The new Maker — what’s changing and how do I get on board?

Rune Christensen, the CEO and Co-Founder of MakerDAO, announced at Devcon that the launch of long awaited Multi-Collateral Dai (MCD) is…

Last updated: November 12, 2019

Rune Christensen, the CEO, and Co-Founder of MakerDAO announced at Devcon that the launch of the long-awaited Multi-Collateral Dai (MCD) is scheduled for November 18, 2019. Since the date is set at barely over a month from today, we wanted to talk about the changes this introduces for Dai holders and CDP owners, as well as what actions they’ll need to take. We’ll also take a sneak peek at our updated dashboards for MCD in order to clarify things as much as possible.

The move to MCD

Firstly, for Dai holders, there will be an extremely simple migration process where you’ll be able to basically exchange your current Dai (Sai) for the new, multi-collateral Dai 1:1. This is a process that will be available at Maker’s dashboard, as well as 3rd party apps such as our own DeFi Saver. If you are currently lending your Dai using protocols such as Compound, dYdX, and Fulcrum, you will most likely need to withdraw those funds first in order to migrate.

Secondly, for CDP owners, there will be a similarly simple migration process that will upgrade and transfer your CDP to the new system. The only requirement is that you will need to pay any currently owed stability fees before you complete the migration. However, the good news is that you will have 3 options for paying accrued fees when migrating using DeFi Saver: using MKR, using Sai or by generating new Sai and using it to pay the fees.

Bear in mind that the current version of the Maker protocol will not be shut down on November 18, but months later (up to 6 months later according to some previous comments from the Maker team), so there will be a comfortable time frame to complete the process.

MCD improvements and additions

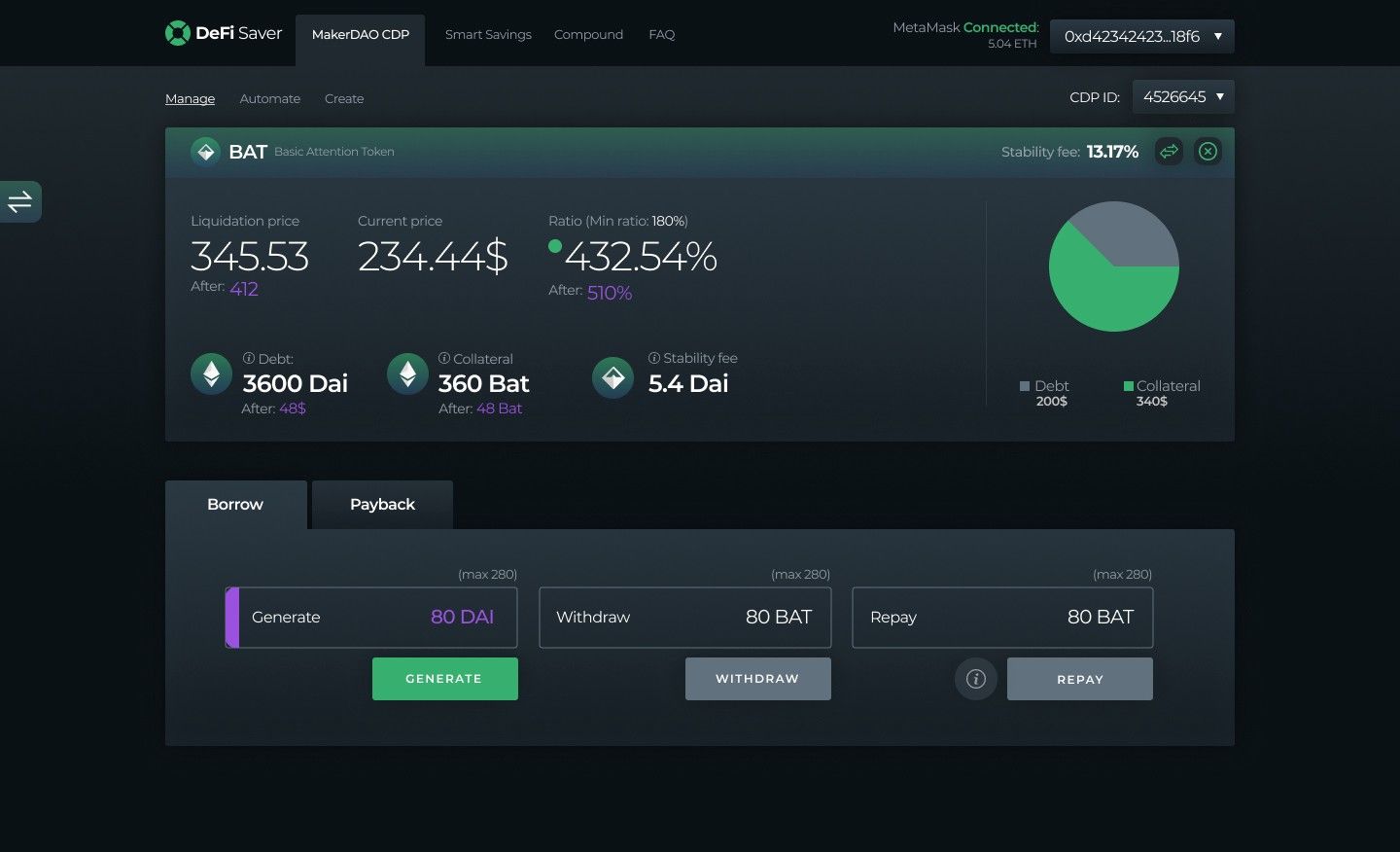

Welcome to the updated DeFi Saver Maker dashboard ready for MCD CDPs. If you’ve already used DeFi Saver to manage your CDP, you will notice that the dashboard hasn’t changed drastically and this is because the core functionality of CDP hasn’t changed either. But let’s focus our attention on a few things that have.

Different types of collateral

If you take a closer look at the screenshot above, you’ll see that this CDP uses BAT instead of ETH as collateral. This is because Ether will no longer be the only collateral type you can use. There is a governance system in MCD that lets Maker token holders vote on introducing new collateral types. Keep in mind that each collateral type will also have a different risk model, depending on its volatility and liquidity. As a consequence, each collateral type will have a different minimum ratio and this will now be explicitly highlighted in our dashboard.

Keep in mind that a CDP will still be limited to using single collateral. However, as always, you will still be able to have more than one CDP, no matter the collateral types used.

UX improvements

Another thing you may have noticed from the dashboard screenshot is that the stability fee is no longer accrued in the Maker governance token (MKR), but rather in Dai. This is an excellent user experience improvement, as users will no longer need to use the Maker token to pay off their stability fee. Another related UX improvement is that the stability fee is automatically added to your debt, so in case you’re repaying or simply paying back your debt, you will be covering Dai debt together with the stability fee at the same time. Keep in mind that this also means that the Stability fee will now affect your liquidation ratio since it’s being automatically added to the Dai debt.

If you are a Maker holder reading this, you needn’t worry. MKR will still be burned, it’s just that the system on how that happens has changed. While part of Dai collected from stability fees goes into DSR (discussed below), the other part goes to an auction system where it gets sold for MKR which then gets burned.

Additionally, there’s also no longer any pooling of Ether, which was known as PETH. Instead, ETH will now be wrapped as WETH to be ERC20 compliant and WETH will be used directly as collateral. In case there is any “bad” debt in the Maker system, no longer will the PETH ratio be diluted. Instead, new Maker tokens will be minted in order to cover the debt.

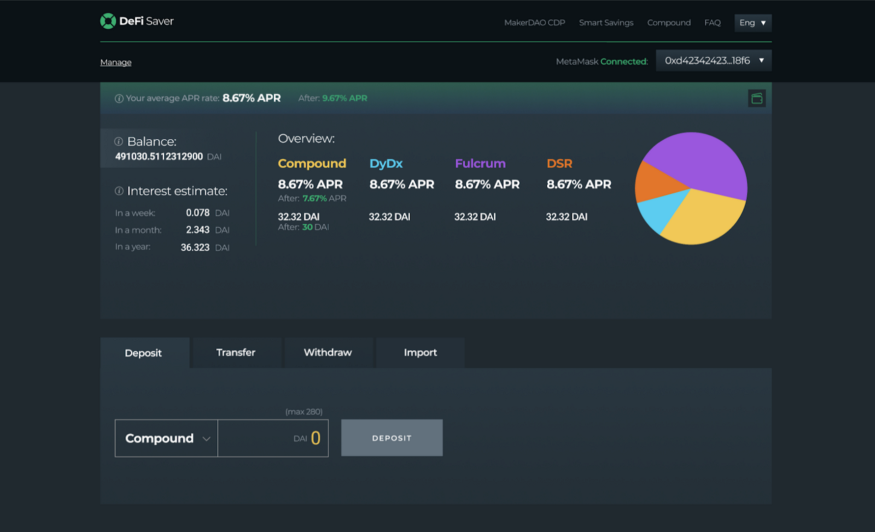

Dai Savings Rate (DSR)

Besides the implementation of different collaterals, another long-awaited change is the addition of DSR. As you can see from the screenshot of our updated Smart Savings dashboard above, the DSR will work similarly to existing lending protocols. In simple terms, DSR means that you will be able to lock your Dai in a DSR smart contract and then earn interest on those locked funds. The amount of interest you earn (APR, or annual percentage rate) is determined by MKR token holders through the governance voting process. Interest earned is accumulated continuously on a per-block basis and users can exit by withdrawing their funds at any time. Please note that simply holding Dai will not yield any earnings — you will need to lock it within DSR first.

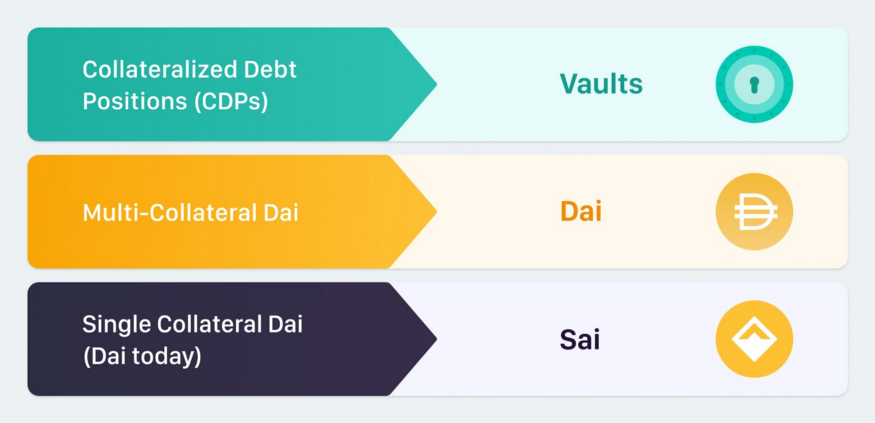

New terminology and system parameters

With the introduction of MCD, the Maker team has also decided to change the terminology slightly. What we know as CDPs today, will now be referred to as Vaults. While this may not sound like a perfect solution, we understand the goal is to make the technology sound more welcoming for new users. As expected, current, single collateral Dai will become Sai and multi-collateral Dai takes its name, together with a new Dai logo.

More recently, the team has also shared initial parameters for MCD that should be active on launch that you can find at the bottom of their Migration risk and contrusct proposal article. It’s interesting to see that both of the initially available collateral types (ETH and BAT) have the same minimum ratio of 150% and the same liquidation penalty of 13%. The initial Stability fee in MCD should also be at least 1% lower than what it currently is in SCD, which will provide an additional reason for users to migrate.

All the changes mentioned above are far from the only ones that will be added to the protocol. Another change, for example, is the liquidation process that will now be an auction system. The critical price oracles system that feeds the external price changes into the Maker protocol has also received a major update. And one change within the Dai token itself that might also greatly improve UX is the ability to perform meta transactions, meaning Dai users will not need any Ether to send Dai to another account. Instead, the transaction fee can be paid in Dai simply by providing a signature.

We are very excited about everything MCD related and cannot wait to build new services on top of the updated protocol. See you November 18! 😉

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter account