Simple DeFi Saver strategies for the crab market

A few simple, basic strategies to consider for this post-merge era, together with DeFi Saver.

Buy when there’s blood on the streets, even if the blood is your own. - Nathan Rothschild

There are really a lot of things you can do in DeFi nowadays. The ecosystem has exploded since the term was coined, and we also launched DeFi Saver somewhere along the line. Even in a bear, or shall we say, crab market, opportunities are everywhere, and CT is swarming with folks shilling various airdrop-degen-highly-efficient trading strategies. Did you miss Aptos? Here are five more blockchains launching. Didn’t get $OP? Don’t miss the Arbitrum airdrop. And what’s the hottest yield farming strategy with double-digit APY? If you’re not aping, are you even doing something in DeFi…?

Let’s tone it down a notch, though. Not everyone wants to ape in the next Terra and Luna. And, if anything, the number of people burned this year only grew more since then. According to Chainalysis, October 2022 was the biggest month in the biggest year in terms of hacking activity, with $718 million stolen from DeFi protocols across 11 different exploits. “At this rate, 2022 will likely surpass 2021 as the biggest year for hacking on record. So far, hackers have grossed over $3 billion across 25 hacks.” Closing the month, The Defiant cites an even bigger figure, concluding that the amount is double that of 2021 and close to 12 times the 2020 total, dubbing it appropriately Hacktober. Let’s not even get started on the most recent FTX fiasco. That would need a long post of its own…

All things considered, relying on stable, trusted, battle-tested protocols in this climate and market conditions shouldn’t be considered conservative but wise and desirable. Bear market teaches the adage that downplaying your moves can often be the best strategy to save your assets and money.

That being said, here are some new and classic, simple strategies that didn’t go out of style. Some have a twist in the form of incentives, some might be considered an airdrop strategy, and some you might find risky. But all of them are sound and take advantage of only the most used and battle-tested protocols in space. There are no surprises. They’re sensible and use our signature features, making complex things simple for your convenience.

Here are some mid-bear strategies for the end of 2022.

Leveraged staking (stETH/ETH) with Aave v2

One of the more stable DeFi yield strategies we shared with our users and community, and the one that gained some momentum post-merge, is the leveraged stETH/ETH position on Aave v2 designed for increased staking rewards. It's available as a premade recipe in our Recipe Creator dashboard with 3x leverage, though you can also decrease the ratio if you wanna stay more on the safe side, depending on your risk profile.

Here are some details that make this strategy worthy of your consideration.

Earlier this year, Aave integrated Lido’s stETH as one of the collateral assets you can borrow assets against, all the while retaining Ethereum staking rewards. stETH is a liquid token representing staked ETH. Whenever you stake ETH with Lido, you receive a stETH token in return. This token rebases daily to reflect staking rewards and will be redeemable for ETH once withdrawals on the beacon chain are supported.

Hence, the strategy is useful as an option for both those already staking their ETH via Lido or those just looking to make the most of the increased staking rewards since stETH is also tradeable on the market. Aave v2 allows you to leverage Lido ETH staking returns by using its stETH token in the protocol. The way strategy works is by borrowing ETH against stETH, and re-staking ETH for more stETH, increasing the amount of leverage.

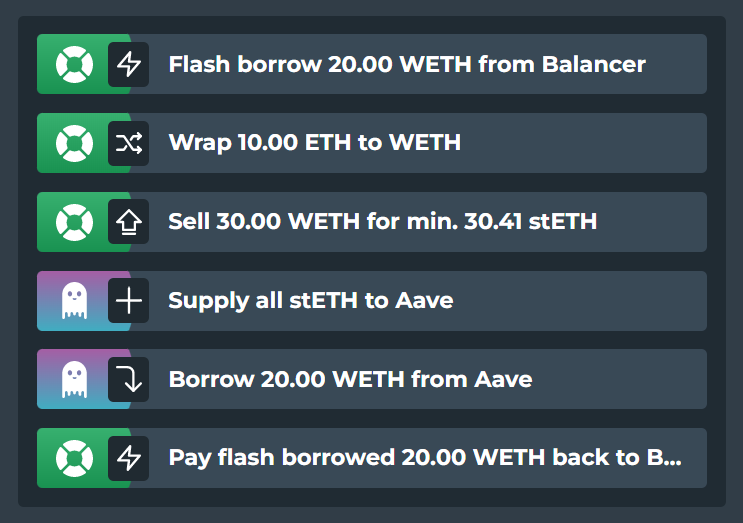

To simplify the strategy as much as possible, we introduced a flashloan from Balancer with no fee. The process involves taking out a loan with Balancer, increasing the leverage 3x, exchanging ETH for stETH, supplying it to Aave, and repaying the Balancer loan by borrowing ETH from Aave. APY currently stands around a stable ~10%.

There are, of course, risks to also consider. Aave ETH borrow APY is variable and can be both lower and higher than the amount of staking rewards received (info available in the Aave dashboard). Secondly, since stETH is liquid, its value against ETH is also variable. Therefore, stETH/ETH ratio can make this position risky. Adding to that, the risk of liquidation is certainly there in the case of this position, the info for which is also available in the Aave dashboard upon position creation.

The premade recipe in the Recipe Creator allows you to insert the amount of ETH you'd like to leverage and execute the strategy in a single transaction! How awesome is that?

Short BTC/ETH ratio with automated leverage management

In its run-up to the Merge, as it drew ever closer, Ethereum surged against Bitcoin and significantly outperformed it. ETH:BTC ratio climbed to a 2022 high in the week leading to the historical event, topping 0.084 for the first time since December 2021. However, the ratio dropped sharply afterwards, until last week, posting its biggest weekly gain since July, fueled by the significant issuance reduction. Ether’s annualised inflation rate dropped from 3.6% to 0%.

The metric forms the basis behind the famous Flippening theory - where the total market cap of Ethereum surpasses and becomes greater than that of Bitcoin. If you’re among the believers that Ethereum will eventually surpass Bitcoin, you might want to short the BTC/ETH ratio. What you’re doing essentially by creating a position to short the ratio is borrowing Bitcoin to acquire more Ethereum. As the value of Ethereum increases more than that of Bitcoin, you’ll be paying back less of the borrowed amount. Jokes and sentiment aside, you can short any two pairs supported by the DeFi Saver integrated protocols. The process is the same.

To be able to short non-stablecoin pairs like this one, you should pick either Compound v2 or Aave letting you borrow non-stablecoin assets. You can even do it on the mainnet or one of the Layer 2 networks using Aave v3, though the number of pairs is a lot smaller.

Here are the basic steps:

- Choose between Compound v2 and Aave

- Create a position by clicking in the upper right dashboard corner

- Choose to create a leveraged position

- Choose ETH as collateral and input desired amount

- Choose WBTC as debt and input desired amount

- Pay attention to the stats section changes

- After creating the position, go to the Automate tab

- Select the Automated Leverage Management strategy and input the desired ratio at which to repay the debt automatically

- Go to Notify tab and enable notifications for your newly created position

Arbitrum L2 asset bridge airdrop hunting

Optimism airdrop was among the most highly-anticipated ones this year and led to many early users earning multi-figure assets for just being that - early. For many in this cycle, it was the first airdrop they ever received. This sparked rumours of whether the other true Layer 2 network will also provide some relief to its users. After the airdrop, Steven Goldfeder, the co-founder of Arbitrum, tweeted, “the appetizer is always served before the main course.” eliminating any doubt in the minds of airdrop hunters about whether Arbitrum will follow suit.

Using our Bridge feature, you can do any of the two previously mentioned strategies by bridging your assets to Arbitrum. You can long or short crypto assets and also specific pairs. After all, drastically lower transaction costs make doing anything on L2s more appealing to the broader masses and the general audience. In a bear market, when every dollar matters, it can make all the difference. By interacting with Arbitrum, you’re ensuring you’ll be on the airdrop list.

Since for the mentioned Bridge feature, we rely on our friends from LI.FI. and their advanced bridge and DEX aggregation solution, which ensures that you get the best rates during any of their bridging activities, by doing this strategy, you’re also exposing yourself to the long-awaited LI.FI. airdrop. You can also rely on any LI.FI. integrated bridge that still hasn’t launched its own token, in hopes that it might will one day.

We ourselves do not intend to launch a token and are not huge fans of airdrop hunting as a strategy. However, for many of our users and community members, it’s a legitimate strategy of acquiring or earning more crypto assets through additional project exposure or by being their early users. For example, Twitter user Olimpio is famous for finding solid airdrop opportunities and sharing them with his followers, so you can consider following him if you’d like to employ this strategy more.

Here are the basic steps:

- Select the Bridge feature

- Select the chains between which you want to transfer the assets

- Bridge assets to the Arbitrum network by choosing one of the offered bridge options

- Wait on your funds to arrive

- Switch to the Arbitrum network in the upper right corner next to the wallet icon

- Create a Smart wallet if it is your first time doing it on Arbitrum

- Create or manage a position ensuring airdrop potential

Yield farming with Liquity Chicken Bonds

Liquity has become a darling among CT and our users as well. It became famous in the crypto and DeFi space for being a fully immutable protocol with a stablecoin that is true to the principle.

Sure, it’s not all sunshine and roses. Liquity is currently only available on the Ethereum mainnet, which can be an issue for those with fewer resources. Furthermore, its slightly more complex liquidation mechanism can be confusing. (We only recommend Liquity for long-term borrowing with a high collateralisation factor to avoid the risk of redemptions. Its built-in LUSD redemption mechanism enables anyone to swap 1 LUSD for $1 of ETH using the protocol and is a process that uses the least collateralised Troves.)

Moving on. To get started with Liquity, you need to either create a new Trove in DeFi Saver (previously created Troves, using other Front-end solutions, do not work with our app) or shift an active position in other protocols to Liquity easily using our cool Loan Shifter feature, creating a Trove in the process. If you’re unfamiliar with Loan Shifter, it enables you to easily shift collateral, debt or entire position between integrated DeFi protocols.

Liquity released a separate protocol that enables you to create bonds and earn amplified yield. It immediately raised a lot of attention, and we decided to support the new Liquity innovation from the get-go. The novel bonding protocol called Chicken bonds allows you to earn amplified yield (from multiple yield sources) on protected principal. Since there is no maturity date and no lock-up, you accrue bLUSD tokens over time which you can claim (Chicken In) at will or withdraw your principal at any time (Chicken Out). You can withdraw 100% of your initial investment at any time and cancel the bond, though you will then, of course, forgo the accrued yield in the process.

To create a Chicken Bond, you need to have Liquity’s stablecoin LUSD at your disposal, which you can either get by opening a Trove (supplying ETH and borrowing it) or by acquiring it on one of the exchanges, in case you find Liquity’s redemption mechanism is not your cup of tea. After that, you can explore our new Chicken Bonds tab within the Liquity dashboard with unique options to claim, claim and sell, rebond or transfer your bond.

The decision boils down to the premium at which bLUSD is trading on the market.

To help you really make the most out of Chicken Bonds, we've just released the first-ever continuous auto-rebond strategy. Simply put, instead of manually choosing to Rebond your bond, the new strategy will automatically do it for you at the optimal rebonding time! Since it's a continuous strategy, it will rebond for as long you have it enabled and LUSD supplied.

Here are the basic steps:

- Acquire LUSD by either creating a Trove or by buying it using the exchange feature

- Go to the Liquity Bonds dashboard and create a bond

- Decide on the amount of LUSD you want to supply (bond)

- Take notice of the info panel to the right

- Decide whether to:

Chicken In - Claim the accrued bLUSD interest and forgo the LUSD deposit

Claim accrued bLUSD interest and sell it instantly for LUSD

Rebond - Claim the accrued bLUSD interest and sell it instantly for LUSD, creating a new bond in the process

Chicken Out - withdraw principal LUSD, cancel the bond at any time and forgo any accrued interest

Automate - enable automatic, recursive rebonding at the optimal rebonding time to maximize yield gain over time. Do note: enabling the strategy is possible only for positions with more than 10K LUSD supplied due to high transaction fees on the mainnet, making it not recommended for smaller bonds.

Comp v3 + Smart Savings strategy

Lastly, a good, reliable, stable yield is always a good idea. One such strategy worth considering if you’re a DFS user relies on Compound's latest protocol version. Immediately after its recent launch, Compound introduced a token incentive scheme for borrowing its only base asset, USDC, which, bundled with any other yield farming protocol, can offer some excellent returns. You can supply several assets as collateral, but for the story's stake, ETH or BTC make sense. USDC borrowing interest is offset by the COMP token distribution incentives, which is variable but at some 3-4% at the moment.

You can then take your newly-acquired USDC and park it in any yield farming protocol. Currently integrated into our Smart Savings dashboard are Yearn, Convex, and mStable, among which mStable Vault offers the highest APY, around 4.5%. Taken together, ~8% interest from a combination of battle-tested protocols is pretty good, all things considered.

As you probably already know, we offer a solid toolkit for advanced DeFi trading. One feature heavily relied upon by advanced traders and users is the Recipe Creator. Now, you can do this strategy manually, but why not use the RC and execute everything in a single transaction? Let’s cook up this simple yield farming strategy.

Here are the basic steps:

- Open the Recipe Creator dashboard

- Click Create Recipe

- From the protocol choosing section at the bottom, select first the DeFi Saver utility option

- Choose the Wrap ETH option and input the desired amount

- Select Compound v3 and add the option to supply to the recipe

- Next, add the step to borrow USDC from Compound v3

- Pick the final recipe ingredient - to supply borrowed USDC to mStable Vault

- Optional: Enable Automated Leverage Management in the Compound v3 Automate tab

It’s a straightforward and short recipe. We always suggest staying on the safe side when creating borrowing positions. No matter your risk profile, you can never be too careful, so you can include an added optional step of turning on Automation for the Compound position to sleep better at night.

So, there you have it—something for everyone. A few simple, basic strategies to consider for this post-merge era, together with DeFi Saver. It’s worth pointing out that new strategies and opportunities emerge each week, so you can keep track of our Twitter and Discord to stay up to date with our latest releases and announcements, as well as occasional helpful advice from our team members.

By all means, please take all the suggestions here merely as ideas and make sure to do your own research for each option. Our Simulation mode should be a great tool for testing anything before proceeding, and our Discord is always a great place to ask for any additional info.

Stay connected:

🌍: DeFiSaver.com

💬: Official Discord

📢: Official Twitter

🗣️: DeFi Saver Forum