Automated Strategies for Liquity: Liquidation Protection for Troves is Now Live

We are very happy to introduce both liquidation protection (stop loss) and take profit options for Liquity Trove owners.

Just over a year ago, in early April 2021, the Liquity protocol went live on the Ethereum mainnet, offering users access to a completely new, fully decentralized and governance minimized lending protocol, while also introducing the ETH-only backed LUSD stablecoin.

Thanks to a very low liquidation threshold at 110% collateralization combined with lack of continuous interest fees, the Liquity launch was a massive success and the protocol skyrocketed past 1.1m ETH collateralized in a matter of weeks.

While we haven't been there on the first day with support at DeFi Saver, we did integrate Liquity just two months later, providing users with an advanced management dashboard including our signature Boost and Repay 1-tx leverage features, as well as other unique options, such as the MakerDAO to Liquity 1-tx loan shift for anyone looking to escape Maker's continuous Stability fees.

Today we are extremely glad to take our Liquity support one big step further with automated liquidation protection for Liquity Troves - a global first for the growing Liquity ecosystem.

Automated Stop Loss and Take Profit options for Liquity Troves

Powered by our new modular automation architecture (that you can read a tech intro to here), we're very happy to introduce both liquidation protection (stop loss) and take profit options for Liquity Trove owners.

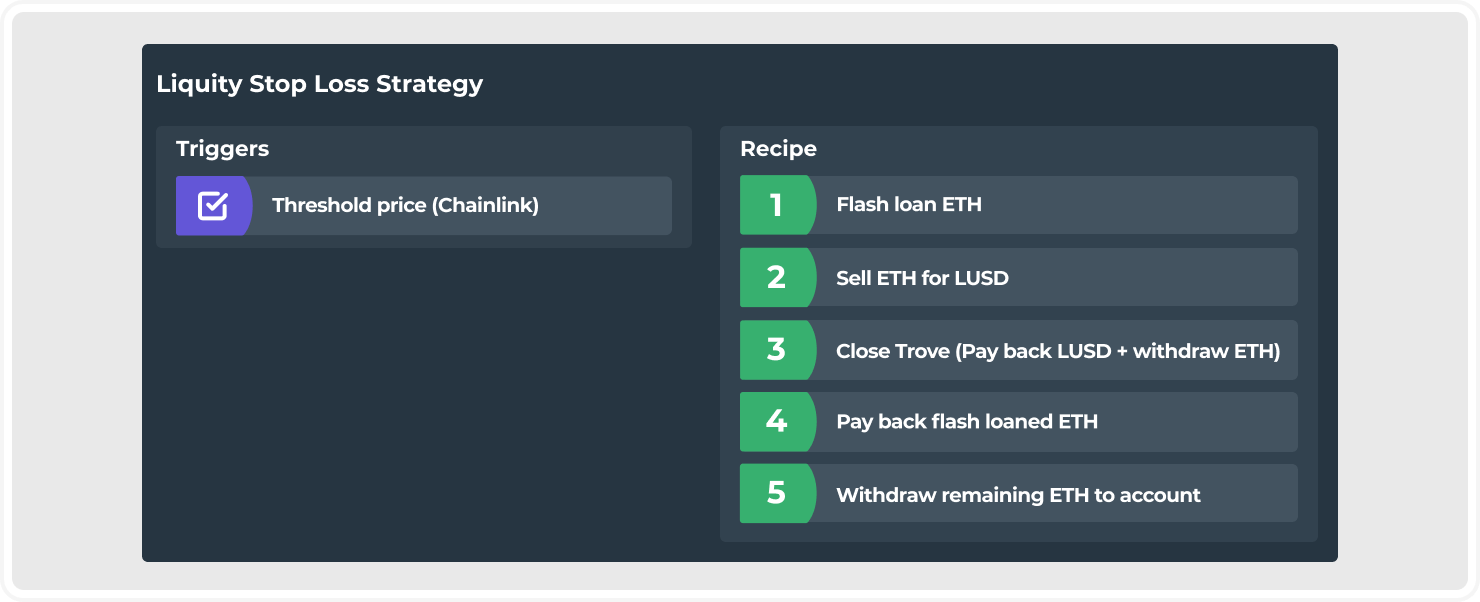

As mentioned in earlier posts, every automated strategy is a combination of triggers and a set of actions that will be executed once the trigger condition is fulfilled.

Here's a quick overview of how the stop loss or take profit strategy for Liquity looks in the background:

Both of these strategies work in a very similar way: the user configures a threshold price and enables the strategy for their Trove, after which the system continuously monitors your Trove and sends out the transaction to close the position as soon as your configured threshold price is crossed.

Note that this strategy fully closes your position into ETH, as will be highlighted in the UI when you go to set it up.

And speaking of setting up, let's quickly cover this process, too.

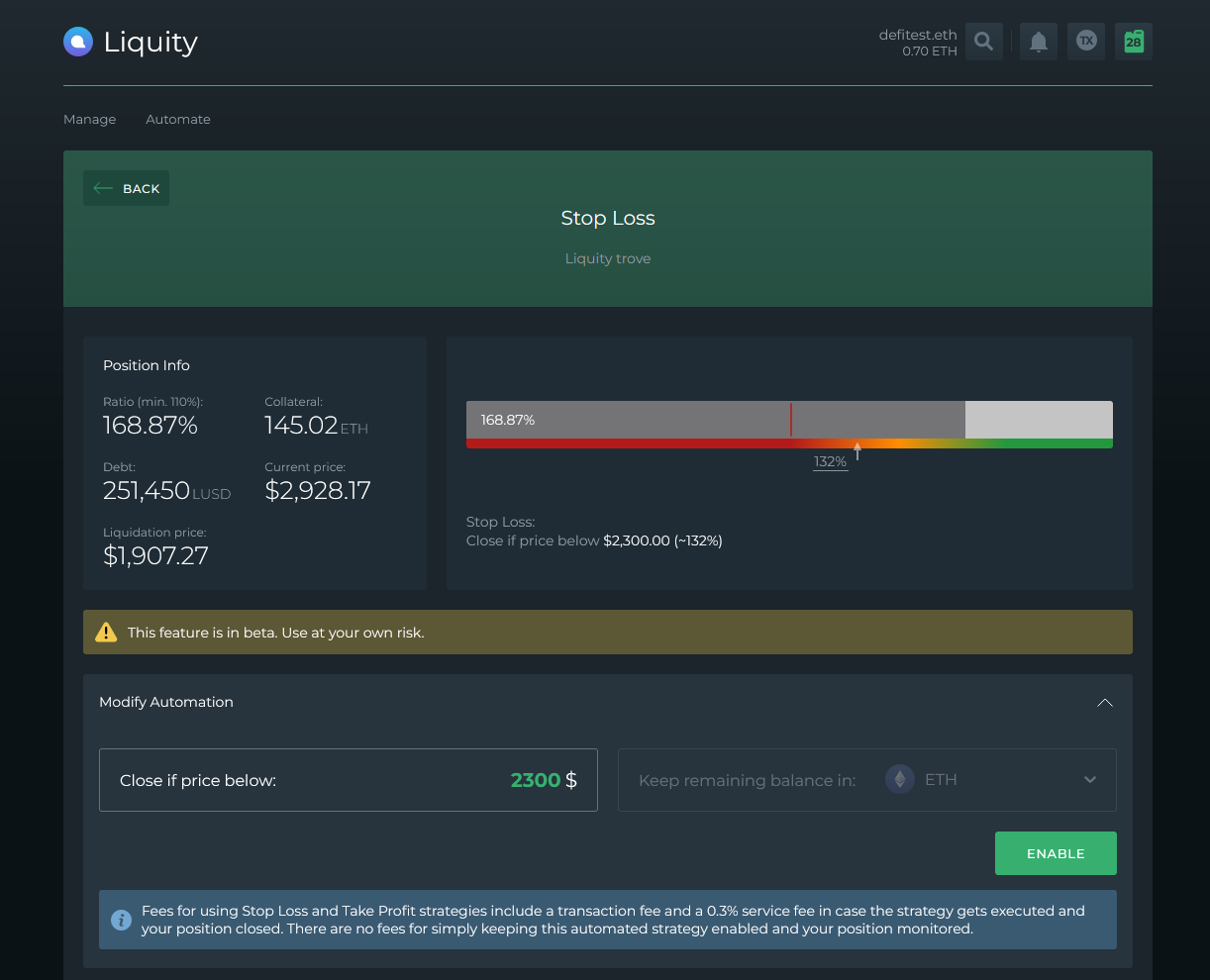

How to set up a stop loss and/or take profit for your Liquity position

Enabling either of these automated strategies for any* existing Liquity Trove is very straightforward.

Once you connect your wallet in the DeFi Saver app and navigate to automated strategies under the Liquity dashboard, you'll find both Stop Loss and Take Profit options available.

In terms of configuration, you only need to select the threshold price below (or above) which you want your position to be closed.

*There are two requirements a user needs to consider for enabling this strategy:

- The Liquity Trove needs to be created on a smart wallet (dsproxy), as the dsproxies are what makes all advanced DeFi Saver features possible, including automated strategies.

Unfortunately, migrating any existing Troves is not possible. - The Liquity Trove needs to have at least 40,000 LUSD of debt.

Because of regularly high transaction fees on Ethereum mainnet, automated strategies unfortunately don't make sense for relatively smaller positions, as the transaction fees charged can make a negative impact.

Please keep in mind that Liquity has additional mechanisms outside of liquidations that can affect your position, including the Recovery Mode and LUSD Redemptions, which you can read about in Liquity docs or in our post comparing Liquity and MakerDAO.

The liquidation protection for Liquity is something that's been regularly requested ever since we introduced Liquity support and we're super glad to finally be able to deliver this feature to the Liquity users and community.

Moving forward, we'll also be looking to provide more automated options specifically tailored to the Liquity protocol and if you already have any ideas we'd absolutely love to hear them, so please make sure to join our discord and let us know!