The fully automated Liquity & Chicken Bonds experience: Introducing automated payback & rebond combo

This automated strategy provides liquidation protection for Liquity Troves by increasing the collateralization ratio from LUSD Chicken bonds!

Since the initial release of a dedicated LUSD Chicken Bonds dashboard on DeFi Saver back in October, we've introduced some additional features for LUSD bonders, including an automated perpetual rebonding strategy as well as a completely new Chicken Bonds explorer for easy tracking of LUSD bond positions and Chicken Bonds protocol stats.

Before we dive into our latest release, let's first do a short recap of the currently available features for LUSD Chicken Bonds:

- Claim + Sell - an advanced 1-transaction option for claiming the bond (bLUSD) and selling it to LUSD in a single transaction.

- Rebond - another advanced 1-transaction option for claiming the bond (bLUSD), selling bLUSD to LUSD, and creating a new bond with the increased LUSD principal.

- Auto-rebond strategy - a continuous 'set and forget' rebonding strategy for earning amplified yield with LUSD. The strategy calculates the optimal rebond time for bond subscribed and rebonds if triggered. The result is a newly created, larger bond with (rebonding) automation enabled.

- Chicken Bonds explorer - a fully fledged CB protocol explorer for tracking the bond positions including history of actions for specified bonds, bond distribution stats, and much more.

As we saw great adoption of the protocol itself so far and are seeing growing usage on DeFi Saver, we decided to build another automated strategy, this time combining the ingredients of both LUSD Chicken Bonds and the issuer of the LUSD stablecoin - the Liquity protocol.

Automated Liquity Trove debt payback from Chicken Bonds

Today, we are thrilled to announce the long-awaited Liquity Troves auto-payback strategy using funds from Bonds.

This automated strategy aims to provide the highly anticipated liquidation protection for Liquity Troves, as well as to lower the risk of Troves getting redeemed against, by increasing the collateralization ratio (and consequently the 'debt in front' amount) using funds from LUSD Chicken Bonds for automatic debt repayment.

Strategy breakdown

First off, we'd recommend checking the technical overview of our new modular system for automated strategies if you want to get familiar with the way our strategies work under the hood.

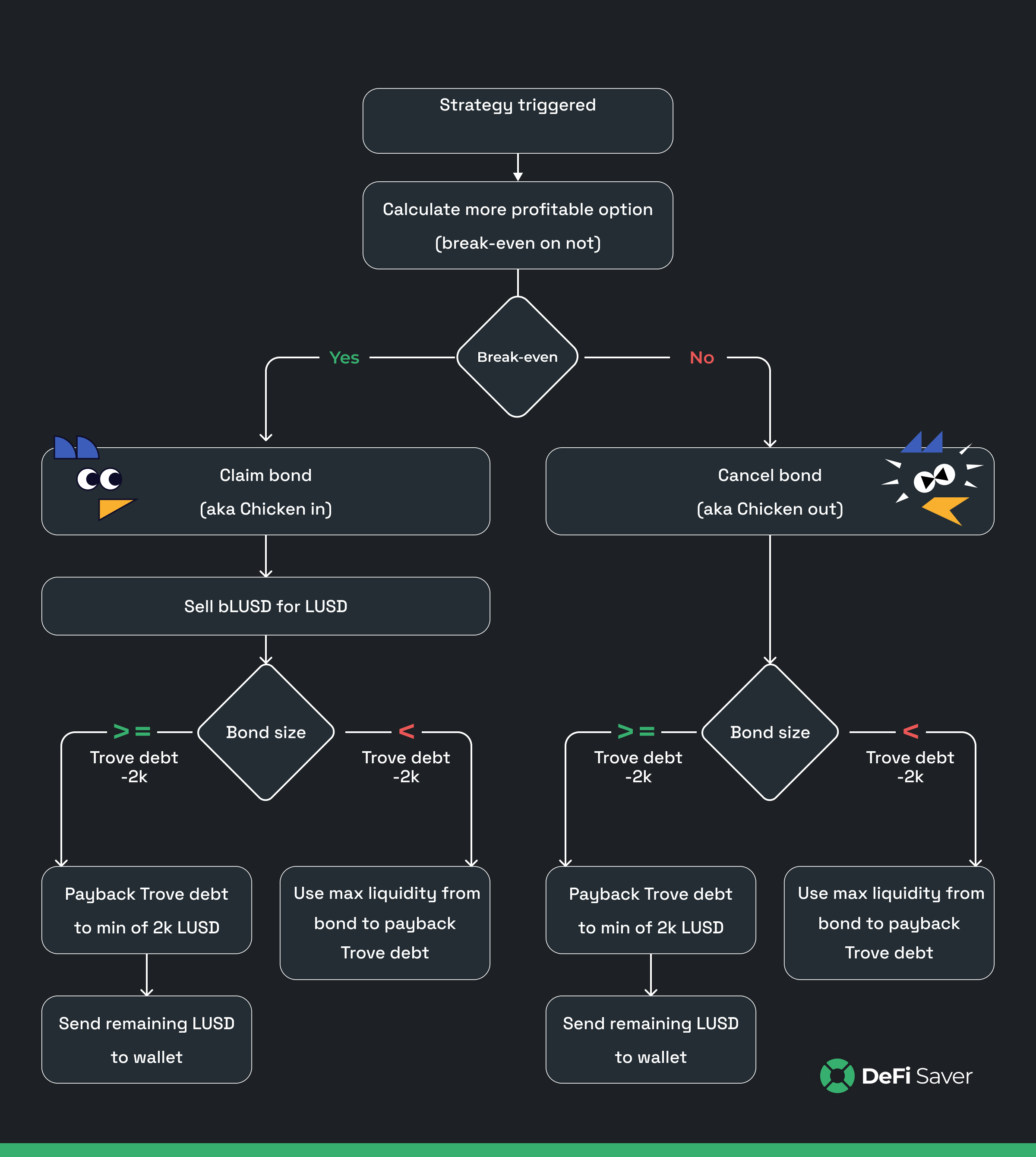

As far as this specific Liquity auto-payback strategy is concerned, it can be viewed as a bundle with two possible ways of unfolding, with the main goal being to use the maximum possible amount of funds for debt repayment in the given moment (i.e. when triggered).

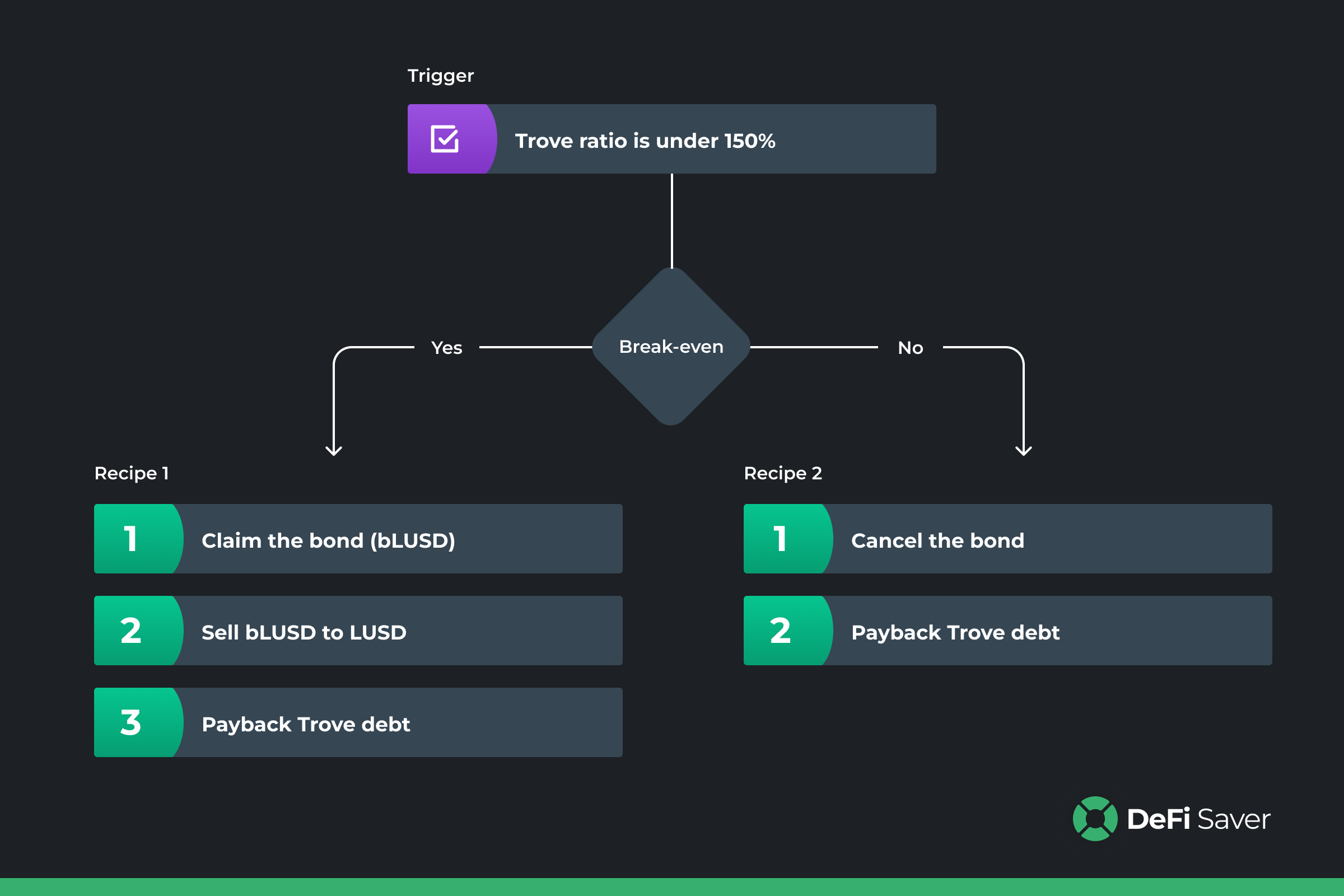

At the moment of triggering, the strategy will execute the more profitable option between claiming (aka chicken in) and canceling (aka chicken out) the bond, by calculating whether the bond has reached the break-even time or not.

Break-even time is reached if the accrued bLUSD is worth more than the deposited LUSD principal, while taking both chicken-in fee (0.3%) and trade price impact into account.

If the bond has reached the break-even time, the strategy will claim the accrued bLUSD and sell it back to LUSD. And if not, the bond will be canceled, meaning 100% of the LUSD principal will be withdrawn.

Next step is to use the LUSD from claimed/canceled bond for the debt repayment of the Trove subscribed.

This is done by either paying back the LUSD debt down to the Liquity minimum debt of 2,000 LUSD (while sending the remaining LUSD to user's EOA), or simply using all LUSD from the bond and thus increasing the collateralization ratio as much as possible (if bond size < Trove debt - 2,000 LUSD).

Keep in mind that the strategy is not designed to fully close a Trove, meaning the maximum amount of debt that can be repaid is up to the Liquity protocol min. debt requirement of 2,000 LUSD.

Auto-rebond & Auto-payback combo

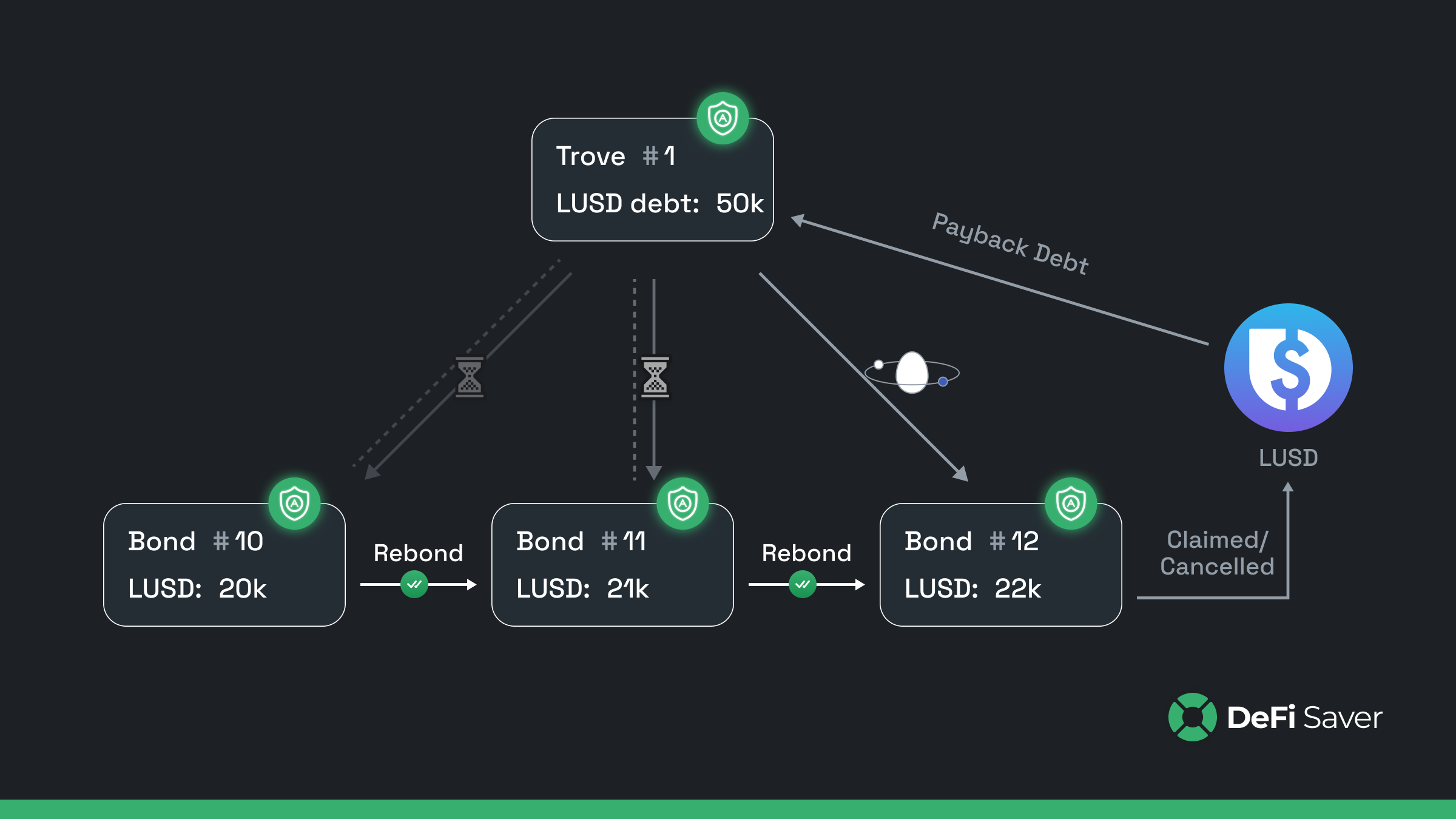

With this release, users are able to combine liquidation protection for Liquity Troves with earning amplified yield from CB protocol by enabling both the auto-payback and auto-rebond strategies for the same LUSD bonds!

If the auto-rebond strategy happens to be triggered before auto-payback, the new bond will also be subscribed to both auto-rebond and auto-payback strategies. Otherwise, if the auto-payback is triggered first, the bond would be canceled or claimed (thus disabling the auto-rebond strategy, too), and used for Trove's debt repayment.

Strategy trigger

Upon enabling the auto-payback from CB strategy, users need to set the trigger collateralization ratio of their Trove in question. If Trove's CR falls below this threshold, the auto debt repayment will be triggered.

Important note: Liquity protocol has a Liquidation Ratio of 110%, which becomes 150% if the protocol enters the Recovery Mode. Aside from liquidation risk, users are also exposed to the redemption risk of their Troves.

How to enable Liquity Auto-payback strategy?

Before we explain the steps for subscribing to the strategy, here are the prerequisites for enabling it:

- Trove needs to be on user's Smart Wallet (DSProxy)

- Trove needs to be active (not liquidated, redeemed, or closed)

- Minimum Trove debt: 20k LUSD

- Bond needs to be on the user's Smart Wallet (DSProxy)

- Bond needs to be in pending state (active)

- Minimum bond size: 10k LUSD

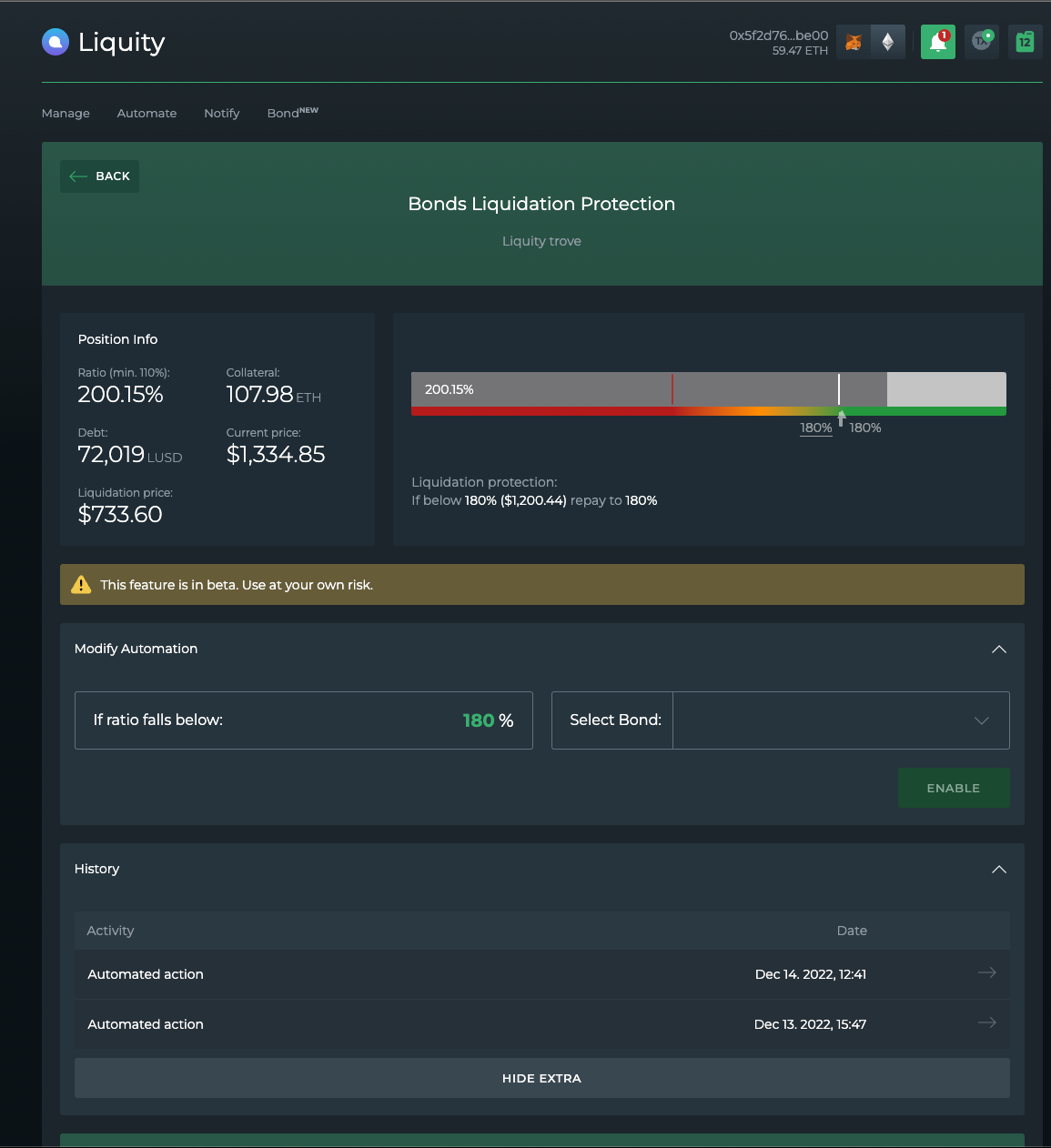

The process of enabling automatic debt repayment from LUSD Chicken Bonds looks like this:

- Head over to the Liquity protocol dashboard.

- Choose the 'Automate' tab.

- Select 'Bonds Liquidation Protection'.

- Configure automation parameters (set trigger ratio and specify the bond).

- Click 'Enable'.

And voila! You can now sit back and enjoy the amplified yield from LUSD Chicken Bonds with much less worrying about the liquidation and redemption risk of opened Trove(s).

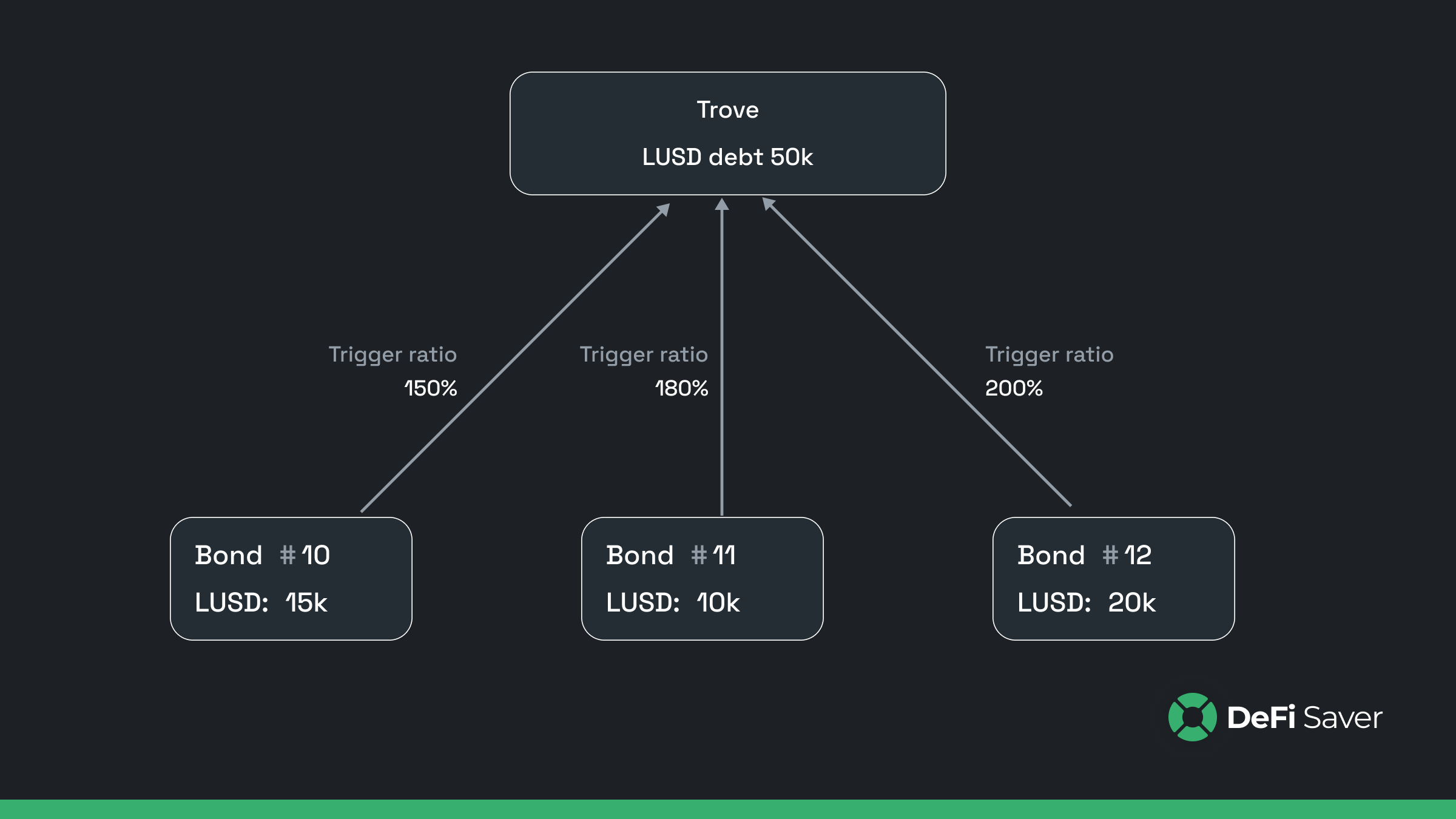

We went with a granular approach when designing this strategy, allowing the possibility to subscribe multiple bonds for auto debt repayment for a single Trove.

This can be done by choosing a new bond with a new trigger ratio, where each trigger ratio needs to be at least +/- 1% different from any previous one(s) enabled for the same Trove.

Note: We are also preparing a pre-made recipe for opening a Trove and using the borrowed LUSD to create the bond that can be subscribed to both auto-rebond and auto-payback strategy, all in one transaction. This is expected to be added to our Recipe Book at the start of the next week!

With this new strategy our goal was to create a complete and unique experience around Liquity and LUSD Chicken Bonds and we hope we have provided tools that let you manage Troves and Bonds in both a very convenient and very advanced manner. But we'll still be keeping a close eye on how the Chicken Bonds protocol keeps growing and how else we can improve the user experience around it.

Speaking of which, you can always find us in the DFS discord for any suggestions and, of course, any questions you may have.

See you there!