WBTC now fully supported in DeFi Saver — what can you do with WBTC in MakerDAO?

WBTC now fully supported in DeFi Saver — what can you do with WBTC in MakerDAO?

Wrapped Bitcoin (WBTC), an Ethereum tokenized version of Bitcoin, has been recently added as supported collateral in MakerDAO, the most popular lending protocol in decentralized finance.

In the few weeks since then, we have seen both the total WBTC supply and the amount of WBTC locked in MakerDAO grow very quickly, with currently 9,4m DAI being backed by it, almost 8% of the total DAI supply.

We have been hard at work at updating DeFi Saver for WBTC and we are proud to share that WBTC CDPs or Vaults are now fully supported. This includes all the unique management features available in our MakerDAO dashboard, as well as Automation support.

So, what are some of the things you can now do with WBTC in MakerDAO?

Creating an instantly leveraged WBTC position

With DeFi Saver, you can quickly and simply create an instantly leveraged WBTC position in MakerDAO.

Once you’ve logged in with your wallet, you can do this in the Create CDP screen, with the process being very straightforward. Simply tick the “Leveraged” checkbox and the generated DAI will be used to immediately obtain additional WBTC instead of being sent to your wallet.

If you want to learn a bit more about how this feature works, you can find more info in one of our previous posts.

Adjusting leverage with Boost and Repay

Boost and Repay are our signature 1-transaction leverage adjustments features that are now available for WBTC positions, too.

Increasing leverage using Boost will generate more DAI, use this DAI to obtain more WBTC via multiple DEXes and instantly add this WBTC to your CDP. Boosting increases your WBTC exposure and leverage at the cost of increased debt.

Decreasing leverage with Repay, on the other hand, will take out a selected part of your WBTC, sell it for DAI and instantly use this DAI to pay back CDP debt. This feature increases your ratio and decreases your debt, but at the cost of reduced WBTC exposure.

These features can be used manually at your convenience, but there’s an even handier way — you can automated them.

Automating your WBTC position

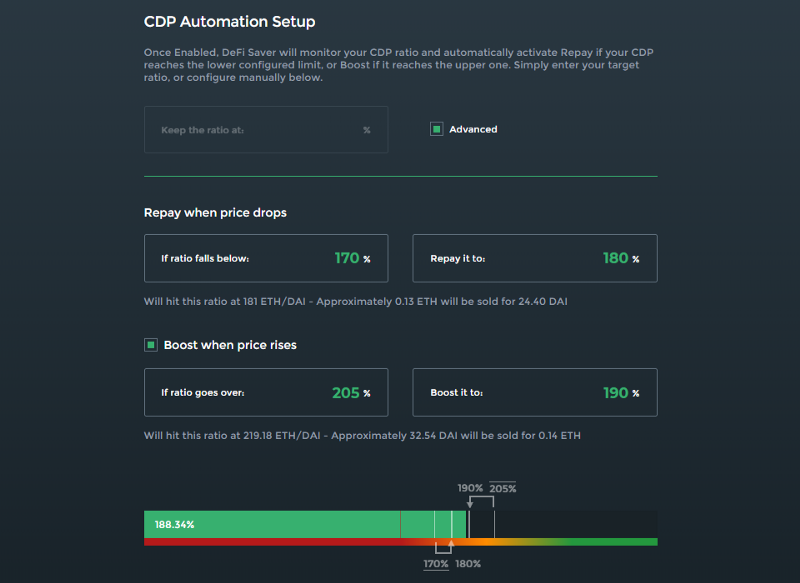

DeFi Saver Automation is a unique system for automated management of collateralized debt positions, which allows you to have automatic liquidation protection in case of collateral price drops, as well as automatic leverage increase in case of price increases.

Once you enable Automation, it will constantly monitor your position and makes adjustments using our Repay and Boost features whenever your CDP leaves your configured thresholds.

Please note that Automation never has access to funds within your actual wallet account and it makes all adjustments solely using the collateral within the CDP. If you look at the screenshot from the Automation configuration screen above, you’ll notice that interface shows estimates of how the adjustments based on your configuration would actually affect your position.

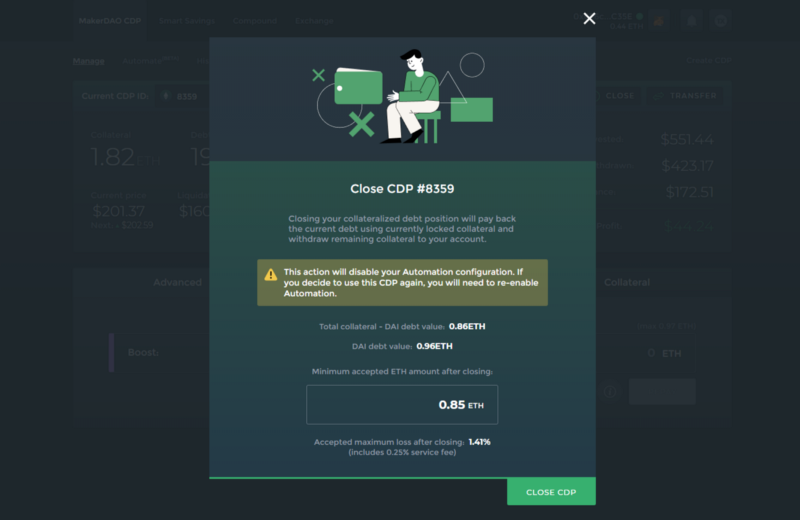

Instantly closing a WBTC position

Our 1-transaction CDP Closing feature allows you to instantly close down any position, paying back all of the debt using the collateral locked within and receiving the remaining collateral instantly to your account.

In case you used MakerDAO to leverage WBTC, chances are you don’t have any DAI in your account for paying back the debt once you decide it’s time to close down shop, then this will be the perfect feature for you.

Will you start using WBTC as collateral in MakerDAO now that it’s fully supported in DeFi Saver? Or are you perhaps waiting for other flavours of tokenized BTC to be onboarded as collateral options?🤔

Feel free to join the discussion with your thoughts in our Discord server!👋

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter