in Phase 1. Please note that the maximum duration is a parameter that can be changed by MakerDAO governance.

Below is a diagram of the whole auction process taken from Maker’s Flipper documentation page, where you can find more details on each of the steps.

Now that we have the basics out of the way, let’s cover how anyone can join these auctions.

How to participate in collateral auctions

Up until this point, the only way to participate was by setting up a Keeper bot, an automated script that would participate in auctions on your behalf.

Today we’re introducing a new way to join collateral auctions that is accessible to anyone, just by loading a page and connecting your wallet.

Step 1: Find an active auction

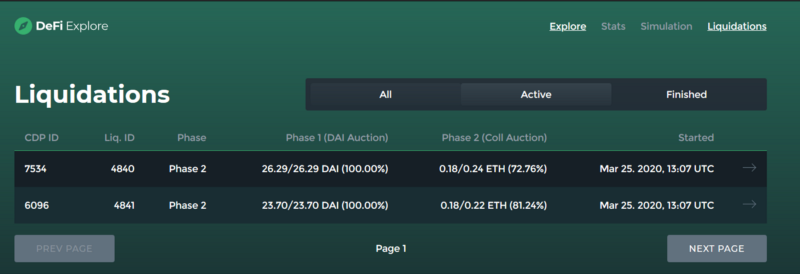

To find ongoing auctions you should go to DeFiExplore.com/Liquidations and check if there are any currently active ones.

If there are, open the one you’re interested in joining. You’ll notice the Participate button, which will take you to the next step.

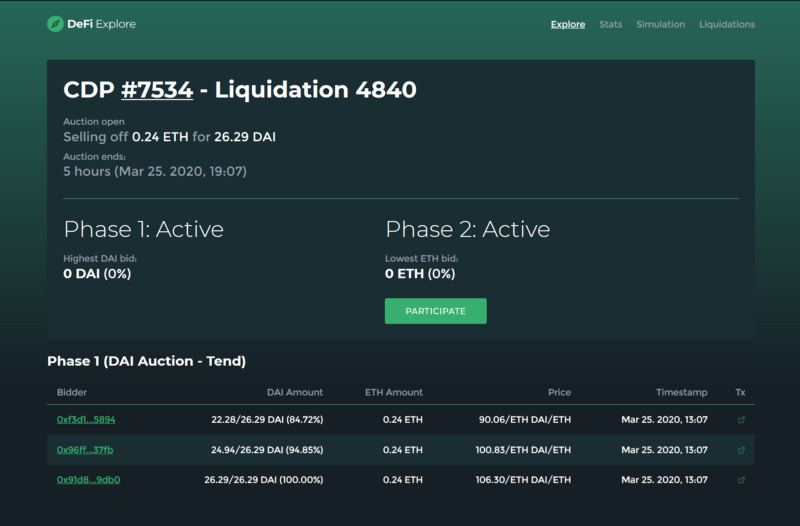

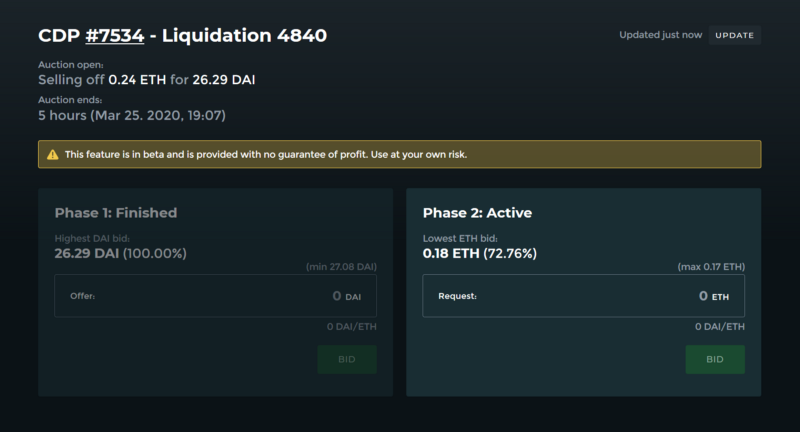

The interface for participating in that specific auction will open (notice the liquidation ID# that you can use to open it later, e.g. https://defisaver.com/makerdao/liquidation/4840).

In case you joined during Phase 1, you can now bid DAI to cover the debt left in MakerDAO from this liquidation. And if you’re joining in Phase 2, you can bid on the amount of ETH you want to win with the DAI amount set in Phase 1. Remember — the smallest ETH bid in Phase 2 wins the auction.

Any time you try to increase your Phase 1 bid or if you’re only joining during Phase 2 for the first time, you will be asked to supply additional DAI above any amount you already have supplied from before*.

The duration of the auction is 6h as per current MakerDAO protocol parameters, which can be changed by MakerDAO governance. Each next bid, in both phases needs to be at least 3% different than the previous (3% greater or 100% debt for Phase 1, and 3% smaller for Phase 2).

Whoever has the smallest bid at the end of Phase 2 wins that amount of collateral and the auction concludes.

*Note: Any DAI you supplied for bidding in auctions you haven’t won remains in the VAT contract of the MakerDAO protocol. This DAI can be used for any future auctions or you can withdraw it at any time.

If you have any feedback or questions regarding this, please feel free to join our DeFi Saver discord, we would love to see you there.

P.S. The Gitcoin CLR Matching round 5 is currently live. Please consider donating to help us keep providing you with cool features such as this one. You can find our page at: https://gitcoin.co/grants/296/defi-saver. A 1 DAI donation will be matched with 13 DAI (and constantly growing!).🙌

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter