Powertools for Pendle users on Aave: Rollover & Unwind

DeFi Saver just got a fresh new feature that caters to Aave and Pendle enthusiasts. Users can now easily prolong their yield-earning endeavors and swap expired pTokens for those with a later maturity rate, as well as close or repay their positions in a matter of a few clicks.

Yesterday, we officially reached the end of Pendle’s PT-eUSDe May maturity rate period, which means users are now able to redeem their pTokens, as the yield component will cease to accrue value after this point.

With many Pendle enthusiasts eager to prolong their yield-earning streak on Aave, we set out to make that process simpler, faster, and far more efficient. Well, we believe that we have done just that, with the introduction of DeFi Saver’s Pendle Rollover feature.

This new feature allows users to move the entirety of their position directly into new pTokens with a later maturity rate (in this case, PT-eUSDe August), all in one transaction, with no fees whatsoever.

Alternatively, for those who would prefer to unwind or close their position, we also introduced proper handling of all steps with integrations of various Pendle and Ethereal smart contract actions. This means that you can now use our Close and Repay features for these positions (which you may have to in either case).

However, before we get into the specifics, if you haven’t read our previous blog post on pTokens and what you can do with them in Aave, we highly recommend checking it out first. It might give you the context you need to get the most out of Pendle support via DeFi Saver.

How Pendle Rollover works behind the scenes at DFS

Once your Pendle position reaches its maturity date, you have two options: either redeem your pTokens and stop there, or extend your yield-earning flow. With DeFi Saver, it looks rather simple, but let’s take a moment to break down how it actually works behind the interface.

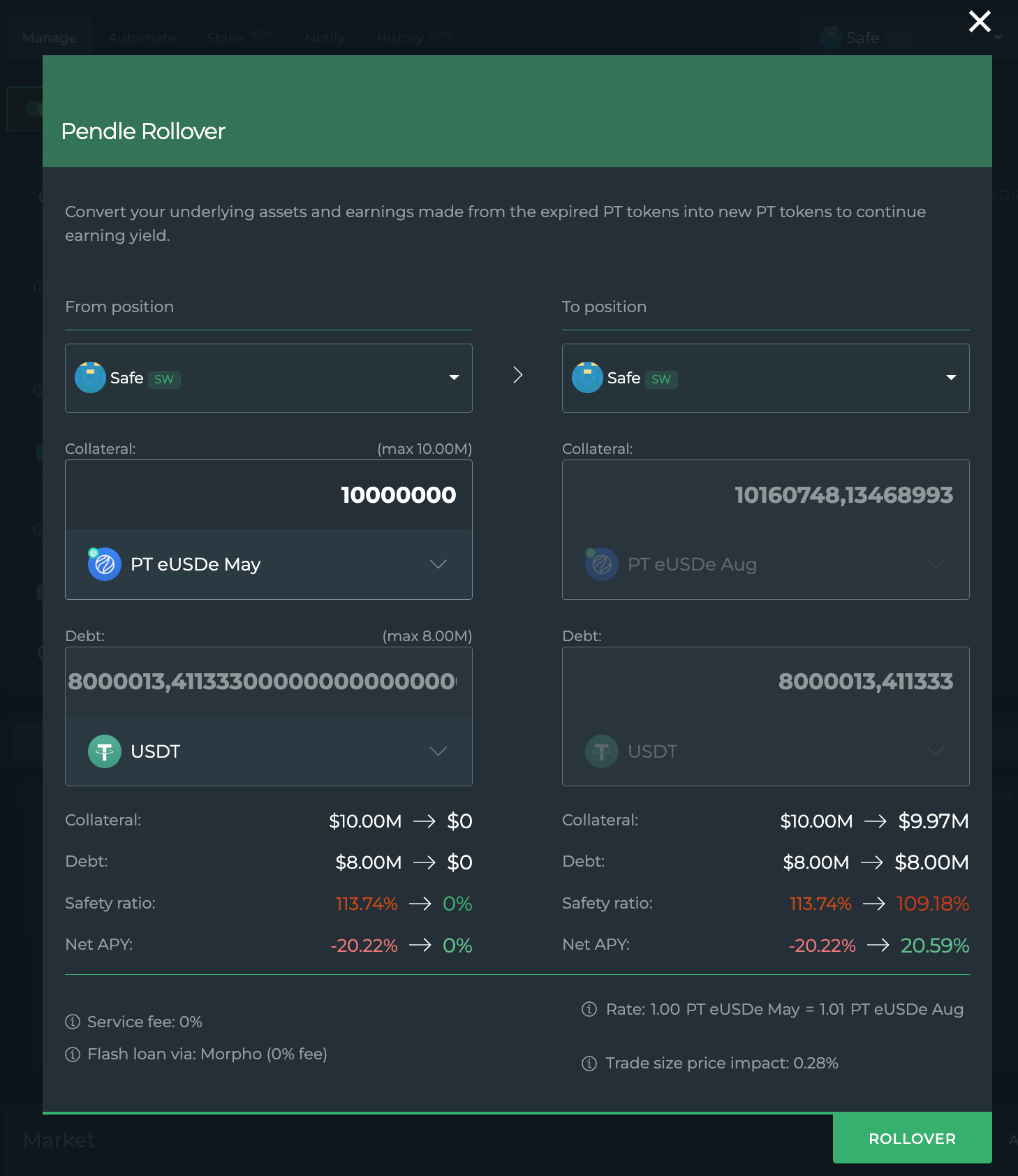

For the purpose of this example, let's say we have stablecoin debt in USDT, and approximately $10 million worth of PT-eUSDe May, in Aave (hey, a girl can dream). Since PT-eUSDe May has now expired and is not generating any yield, naturally, we want to escape this position as soon as possible, since our net APY is now negative.

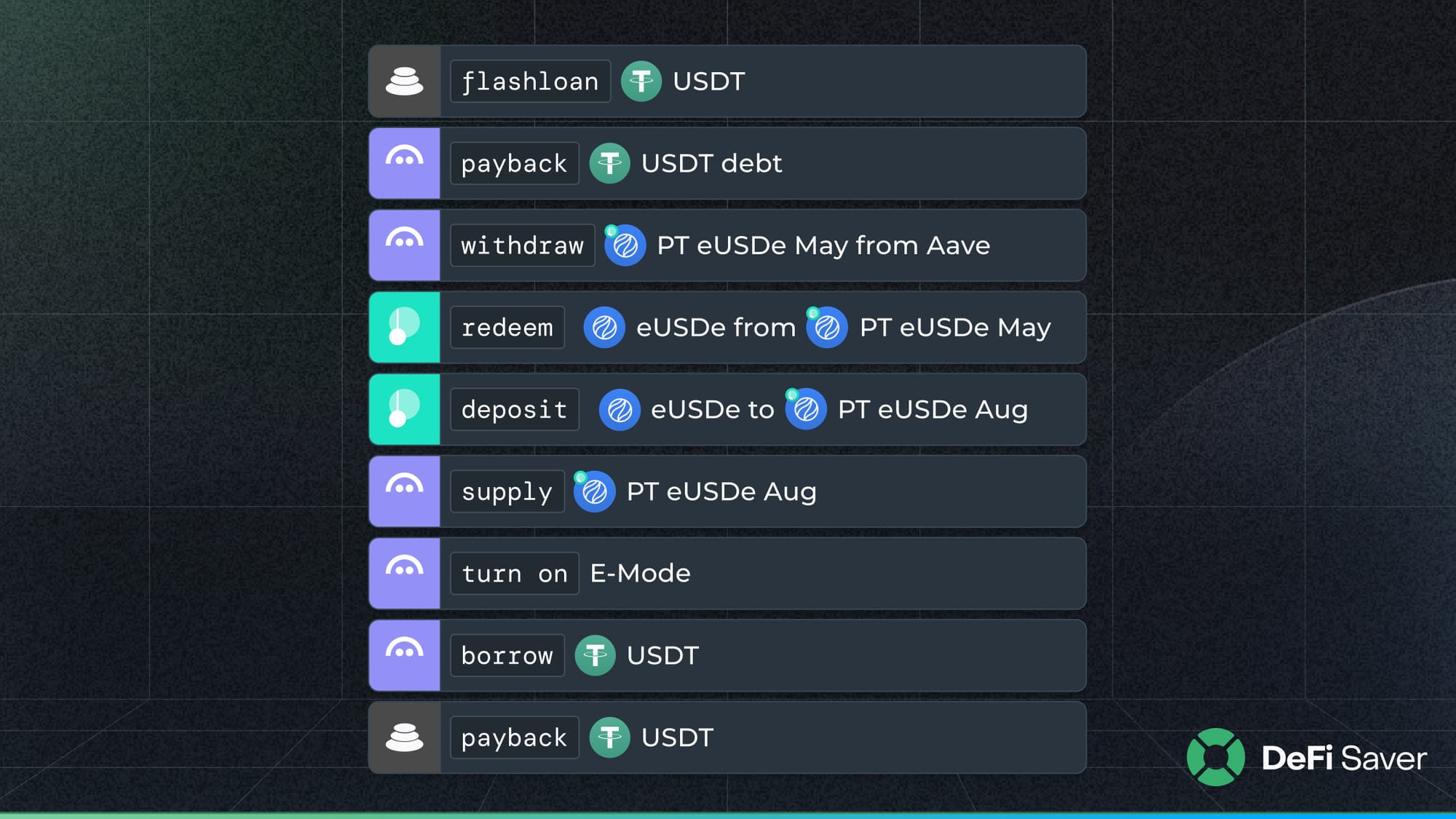

We’ll head over to our position in the Aave dashboard, click on the Rollover option, and put the numbers down. With a click of a button, DeFi Saver will execute a flash loan to pay back the USDT debt on Aave, transfer the pTokens to Pendle, redeem the principal, and unlock the $10 million (the value of the underlying asset plus the accrued yield).

Then, it will supply that amount to Pendle once again, in order to acquire the latest PT-eUSDe August tokens. Finally, those pTokens are then supplied to Aave and used to borrow USDT to repay the flash loan.

And voila! We’ve extended the yield-earning streak on our ten figures.

Closing and Repaying Aave Pendle positions

Maybe you’ve had your fill of yield farming endeavors and want to close the entire position or repay your position.

Previously, closing or repaying a position with expired pTokens (manually) would have been a headache, as simply swapping expired tokens wasn’t possible. So, to manually unwind, you’d have to withdraw a small portion of the pTokens, redeem them at Pendle for the underlying asset, sell for USDT (in our example), and pay back a fraction of the loan.

Now, you’d have to repeat these steps over and over until you’ll finally be able to close your position. And in the case of our $10 million pToken position, we’d possibly spend an hour cycling through these steps.

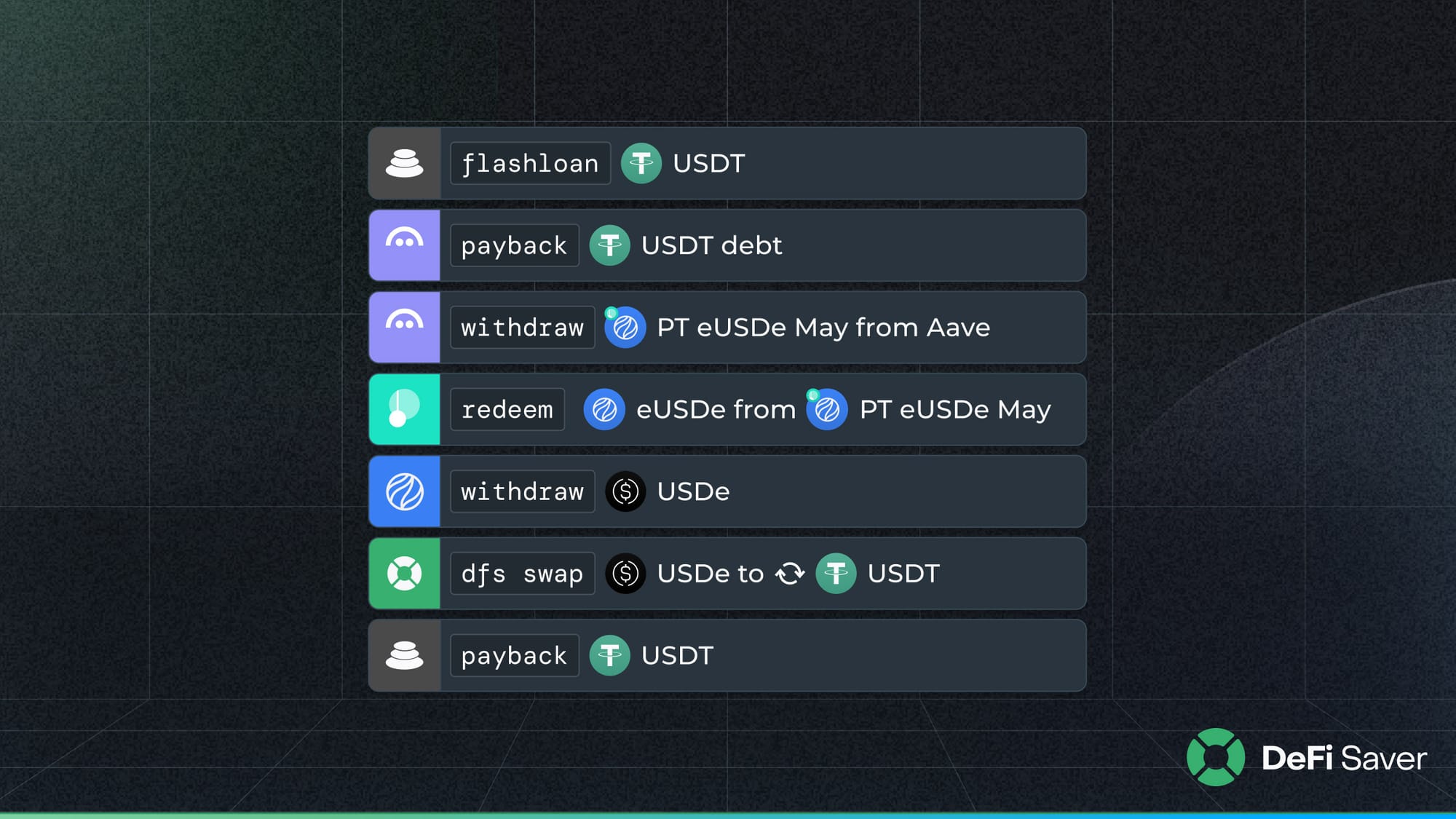

In classic DeFi Saver style, this now gets done in, you guessed it, one transaction. Here’s a breakdown of the steps this transaction goes through:

All in all, we love designing super useful niche tools such as this, and hope you enjoy using them as much as we did making them. If you’d like to learn more before you start, check out our Knowledge Base article that provides an even more detailed walkthrough.

And if you have additional questions about managing your Pendle strategies via DeFi Saver, or just want to chat, please feel free to drop by our Discord server.

Take care and stay safe out there! 🛟