Introducing automated Stop Loss (and Take Profit) strategies for MakerDAO Vaults

Today, DeFi Saver team is taking liquidation protection one step further with stop loss options for MakerDAO Vaults.

Just weeks ago we introduced our new modular automated strategies system, together with the first showcase strategy connecting MakerDAO with yield producing protocols like Yearn, mStable and Rari and effectively providing users with riskless yield farming.

Today, we’re taking liquidation protection one step further with stop loss options for MakerDAO Vaults.🛡️

New Stop Loss and Take Profit options for Maker Vaults

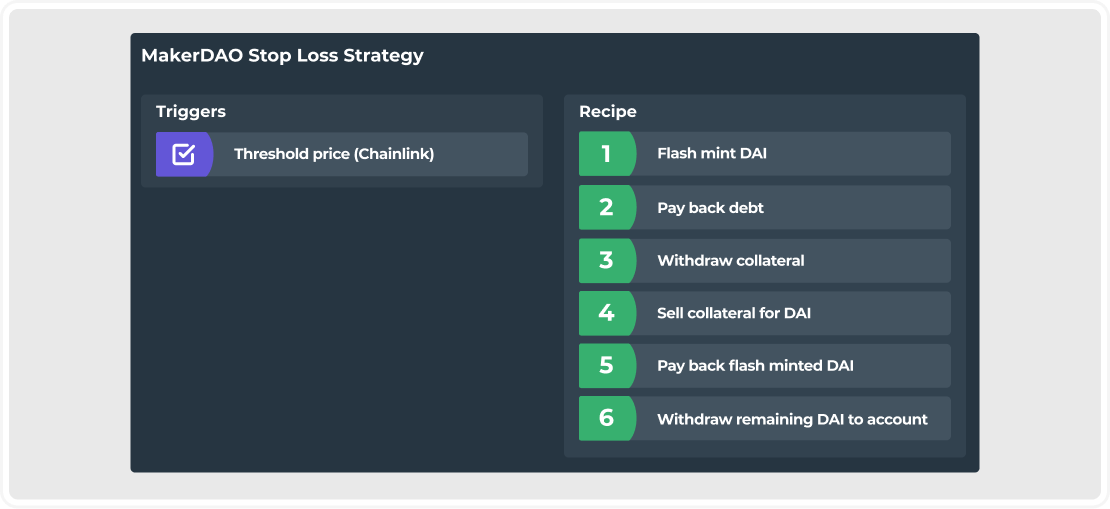

As explained in our technical overview post, the way our new automated strategies work is through a combination of triggers and a set of actions that execute once the trigger condition is fulfilled.

In the case of the stop loss automated strategy, the trigger is based on user configured threshold price (checked against Chainlink oracles), while the set of actions to be executed includes flash minting DAI to clear debt and swapping collateral to DAI to clear debt and withdraw the rest to the account.

Here's the exact rundown:

💡As a MakerDAO user, you probably know that the Maker OSM (short for Oracle Security Module) has a 1-hour delay between updates, where a fairly large gap between the current market prices and in-protocol prices can happen. In order to alleviate this and make the stop loss and take profit options more effective, the trigger price you configure is checked against Chainlink feeds, which react to market movements almost instantaneously.

Note that this automated strategy fully closes your position into DAI, making it similar to the way you'd use perpetuals, for example. This probably makes this strategy most attractive to users utilising MakerDAO for leveraged long positions on assets like ETH, WBTC or LINK.

On the other hand, what's more interesting is that this same strategy can be used as both a stop loss and take profit option and, indeed, you can set up both options for the same position.

One specific thing we'd like to point out, in terms of technical details, is that the stop loss and take profit are non-recurring strategies, meaning that once either is executed, it automatically becomes disabled and you’d need to re-enable it for any future positions. In contrast to this, the Savings Liquidation Protection, for example, is a recurring strategy.

Setting up a stop loss and/or take profit for your Maker position

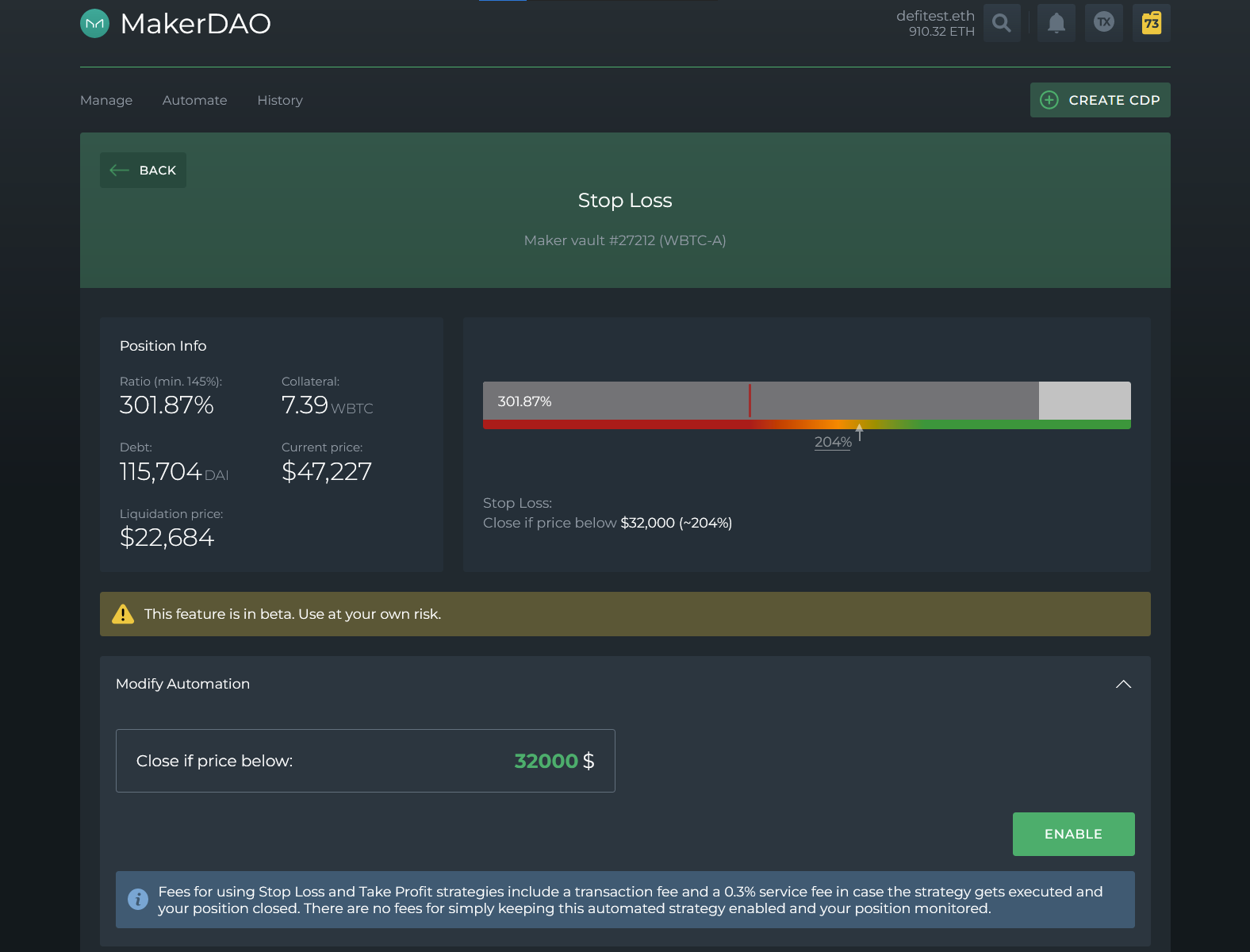

Enabling this automated strategy for any existing Maker Vault is very straightforward.

Once you connect your wallet in the DeFi Saver app and navigate to automated strategies under the MakerDAO dashboard, you'll find both Stop Loss and Take Profit strategies available.

In terms of configuration, you only need to select the threshold price below (or above) which you want your position to be closed.

Once you enable either (or both) of these automated strategies, the system will continuously monitor your position and send out the transaction to close the position as soon as the trigger condition is fulfilled, meaning as soon as the price

We mentioned both, because you can have both a stop loss and take profit strategy enabled, but please note that these cannot be currently combined with any of our other automation options. This is something we'll be looking to enable in the next few months, as we continue working on other strategies on this new modular automation system.

Speaking of other strategies, we'd love to hear your feedback on the new strategies we introduced for MakerDAO this month and what you would want to see next.

Would you like to see a Close to ETH strategy instead of a Stop Loss in DAI? Have you got ideas for something completely different? Jump into our discord and let us know, as we're looking to keep rolling out new strategies regularly.