Liquity support is live at DeFi Saver — should you consider switching?

Liquity is a new lending protocol on Ethereum that introduced the LUSD stablecoin backed solely by ETH. What makes Liquity so interesting?

A brief introduction to DeFi’s new sweetheart and an overview of Liquity tools available in DeFi Saver to help you decide if you should move existing positions to Liquity.

Liquity is a new lending protocol on Ethereum that launched on April 5th and introduced the LUSD stablecoin backed solely by ETH, together with promises of interest free borrowing combined with an extremely low minimum collateralization ratio of 110%.

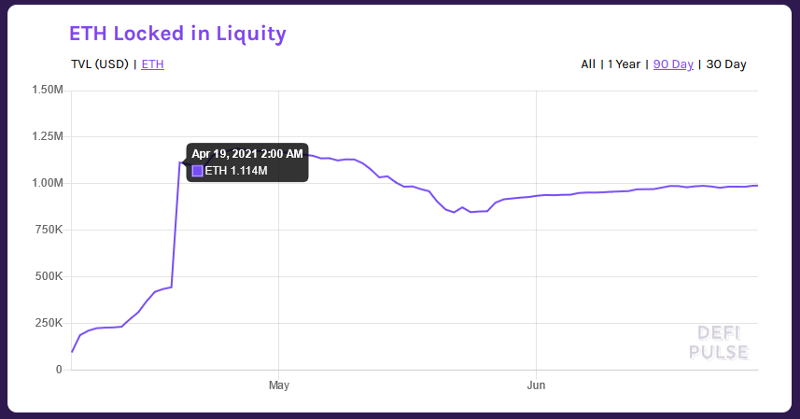

The launch was an instant hit and these promises helped the protocol amass an incredible 1m of ETH deposits in a matter of mere two weeks. And even now, with Ether down 50% since their launch date, the protocol is still sitting at 990k ETH locked and over 731m LUSD borrowed.

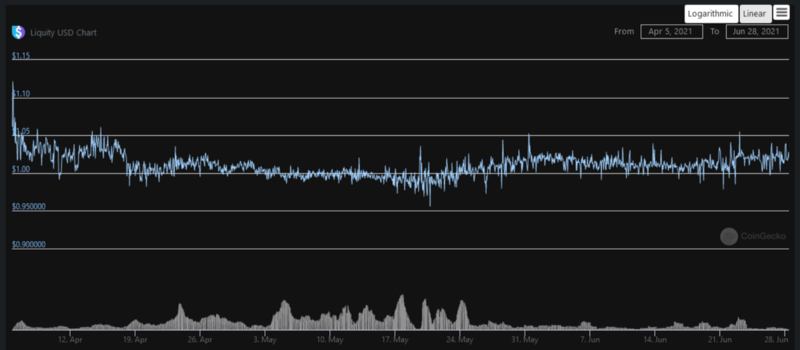

Though Liquity faced a baptism by fire with a major market crash happening just 30 days after launch, the new protocol showed remarkable stability, and so did the very young LUSD stablecoin.

We recently introduced our Liquity integration, including a dedicated Liquity dashboard, as well as full Recipe Creator support. But before we get into the details of what unique things can be done with Liquity, let’s first get into a bit more details about the protocol itself.

What makes Liquity so interesting?

Like mentioned earlier, Liquity introduced two extremely enticing features that simply weren’t there in the current top lending protocols: interest free borrowing and a low collateralization ratio of 110%.

Both of these come with nuances, though, and you should be aware of all the fine print before deciding whether switching to Liquity is the right move for you.

Firstly, Liquity replaces the usual model of continuous borrowing fees at a certain interest rate as seen in lending protocols such as Maker, Compound, Aave and Reflexer, with a one-time borrowing fee charged at the moment the user takes on debt. So it’s not that there are no fees, but they certainly work very differently.

Secondly, it’s important to note that the collateralization ratio of your own Trove is not the only important thing in Liquity. In Liquity there are additional mechanisms that could effectively get you liquidated even if your position is above the 110% ratio (though it would still have to be very low). These are the recovery mode and the LUSD redemption option.

- The Recovery mode can be activated when the global protocol collateralization drops below 150%. When this happens, Troves that are under <150% ratio are liquidated until the protocol reaches 150% global collateralization again. (This is something that actually already happened during the market crash on May 19.)

- The LUSD Redemption option allows anyone to redeem 1 LUSD for $1 of ETH and in case anyone utilizes this, the same principle applies where the lowest collateralized Trove will be redeemed against first. Though it’s also worth noting that redemptions are net-negative for the Trove owner and an equal amount of debt is paid off in return for ETH.

In short — you don’t ever really want to keep your Trove close to 110%.

Besides these main differences to other currently popular lending protocols, there are more things to like about Liquity, including the fact that it has no governance and that the only asset supported is ETH.

Should you make the switch?

For anyone borrowing significant amounts, and especially over longer periods, the math is quite simple and moving their loan to Liquity will most likely make a lot of sense and pay off very quickly.

Let’s look at an example loan of $500,000:

- With a MakerDAO ETH-A Vault, where the Stability fee is currently at 3.5%, you would be paying 17,500 Dai in fees over one year.

- With Liquity there would only be a 2,500 LUSD initial borrowing fee (at the current 0.5% rate) and that’s it.

The only time you’d be better off with MakerDAO would be with a short-term, 1 month loan.

There is a third case to consider, though, and that’s using lending protocols for leverage. If you’re looking to open a leveraged long position on ETH, Liquity will allow you much higher leverage, yes. But note that there would be a borrowing fee every time you take on more debt (ie. every time you leverage more), so that’s definitely something to consider if you’re someone who likes to actively manage their position over longer time periods.

Using Liquity at DeFi Saver

As with all other integrations so far, we aim to provide the most advanced management tool for the Liquity protocol.

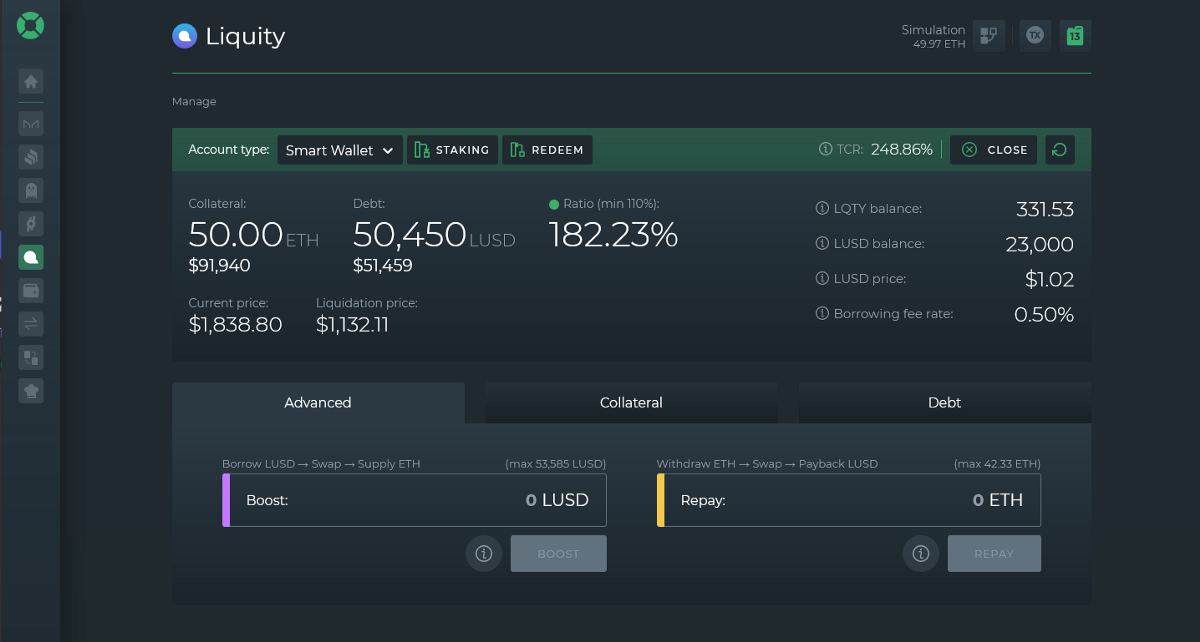

This currently includes a dedicated dashboard with our signature Boost and Repay leverage management options, as well as full Recipe Creator support for unique interactions with any of the other integrated protocols, though note that there’s no Automation support just yet.

Oh, and the kickback rate at DeFi Saver is 100%!💡

Our dedicated Liquity management dashboard

The DeFi Saver Liquity dashboard is available at https://app.defisaver.com/liquity and you can both manage existing Troves or create a new one.

ℹ️Before we move on, one important thing to note is that a Trove created at DeFi Saver will be created on your Smart Wallet (dsproxy) in order to enable all the advanced features. This will probably mean that this Trove won’t currently show up in other available frontends, though we hope to see more of them add support for Troves on dsproxies.

As part of our initial rollout, there is already Boost and Repay support for Troves created on a Smart Wallet, with more options, such as 1-tx leveraged Trove creation, coming in the next few weeks.

We are also looking for feedback from all existing and new Liquity users on what kind of information you would like to see added to our dashboard, so please feel free to jump into our discord and share any suggestions!

Liquity support in Recipe Creator

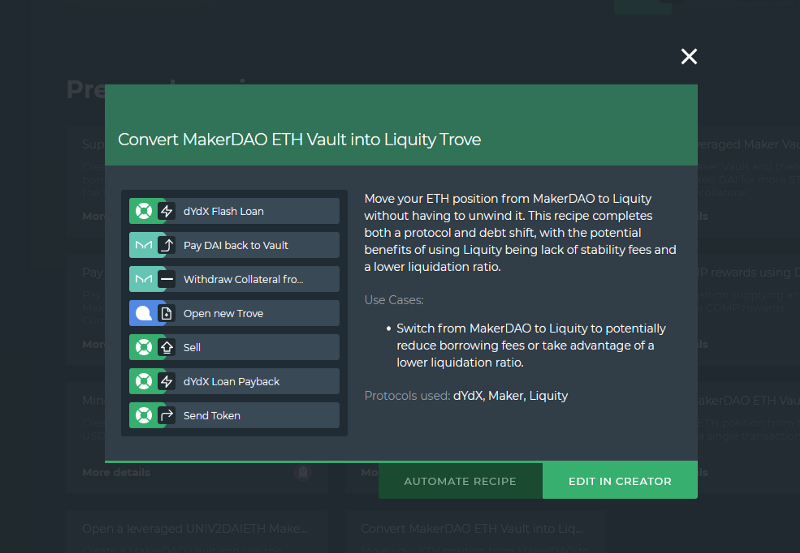

The Recipe Creator support for Liquity means that users can create any number of unique interactions between all other supported protocols. This sounds very vague, though, so let’s look at two very interesting options.

1 — Migrating an existing ETH position from Maker, Compound, Aave or Reflexer to Liquity

For the first time ever, users can convert their MakerDAO ETH Vault (or any other ETH-based position in supported lending protocols) into a Liquity Trove.

The template recipe for this process is available here and you will need to update all steps so that they apply for your specific position — including all amounts in the steps, as well as the choice of the protocol you’re migrating from.

First @MakerDAO to @LiquityProtocol shifts are happening!👀

— DeFi Saver (@DeFiSaver) June 20, 2021

This Vault owner used our Recipe Creator to shift their 1,150 $ETH position and convert it into a Trove:https://t.co/UTGOVMyssp

Kudos to @0xProject for the liquidity on this juicy $LUSD <> $DAI swap, too.👌 pic.twitter.com/yGpj2Mgan5

So far, we have already seen over 2,748 ETH and 2.96m debt moved from MakerDAO to Liquity using our Recipe.

2 — Creating a Trove and depositing LUSD

Another thing you could do is create a Recipe where you instantly use the borrowed LUSD for either depositing into the Stability pool or depositing into Uniswap v2 (v3 support is coming soon, too!) or swapping into Dai and depositing the Dai into Compound or Aave v2 (where you would also get COMP or stkAAVE rewards).

There are dozens of different options you could go with if you’re looking to earn a passive income on your newly obtained LUSD liquidity, so we’ll leave the choice up to you.

Remember that you can turn on Simulation mode and try anything wanted out before having to commit actual funds.

Additional reading

The goal of this post was to introduce Liquity, especially in terms of borrowing and how that compares to other existing options, as well as what unique things can be done with Liquity using DeFi Saver. In order to keep the post at least relatively short, we skipped a lot of important details on the LUSD stablecoin, LUSD Stability pool and LQTY staking, among other things.

If you’re looking to dive deeper, the first place we’d definitely recommend visiting is Liquity docs, which offer an excellent overview of all unique Liquity mechanisms.

For those well acquainted with Maker, we would recommend this great post by DerrickN where he compares Liquity with MakerDAO, too.

The Liquity team also does weekly posts with news in the Liquity world, so make sure to check out their Medium blog and Twitter account for the latest news on the growing Liquity ecosystem.

As always, thank you for checking out our blog and make sure to jump into our Discord with any questions or just to join the discussion.

Stay safe out there! 🙏

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum