Automated Perpetual Rebonding Strategy on DeFi Saver

Continuous Automation for LUSD Chicken Bonds is now available on the DeFi Saver app.

Since the launch on October 4th, Liquity's LUSD Chicken Bonds have seen respectable adoption, managing to attract over $40m of LUSD in the form of 1,506 unique bonds, at the moment of writing.

The floor price of bLUSD (boosted LUSD) has so far reached 1.042 LUSD and, more importantly, it cannot go down by design. That results in a 4.2% yield on your principal in just a little over one month, guaranteed by the CB redemption mechanism - the possibility to redeem bLUSD for LUSD at redemption price (floor price) from the Reserve Bucket anytime.

However, as the bLUSD yield depends on the incoming LUSD liquidity (aka new bonds) and two yield sources (Stability Pool and Yearn's LUSD vault), users should bear in mind that this may vary in the future.

From October 18th, users were able to use this novel bonding protocol on DeFi Saver, too, with the addition of some advanced DFS features like claiming & selling bLUSD or rebonding (claiming, selling, and creating a new bond with greater LUSD principal), both available as 1-tx options.

A quick look at the stats shows that there've been 320+ Chicken Bonds related transactions at DeFi Saver, including over $4m of fresh LUSD deposited into newly created bonds.

In our Chicken Bonds release blog post, we teased that we were already working on automating some of these options, and one of our goals was to provide a fully autonomous rebonding strategy.

Today we are proud to share that we are turning this into a reality.

Continuous auto-rebond strategy breakdown

First off, we'd recommend checking the technical overview of our new modular system for automated strategies, if you want to get familiar with the way our strategies work under the hood.

Here, we'll explain the latest work of ours, the perpetual auto-rebond strategy.

It can be seen as a 'set and forget' strategy for earning amplified yield with LUSD, as it can run continuously, although you of course have the option to opt out at any given time.

The rebonding strategy trigger

The goal of the strategy is to maximize profit, and compound it in an automated fashion.

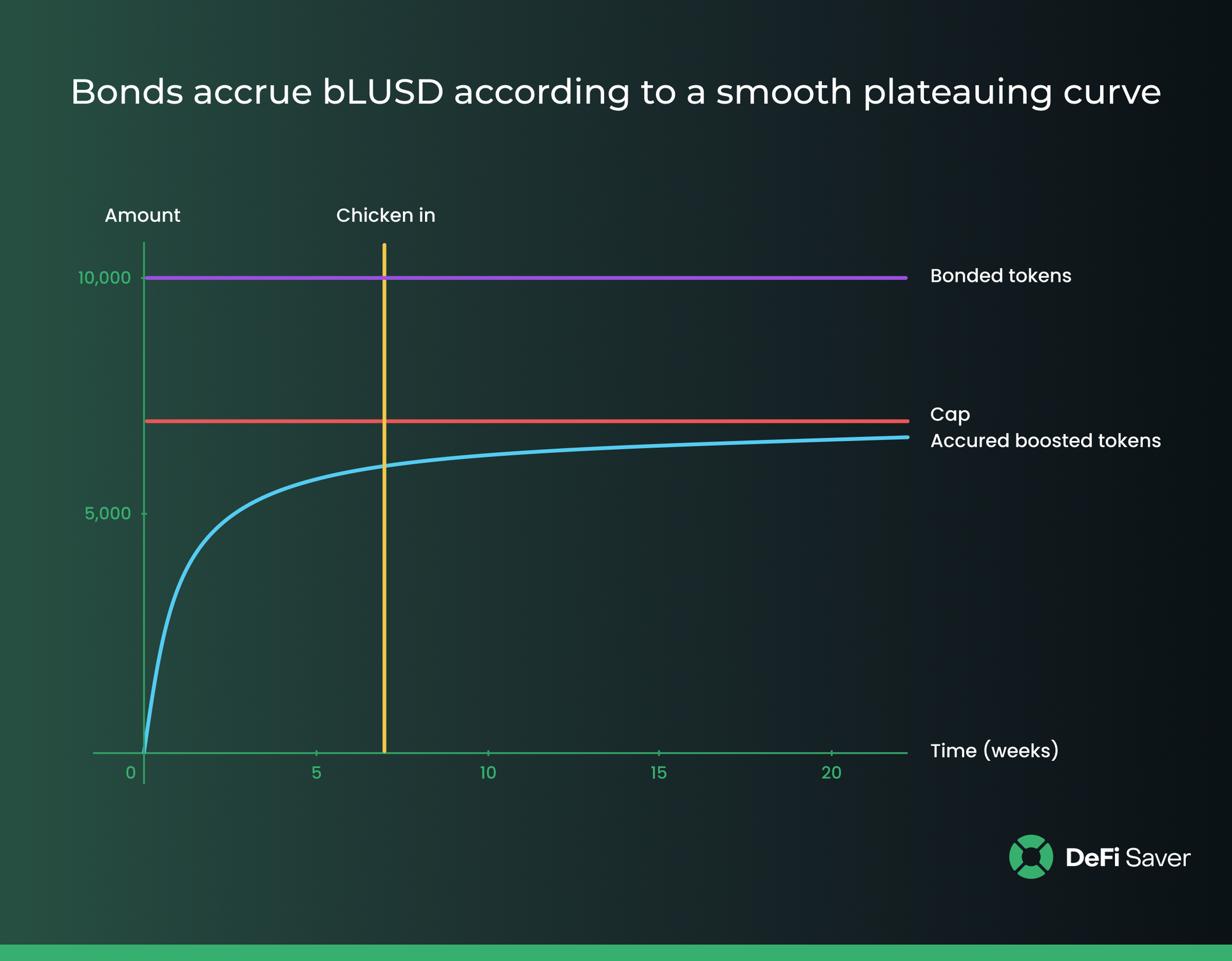

This is done by calculating the "Optimal rebonding time" - the point at which accruing more bLUSD at the current market price and current accrual rate for your bond is less profitable than selling your current bLUSD accrued for LUSD and opening a new bond with the increased LUSD principal. This is due to the steeper accrual curve at the start of the bond.

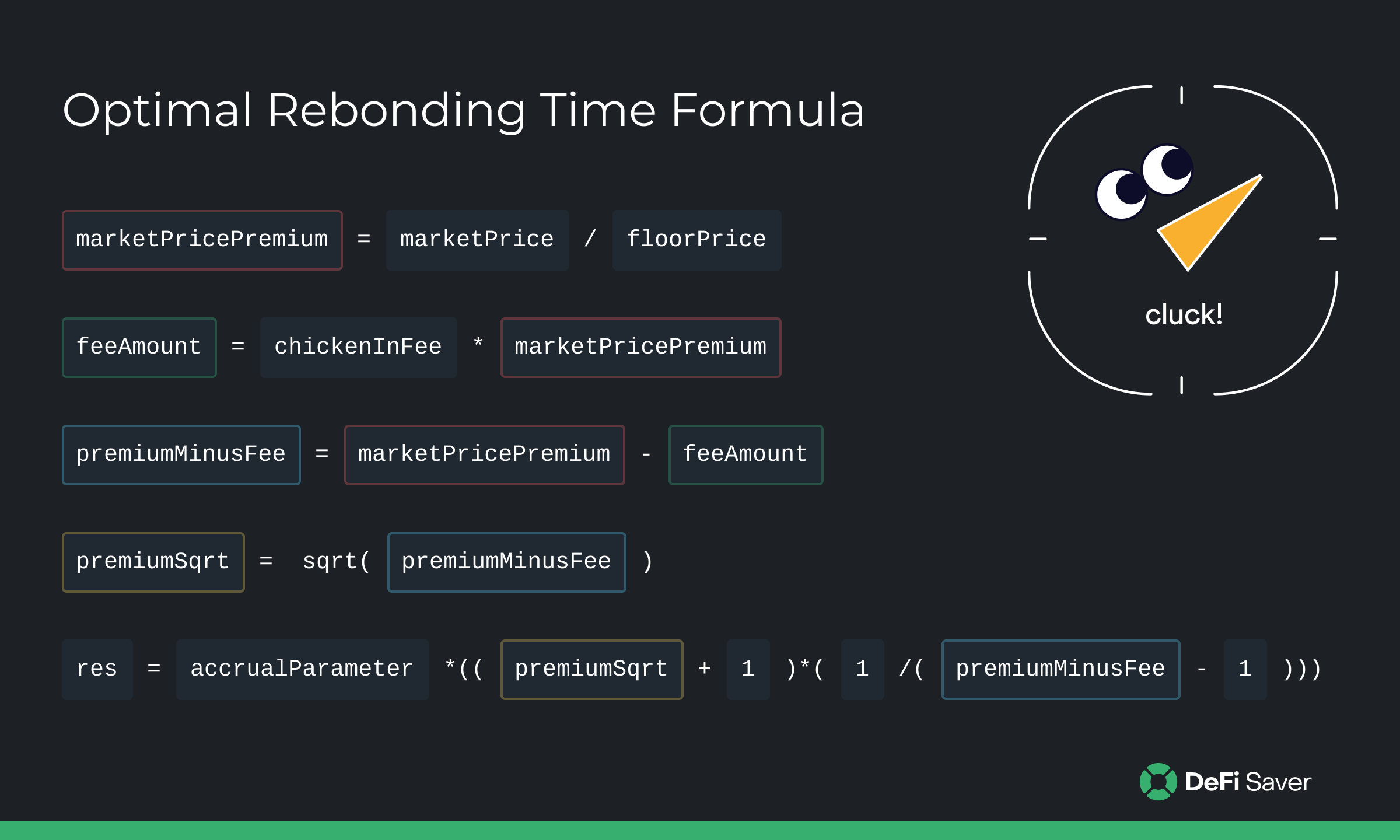

For anyone interested, the formula for calculating the Optimal rebond time in plain English looks like this:

The result of the formula represents the number of days needed to pass from the moment of opening a bond, for the rebonding strategy to be the most profitable one in the CB system (e.g. 81 days).

After calculating the optimal rebonding time (the number of days of accumulating bLUSD according to the accumulation curve), we can easily get the optimal (target) LUSD amount for rebonding action.

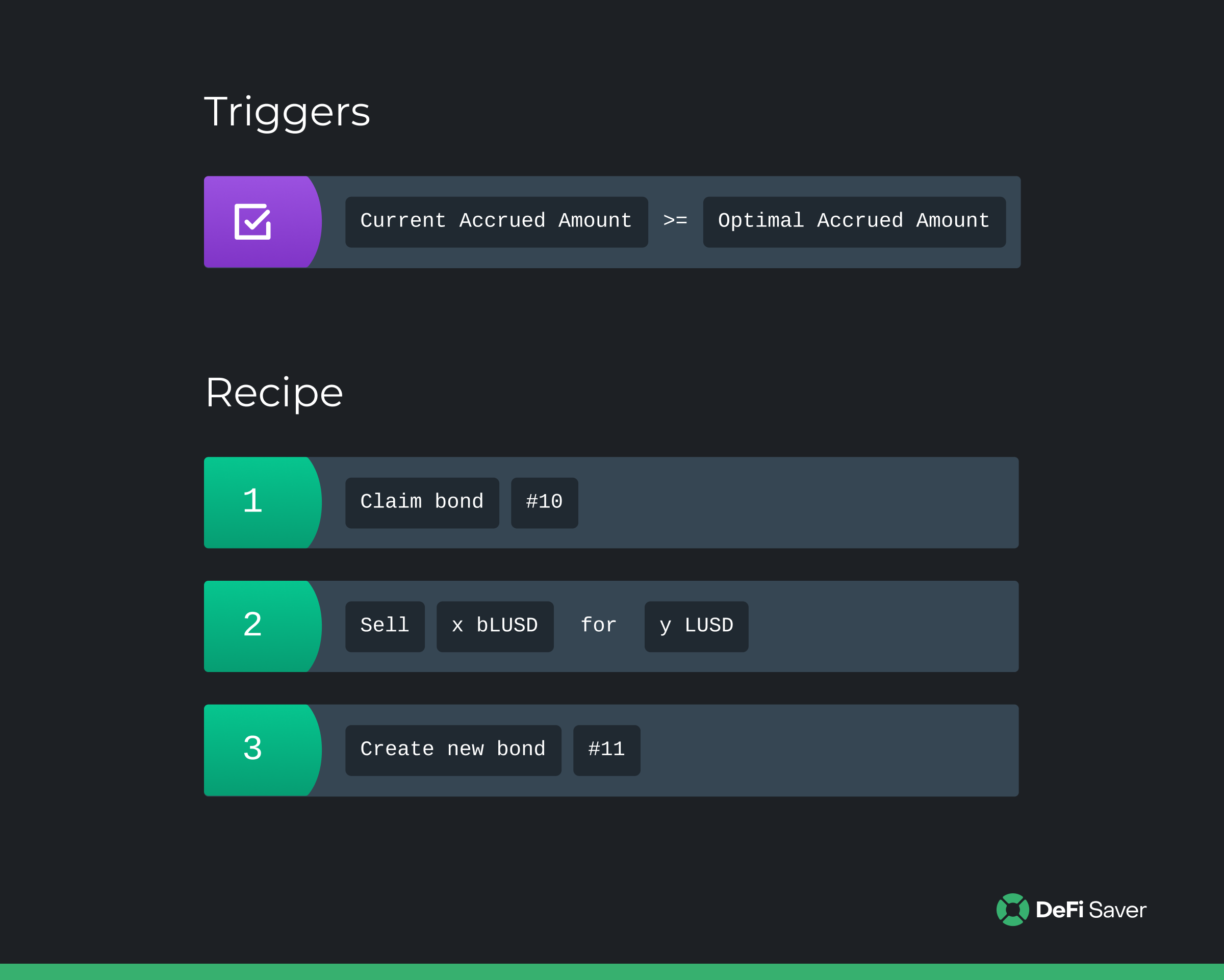

Then, we can just do the periodical comparison to see if the current accrued amount has reached the optimal accrued amount, which essentially describes our on-chain trigger for this strategy:

- if (currentAccruedAmount >= optimalAccruedAmount) then rebond

Or in short, the trigger is calculated as following:

optimal rebond time -> optimal bLUSD accrued (in LUSD) -> if currentAccruedAmount >= optimalAccruedAmount -> rebond

We created a quick calculator tool for anyone interested in simulating different bLUSD market prices, and its reflection on the optimal rebonding time.

As with other automated strategies, this strategy's on-chain trigger is continuously monitored by DFS Automation bots, with verification during execution done fully on-chain within the strategy's smart contracts.

What do you mean "perpetual" automated strategy?

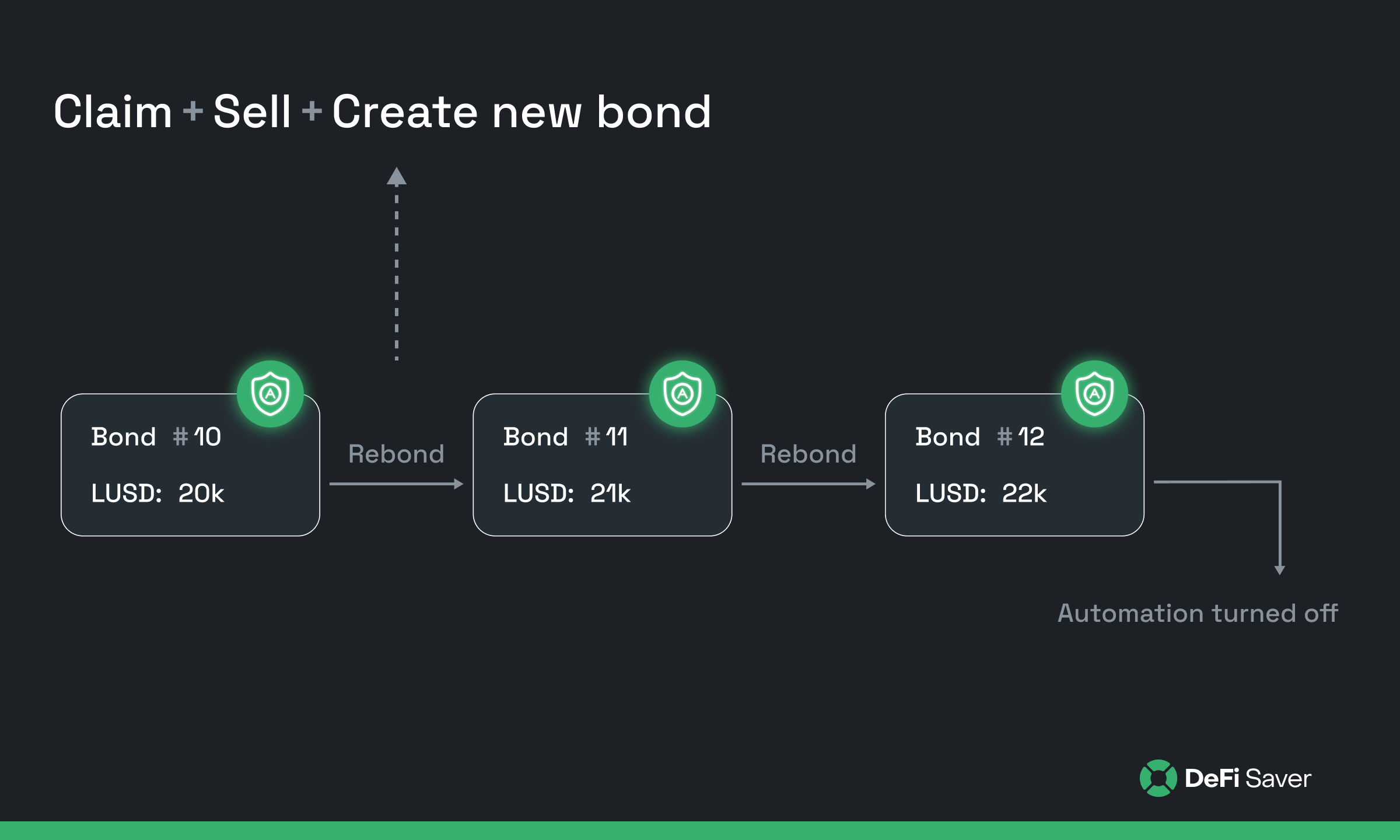

Unlike previous automated strategies released on DeFi Saver, this one is a continuous one, meaning that the automation is enabled for each new bond created by the strategy.

This is done by changing strategy's subData during execution, resulting in perpetual rebonding experience, until the user decides to turn off Automation feature for a specific bond (which can be done anytime).

It's also worth noting that users can have multiple auto-rebond strategies enabled for multiple bonds (one active auto-rebond strategy for each bond in pending state).

How to enable Automation for Chicken Bonds?

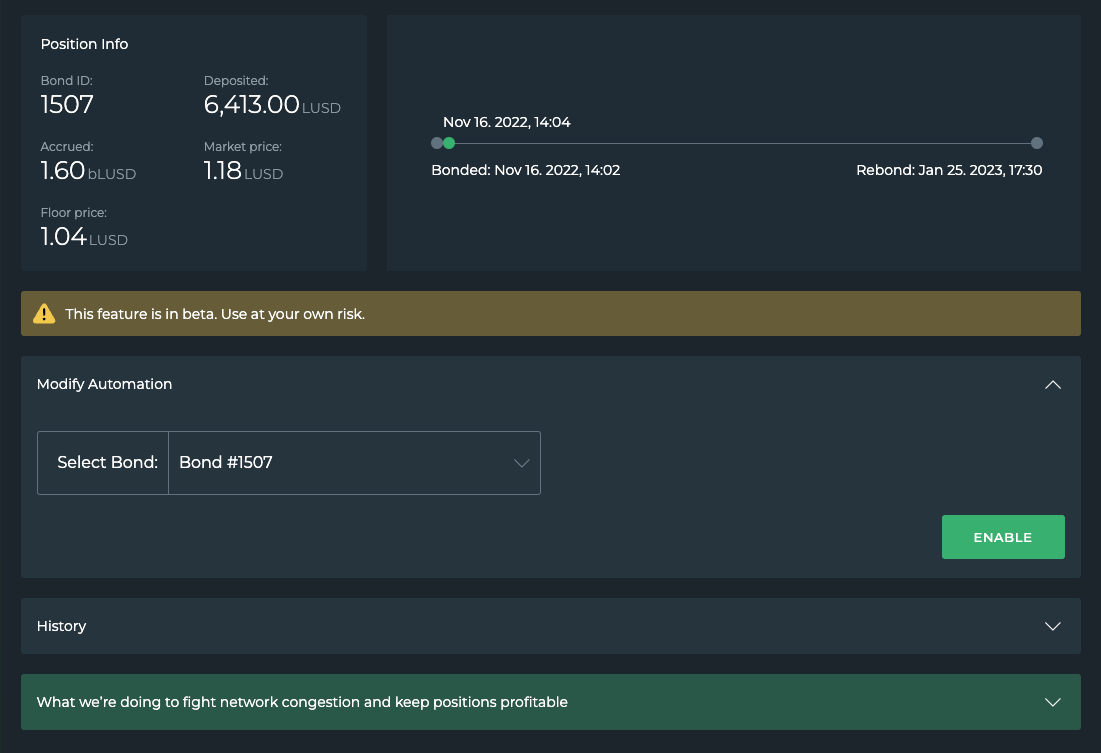

First, there are some requirements for enabling this auto-rebond strategy:

- Bond needs to be on the user's Smart Wallet (DSProxy)

- Bond needs to be in pending state (active)

- Minimum bond size: 10k LUSD

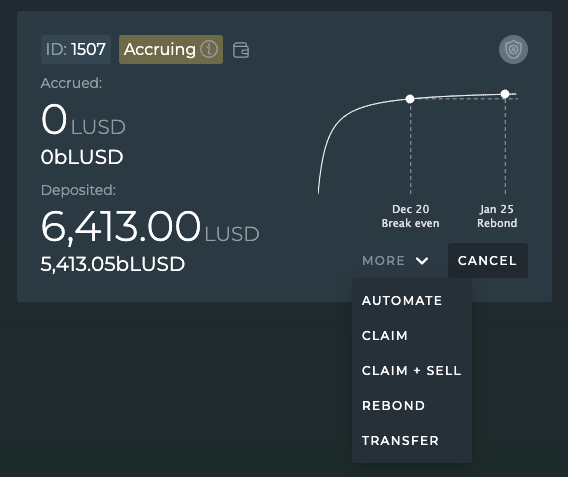

Considering the above conditions, the flow for enabling automation for a bond is quite simple:

1. Create LUSD Chicken Bond on DeFi Saver (bond size > 10k LUSD).

2. Choose the 'Automate' option.

3. Review automation configuration (including the estimated rebond date).

4. Enable auto-rebond strategy.

And voila! You are now subscribed to the automated perpetual rebonding strategy.

As always, we'd love to hear any other ideas for automated strategies and really any feedback for our new Chicken Bonds integration, so make sure to join us in the DFS discord!

Were also always available there for any questions, with some of our Nikolas always standing by to help.