Introducing Compound Automation — automatic liquidation protection for Compound is now LIVE

Our Automation service is finally expanding beyond MakerDAO, starting with Compound!🎉

DeFi Saver Automation is a unique trustless system for automated management of collateralized debt positions in decentralized finance on Ethereum. Or, in simpler English, it’s a system that can automatically protect your position against liquidation, as well as automatically increase your leverage, depending on market movements.

Initially introduced in September 2019 for MakerDAO, Automation has executed thousands of transactions on behalf of users since then and kept their CDPs safe against liquidation during multiple market crashes, most recently during Black Thursday.

In terms of Compound, if you were to face liquidation, the penalty would be 8%, meaning your collateral would be sold off at a ~8% discount to cover the debt. However, while this penalty is noticeably lower than the 13%+ in MakerDAO, there’s also the question of how much of your position will be affected. In Compound, the liquidator is allowed to bite your position for up to 50% of the borrowed amount, which may be far more than you would prefer.

Using Automation for Compound will allow you to configure automatic debt repayment in case the value of your supplied collateral drops, without any discount or penalty and at the exact scale that you want — 5% or 15% or however much you configure.

Additionally, Automation can also automatically increase leverage for your position if you’re using Compound as a mechanism to long or short any chosen asset.

How does Automation work?

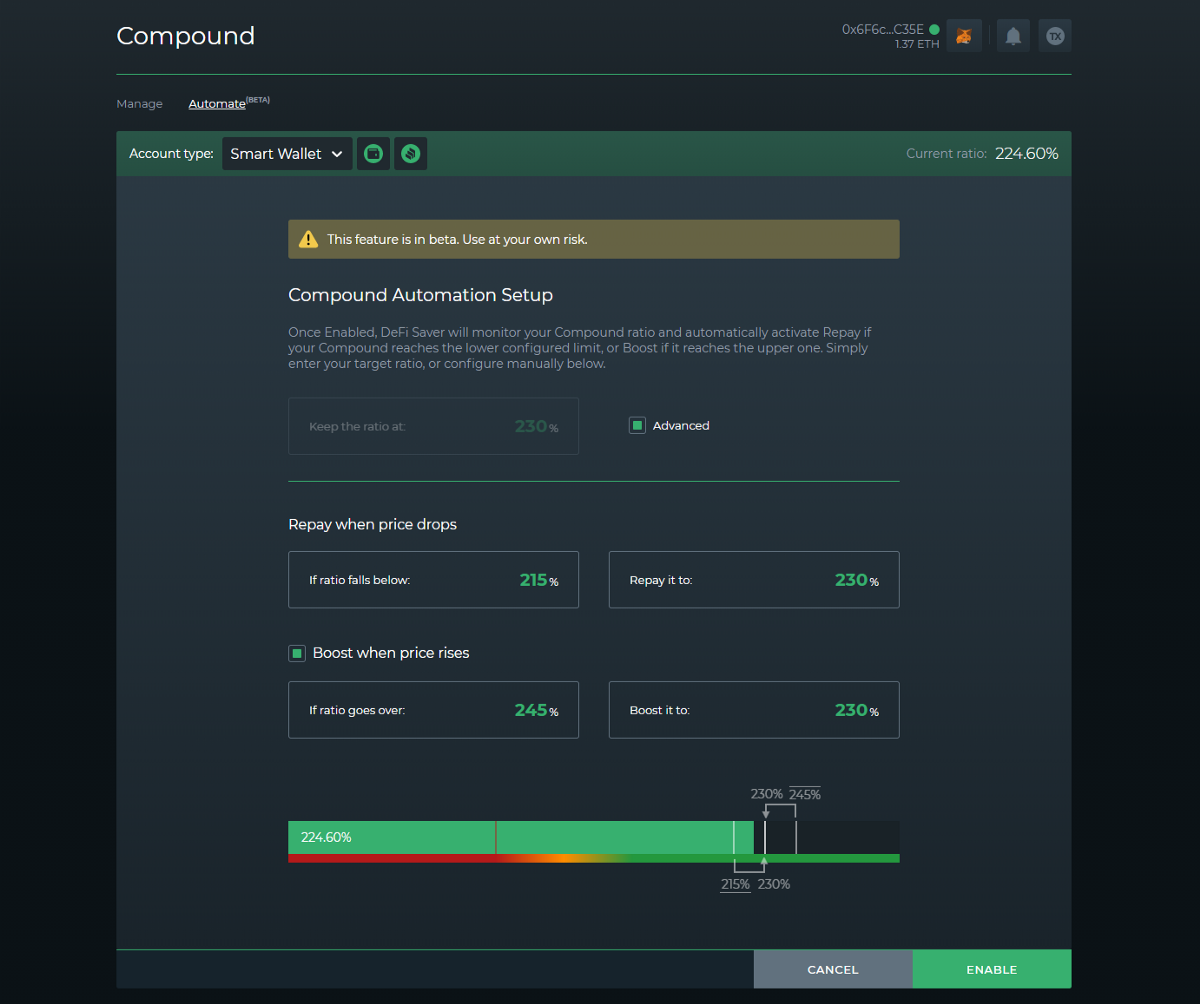

Once enabled, Automation will actively monitor your Compound portfolio and automatically increase (Boost) or decrease (Repay) leverage when the value of your supplied collateral changes.

Leveraging and deleveraging is done using our signature Boost and Repay features, where Boost takes on more debt and uses it to obtain additional collateral funds that are instantly added to your Compound position, and Repay takes out a part of your supplied collateral and uses it to instantly pay back debt making your position safer against liquidation.

The cool thing about Boost and Repay is that they use Aave flash loans to maximize the effectiveness of an adjustment in a single transaction when needed.

An important thing to note about Automation is that it never has access to any funds in your Ethereum wallet account. All of the adjustments are made solely using the funds within your Compound portfolio.

For example, if you have supplied BAT and borrowed USDC, this means that Automated Boosting would take on more USDC debt in order to obtain more BAT that is added to your position, while Automated Repay would take out a percentage of the BAT and use it to reduce the USDC debt in order to make your position safer.

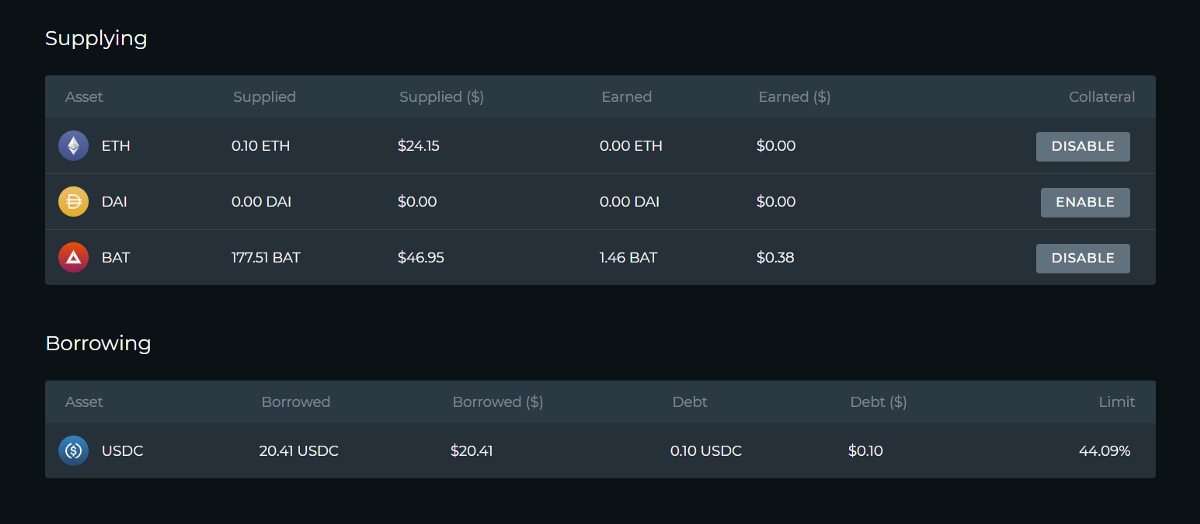

The Compound protocol is unique in comparison to MakerDAO because it supports using multiple assets as collateral within the same position. Automation for Compound fully supports such multi-collateral positions and will simply use the most dominant pair at any given time. For example, looking at the position in the screenshot below, this means that Automation would make adjustments based on the BAT/USDC pair in this portfolio.

Now, let’s cover how you would actually go about enabling and configuring Automation for Compound.

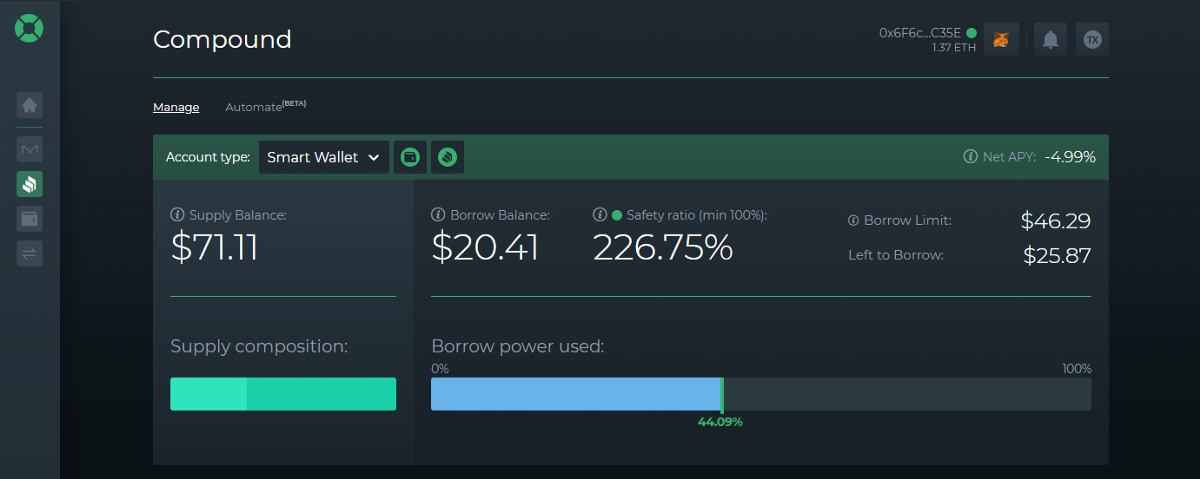

Introducing the Compound Safety Ratio

The Safety Ratio is our solution to creating a simple, understandable value that can be used to configure Automation for Compound positions.

Put simply, the Safety Ratio is nothing more than the Borrow power used, except the other way around. The formula is really simple: Safety Ratio = 1 / Borrow power used. For example, a 66% Borrow power used would be equal to a ~150% Safety Ratio.

The main point of the Safety Ratio is to have a value that will have a fixed liquidation point for each position. In this case hitting (and dropping below) a 100% Safety Ratio would mean a position is going to be liquidated.

Once you’re acquainted with the Safety ratio, you can go ahead and setup Automation by configuring the minimum and maximum Safety ratio thresholds:

Note that you can disable automatic leveraging (Boost) if you only want liquidation protection for your position.

Once enabled, Automation will constantly monitor your position and make an adjustment as soon as it leaves the configured thresholds. Please note that each automated adjustment includes a 0.3% fee (of the transaction size), while simply enabling Automation and having it monitor your position does not include any time-based fees or anything similar.

When should you use Compound Automation?

Automation can be useful for Compound in pretty much any Compound use case — if you are simply borrowing a stablecoin against your collateral, if you are leveraging an asset (be it longing or shorting), and even if you are currently mining COMP tokens by recycling a same asset borrow-supply pair.

Firstly, if you have, for example, supplied ETH and borrowed DAI or USDC that you have used wherever else, you can enable Automation so it monitors and keeps your ETH safe against a potential liquidation. You can configure Automation so it uses only a small percentage of ETH to pay back the stablecoin debt and get you back to a higher Safety Ratio (lower Borrow power used) and prevent liquidation.

Secondly, you may be using Compound to leverage an asset, for example supplying ETH, then borrowing DAI and then using this DAI to obtain more ETH. In this case, you can configure Automation to both deleverage (Repay) and leverage more (Boost) as the value of ETH drops or grows, respectively.

Finally, there’s the currently on-going COMP mining craze that you have probably heard of and you are potentially taking part in. If you are, chances are that you have supplied DAI and borrowed DAI, then supplied the DAI again and borrowed again, etc etc. In this case, you would want to keep an eye on the decreasing Safety Ratio as the interest rate on your debt keeps accruing. Except you don’t have to, as Automation can also do this for you and simply keep your Safety ratio above liquidation whenever interest gets accrued.

Are there any requirements for using Compound Automation?

As mentioned earlier, Automation for Compound can be used for any position, no matter how many different assets are supplied or borrowed. But there are some other requirements.

Most importantly, in order to use Automation, your Compound position needs to be made via your Smart Wallet, instead directly via your main wallet account. The use of the Smart Wallet is what enables the usage of Boost and Repay, as well as the privilege providing mechanism that allows Automation that make the configured adjustments on your behalf. In case you’re not currently using a Smart Wallet, you’ll find the option to migrate in our Compound dashboard.

Outside of that, the only other requirement is that the position that you want to enable Automation for has no less than 200USD worth of debt.

In case you meet these two criteria, you are all set to enable Automation for your Compound position today.👌

We are extremely happy to finally expand Automation support to other protocols besides MakerDAO. Automation for Compound has been a regular request and we certainly hope you will enjoy the Automation experience.

For future Automation updates we plan both adding more configurability, as well as support for more protocols, stay tuned for those!

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter